Lien Liability Company With The Us Government

Description

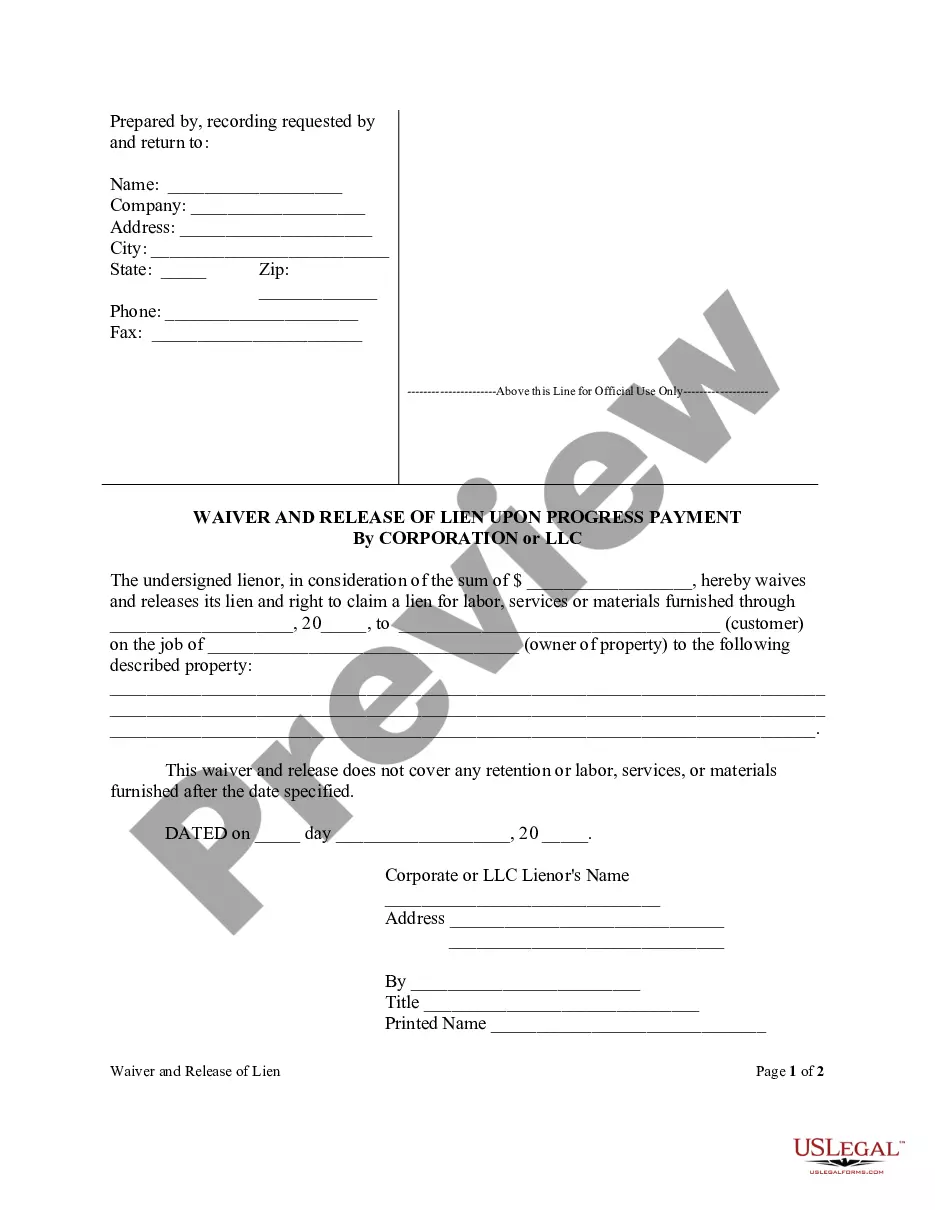

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Start by logging into your existing US Legal Forms account. If you haven’t registered yet, create a new account for full access.

- Browse and select the specific lien liability form you need. Use the Preview mode to confirm it meets your requirements.

- If the form does not fit your needs, utilize the Search feature to find an alternative that is compliant with your local jurisdiction.

- Once you identify the correct document, click the Buy Now button and select your desired subscription plan.

- Complete your purchase by providing your payment information for either credit card or PayPal.

- After successfully purchasing, download the form directly to your device. You can also find it later in the My Forms section of your account.

US Legal Forms stands out with its robust collection of over 85,000 legal documents, giving you access to a wider selection than most competitors. Additionally, users can seek expert assistance to ensure that their forms are completed correctly and hold up in legal situations.

In conclusion, navigating the process of obtaining legal documents has never been easier with US Legal Forms. Start today to ensure you have the necessary forms at your fingertips. Visit the website to explore your options!

Form popularity

FAQ

An example of an LLC is a company formed by a group of professionals, like lawyers or accountants, pooling their resources to operate together. The LLC structure provides them with protection from personal liability while allowing them to share profits and losses according to their ownership stakes. This setup is beneficial for those involved in a lien liability company with the US government, as it promotes security and collaboration.

A limited liability company (LLC) is a business structure that combines elements of both partnerships and corporations. In an LLC, owners, known as members, are shielded from personal liability for the company's debts. This feature is particularly relevant for a lien liability company with the US government, as it can help manage financial risk while operating within legal boundaries.

An example of a limited liability company is an LLC formed to provide services such as consulting or rental properties. In this setup, the owners benefit from personal liability protection while maintaining flexibility in management and tax treatment. For those exploring the option of a lien liability company with the US government, an LLC can be a suitable choice to safeguard personal assets.

Limited liability is a legal structure that protects individual owners from being personally liable for the company’s debts. For example, if a business fails, a limited liability company (LLC) allows the owners to keep their personal assets safe from creditors. This feature is particularly important when dealing with a lien liability company with the US government, as it ensures that personal finances remain secure even in case of debts related to government obligations.

A limited company is a type of business structure that limits the liability of its shareholders. An example is a privately held corporation, where the owners are not personally responsible for the company's debts. This structure protects personal assets while allowing the company to operate effectively. When considering a lien liability company with the US government, understanding these examples is crucial.

A federal lien lasts for 10 years from the date of filing, unless the IRS takes steps to extend it. Once this period ends, the lien typically expires, releasing your property from the government's claims. To ensure a smooth transition from this process, it's beneficial to consult a lien liability company with the US government for clarity and support.

A federal tax lien is a serious matter as it can create significant financial challenges. It affects your credit score, limits future borrowing options, and complicates selling property. Engaging with a lien liability company with the US government can help you understand your obligations and identify steps to mitigate the impact.

Yes, the government can place a lien on your house if you have unpaid federal taxes. This lien serves as a legal claim against your property, affecting your ability to sell or refinance. Consulting a lien liability company with the US government can provide assistance in addressing your situation and exploring options for resolution.

An IRS lien arises when the IRS files a Notice of Federal Tax Lien due to unpaid tax debts. This formal notice secures the government's interest in your property and assets. Working with a lien liability company with the US government can help you navigate the complexities of tax liabilities and seek a resolution.

After 10 years, the IRS generally cannot legally collect a federal tax debt, as liens typically expire at this point. This rule provides individuals an opportunity for a fresh start if they address remaining tax issues. If you’re uncertain, a lien liability company with the US government can provide clarity on your situation and possible next steps.