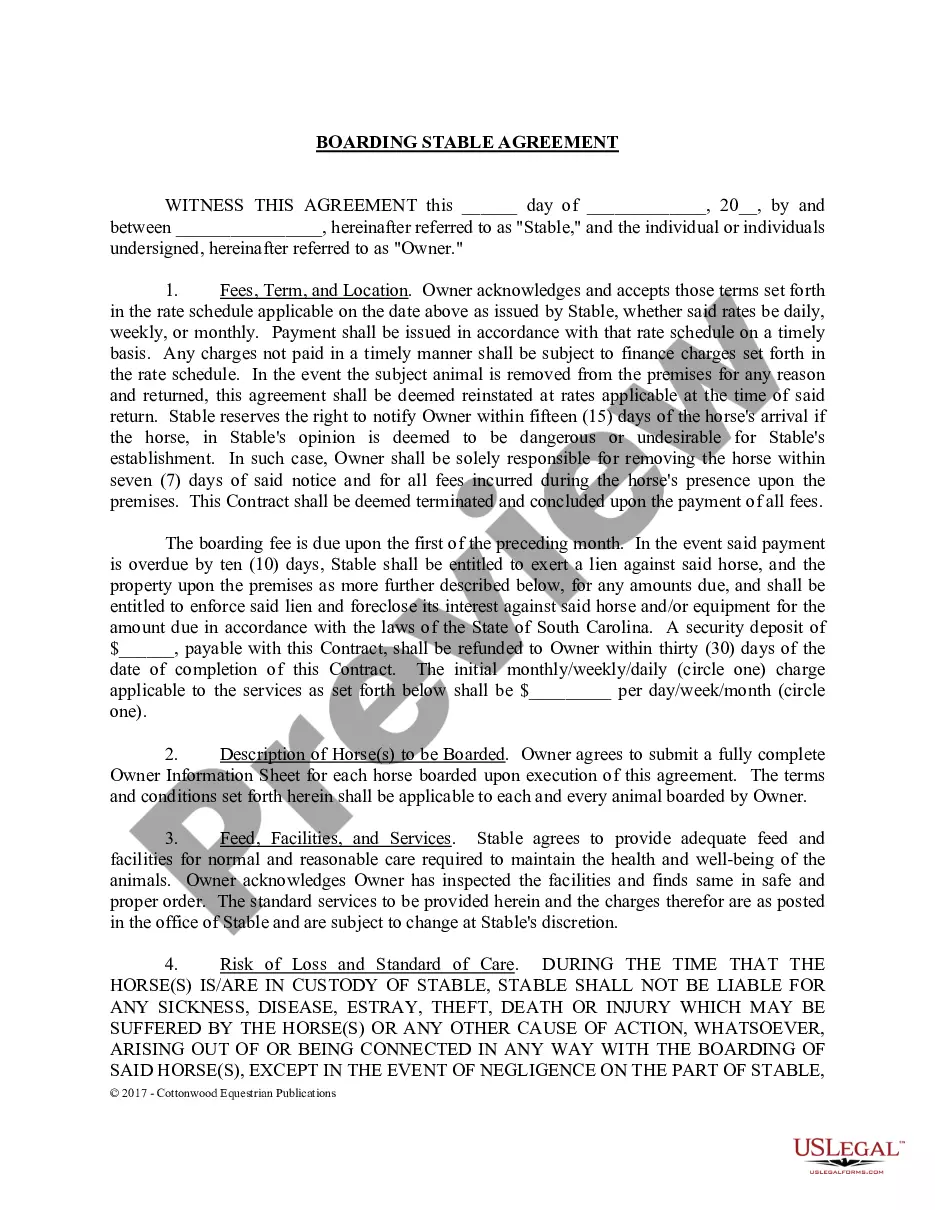

This is the Notice to Owner required to be given by liens of corporate or limited liability entities not in privity with the owner.

