Motion To Reopen Case Florida Sample For Divorce

Description

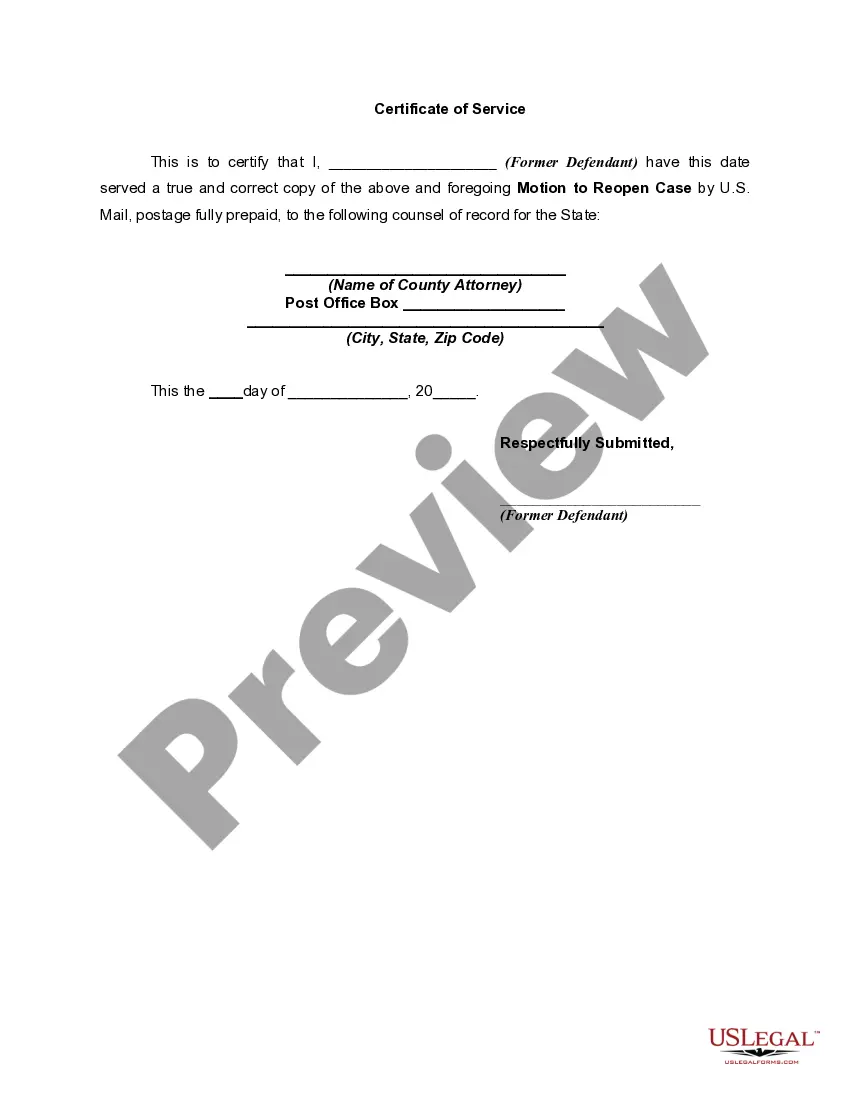

How to fill out Florida Motion To Reopen Case In Order To Acquire Copies Of Pleadings?

It’s widely acknowledged that achieving expertise in law is not instantaneous, and you also cannot easily learn how to swiftly draft Motion To Reopen Case Florida Sample For Divorce without possessing a unique set of competencies.

Creating legal paperwork is a labor-intensive endeavor that necessitates particular education and proficiency. Therefore, why not entrust the drafting of the Motion To Reopen Case Florida Sample For Divorce to the experts.

With US Legal Forms, one of the most comprehensive legal document collections, you can locate anything from court documents to office communication templates. We recognize the significance of compliance with federal and state laws and regulations. That’s why all templates on our website are tailored to specific locations and consistently updated.

Select Buy now. Once your payment is processed, you can download the Motion To Reopen Case Florida Sample For Divorce, fill it out, print it, and deliver it to the relevant parties or entities.

You can regain access to your documents anytime from the My documents section. If you’re a current customer, simply Log In to find and download the template from the same section. Regardless of the purpose of your forms—whether financial, legal, or personal—our site has you covered. Experience US Legal Forms today!

- Begin by visiting our website to acquire the document you need in just a few moments.

- Utilize the search function at the top of the page to find the form you require.

- If available, preview the form and read the accompanying description to ascertain if Motion To Reopen Case Florida Sample For Divorce is what you are looking for.

- If you need another template, start your search again.

- Register for a complimentary account and select a subscription plan to purchase the template.

Form popularity

FAQ

The South Carolina Department of Revenue Oct. 19, 2022 released Form I-385, 2022 Motor Fuel Income Tax Credit. The individual income, corporate income, and excise tax form is for resident taxpayers who are eligible for the tax credit. The form provides a chart to determine eligibility for the tax credit.

Registering a DBA in South Carolina is not a requirement to do business in the state. However, it does help with some business transactions, particularly banking. It is a somewhat complicated process, because DBAs are registered in South Carolina by county, and not with the state itself.

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

Step 3 ? Pay South Carolina DBA filing fees The DBA cost for LLCs, incorporations, and LLPs is $10. Your South Carolina DBA expires every five years and requires renewal. The fictitious business name renewal fee is $10.

There isn't a requirement in South Carolina for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.

Under North Carolina law, any business that seeks to use a name other than the name of its owners, or other than the name under which it was formed must file for a DBA. Specifically, such businesses will need to file official paperwork in the office of the register of deeds of such county where the business is located.

South Carolina businessfilings.sc site maintains a database of corporations that are registered in the state of South Carolina. The database maintains a list of active and expired businesses that is free for the public to search.

This is often called filing for a DBA, or doing business as. For example, if ?ABC Company, LLC? wants to do business as ?Best Hot Dogs in Town? then the owners may have to file a DBA. Generally speaking, South Carolina does not require the registration of a DBA.