Florida Form Lien Waiver

Description

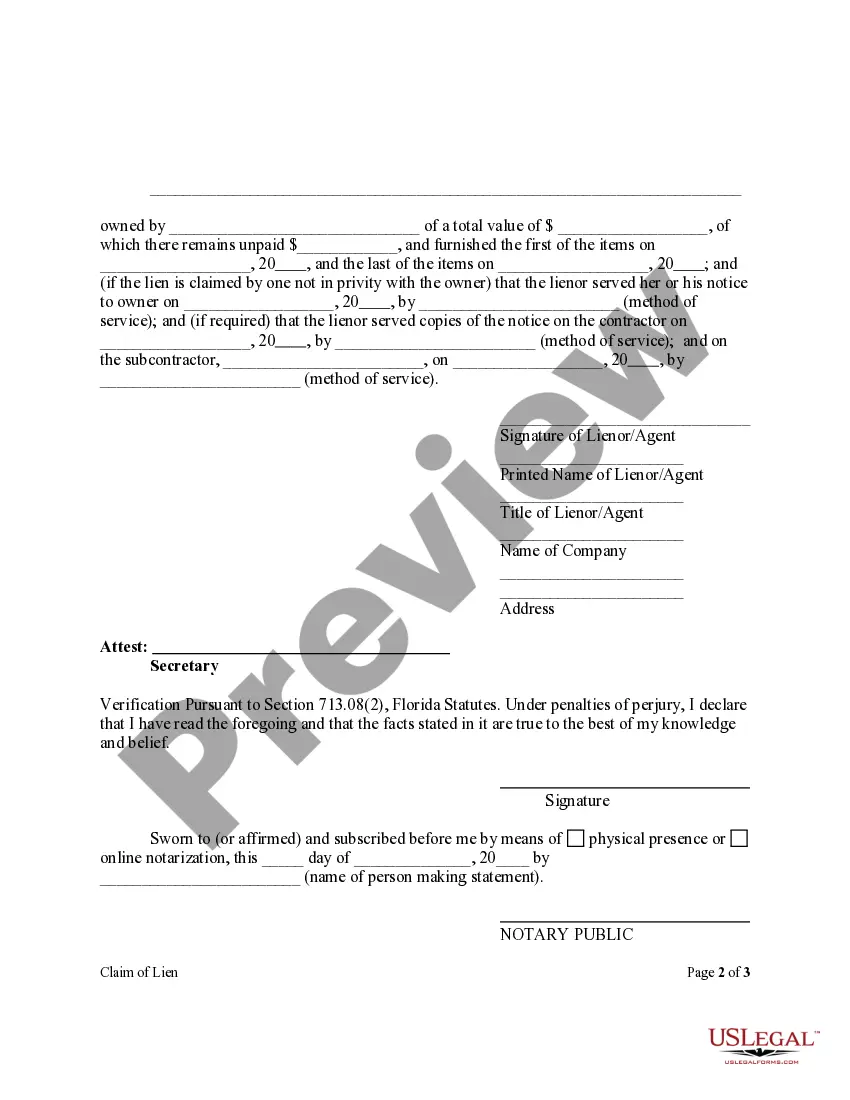

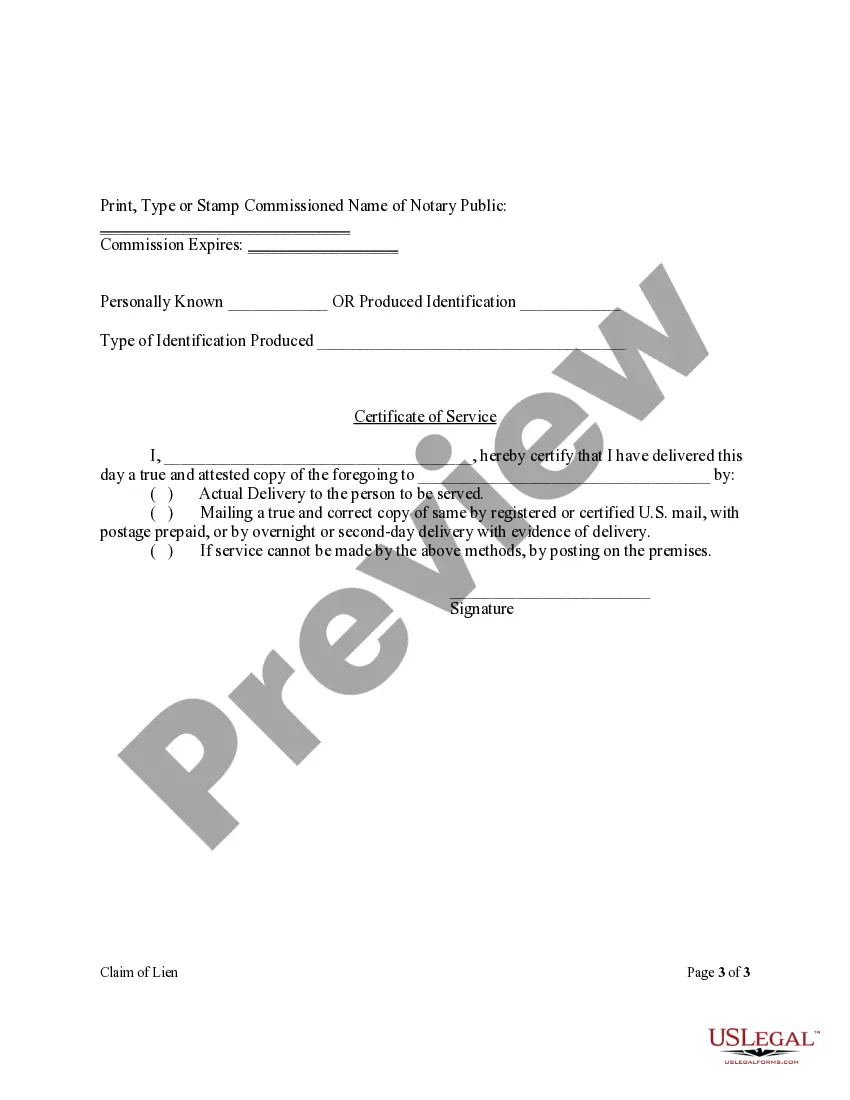

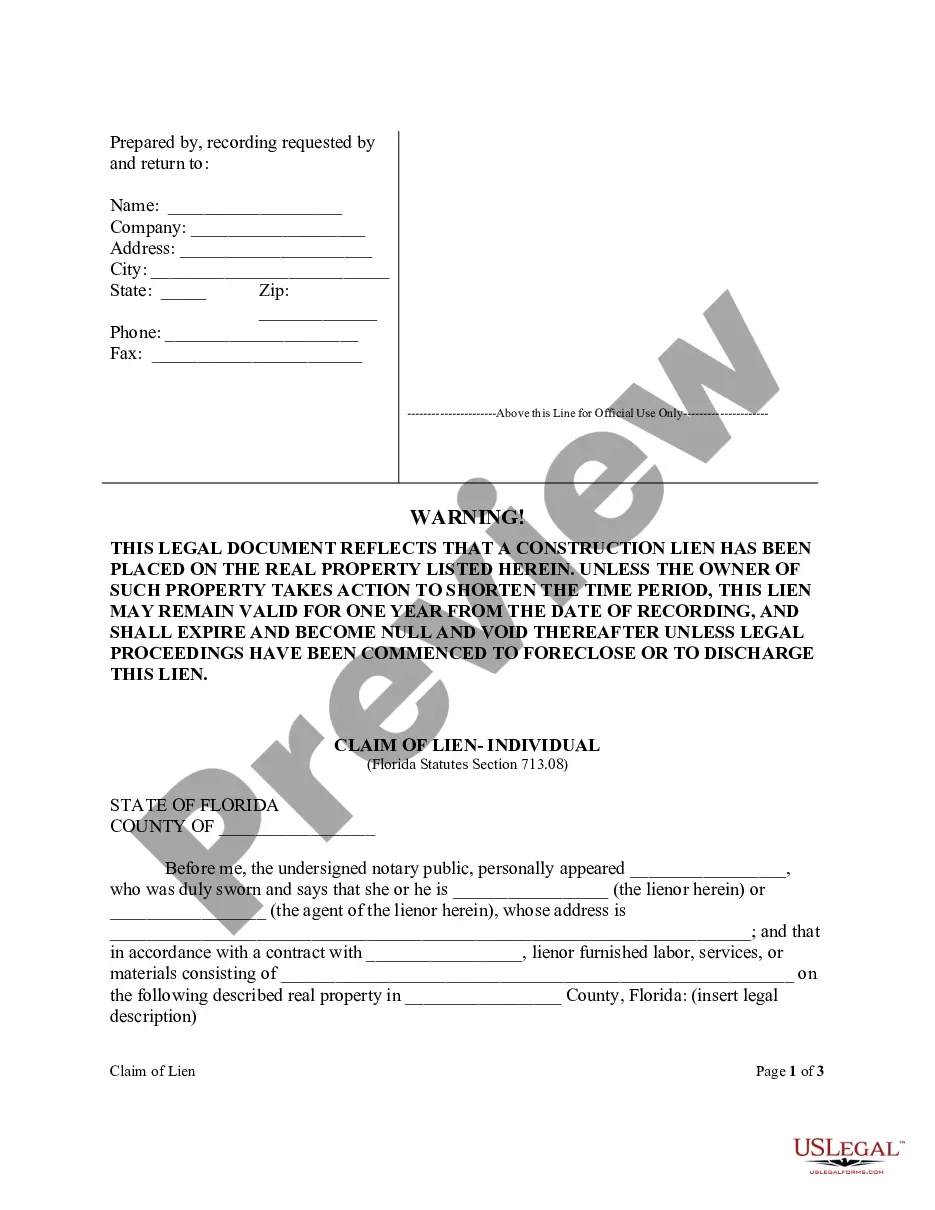

How to fill out Florida Claim Of Lien Form - Construction - Mechanic Liens - Corporation Or LLC?

Handling legal paperwork can be perplexing, even for experienced professionals.

When you seek a Florida Form Lien Waiver and lack the time to commit to finding the appropriate and updated version, the process can become overwhelming.

Utilize a valuable repository of articles, guidance, and manuals pertinent to your situation and needs.

Conserve time and effort searching for the documents you require, and leverage US Legal Forms’ enhanced search and Review tool to obtain the Florida Form Lien Waiver.

Leverage the US Legal Forms online library, supported by 25 years of expertise and trustworthiness. Transform your routine document management into a straightforward and user-friendly process today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check your My documents section to see the documents you have previously downloaded and manage your folders as desired.

- If it’s your first experience with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- After obtaining the form you need, verify that it is the correct document by previewing it and reviewing its details.

- Confirm that the template is accepted in your state or county.

- Click Buy Now when you are ready.

- Choose a subscription plan.

- Select the format you want and Download, complete, eSign, print, and deliver your document.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms addresses all your requirements, ranging from personal to business paperwork, all in one location.

- Use advanced tools to complete and manage your Florida Form Lien Waiver.

Form popularity

FAQ

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

You can check the loan documents to see whether assumptions are permitted. The loan document will typically state whether or not the loan is assumable under the "assumption clause." The terms may also appear under the "due on sale clause" if loan assumption isn't permitted.

This document was created when a mortgagee wished to recover his money, but the mortgagor could not pay it back. The mortgagee would assign the mortgage to another person, who would pay him the money he was owed.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.