Florida Corporations With Credit Package

Description

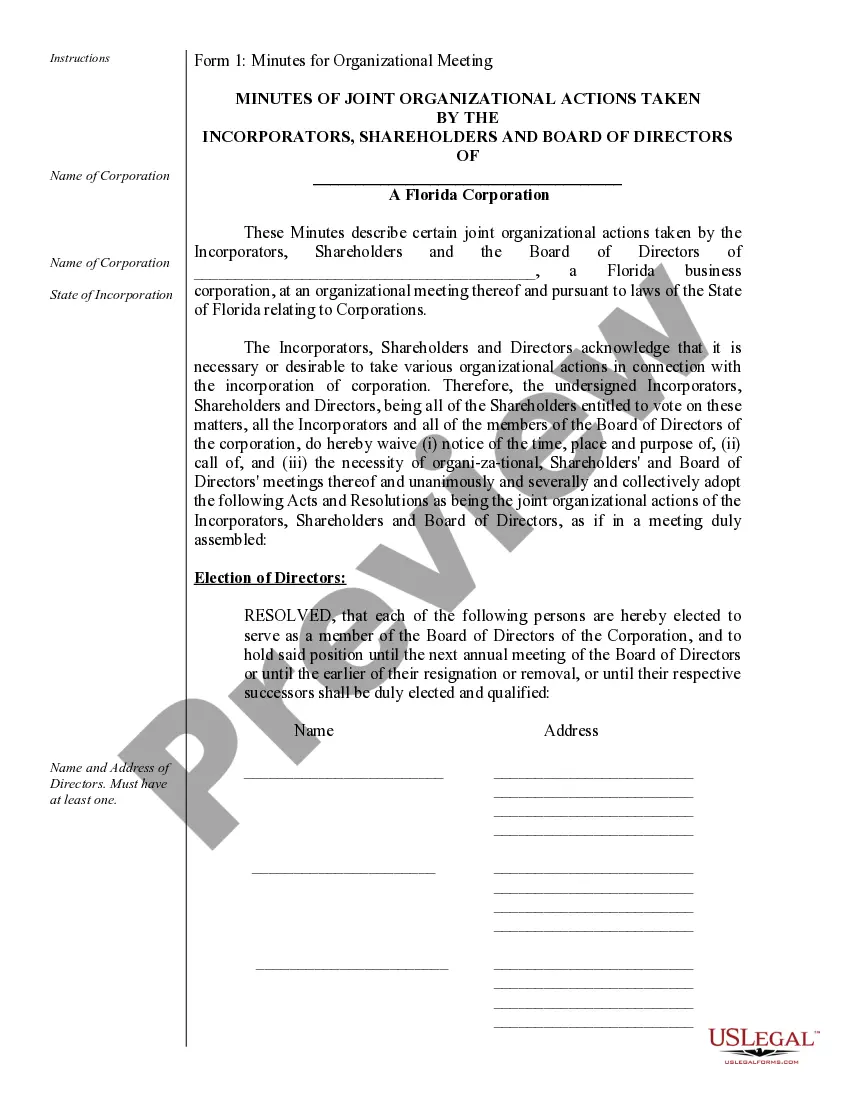

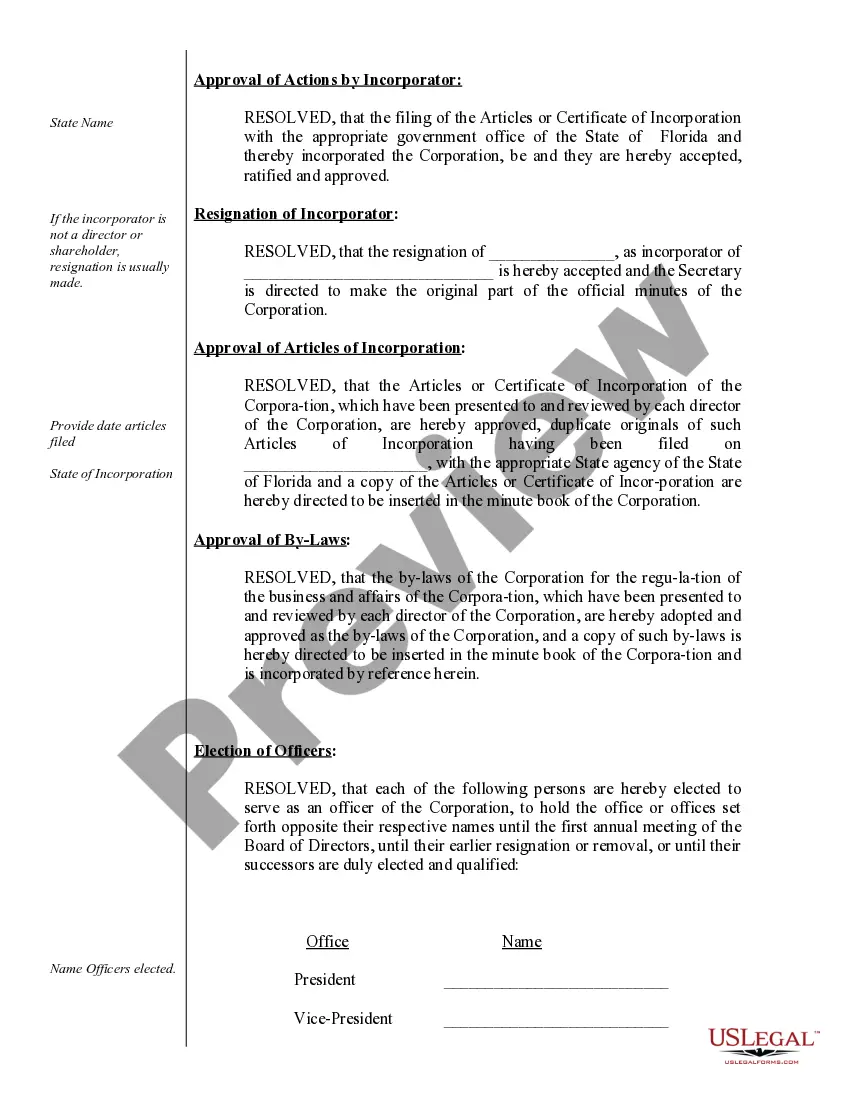

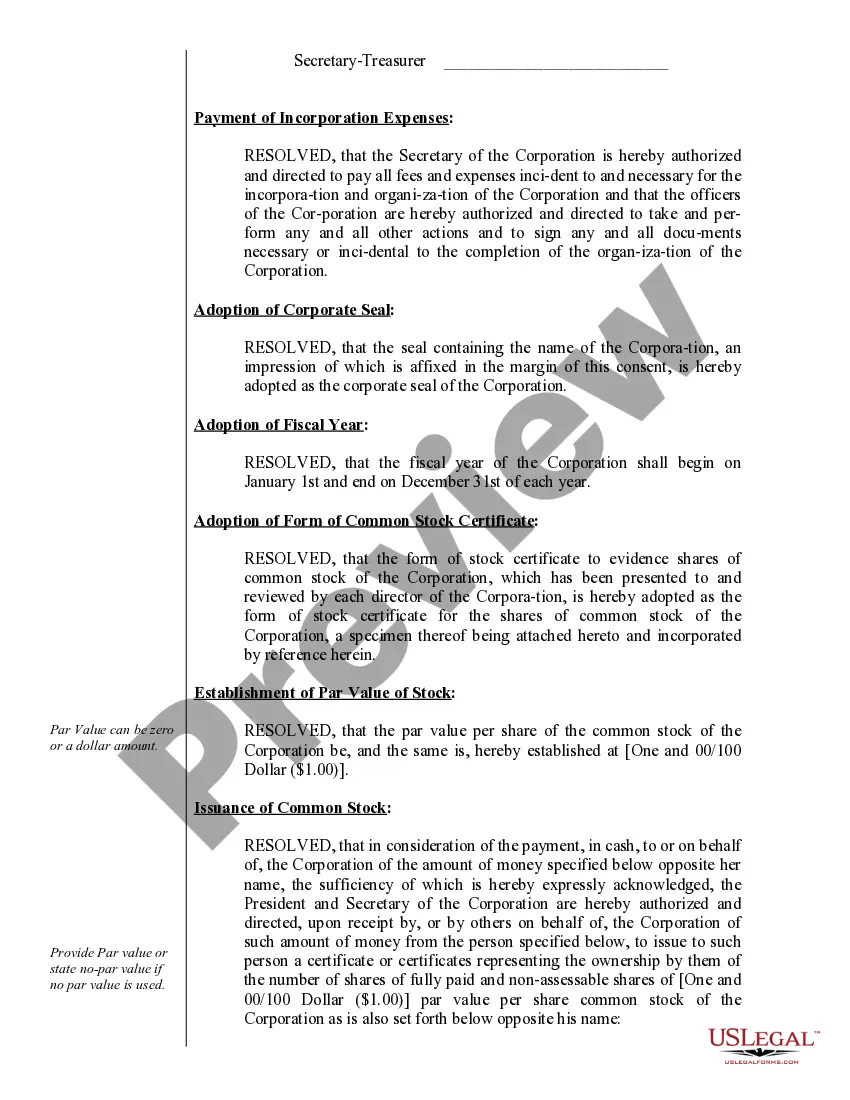

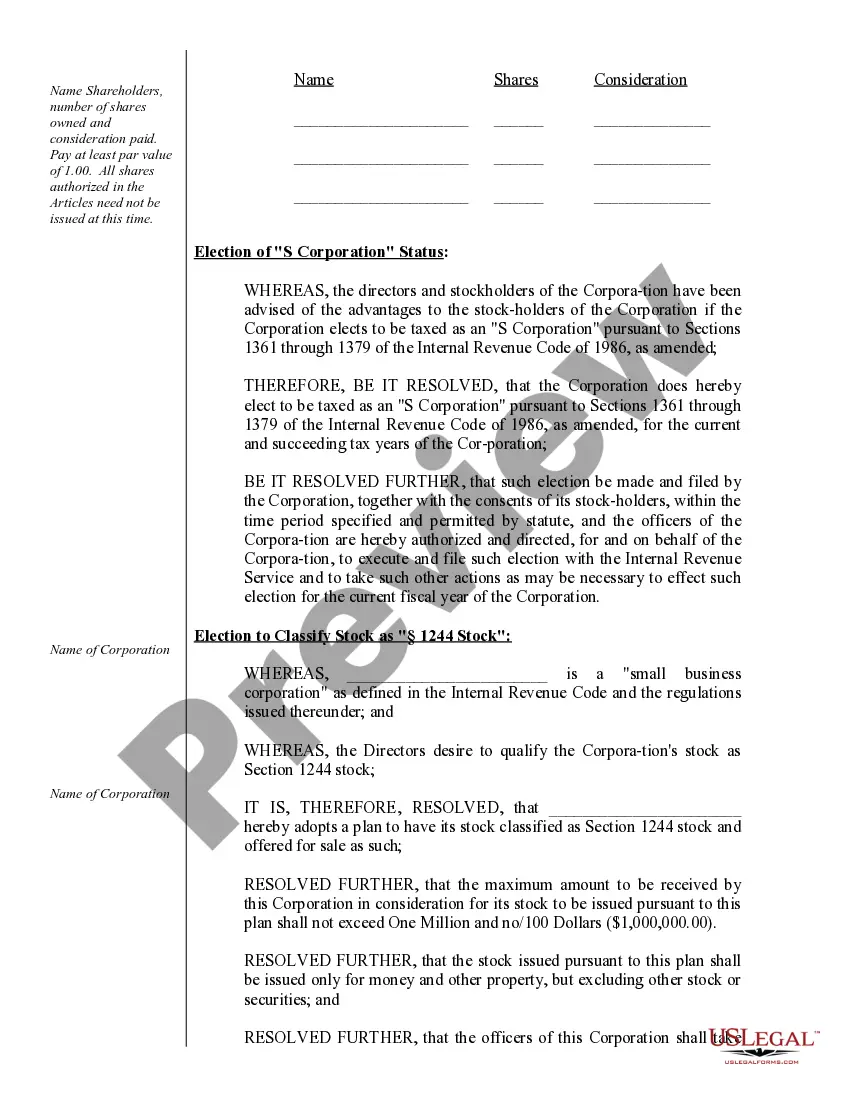

How to fill out Florida Corporate Records Maintenance Package For Existing Corporations?

Legal management may be overwhelming, even for knowledgeable specialists. When you are searching for a Florida Corporations With Credit Package and don’t have the a chance to spend searching for the right and up-to-date version, the operations might be stressful. A strong web form catalogue can be a gamechanger for anybody who wants to handle these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from individual to enterprise papers, in one spot.

- Employ innovative tools to complete and deal with your Florida Corporations With Credit Package

- Access a resource base of articles, guides and handbooks and materials highly relevant to your situation and needs

