Quitclaim Deed Real Estate

Description

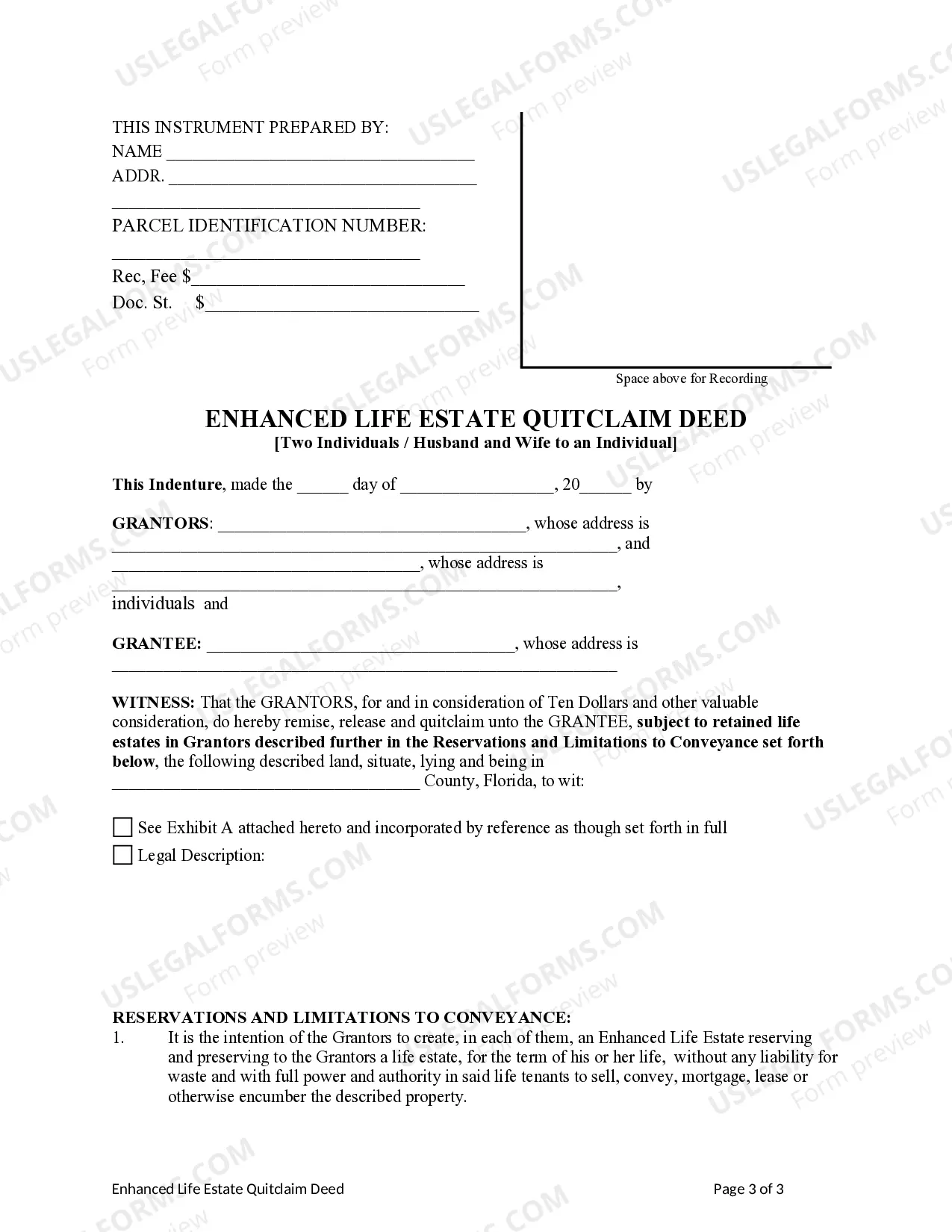

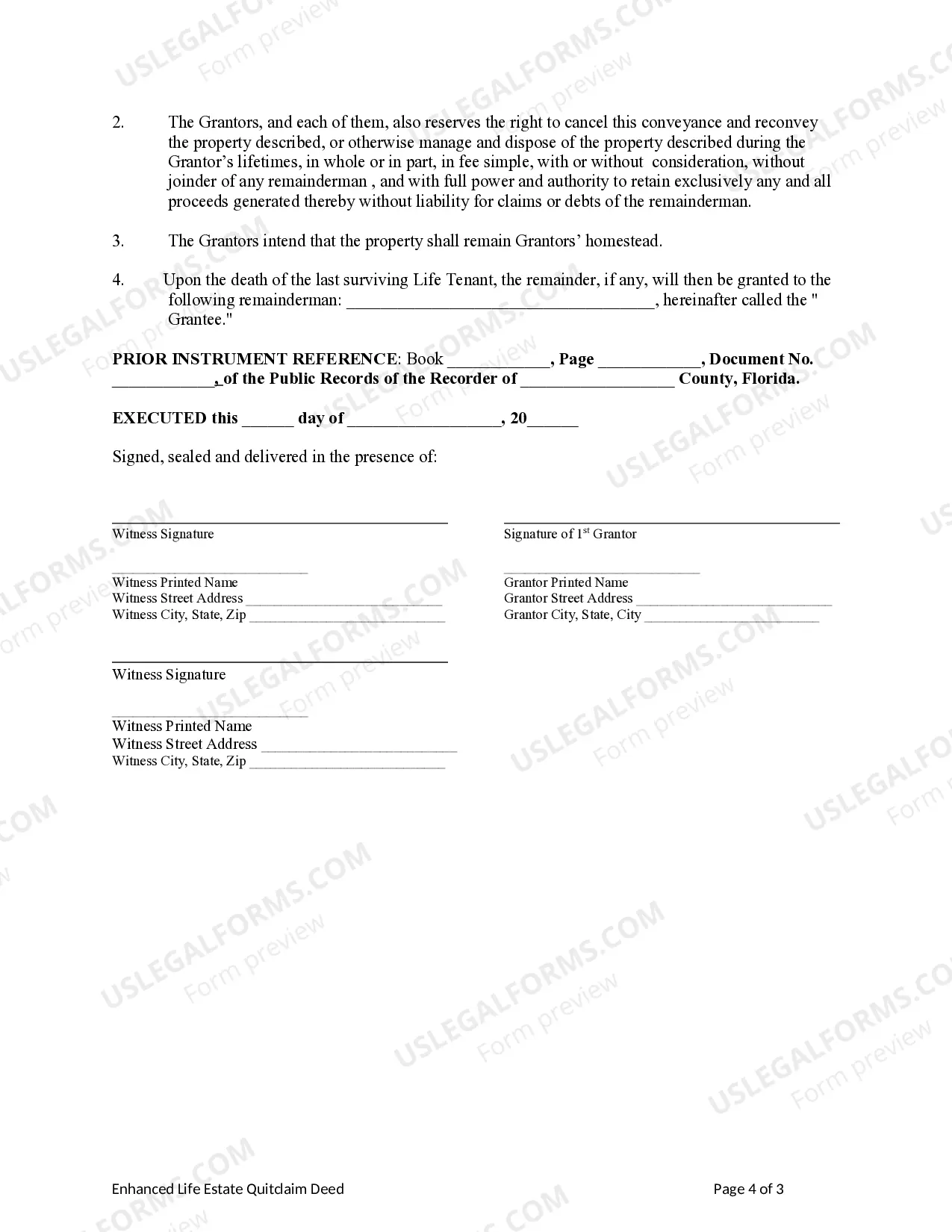

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Two Individual Or Husband And Wife To Individual?

- Log in to your US Legal Forms account if you're an existing user. Ensure your subscription is active to access your documents.

- For first-time users, visit the US Legal Forms website and familiarize yourself with the available forms. Check the preview mode to ensure you select the correct quitclaim deed that matches your local regulations.

- If necessary, utilize the Search tab to find alternative templates that meet your exact requirements.

- Once you've identified the correct form, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access all library resources.

- Complete your purchase by entering your credit card information or using PayPal for secure payment.

- Download the quitclaim deed template to your device. You can find it anytime in the My Forms section of your profile for future reference.

In conclusion, US Legal Forms provides an extensive library and expert assistance, making the process of obtaining a quitclaim deed for real estate not only easy but also efficient. Take advantage of their resources to ensure your legal documents are accurate and compliant.

Start your journey with US Legal Forms today and simplify your legal documentation process!

Form popularity

FAQ

Disadvantages of a quitclaim deed include the absence of protection for the grantee, as the deed does not guarantee that the grantor actually owns the property. This lack of assurance can lead to significant risks, including unwanted liabilities. When considering quitclaim deed real estate transactions, it is essential to evaluate your specific situation and possibly seek alternatives or legal advice to mitigate such risks.

Yes, quitclaim deeds are legal in New York. They can be used to transfer property ownership, but parties should be aware that this type of deed carries certain risks. To ensure a smoother transaction in quitclaim deed real estate, it's wise to consult with a legal professional familiar with New York's property laws.

The main disadvantage of a quitclaim deed is the lack of warranty, meaning the buyer receives no certainty regarding the title's validity. This can lead to potential legal issues if other claims are made against the property later. Additionally, quitclaim deed real estate transactions do not provide a thorough title search or protection, making it advisable to consider other options if you require a more secure transfer.

A quitclaim deed is most commonly used to transfer property ownership without guarantees. It is often utilized in real estate transactions among family members, divorcing couples, or in cases of gift transfers. By using a quitclaim deed, the grantor relinquishes any claim they might have on the property, making it a straightforward solution for clarifying ownership in quitclaim deed real estate cases.

In Georgia, you can prepare your own quitclaim deed as long as you follow the state's legal guidelines. Be sure to include necessary details such as the grantor's and grantee's information, property description, and signatures. If you need assistance, US Legal Forms offers resources that can help you navigate the process and ensure your quitclaim deed real estate is valid.

