Partial Lien Release With Mortgage Company

Description

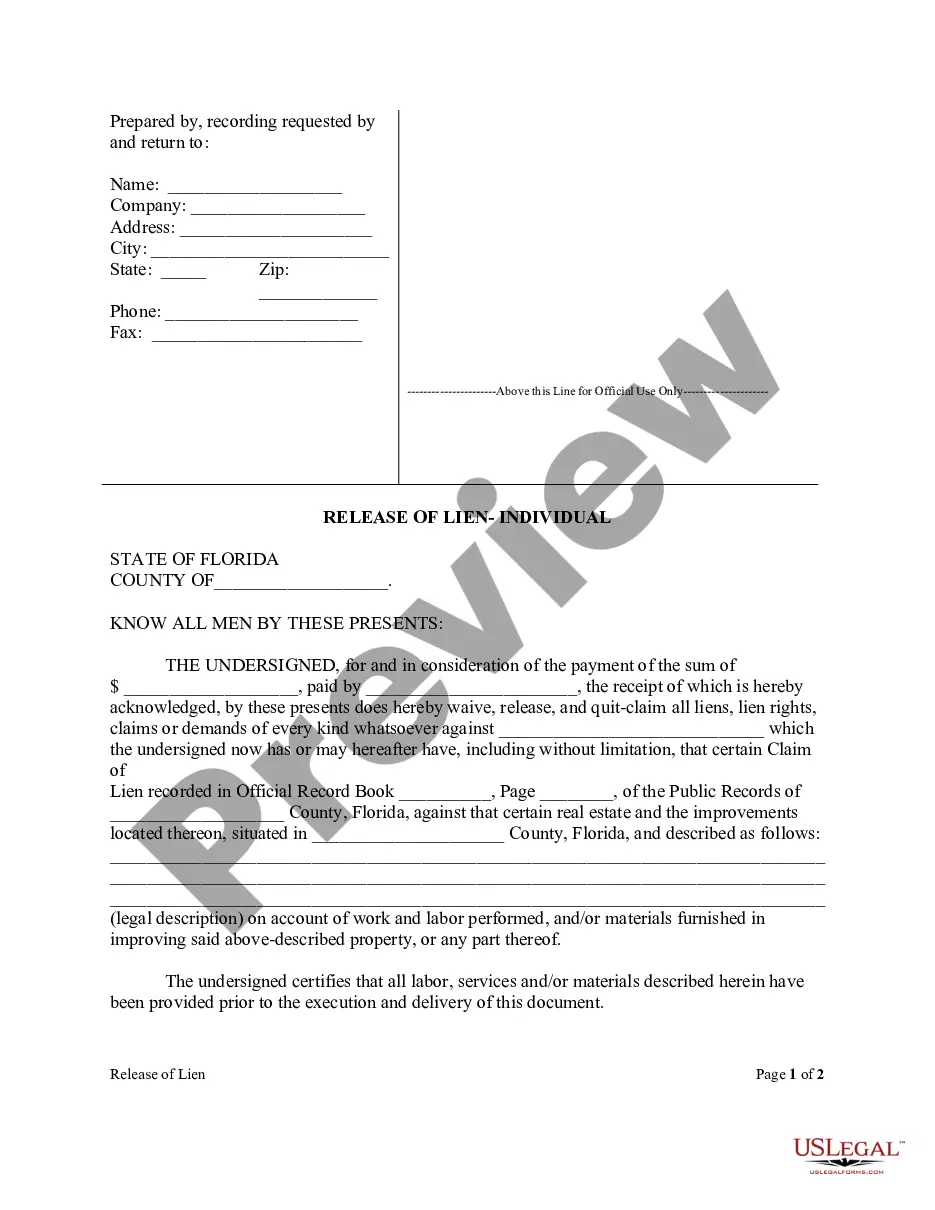

How to fill out Florida Conditional Partial Release And Waiver Of Lien Form - Construction - Mechanic Liens - Individual?

Obtaining legal document samples that meet the federal and local regulations is essential, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Partial Lien Release With Mortgage Company sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are simple to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Partial Lien Release With Mortgage Company from our website.

Obtaining a Partial Lien Release With Mortgage Company is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Examine the template utilizing the Preview feature or via the text outline to ensure it meets your requirements.

- Browse for a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Partial Lien Release With Mortgage Company and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Definition and Examples of Partial Release of a Mortgage If a property owner wants to sell part of their property but still has a mortgage loan on it, they have to obtain this permission and verify that the new parcel is clear to be sold with the appropriate authority, often a county recorder's office.

Full discharge: Request to discharge security as AMP loan will be (or has been) repaid. Partial discharge: Request to release one of the securities on an AMP Loan where there are multiple properties held as security for the loan. Substitution of security: Request to replace an existing security with another security.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Partial Release Price means the highest of the following amounts: (i) 125% of the Allocated Loan Amount for Release Property; (ii) the amount that, after giving effect to the Partial Release, would result in a minimum Debt Service Coverage Ratio of 1., and (iii) in the event that the Release Property is being to a ...

A partial discharge is when you have more than one property secured by the same home loan, and you want to release one of those properties as security without repaying the entire loan amount. These may take longer than traditional discharges because your Lender may need a valuation done on the remaining properties.