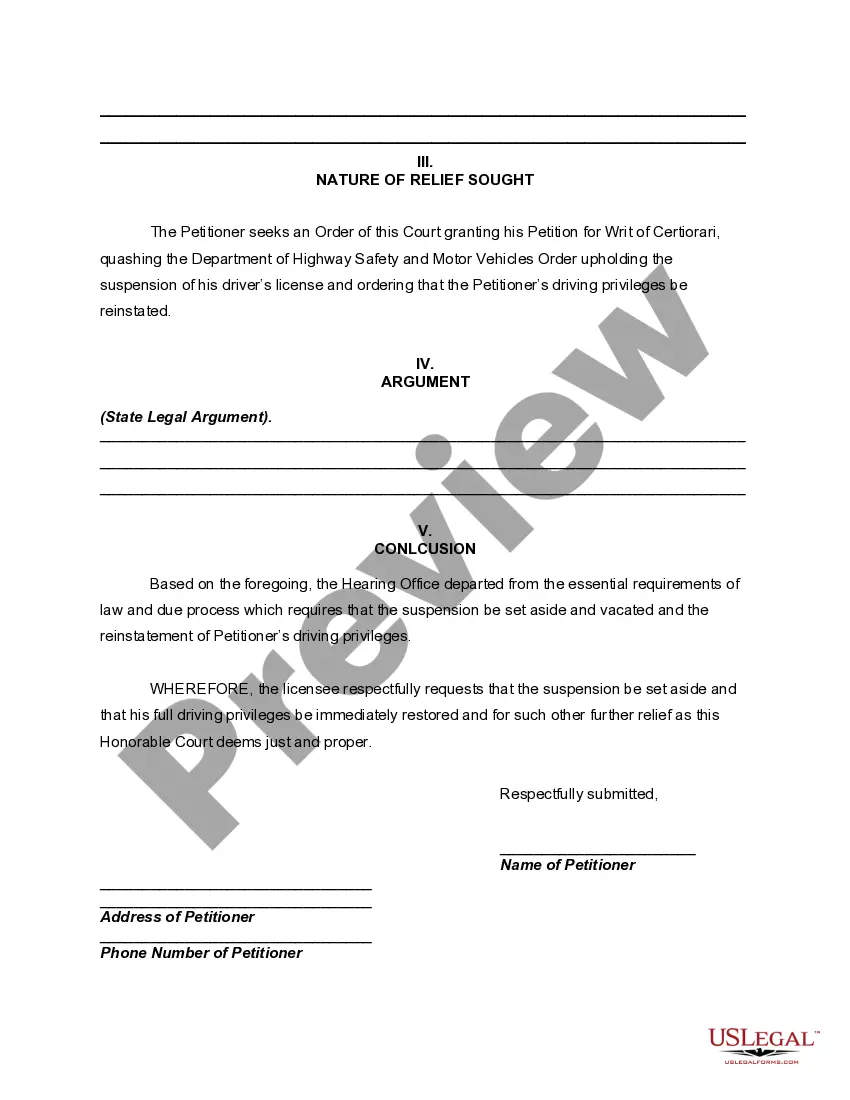

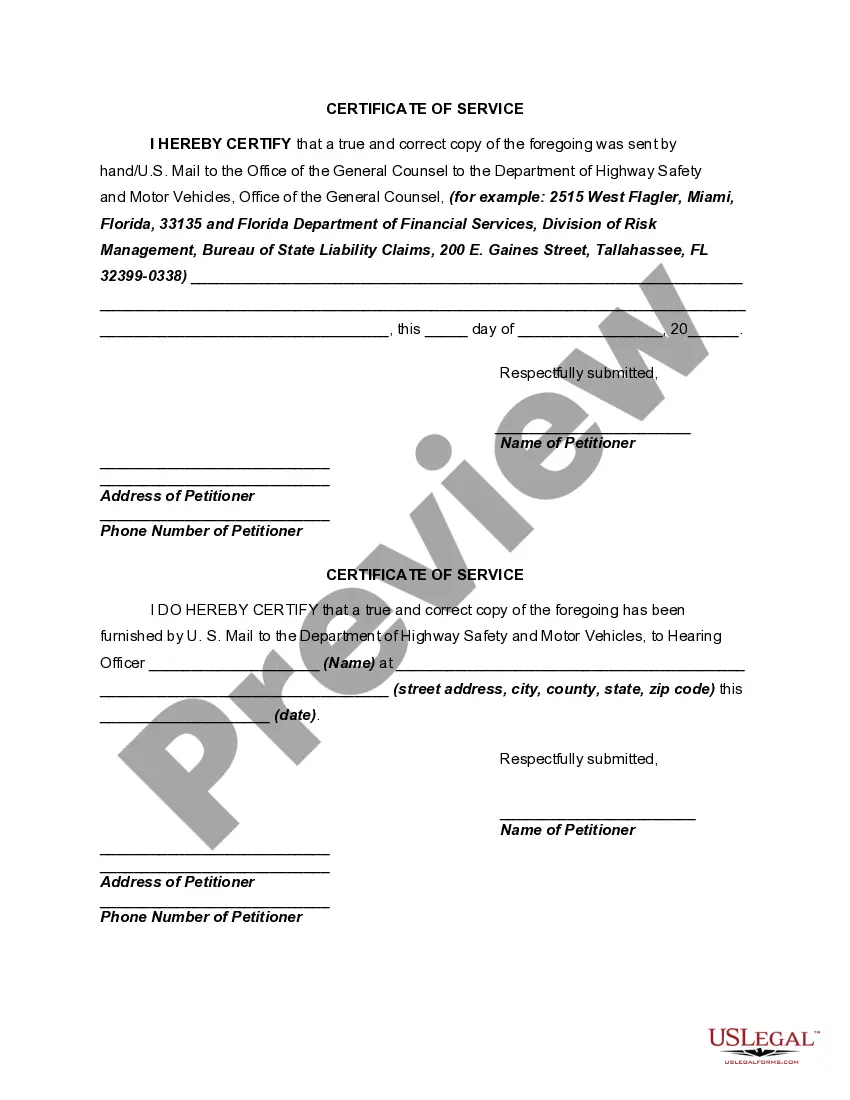

Writ Of Certiorari Form With Example

Description

How to fill out Florida Writ Of Certiorari And Appeal Of License Suspension?

Whether for commercial reasons or personal matters, everyone must encounter legal circumstances at some point in their life.

Filling out legal documents requires meticulous focus, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the suitable form for any situation.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to ensure it fits your needs, state, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Writ Of Certiorari Form With Example template you need.

- Acquire the template when it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate payment option.

- Fill out the profile registration form.

- Select your payment method: use a credit card or PayPal.

- Choose the file format you desire and download the Writ Of Certiorari Form With Example.

- Once it is downloaded, you can complete the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

Even if the original note is lost, the other original documents or the copies can be used to establish the existence of the loan. You may want to hire an online service provider to assist you in preparing the replacement promissory note, as well as the Affidavit of Lost Promissory Note and Indemnity Agreement.

3 Year Statute of Limitations on Most Debts in North Carolina. In North Carolina, Section 1-52.1 of the North Carolina Rules of Civil Procedure explains the statute of limitations for debts is 3 years for auto and installment loans, promissory notes, and credit cards.

A standard promissory note includes the following: The principal amount, Interest rate (if any), Issuing location and date, Maturity date, and. Drawer's signature.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on ?Completed Master Promissory Notes? under the menu bar heading that says ?My Loan Documents.? The completed Master Promissory Notes will appear, and you can download them directly.

How to get your federal student loan documents. The Department of Education has copies of all of your master promissory notes you signed so you could get your federal student loans. You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID.

The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information: The total amount of money borrowed; Your interest rate (either fixed or adjustable);

Your lender will keep the original promissory note until your loan is paid off. When you close, you'll also receive a copy of your mortgage and promissory note and the remainder of your closing documents.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.