Llc Limited Company With Ein Number

Description

How to fill out Florida Notice To Owner Form - Construction - Mechanic Liens - Corporation?

Acquiring legal document templates that comply with federal and state regulations is essential, and the web presents numerous alternatives to choose from.

However, why waste valuable time searching for the appropriate Limited Liability Company template with an EIN online when the US Legal Forms online database already compiles such templates in one location.

US Legal Forms is the largest digital legal repository featuring over 85,000 fillable templates prepared by legal professionals for various professional and personal situations. They are user-friendly, with all documents categorized by state and intended use. Our experts keep abreast of legal updates, ensuring that your form remains current and compliant when acquiring a Limited Liability Company with EIN from our site.

Once you've identified the appropriate document, click Buy Now and select a subscription plan. Create an account or Log In and complete your payment using PayPal or a credit card. Choose the correct format for your Limited Liability Company with an EIN and download it. All templates available through US Legal Forms are reusable. To redownload and fill out previously acquired documents, access the My documents section in your account. Make the most of the most comprehensive and user-friendly legal document service!

- Securing a Limited Liability Company with an EIN is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and store the document template you require in your desired format.

- If you are a newcomer to our site, follow the steps outlined below.

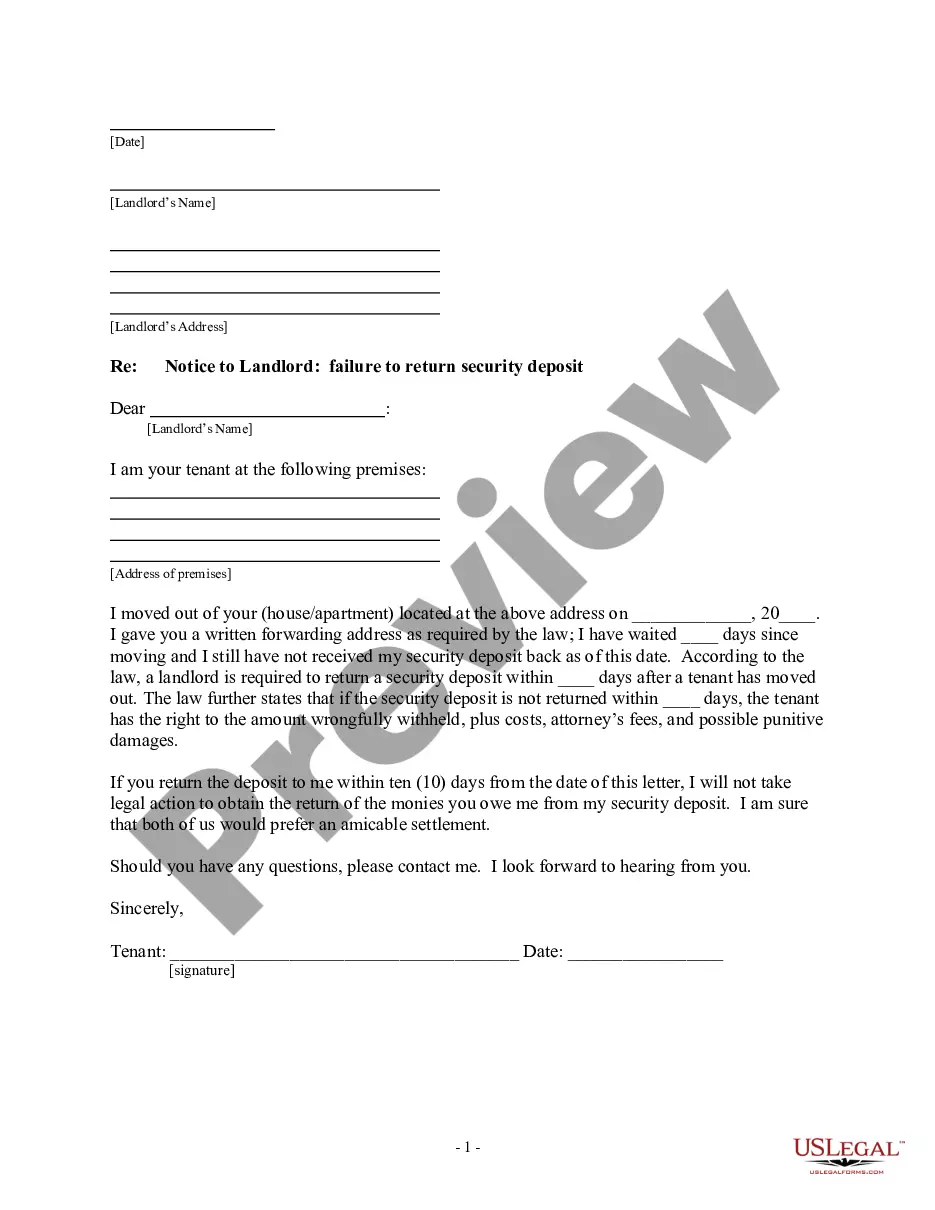

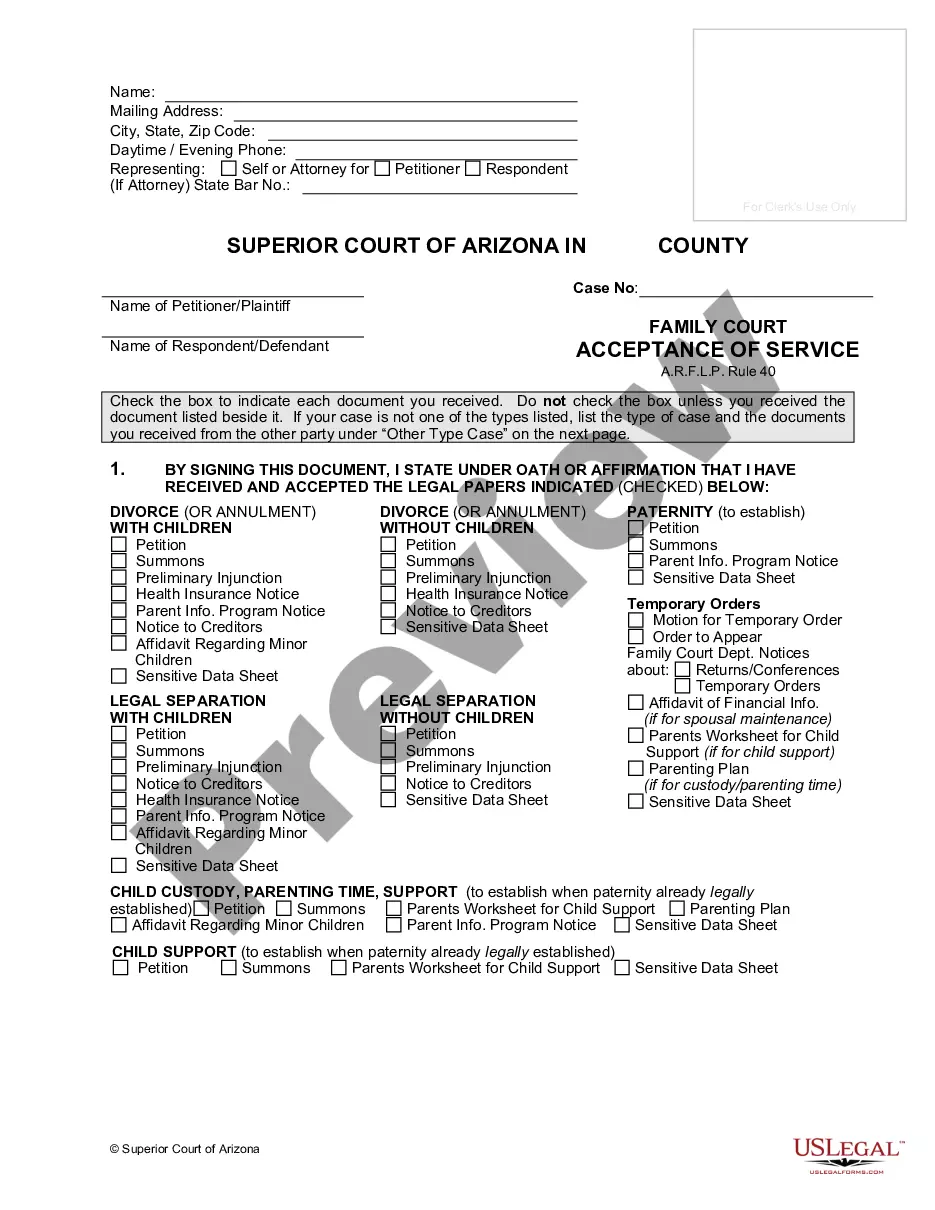

- Review the template using the Preview function or read the text description to ensure it suits your needs.

- If needed, search for an alternative template using the search feature at the top of the page.

Form popularity

FAQ

An LLC will need an EIN if it has any employees or if it will be required to file any of the excise tax forms listed below. Most new single-member LLCs classified as disregarded entities will need to obtain an EIN. An LLC applies for an EIN by filing Form SS-4, Application for Employer Identification Number.

If you are planning to start a new business and the entity being formed is a Limited Liability Company (LLC) then you will need to apply for and obtain a new EIN.

An EIN is not the same as an LLC (Limited Liability Company). An EIN, also known as a federal identification number or business tax ID, is a tax identity. The IRS assigns EINs to distinguish unique business entities, including sole proprietors, LLCs, corporations, partnerships, and nonprofit organizations.

We recommend you form your LLC before you get your EIN. One of the main reasons is that when you apply for your EIN, the IRS application asks you to submit the approved legal name of your business and the date it was formed. So, it is helpful to have your LLC formed and registered before you try to get your EIN.

What is an EIN? An Employer Identification Number (EIN) is a nine-digit number that IRS assigns in the following format: XX-X.