Land Contract Forfeiture Form With Mortgage

Description

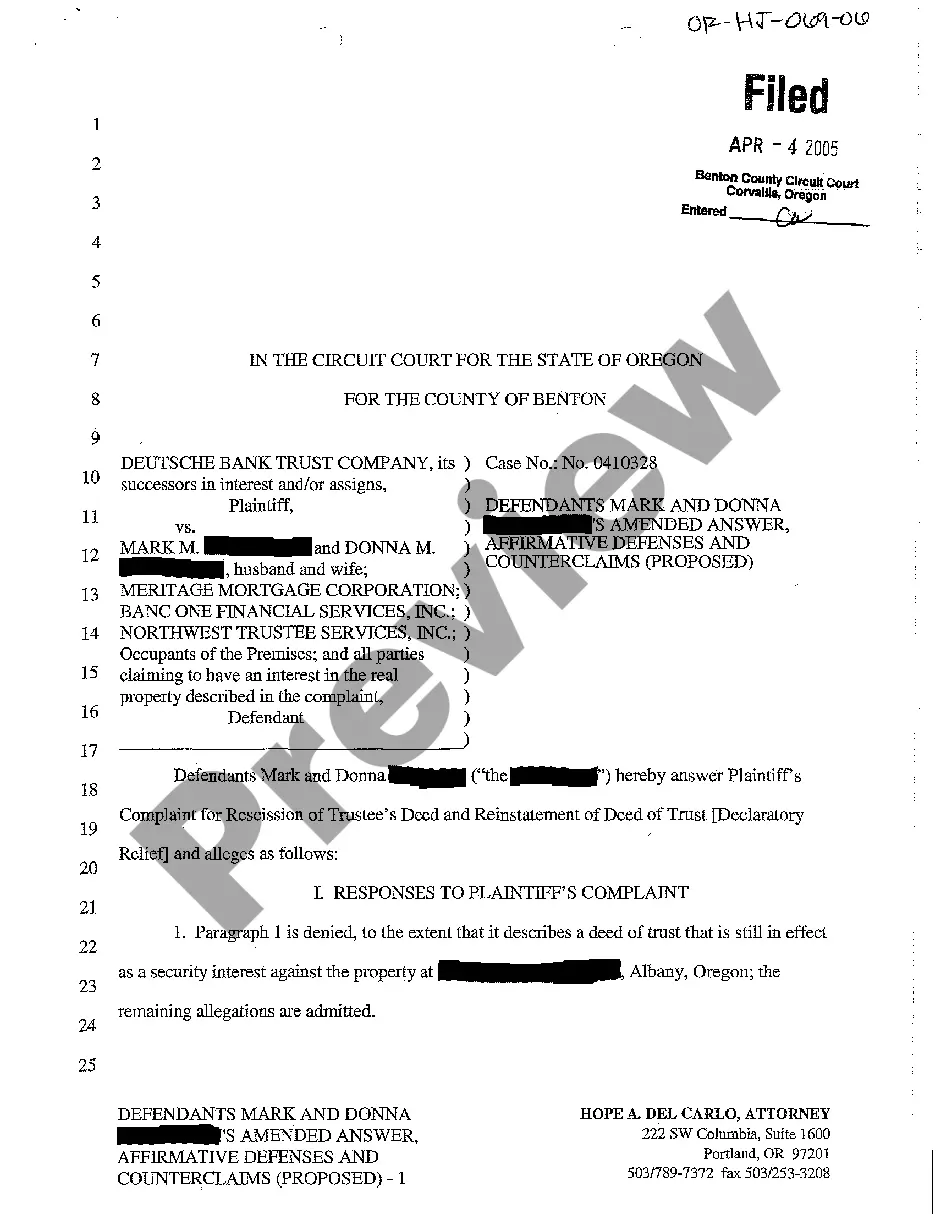

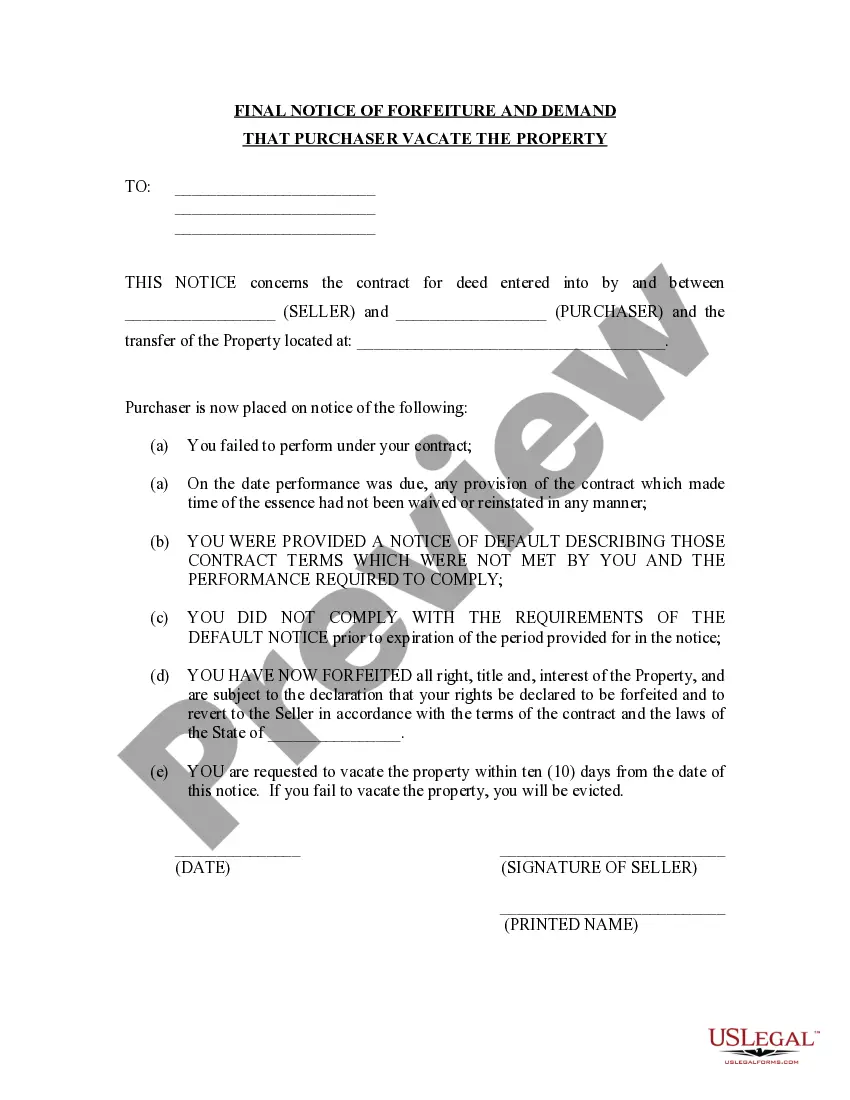

How to fill out Florida Final Notice Of Forfeiture And Request To Vacate Property Under Contract For Deed?

Handling legal paperwork and procedures could be a time-consuming addition to your entire day. Land Contract Forfeiture Form With Mortgage and forms like it often need you to look for them and navigate how you can complete them properly. Therefore, whether you are taking care of financial, legal, or individual matters, using a thorough and practical web catalogue of forms when you need it will significantly help.

US Legal Forms is the top web platform of legal templates, featuring more than 85,000 state-specific forms and a variety of tools that will help you complete your paperwork easily. Discover the catalogue of appropriate documents available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Safeguard your papers management operations having a top-notch services that allows you to make any form within a few minutes with no extra or hidden fees. Simply log in to the account, find Land Contract Forfeiture Form With Mortgage and acquire it right away in the My Forms tab. You may also access formerly saved forms.

Could it be the first time utilizing US Legal Forms? Sign up and set up up your account in a few minutes and you will get access to the form catalogue and Land Contract Forfeiture Form With Mortgage. Then, adhere to the steps below to complete your form:

- Make sure you have the correct form using the Preview feature and looking at the form description.

- Choose Buy Now when ready, and choose the subscription plan that is right for you.

- Select Download then complete, sign, and print out the form.

US Legal Forms has 25 years of experience helping consumers manage their legal paperwork. Get the form you require right now and improve any operation without having to break a sweat.

Form popularity

FAQ

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

A seller needs to go through circuit court to foreclose on a home. Unlike mortgage foreclosures, a seller in a land contract cannot foreclose by advertisement. They must go through the courts. To learn more about judicial (court) foreclosures, read Foreclosure and Eviction for Homeowners.

If a buyer defaults, the seller cannot simply take possession of the property, with the buyer losing all the payments already made. Instead, the seller must foreclose, sell the property, and pay to the buyer any proceeds from the sale in excess of the unpaid balance of the purchase price.

As a type of specialty home financing, a land contract is similar to a mortgage. However, rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.

MCL 600.5726. If there is a default (buyer fails to pay the installments due under the contact or breaches the contract), seller may seek to retake the possession of the property through the forfeiture process. First, the seller must serve a written notice of the forfeiture upon the buyer.