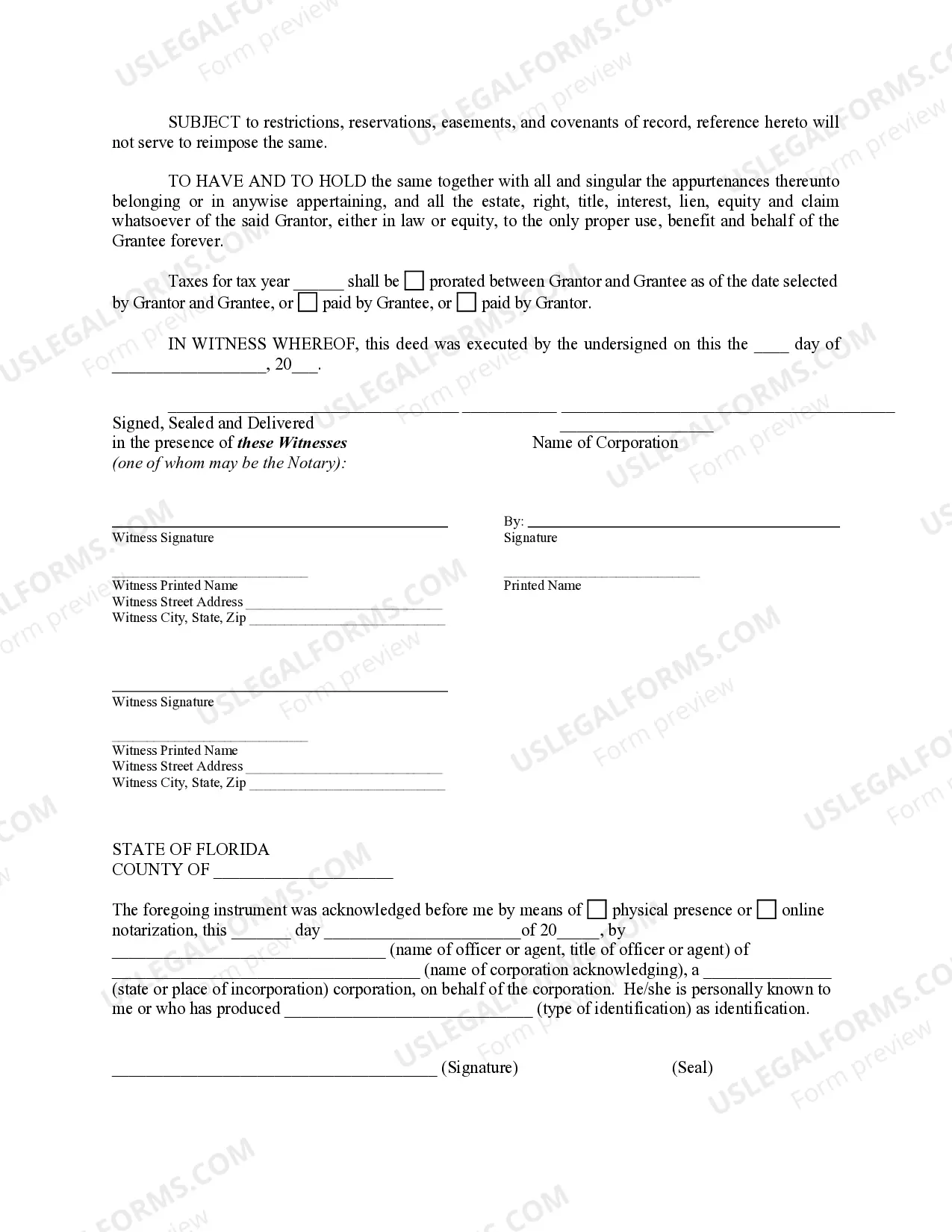

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Quitclaim Deed Florida Joint Tenancy With Right Of Survivorship

