Limited Liability Company With One Member

Description

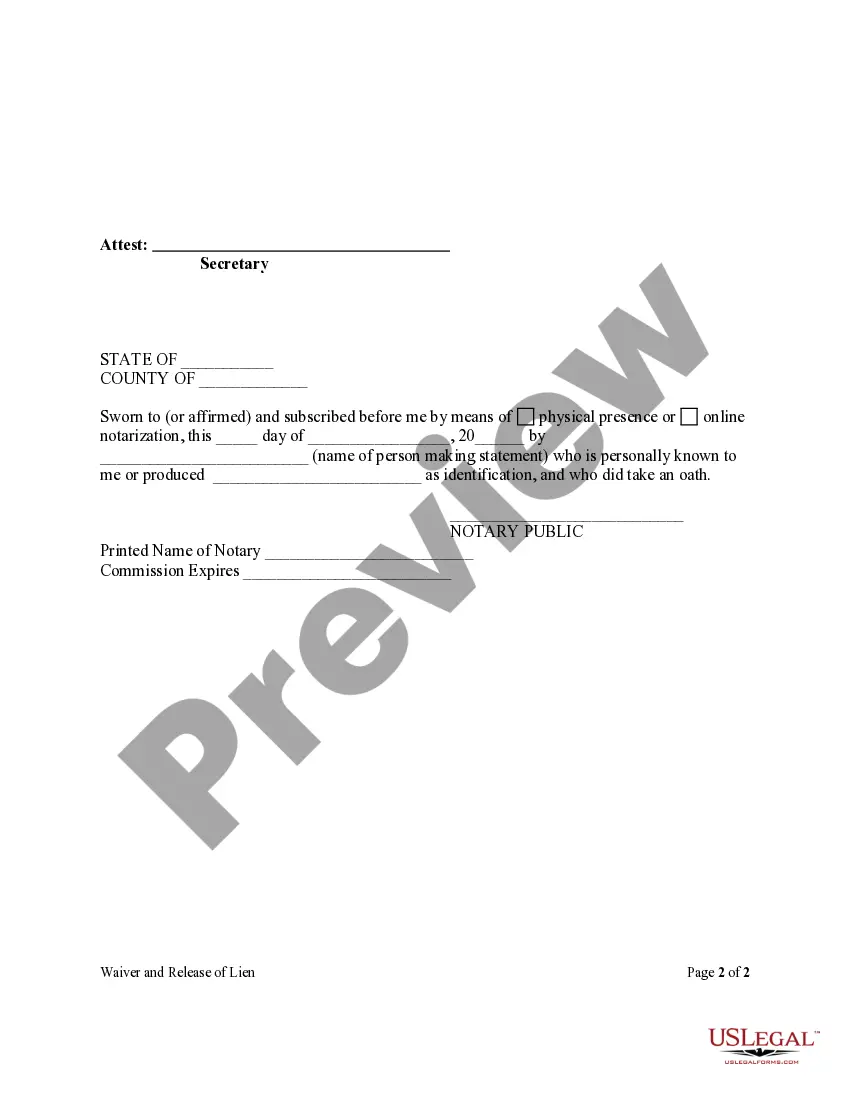

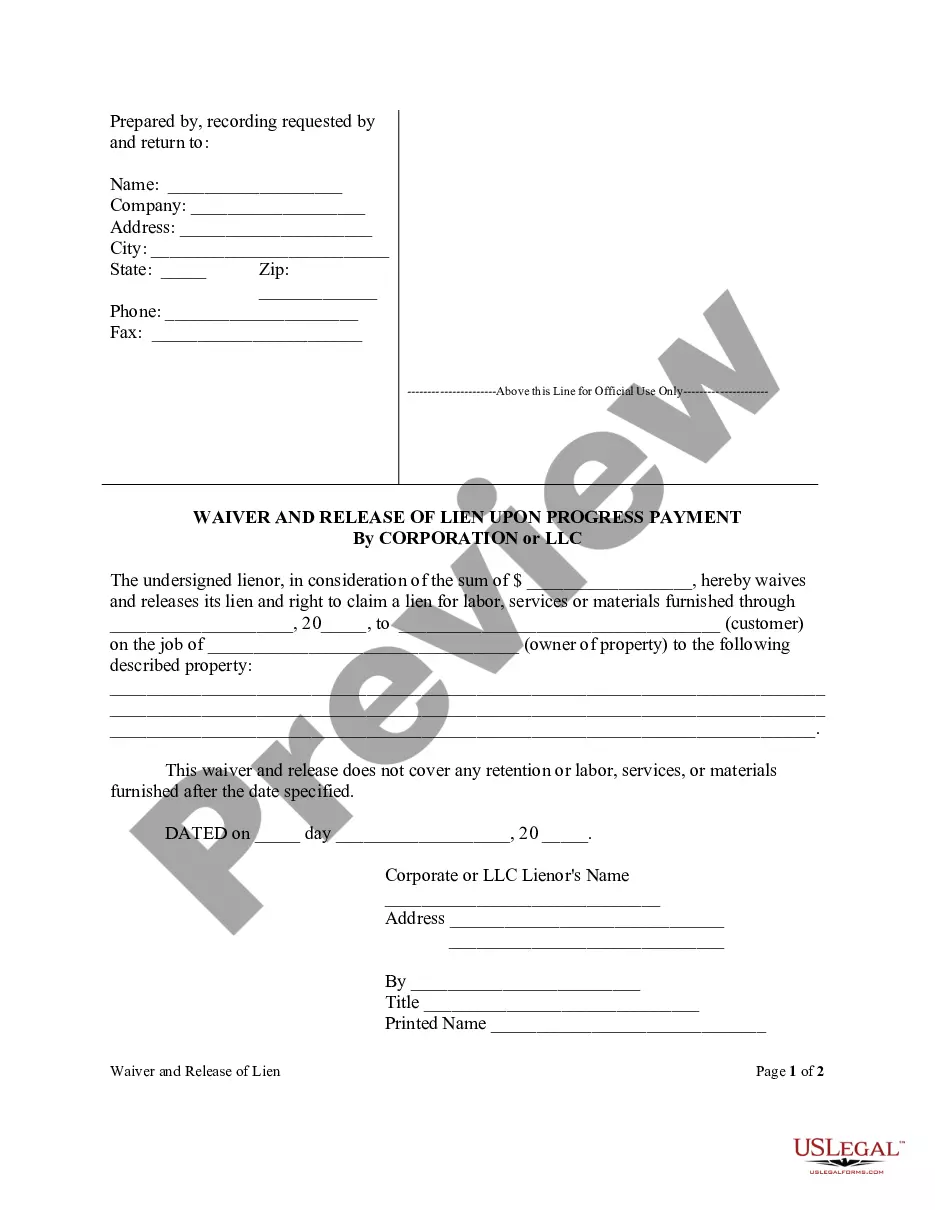

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- If you’re a returning user, log into your account and select the desired form to download by clicking the Download button, ensuring your subscription is active or renewing it if necessary.

- For new users, start by reviewing the form preview and description. Make certain it aligns with your local jurisdiction's requirements before proceeding.

- If adjustments are needed, use the Search feature at the top to find the appropriate template. Ensure it meets your requirements before continuing.

- Once the correct document is identified, click on the Buy Now button to select your preferred subscription plan. You'll need to register for an account to access the library.

- Proceed with your transaction by entering your payment information, either through credit card or PayPal, to finalize the subscription.

- After your purchase is confirmed, download the required form to your device. You can revisit your downloaded templates anytime through the My Forms section.

In conclusion, US Legal Forms provides an extensive collection of over 85,000 editable legal templates, ensuring everyone can find what they need. Accessing expert assistance is also available for accurate document completion.

Start using the resources today to streamline your legal documentation process!

Form popularity

FAQ

member LLC is simply referred to as a singlemember limited liability company. This designation emphasizes that the business has only one owner, which simplifies decisionmaking and management. member LLC retains the benefits of limited liability, making it a popular choice for solo entrepreneurs. It allows you to enjoy the advantages of both a company structure and personal protection.

If you own a limited liability company with one member, you typically refer to yourself as the 'Owner' or 'Member.' This designation clearly indicates your role in the business while highlighting your ownership. It is important to communicate your status accurately in contracts and discussions. Clear titles help establish your authority and responsibility within the business landscape.

While a single-member LLC provides limited liability protection, it is important to understand that liability is not entirely eliminated. As the owner, you generally have protection against personal liability for business debts and obligations. However, maintaining proper separation between personal and business finances is crucial to safeguard this protection. If the boundaries are blurred, you risk losing your limited liability status.

