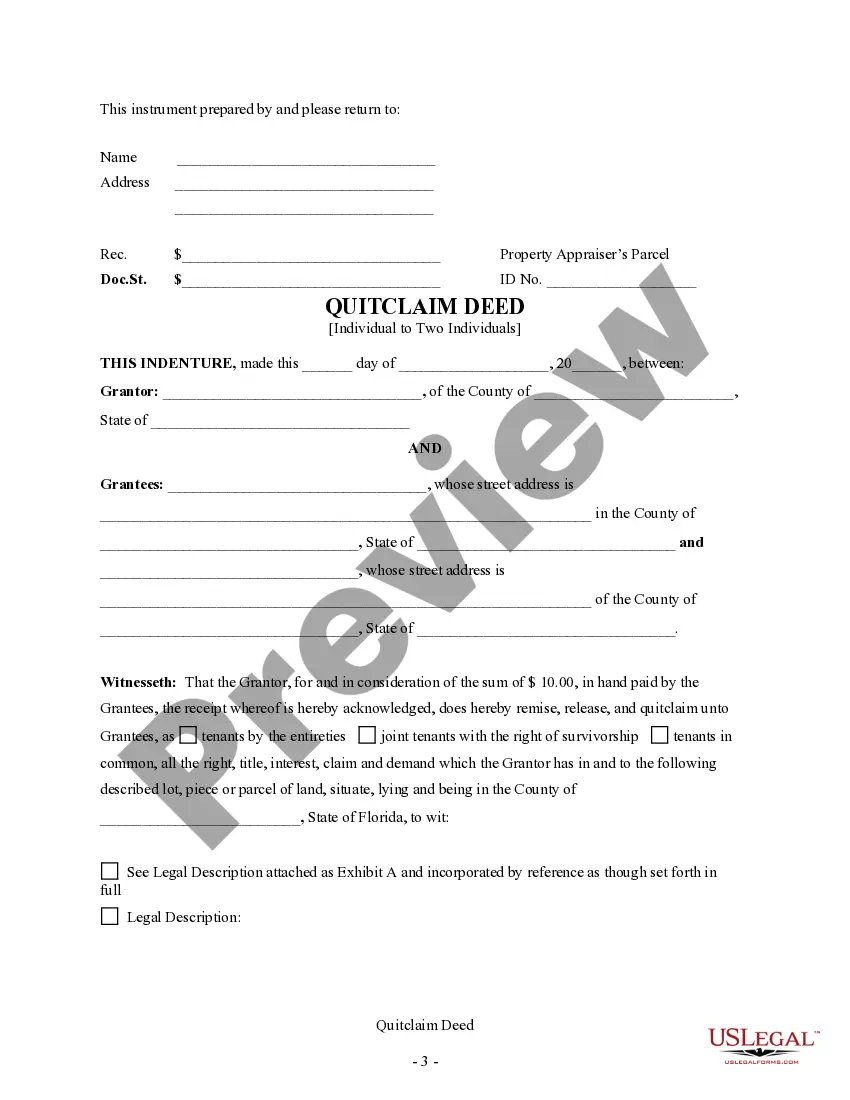

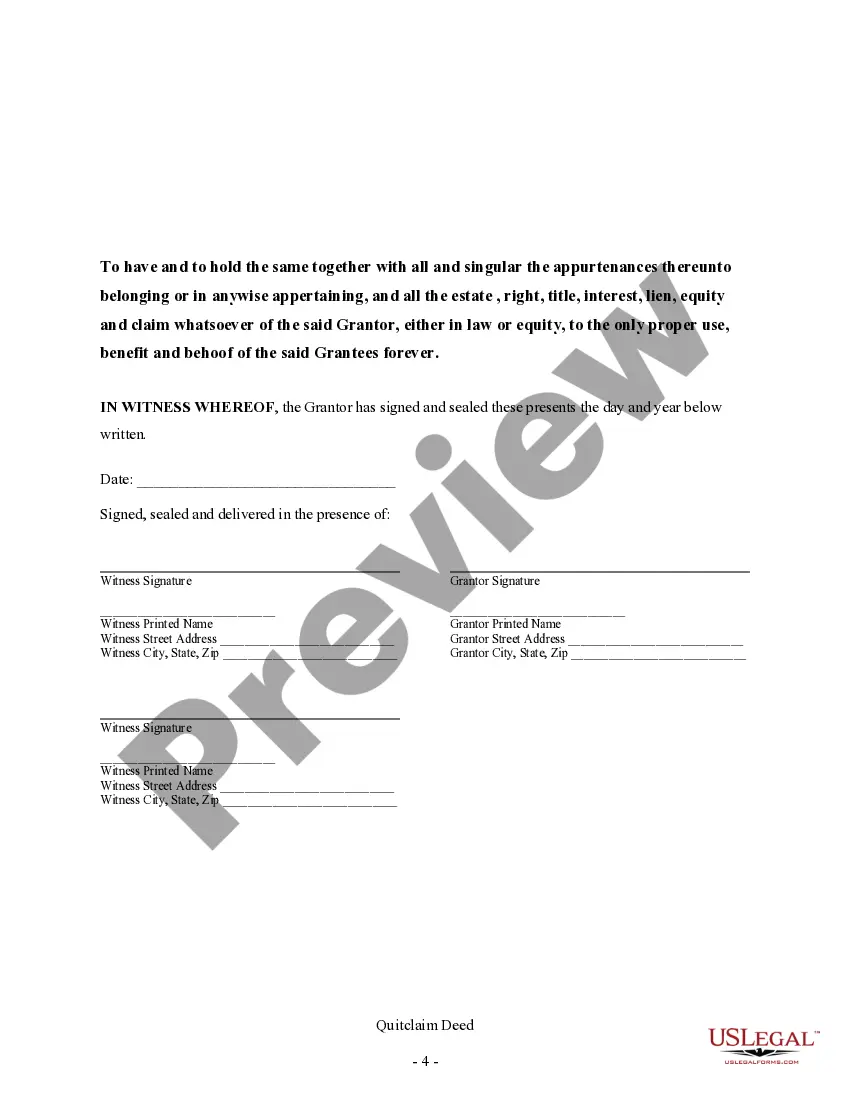

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This form complies with all state statutory laws.

Florida Deed With Right Of Survivorship

Description

How to fill out Florida Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

Navigating through the red tape of official documents and templates can be challenging, particularly when one does not engage in such tasks professionally.

Selecting the appropriate template for acquiring a Florida Deed With Right Of Survivorship can be laborious, as it must be valid and accurate down to the final digit.

However, you will need to invest noticeably less time obtaining a suitable template from a trustworthy source.

Acquire the correct document in a few straightforward steps.

- US Legal Forms is a platform that streamlines the hunt for the correct forms online.

- US Legal Forms is the singular location you require to locate the most current examples of documents, seek guidance on their use, and download these templates for completion.

- This is a repository containing over 85K documents relevant to various fields of work.

- When searching for a Florida Deed With Right Of Survivorship, you won't have to doubt its validity as all documents are verified.

- Establishing an account at US Legal Forms ensures you have all the essential samples at your fingertips.

- Archive them in your history or add them to the My documents collection.

- You can retrieve your saved forms from any device simply by clicking Log In on the library's website.

- If you don't yet have an account, you can continuously search again for the template you need.

Form popularity

FAQ

A significant disadvantage of joint ownership is the potential for conflicts between co-owners. Decisions about the property must be made collectively, which can lead to disagreements and even legal disputes. Opting for a Florida deed with right of survivorship can help mitigate those risks, as it clarifies ownership stakes and eases transitions after an owner's death.

The beneficial right of survivorship allows co-owners to inherit property automatically upon the death of another owner. This feature is integral to a Florida deed with right of survivorship, streamlining property transfers and avoiding probate. It gives you confidence that your property will be managed according to your wishes, reducing stress for your loved ones.

A quit claim deed transfers ownership without guarantees about the title, meaning you take the property as-is. In contrast, a ladybird deed, or enhanced life estate deed, allows you to retain control of your property during your lifetime while designating beneficiaries to inherit it automatically. Choosing a Florida deed with right of survivorship might be simpler for those who want clearer ownership transitions.