Description

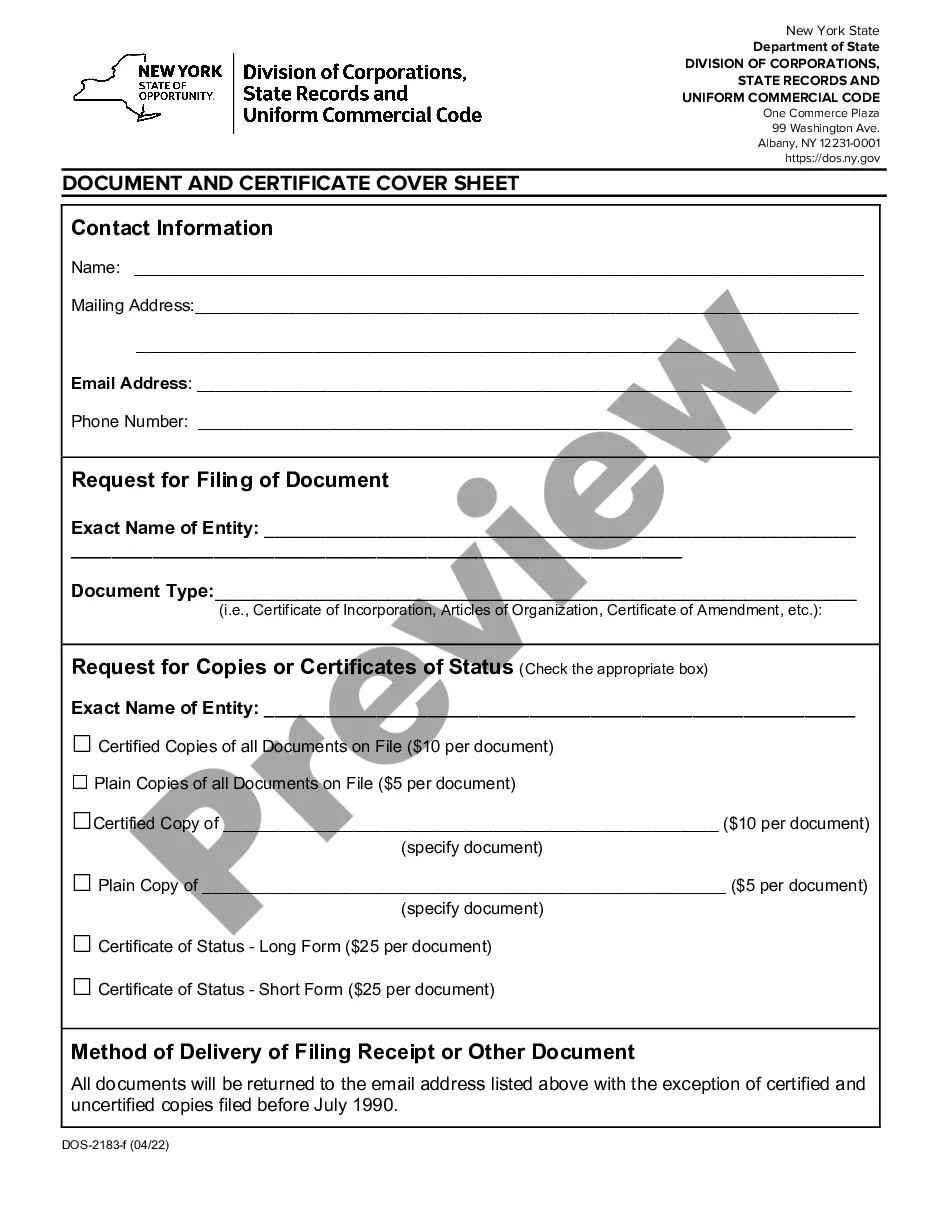

How to fill out Florida Quitclaim Deed From Corporation To Individual?

There's no longer a necessity to spend extensive hours searching for legal documents to comply with your local state regulations.

US Legal Forms has gathered all of them in a single location and simplified their access.

Our site provides over 85,000 templates for any business and personal legal situations organized by state and usage area.