As the owner of a limited liability company with one member, you can choose any title that fits your preference. Common titles include 'Owner,' 'Member,' or 'Managing Member.' While your official designation can vary, the essence of your role remains the same: you have full responsibility for the LLC's operations and decisions. Using a professional title can help clarify your position when dealing with clients or vendors.

An LLC with one person is commonly referred to as a single-member LLC. This type of structure allows business owners to benefit from limited liability while maintaining complete control over business operations. It combines the perks of a corporation with the flexibility of a sole proprietorship. This flexibility makes a single-member LLC an attractive option for many entrepreneurs.

Filling out a W-9 for a limited liability company with one member is straightforward. Start by providing your name as the single member and then list your LLC's name in the appropriate field. Indicate that your business structure is a limited liability company, and ensure you check the box for 'Single-member LLC' under Part I. Finally, provide your tax identification number, typically your Social Security number unless you have an EIN.

Absolutely, a limited liability company with one member can have W-2 employees. Once you have your EIN and comply with local employment laws, you can hire employees who receive salary and benefits documented on a W-2. This setup helps legitimize your business operations and provides your employees with important tax documentation.

To add an employee to your limited liability company with one member, you must first obtain an Employer Identification Number (EIN) from the IRS. After that, familiarize yourself with your state's labor laws and required documentation. You should also ensure that you have a proper payroll system in place to manage withholdings and other obligations.

Filling out a W-9 for a limited liability company with one member is straightforward. First, indicate your LLC's name as it appears on your formation documents. Next, select the appropriate tax classification and provide your LLC's EIN or your Social Security number if you haven’t obtained an EIN yet.

Certainly, you can hire contractors as a limited liability company with one member. Contractors can bring specialized skills to your business without the complexities of full-time employment. This option can provide you with the flexibility needed to meet various project demands.