Limited Business

Description

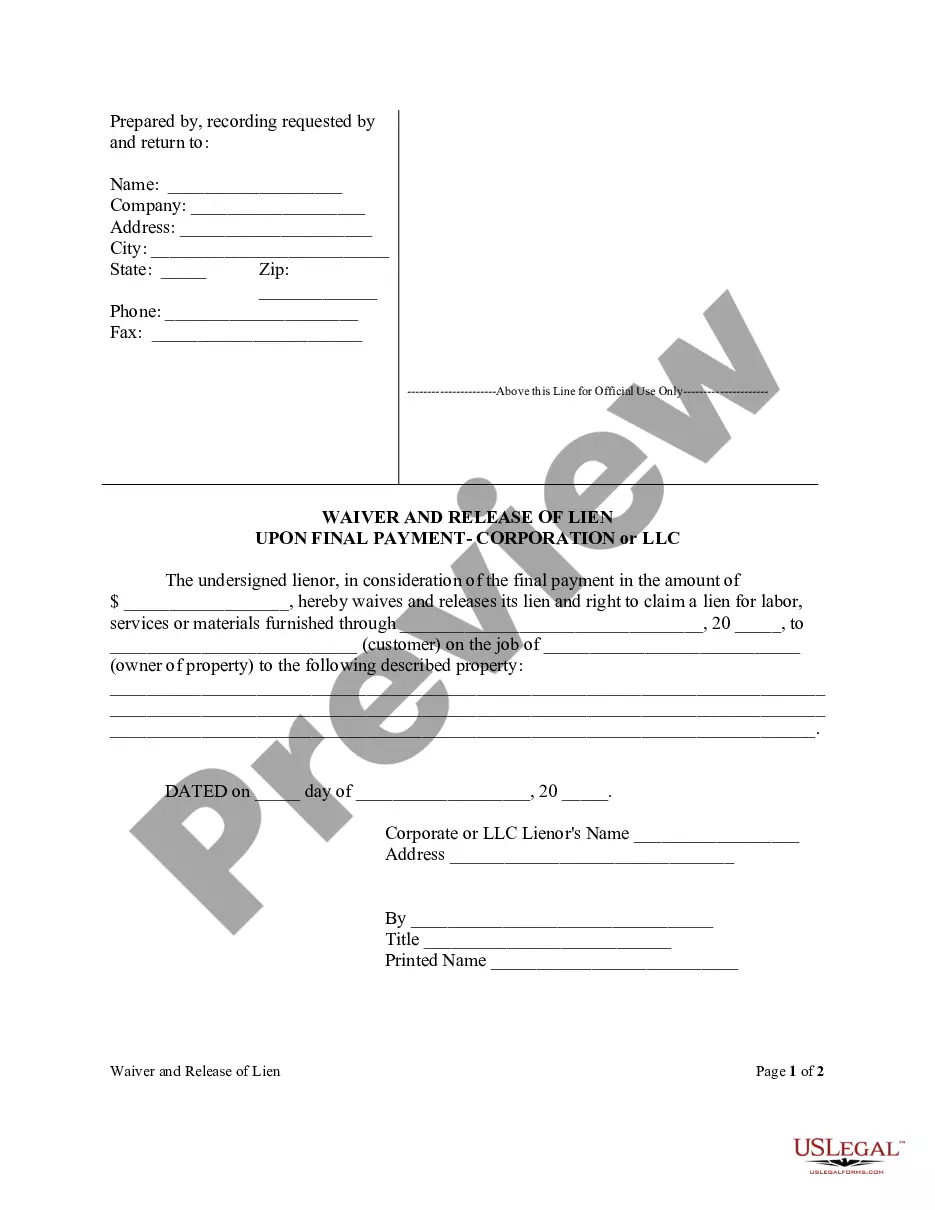

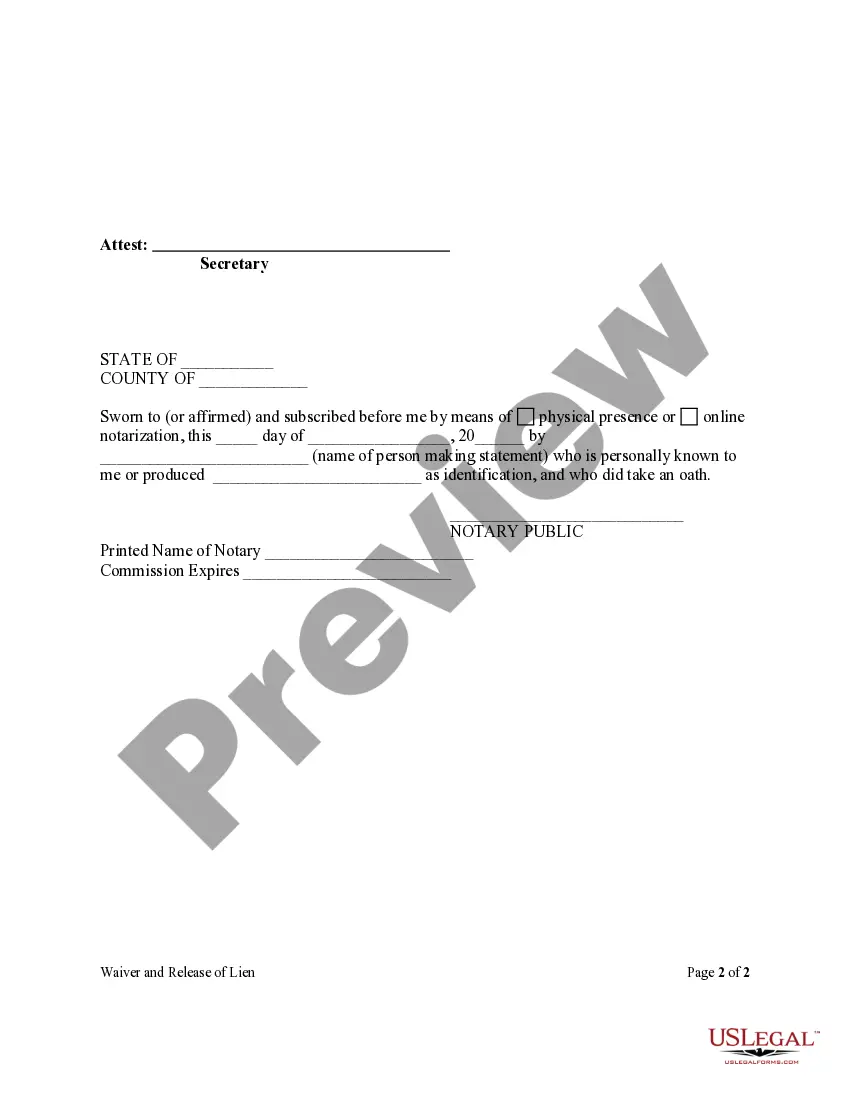

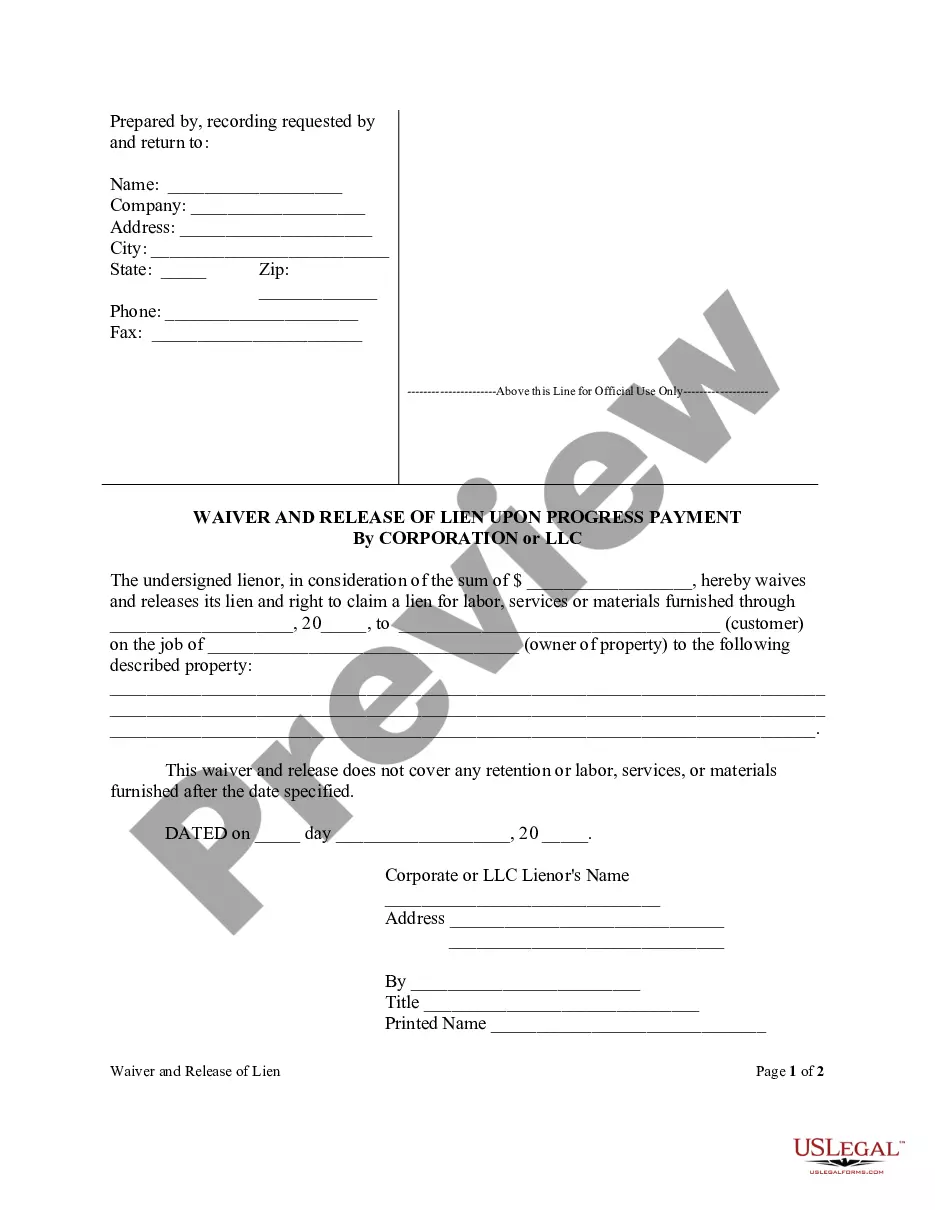

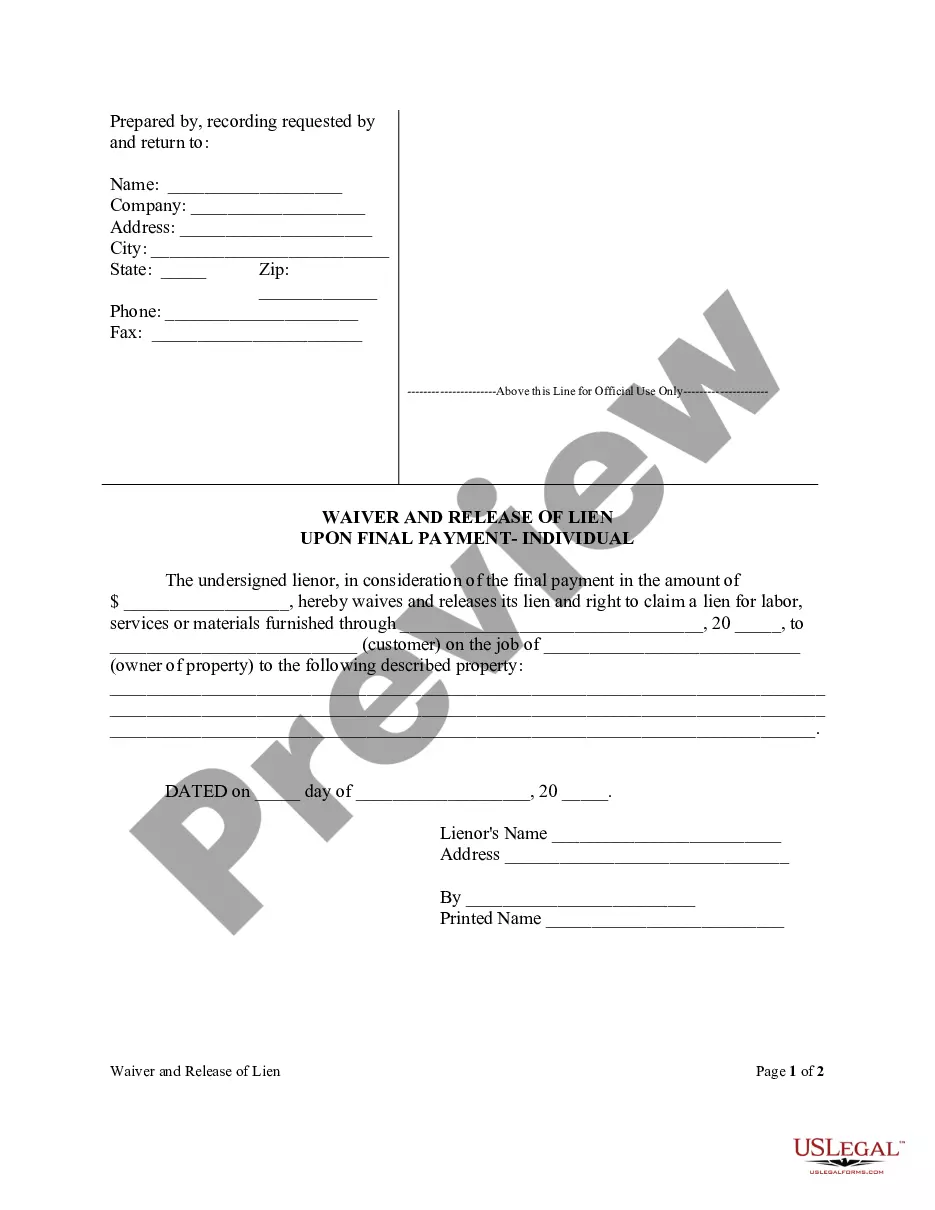

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your US Legal Forms account. If you're a first-time user, create an account to begin.

- Check the Preview mode for your selected form. Ensure it meets your requirements and complies with local jurisdiction.

- If your chosen template doesn’t fit your needs, use the Search tab to find a more suitable document.

- Select the appropriate subscription plan by clicking the Buy Now button.

- Enter your payment information, either through credit card or PayPal, to complete the purchase.

- Download your limited business form and store it on your device for easy access anytime through the My Forms section.

US Legal Forms provides a robust library of over 85,000 legal documents, ensuring that you have a plethora of options to choose from. With the assistance of premium experts, you can be confident that your documents will be both accurate and compliant.

Start leveraging the advantages of US Legal Forms today and make the process of obtaining your limited business documentation simpler than ever. Visit the site now to get started!

Form popularity

FAQ

