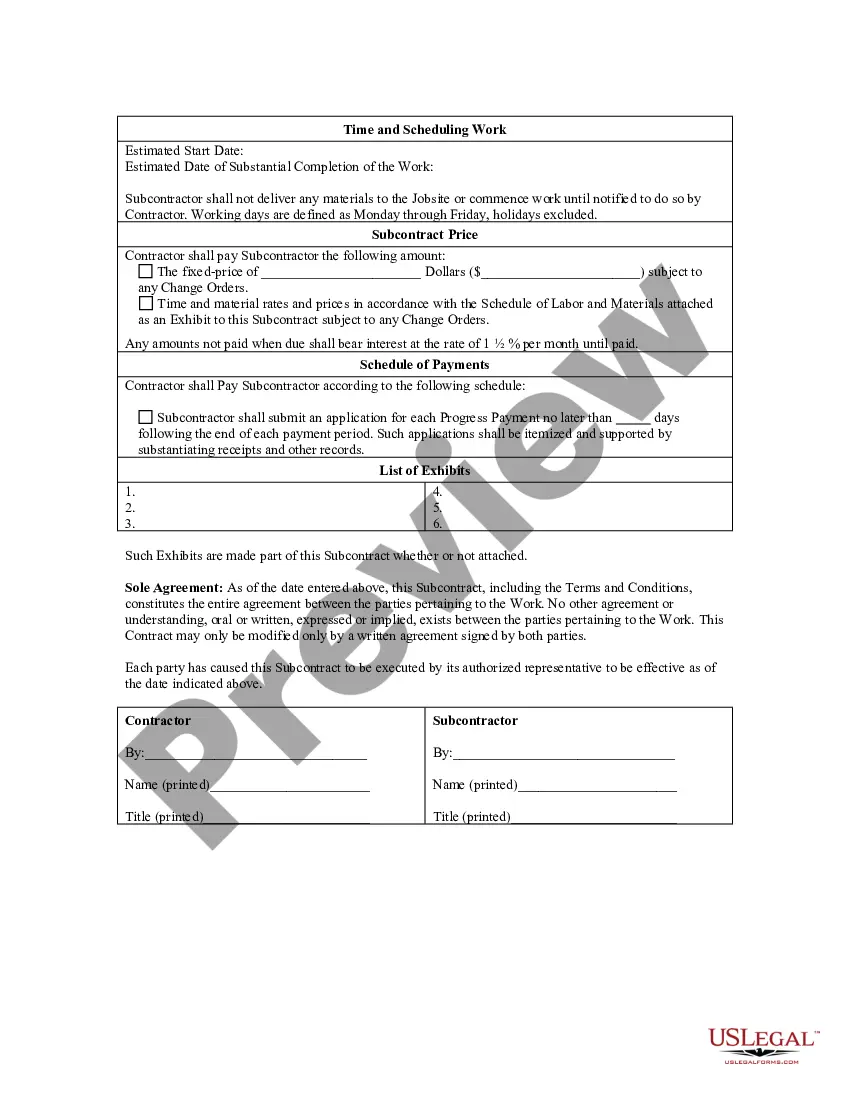

Subcontractors Contract Template For Construction

Description

How to fill out Florida Subcontractor's Agreement?