Using the Search bar above to find another template if the current one does not suit you, click Buy Now next to the template title when you identify the appropriate one. Choose the most suitable pricing plan and create an account or Log In. Complete your subscription payment with a credit card or PayPal to proceed. Choose the file format for your Quitclaim Deed Florida Joint Tenancy With Right Of Survivorship and download it to your device. Print your form to complete it in writing or upload the sample if you prefer to utilize an online editor. Preparing official documents under federal and state laws is quick and simple with our platform. Explore US Legal Forms today to keep your documentation organized!

- All forms are professionally crafted and validated for authenticity, ensuring you receive an up-to-date Quitclaim Deed Florida Joint Tenancy With Right Of Survivorship.

- If you are familiar with our service and already possess an account, be sure to verify your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all purchased documents at any time by accessing the My documents tab in your profile.

- If you've never utilized our service before, the process will involve a few additional steps.

- Here's how new users can find the Quitclaim Deed Florida Joint Tenancy With Right Of Survivorship in our directory.

- Review the page content carefully to ensure it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

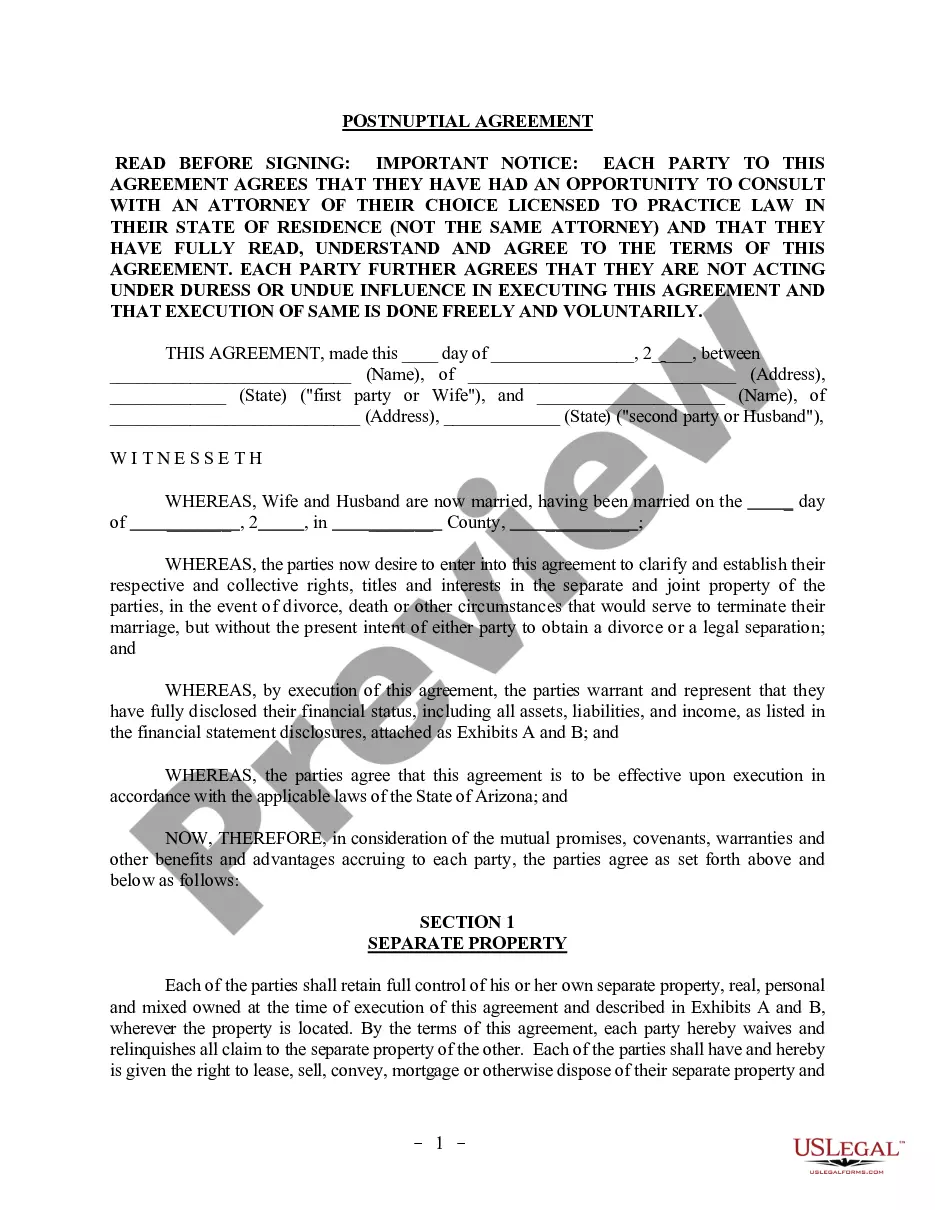

A quitclaim deed and a ladybird deed serve different purposes in Florida real estate. A quitclaim deed transfers ownership immediately without retaining any control, while a ladybird deed allows the current owner to retain ownership and control during their lifetime, with automatic transfer to beneficiaries upon death. This distinction makes the ladybird deed particularly suitable for estate planning. When considering options, US Legal Forms can facilitate understanding these differences and choosing the right deed.

In Florida, a joint tenant with right of survivorship denotes a shared ownership of property where all tenants have an equal stake. This means that if one tenant dies, their ownership interest automatically passes to the remaining tenants, bypassing probate. This arrangement provides financial security and peace of mind for property owners. It's an ideal setup for couples and close family members wanting to protect their interests.

A quitclaim deed joint tenancy with right of survivorship in Florida is a legal document that transfers ownership of property to two or more individuals, where they have equal rights to the property. With this arrangement, when one owner passes away, their share automatically goes to the surviving owners. This deed is particularly advantageous for avoiding probate delays and expenses. Using US Legal Forms can help streamline the drafting process for such vital documents.

