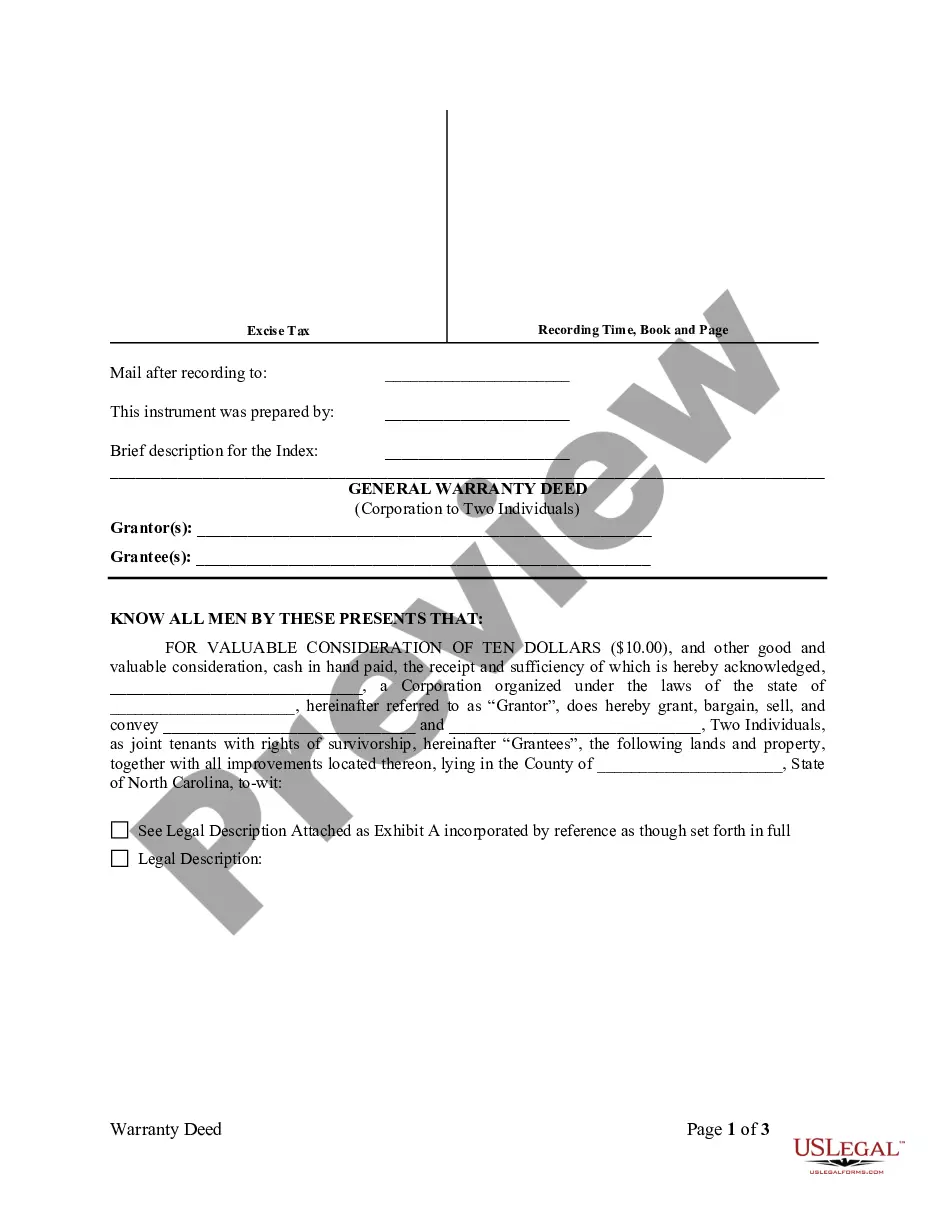

This form is an Enhanced Life Estate Deed where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to a retained enhanced life estate. Further, the Grantors retain for life the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Estate Lady Deed For Sale

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Two Individual / Husband And Wife To Individual?

Dealing with legal paperwork and procedures could be a time-consuming addition to the day. Estate Lady Deed For Sale and forms like it typically require that you look for them and navigate how to complete them correctly. For that reason, regardless if you are taking care of economic, legal, or individual matters, having a thorough and practical online catalogue of forms when you need it will go a long way.

US Legal Forms is the number one online platform of legal templates, featuring more than 85,000 state-specific forms and a variety of resources that will help you complete your paperwork quickly. Discover the catalogue of relevant papers available to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your papers managing processes with a top-notch services that lets you make any form within a few minutes without any additional or hidden charges. Simply log in to the account, find Estate Lady Deed For Sale and download it immediately within the My Forms tab. You can also access formerly downloaded forms.

Would it be the first time making use of US Legal Forms? Register and set up an account in a few minutes and you’ll get access to the form catalogue and Estate Lady Deed For Sale. Then, stick to the steps listed below to complete your form:

- Ensure you have discovered the right form by using the Review feature and looking at the form description.

- Select Buy Now as soon as ready, and choose the monthly subscription plan that suits you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience helping consumers control their legal paperwork. Find the form you need today and enhance any operation without having to break a sweat.

Form popularity

FAQ

It's generally not advisable to do this without legal expertise. The preparation of a Lady Bird deed requires a precise understanding of Florida property law and estate planning law.

Disadvantages. The downside is that property transferred via a lady bird deed will be subject to a new tax assessment that could (and often does) result in higher property taxes generally.

Transfer on death deeds cannot be signed by anyone other than the property owner. But as long as the Lady Bird deed form is signed in the presence of a licensed notary, Lady Bird deeds can be signed by the owner or the owner's agent under power of attorney.

Transfer on death deeds cannot be signed by anyone other than the property owner. But as long as the Lady Bird deed form is signed in the presence of a licensed notary, Lady Bird deeds can be signed by the owner or the owner's agent under power of attorney.

One of the significant benefits of a Lady Bird Deed is the low cost it attracts in creating it and helping your beneficiaries avoid probate court. Counties charge a recording fee, typically $30, in Michigan. You will also incur legal fees. While the cost varies, it's typically less than $500.