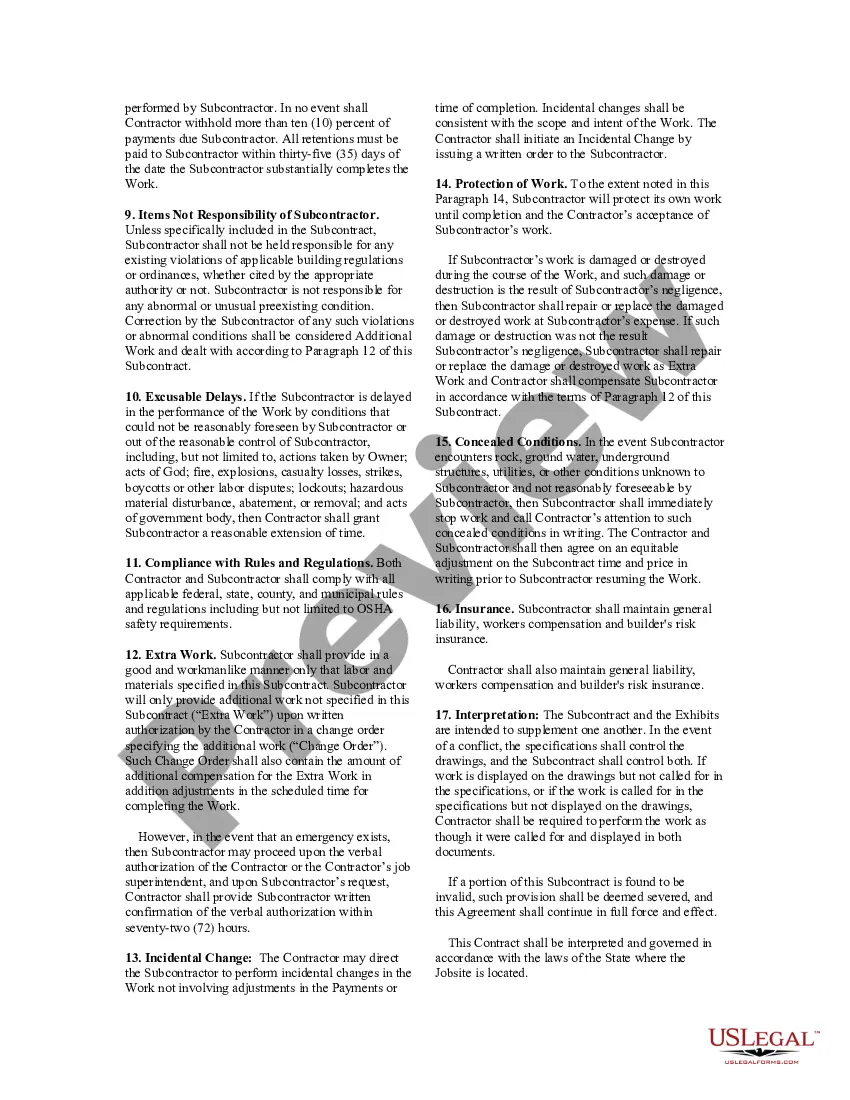

The Subcontractor Agreement Template for Building work that you find on this site is a reusable legal document crafted by expert attorneys in accordance with national and regional laws and regulations.

For over 25 years, US Legal Forms has furnished individuals, businesses, and legal professionals with upwards of 85,000 validated, state-specific documents for any commercial and personal scenario. It’s the quickest, simplest, and most reliable method to acquire the paperwork you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Complete and sign the document. Print the template to fill it out by hand. Alternatively, utilize an online versatile PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature. Download your document again when needed. Access the My documents tab in your profile to redownload any forms you have purchased previously. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and review it.

- Browse through the sample you searched for and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, utilize the search tool to find the correct one.

- Click Buy Now once you have found the template you need.

- Choose a pricing plan that works for you and create an account. Pay promptly using PayPal or a credit card. If you already have an account, Log In and verify your subscription to continue.

- Select the desired format for your Subcontractor Agreement Template for Building work (PDF, Word, RTF) and download the document to your device.

Form popularity

FAQ

The name of a limited partnership must contain, without abbreviation, the words ?limited partnership.? iv. LIMITED LIABILITY PARTNERSHIP DESIGNATIONS. The name of a limited liability partnership must end with one of the following designations: Limited Liability Partnership, L.L.P., or LLP.

Create a General Partnership in Connecticut Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Connecticut state tax identification numbers.

Starting a partnership is easy. You just need a partnership agreement. You might include all details in the partnership agreement, or you might draw up other documents, too. For example, you might want to create an exit plan in case a partner wants to leave and you need to dissolve the partnership.

You don't have to file paperwork to form a partnership?you create a partnership when you agree to go into business with another person. While you can form a partnership without formally filing or registering the entity, partnerships must comply with licensing and tax requirements that apply to all businesses.

How to start a Connecticut Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.