Individuals transferring property between family members typically benefit the most from a quitclaim deed. This type of deed is effective for conveying ownership without the need for a formal sale or appraisal. For instance, parents often use a quitclaim deed to transfer property to their children while retaining certain rights. In situations like these, a quitclaim deed in Florida, especially in joint tenancy with right of survivorship, simplifies the process.

To terminate a joint tenancy with right of survivorship in Florida, one of the joint tenants must take action to sever the joint tenancy. This can be accomplished by filing a quitclaim deed that indicates the intent to terminate the joint tenancy. Alternatively, mutual agreement among all parties involved can also lead to a change in ownership structure. It is advisable to consult legal resources like US Legal Forms for accurate documentation.

Yes, Florida recognizes joint tenancy with right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the surviving tenant. This arrangement provides a seamless transfer of assets without the need for probate, making it a popular choice for couples and family members. Utilizing a quitclaim deed in Florida is commonly how individuals establish this form of ownership.

In Florida, if one spouse signs a quitclaim deed transferring their interest in the property, that interest is relinquished. However, the other spouse typically retains their rights to the property unless stated otherwise. It's crucial to understand the implications of signing a quitclaim deed, as this can affect ownership rights. Consulting resources like USLegalForms can provide clarity on how to handle property rights post-deed.

To break a joint tenancy with right of survivorship in Florida, all parties must agree to the termination, or one can file a lawsuit seeking partition. This legal action can divide the property or force a sale, allowing each party to receive their fair share. Alternatively, a joint tenant may transfer their interest through a quitclaim deed, effectively ending the joint ownership. If you're considering this option, it's useful to explore how a quitclaim deed in Florida can fit your needs.

Yes, a joint tenant in Florida can sell their share of the property, but this action may affect the joint tenancy arrangement. If one owner sells their portion, the property may become a tenancy in common, which does not provide the right of survivorship. Therefore, both owners should communicate before any sale to avoid misunderstandings. Consulting a legal professional can guide you through the implications of using a quitclaim deed in Florida in such situations.

In Florida, when a property is held in joint tenancy with right of survivorship, the surviving owner automatically inherits the deceased owner's share. This means that the property does not go through probate and transfers directly to the surviving owner. This simplifies the transfer process and ensures that the property remains within the family. Understanding this process can help you decide if a quitclaim deed in Florida is the right choice for your joint ownership situation.