Sunbiz Florida File Annual Report For Llc In Illinois

Description

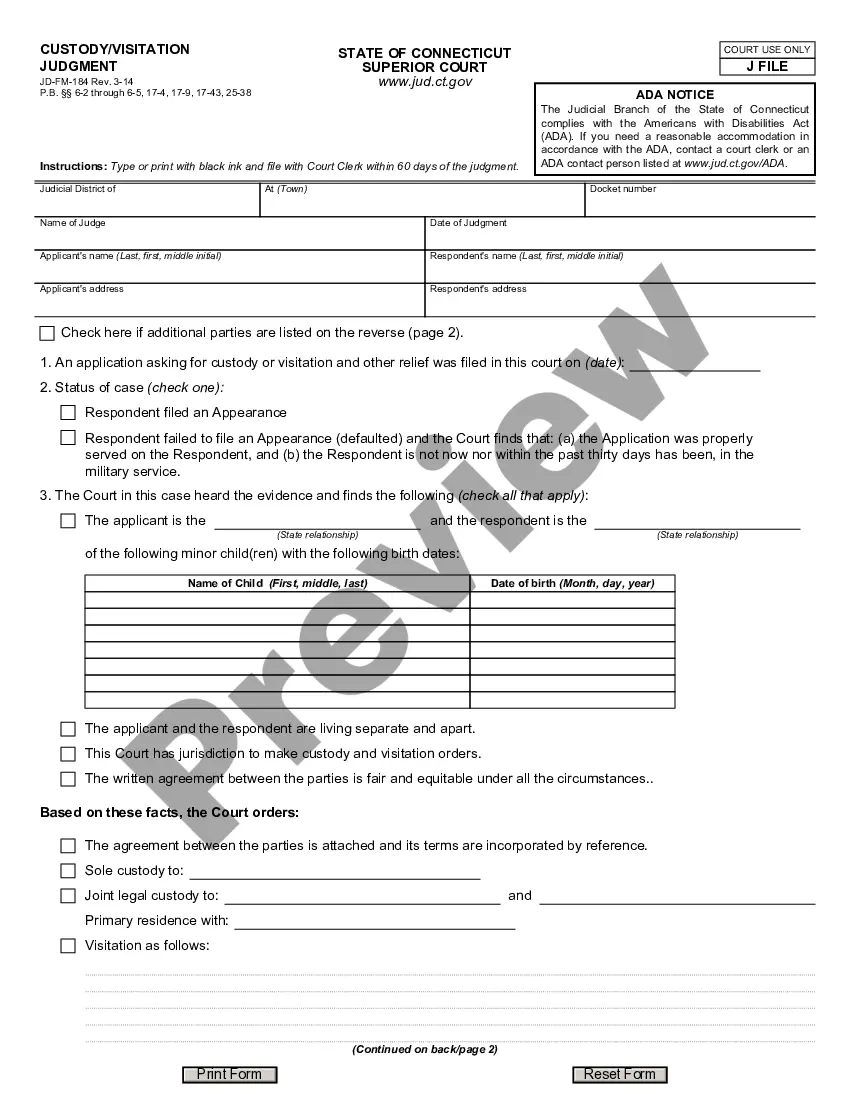

How to fill out Florida Notice To Owner Form - Construction - Mechanic Liens - Corporation?

It’s obvious that you can’t become a law expert immediately, nor can you figure out how to quickly draft Sunbiz Florida File Annual Report For Llc In Illinois without the need of a specialized set of skills. Putting together legal documents is a long process requiring a specific training and skills. So why not leave the preparation of the Sunbiz Florida File Annual Report For Llc In Illinois to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Sunbiz Florida File Annual Report For Llc In Illinois is what you’re looking for.

- Start your search again if you need any other form.

- Register for a free account and select a subscription option to buy the form.

- Choose Buy now. Once the transaction is complete, you can download the Sunbiz Florida File Annual Report For Llc In Illinois, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

After you form an LLC in Illinois, you must file an Annual Report and pay a $75 fee every year. You need to file your Annual Report in order to keep your Illinois LLC in compliance and in good standing with the Illinois Secretary of State.

Annual reports for all corporations, limited liability companies, limited partnerships and limited liability limited partnerships are due each year between January 1 and May 1. The Department of State encourages business owners to file early. Submitting your annual report on time avoids a late fee.

Annual report. Illinois requires LLCs to file an annual report during the 60-day period before the first day of the anniversary month of the incorporation date. The annual report fee is $250.

Furthermore, if you don't file your annual report by the 3rd Friday of September, the Florida Department of State will administratively dissolve your business. If you fail to file an annual report, first you will be served with a $400 penalty. If you continue to ignore the annual fee, your LLC will be dissolved.

There is a $150 one-time state filing fee to form a Limited Liability Company in Illinois. There are also ongoing filing fees (like a $75 Annual Report fee), which we discuss below.