Florida Liens On Real Property

Description

Form popularity

FAQ

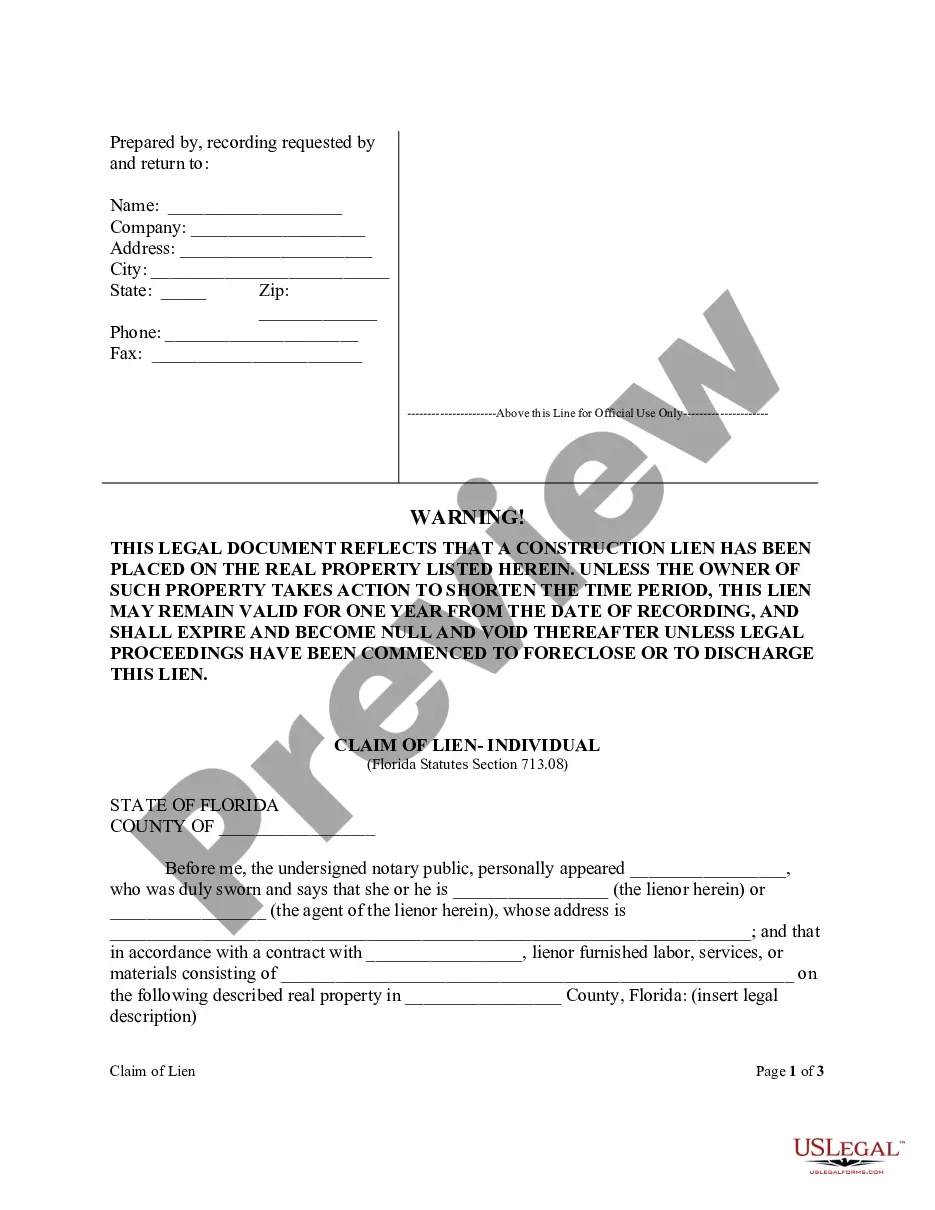

Placing a lien on someone's property in Florida involves filing the lien with the county clerk where the property is located. First, gather all necessary information about the debt and the property. Then, ensure the lien is properly recorded to protect your interests under Florida liens on real property, allowing you to claim your rights in case of non-payment.

To place a lien on a Florida title, you must prepare a lien application and file it with the local tax collector or the Department of Highway Safety and Motor Vehicles, depending on the asset type. Include details such as the debtor's information and the amount owed. By following this process, you can enforce your claim through Florida liens on real property effectively.