Yes, you can create a quitclaim deed yourself, especially if you understand the process and legal requirements involved. However, it is crucial to ensure that you comply with state laws and regulations governing quitclaim deed real estate. Using online platforms like US Legal Forms can simplify the process, providing templates and guidance to help you complete the deed properly.

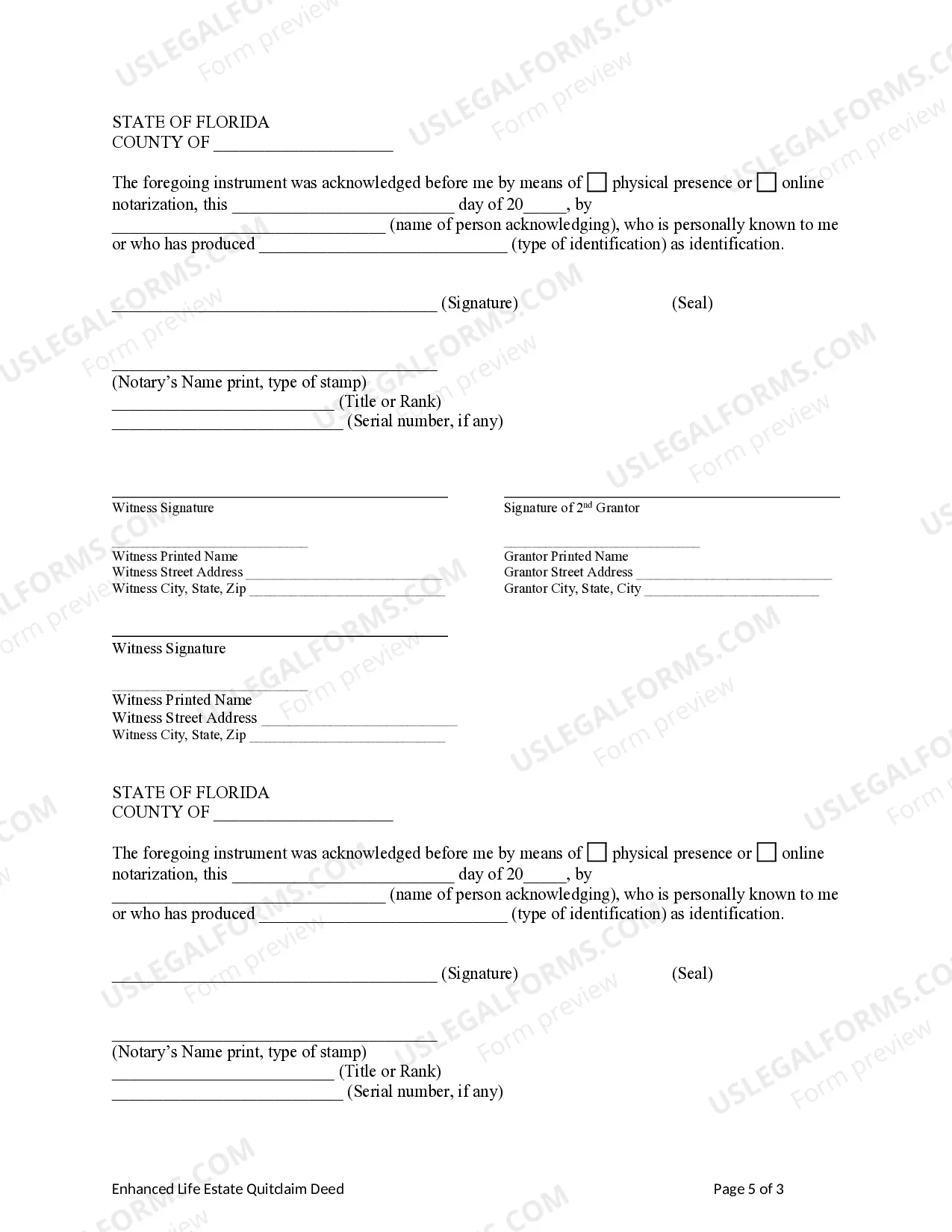

To properly fill out a quitclaim deed, start by including the names and addresses of both the grantor and grantee, as well as a proper legal description of the property. It's essential to ensure that all parties understand the implications of the transfer before signing. For those looking for guidance, US Legal Forms offers templates and resources to ensure your quitclaim deed meets all legal requirements.

Quitclaim deeds are sometimes frowned upon due to the lack of legal protection for the buyer. Without guarantees about the title, buyers may face significant risks if previous claims on the property surface. As a result, many real estate professionals recommend more secure options, suggesting that you consider the long-term implications before using a quitclaim deed.

Individuals who benefit most from a quitclaim deed are usually those involved in informal property transfers, such as family members or divorcing couples. In these situations, a quitclaim deed allows parties to quickly remove or transfer their interests in a property without engaging in lengthy processes. This straightforward approach can simplify real estate arrangements among trusted individuals.

A quitclaim deed can be considered risky because it offers no warranty on the property title. This means that if any issues arise, such as unresolved liens or claims against the property, the new owner must handle these challenges alone. Therefore, it is important to evaluate the potential risks before opting for a quitclaim deed in real estate transactions.