Florida Incorporate With Florida

Description

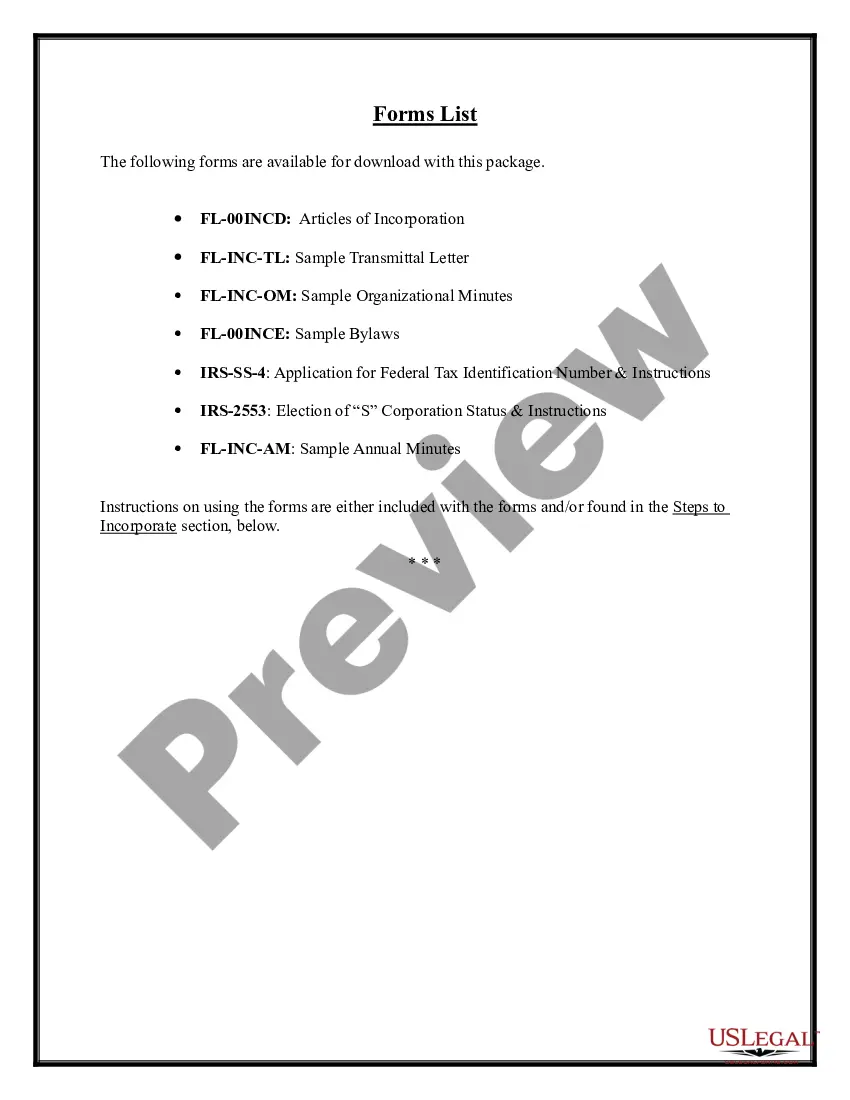

How to fill out Florida Business Incorporation Package To Incorporate Corporation?

Regardless of whether it's for corporate objectives or personal matters, everyone must handle legal issues at some stage in their life.

Completing legal documentation necessitates meticulous attention, starting with selecting the correct form template. For instance, if you choose an incorrect version of the Florida Incorporate With Florida, it will be rejected once submitted. Therefore, it's essential to have a trustworthy source for legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you will never need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to find the suitable template for any circumstance.

- Obtain the sample you require by using the search bar or browsing the catalog.

- Review the form’s details to confirm it aligns with your case, jurisdiction, and locality.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to locate the Florida Incorporate With Florida template you need.

- Acquire the template when it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you wish and download the Florida Incorporate With Florida.

- Once saved, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

Pursuant to Chapter 607 or 621 F.S., the articles of incorporation must set forth the following: Article I: The name of the corporation must include a corporate suffix such as Corporation, Corp., Incorporated, Inc., Company, or Co.

You must: Choose an organization name ing to Florida's rules. File your organization's articles of incorporation with the Department of State. Request a Federal Employer Identification Number (FEIN) from the IRS. Obtain all necessary licenses from the state, city, and county. Pay the relevant costs and fees.

When you register a new business in Florida, you will be able to benefit from the highly stable as well as favorable tax climate the state offers. Some of the benefits include: No corporate income tax on subchapter S-corporations and Limited Partnerships. Exemption of capital stock from corporate franchise tax.

Business Corporation: Must contain the word "corporation", "incorporated", "company", or "limited," or the abbreviation, with or without punctuation, "corp.", "inc.", "co.", or "ltd.". A corporate name may include words in any language but must be written in English letters or characters.

Setting up an S corp in Florida takes five steps: Choose a business name. File Articles of Incorporation. Apply for a business license. Obtain an EIN. Complete and submit Form 2253.