Typically, you will file your LLC and personal taxes separately, unless you have chosen to treat your LLC as a disregarded entity for tax purposes. Most single-member LLCs can report their business income on their personal tax return using Schedule C. However, understanding your filing requirements can be complex. Utilizing UsLegalForms can provide valuable insights into how to manage your tax filings effectively.

A small business needs to start paying taxes once it earns at least $400 in net income. This threshold applies under most circumstances, including for LLCs. However, other factors could influence your tax situation, such as deductions and credits. Therefore, it's wise to consult a tax professional or resources from UsLegalForms to fully understand your obligations.

While you do not need an LLC to operate a small business, forming one provides significant benefits. An LLC, or limited liability company, offers personal liability protection and potential tax advantages. It enhances your business's credibility and can simplify your taxes. Therefore, consider how forming an LLC aligns with your goals when starting a limited business.

You still need to file taxes if you are self-employed, even if your income is less than $5000. The IRS requires all self-employed individuals to report their earnings irrespective of the amount earned. Keeping accurate records of your income and expenses is vital for determining your tax responsibility. Using services like UsLegalForms can help you stay compliant while making the process easier.

As a small business or limited business owner, you typically need to file taxes if you earn at least $400 in net income. This figure applies to self-employed individuals and limited businesses alike. Once you reach this threshold, filing becomes a crucial step in maintaining compliance with IRS regulations. Consider using the resources provided by UsLegalForms to simplify your filing process.

Yes, even if your limited business earns less than $600, you must report all income. The IRS expects full transparency when it comes to your earnings, regardless of the amount. Not reporting income, even small amounts, can lead to complications later on. Make sure to document all your income, as it contributes to your overall financial picture.

The IRS requires all limited businesses, including LLCs, to file annual tax returns regardless of income level. However, if your LLC does not generate any income, you may still need to file a return to report your financial status. It's essential to keep accurate records, as they can help determine whether you have any tax obligations. Consulting a tax professional can guide you on your specific situation.

Being a limited company means that the business is registered as a separate legal entity, distinct from its owners. This separation gives shareholders protection from personal liability regarding business debts, thus limiting their financial exposure. Limited companies can raise capital more easily, making them appealing for growth. If you're considering this structure, platforms like uslegalforms can help you navigate the registration process.

In a business context, 'limited' stands for 'limited liability', which describes a legal distinction that protects owners from personal liability for company debts. This means that in the event of business failure, creditors cannot claim personal assets of the owners beyond their investment in the company. Many entrepreneurs choose this structure to pursue business opportunities while minimizing personal financial risk. It helps create a more stable business landscape.

When a business has 'limited' in its name, it signifies that the company operates under a limited liability structure. This status protects shareholders from being personally liable for the company's debts or obligations. Therefore, the extent of financial risk is contained to their investment in the business. It is an appealing choice for many entrepreneurs seeking to mitigate personal financial risk.