Save time and effort searching for the papers you need, and utilize US Legal Forms’ advanced search and Review tool to discover Florida Corporations With Credit Package and get it. For those who have a monthly subscription, log in to your US Legal Forms account, search for the form, and get it. Review your My Forms tab to view the papers you previously saved and also to deal with your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and get limitless use of all benefits of the platform. Listed below are the steps to consider after accessing the form you need:

- Verify it is the proper form by previewing it and reading its description.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now once you are all set.

- Select a subscription plan.

- Pick the formatting you need, and Download, complete, sign, print out and send out your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of expertise and reliability. Enhance your daily papers management in a easy and intuitive process today.

Form popularity

FAQ

?S? corporations are not subject to the tax, except for taxable years when they are liable for the federal tax under the Internal Revenue Code. An ?S? corporation must file a Florida Corporate Income/Franchise and Emergency Excise Tax Return (Form F-1120, incorporated by reference in rule 12C-1.051, F.A.C.)

How is an S Corp Taxed in Florida? S-Corps are pass-through entities. This means the company does not file and pay taxes.

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

Under Florida law, corporations are required to apportion their business income to the state using a three-factor formula comprised of a payroll, property, and double-weighted sales factor.

Once enrolled, select "Corporate Income Tax File and Pay" from the File and Pay webpage to: File the Florida Corporate Short Form Income Tax Return (Form F-1120A) File Form F-7004. Pay the corporate income tax due on Forms F-1120 and F-1120A. Pay the tentative tax due on Form F-7004.