Final Payment Construction Withholding

Description

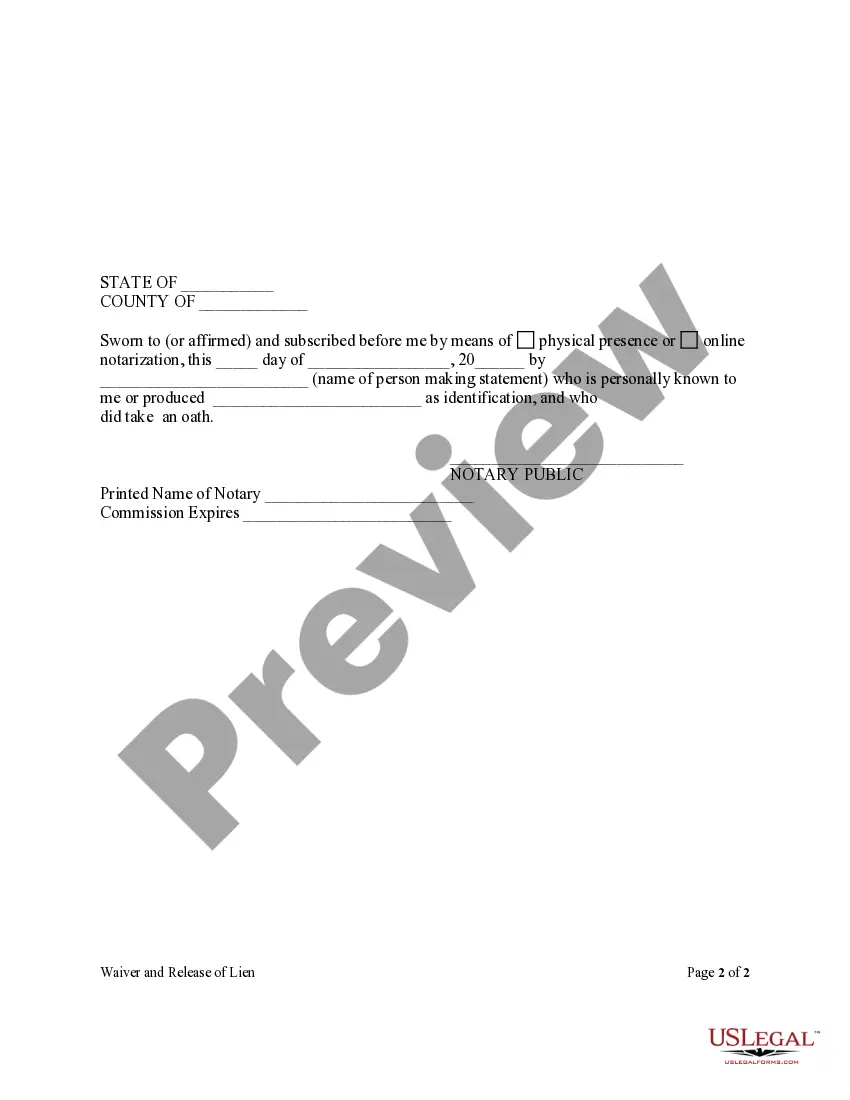

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Individual?

When you need to complete the Final Payment Construction Withholding that adheres to your local state's rules, there can be numerous options to select from.

There's no requirement to scrutinize every document to verify it fulfills all the legal standards if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in acquiring a reusable and current template on any subject.

Acquiring expertly crafted official documents becomes simple with the US Legal Forms. Additionally, Premium users can also take advantage of the powerful integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most comprehensive online catalog featuring an archive of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's laws and regulations.

- Consequently, when obtaining the Final Payment Construction Withholding from our site, you can feel assured that you possess a valid and up-to-date document.

- Accessing the necessary sample from our platform is remarkably straightforward.

- If you already hold an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can navigate to the My documents tab in your profile and maintain access to the Final Payment Construction Withholding at any moment.

- If this is your first experience with our library, please follow the instructions below.

Form popularity

FAQ

To hold a contractor accountable, start by establishing clear expectations in the contract. Regularly communicate during the project, and document any concerns or issues that arise. If problems occur, utilize final payment construction withholding strategically, as this motivates the contractor to address the issues promptly. Using resources from platforms like US Legal Forms can help you draft effective communication and documentation to support your position.

Filling out a contractor's final payment affidavit involves providing accurate details about the project and confirming that all payments have been made. Include information such as the contractor's name, project address, and payment amounts. Make sure to clarify any conditions related to final payment construction withholding, as this may affect the contractor’s liability. You can utilize online platforms like US Legal Forms for guidance and templates to simplify the process.

Yes, you can withhold payment for poor workmanship as part of final payment construction withholding. If the contractor does not deliver quality work as per the contract, it is your right to request corrections before making the final payment. Document any issues thoroughly to support your case if disputes arise. This approach ensures the contractor remains accountable for their work quality.

Poor workmanship refers to the failure to meet the agreed-upon standards during construction. This may include shoddy materials, improper installation, or failure to follow the project specifications. It's important to document any instances of poor workmanship to justify final payment construction withholding if necessary. By recognizing these issues early, you can protect your investment.

Understanding when to withhold taxes from contractor payments is essential to ensuring compliance with tax regulations. Generally, you must consider final payment construction withholding when contractors do not provide necessary tax information, such as a valid W-9 form. Additionally, if a contractor has a history of non-compliance, withholding can safeguard you against unexpected tax liabilities. Use our US Legal feature to stay informed and compliant with your tax withholding obligations.

Yes, you can sue a contractor for failing to finish on time if it violates the contract terms. This often includes seeking damages or enforcing final payment construction withholding to ensure compliance. However, it's wise to attempt resolution through communication first. If those efforts fail, legal action may become necessary, and a platform like US Legal Forms can provide the resources needed to navigate the legal process.

Generally, a contractor cannot be sent to jail solely for not finishing a job as this falls under civil, not criminal, issues. However, if there is fraudulent intent or misrepresentation involved in accepting work and failing to complete it, legal actions might escalate. This could include fines or even jail time, depending on the severity of the situation. Always understanding your contractual obligations can help mitigate risks.

If a contractor fails to finish the work, the project owner has several options, including seeking damages for breach of contract. The project owner may also enforce final payment construction withholding, which serves as a financial incentive for the contractor to complete the job. In some cases, the owner might need to hire another contractor to finish the work, leading to additional costs. Clear contracts and communication can prevent such issues.

The time a contractor has to finish a job can vary based on the terms set in the contract. Typically, the contract outlines a deadline for completion, which is crucial for managing expectations. If the contractor needs more time, it is vital to negotiate with the project owner to avoid final payment construction withholding. Open dialogues can lead to extensions and mutual understanding.

If you do not finish a contract job, the project owner may withhold final payment construction withholding as a remedy. This means that the contractor might not receive the funds owed until the work is completed satisfactorily. Additionally, leaving a job unfinished can lead to a damaged reputation and possible legal repercussions. Therefore, it's essential to communicate openly about any delays or issues.