In Florida, you typically have one year from the date the debt is due to file a lien against a property. However, certain types of liens may have different timelines, so it’s essential to verify specific requirements for your situation. Understanding the timeline is crucial to protect your interest under Florida liens on real property.

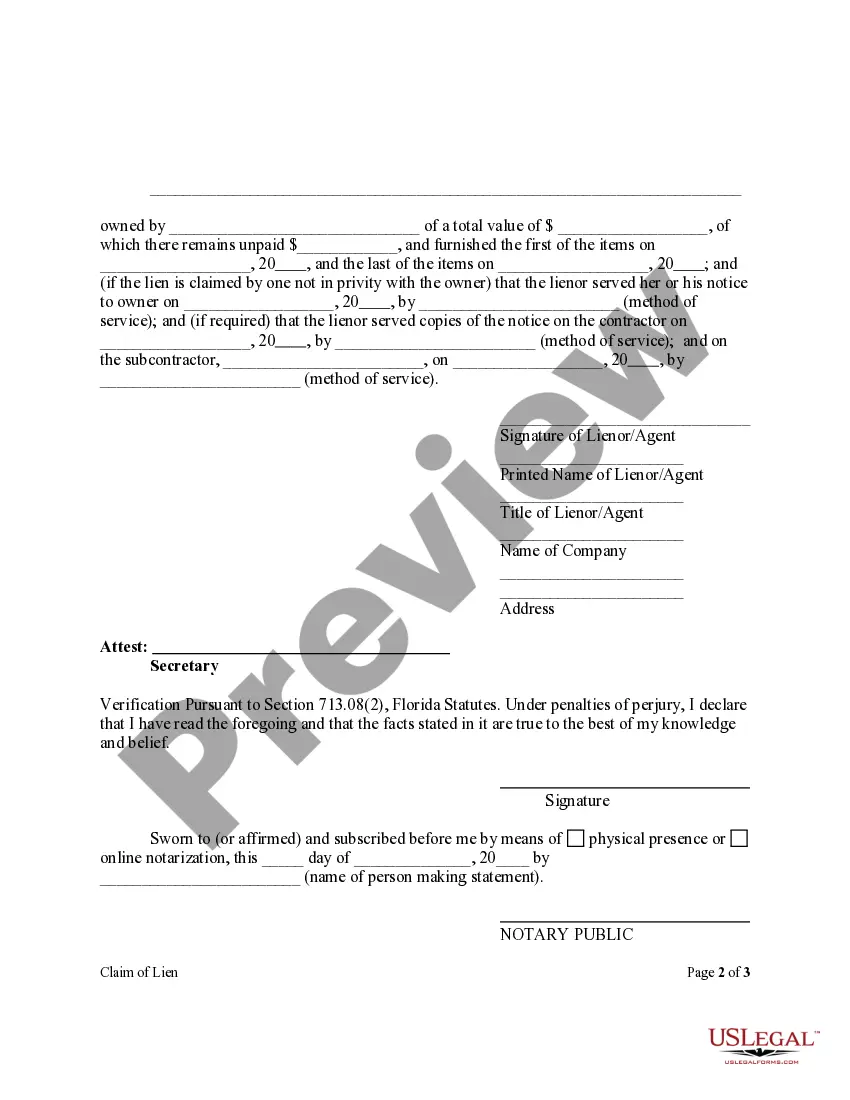

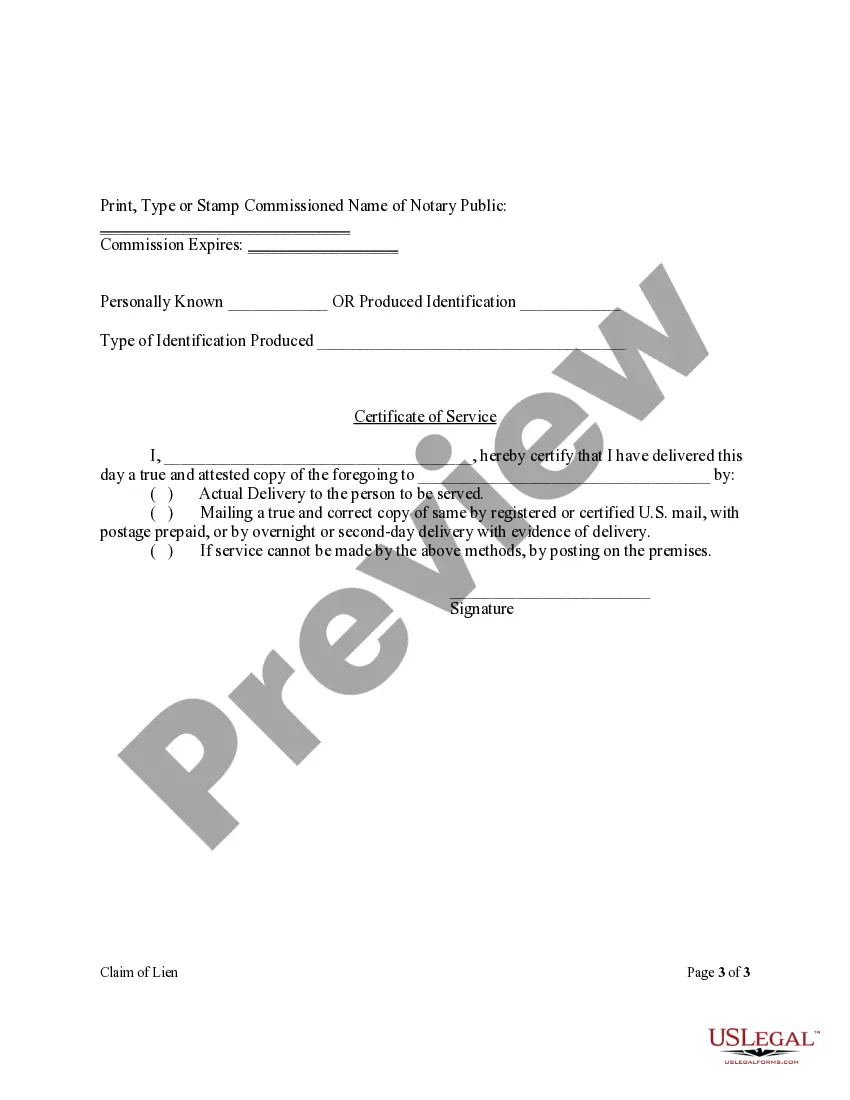

To file a lien in Florida, you generally need to prepare a written document that outlines the debt owed. This document must include the names of the parties involved and a description of the property. Once drafted, the lien must be recorded in the appropriate county clerk's office, ensuring it complies with Florida statutes governing Florida liens on real property.

In Florida, the duration of a lien on property primarily depends on its type. Generally, a judgment lien lasts for 10 years, while other liens like mortgage liens continue until the debt is satisfied. Understanding these timeframes can help property owners plan their financial obligations. Consulting resources like US Legal Forms can provide valuable information and assistance to navigate these complexities.

Yes, you can sell a house with a lien on it in Florida, but it can complicate the process. Potential buyers may hesitate if they discover existing Florida liens on real property. Often, sellers need to address liens before closing the sale to ensure a smooth transaction. This situation may require negotiation and possibly legal assistance to clear the lien.

Yes, Florida liens on real property can expire. The duration of a lien depends on the type, but generally, a judgment lien remains enforceable for up to 10 years. After this period, you may need to renew the judgment to maintain its validity. Be aware that tracking expiration dates is essential to protect your property.

A lien search in Florida typically takes anywhere from a few hours to a couple of days, depending on the resources used. If you search through county records manually, it may take longer due to the volume of information and the need for detailed examination. Using professional services like US Legal Forms can expedite the process and provide accurate results, ensuring you receive timely information about any existing Florida liens on real property.

Yes, a lien can be placed on your property in Florida without your immediate knowledge. Creditors and service providers may file liens based on unpaid debts or services rendered, which can occur without notifying the property owner. Regularly checking for Florida liens on real property can help you stay informed and take timely action to address any unexpected claims.

To find Florida liens on real property, you can start by searching the public records in the county where the property is located. Most counties provide online access to their records, allowing you to check for any filed liens by entering the property address or the owner's name. Additionally, third-party services, such as US Legal Forms, can assist you with comprehensive searches to ensure you uncover all existing liens.