In the UK, the right of survivorship functions differently than in Florida. While joint ownership exists, the laws surrounding property transfer can vary. If you have a Florida deed with right of survivorship, challenges are rare, but understanding local laws is crucial if considering ownership arrangements in other countries.

Survivorship laws in Florida allow co-owners to dictate how property is transferred upon death. Specifically, a Florida deed with right of survivorship ensures that the deceased owner's share passes directly to the surviving owner. These laws aim to minimize the complexities involved in property succession, providing peace of mind for owners.

Yes, Florida recognizes survivorship deeds, which are also known as deeds with right of survivorship. This legal structure allows co-owners to automatically inherit each other’s share without going through probate. By using a Florida deed with right of survivorship, you ensure your property transfers directly to your co-owner upon your death, simplifying the process.

Joint ownership can lead to complications in property decisions, especially when co-owners have differing opinions. For instance, if one owner wants to sell and the other does not, conflicts can arise. Instead, using a Florida deed with right of survivorship provides clearer terms and facilitates smoother transitions in property ownership after one owner's passing.

Yes, one owner can lease out property that is jointly owned in Florida, but there are important considerations. When you hold the property as joint tenants with right of survivorship, each owner has equal rights to the property. Thus, it is best to communicate with fellow owners before proceeding with any lease agreements. Using resources like US Legal Forms can help in drafting leases that respect joint ownership rights.

To add a family member to a property title in Florida, you will need to create a new Florida deed with right of survivorship. This requires preparing a new deed that names both you and the new owner as joint tenants with the right of survivorship. Ensure that you properly execute and record the deed with the county clerk. Using a platform like US Legal Forms can simplify this process, offering templates and guidance tailored to your needs.

In Florida, a surviving spouse does not automatically inherit everything unless specifically stated in a valid will or a Florida deed with right of survivorship. However, Florida law provides certain protections that offer a surviving spouse a share of the deceased spouse's estate. To clarify any inheritance rights or ensure specific arrangements, consulting an estate planning professional can be beneficial.