Delaware Law For Corporations

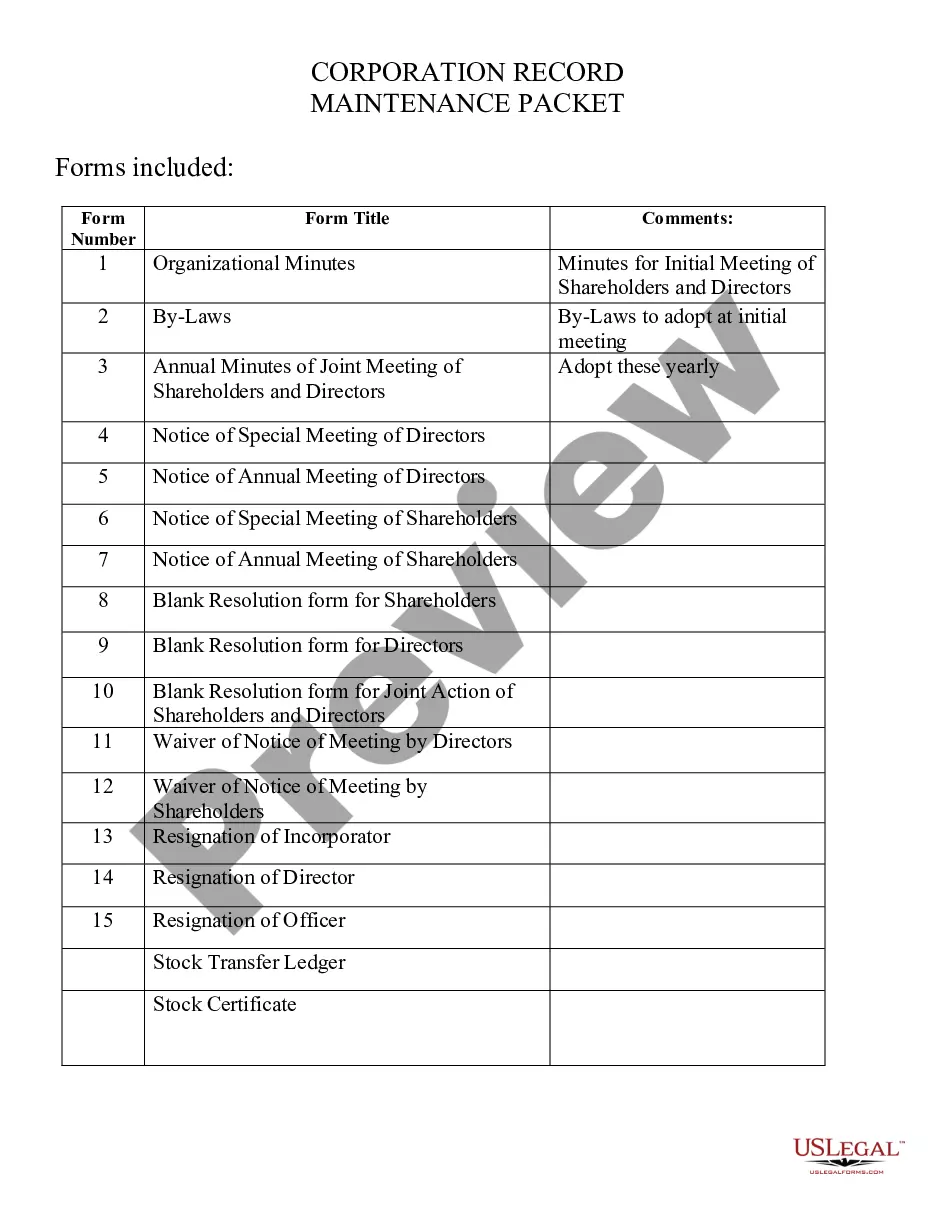

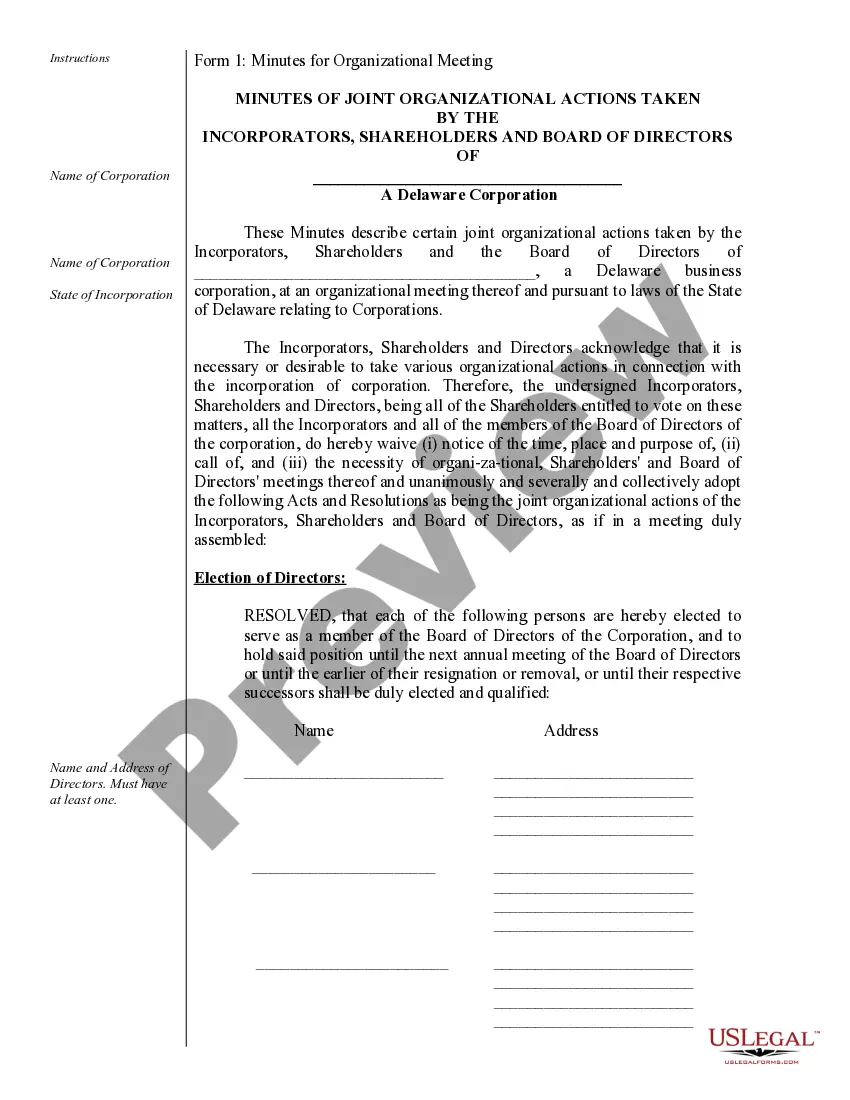

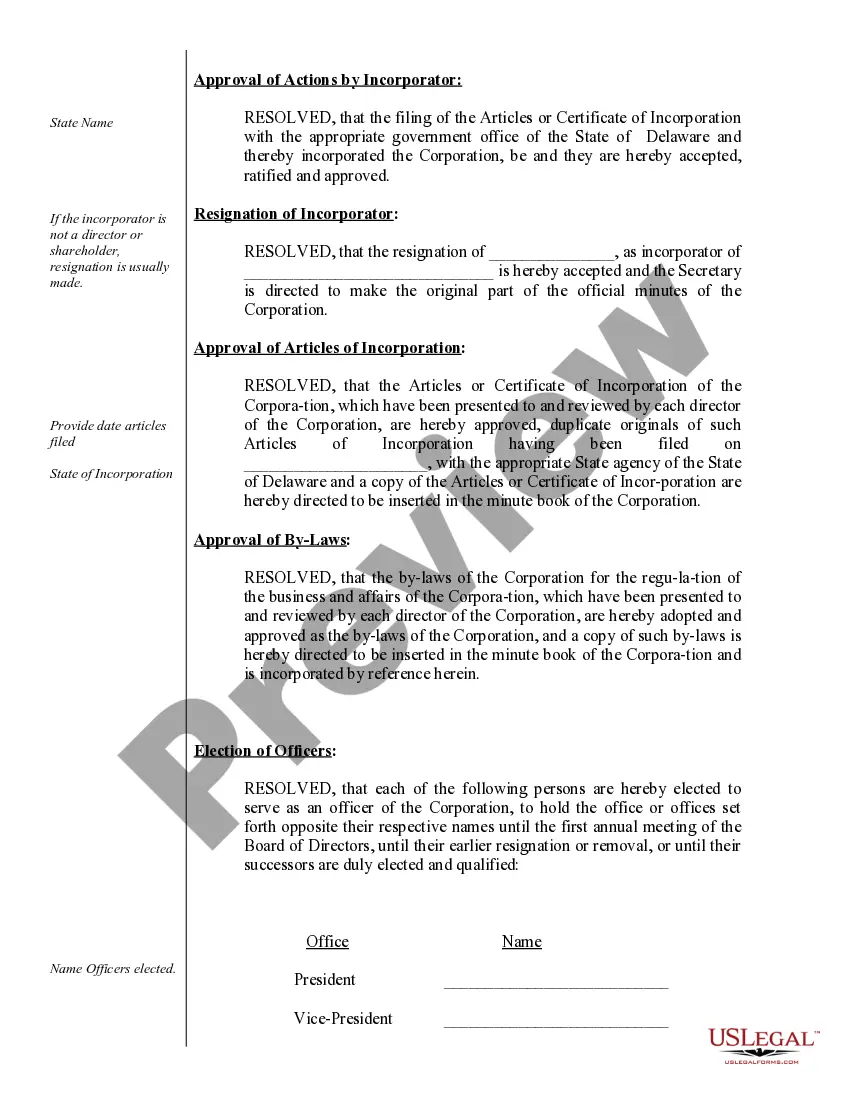

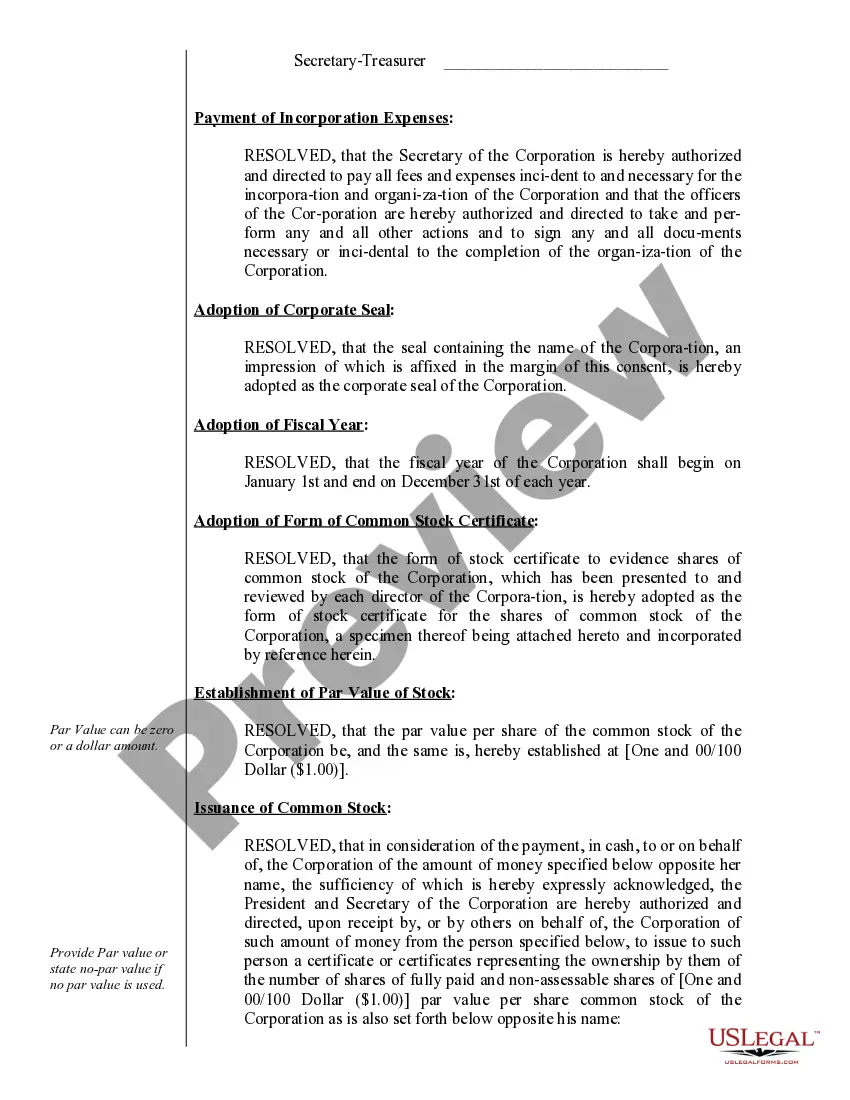

Description

How to fill out Delaware Corporate Records Maintenance Package For Existing Corporations?

Managing legal documents can be irritating, even for seasoned experts.

When you are looking into Delaware Corporate Law and miss the opportunity to engage in finding the correct and current edition, the processes can be taxing.

Tap into a valuable resource library of articles, guides, and manuals pertinent to your circumstances and requirements.

Conserve time and energy in hunting for the documents you require, and utilize US Legal Forms’ sophisticated search and Review tool to locate Delaware Corporate Law and obtain it.

Leverage the US Legal Forms online repository, backed by 25 years of expertise and trustworthiness. Change your routine document handling into a straightforward and user-friendly experience today.

- If you hold a membership, Log In to your US Legal Forms account, search for the document, and obtain it.

- Check your My documents section to view the documents you have previously saved and organize your files as you wish.

- If this is your initial experience with US Legal Forms, create a complimentary account and gain unrestricted access to all platform features.

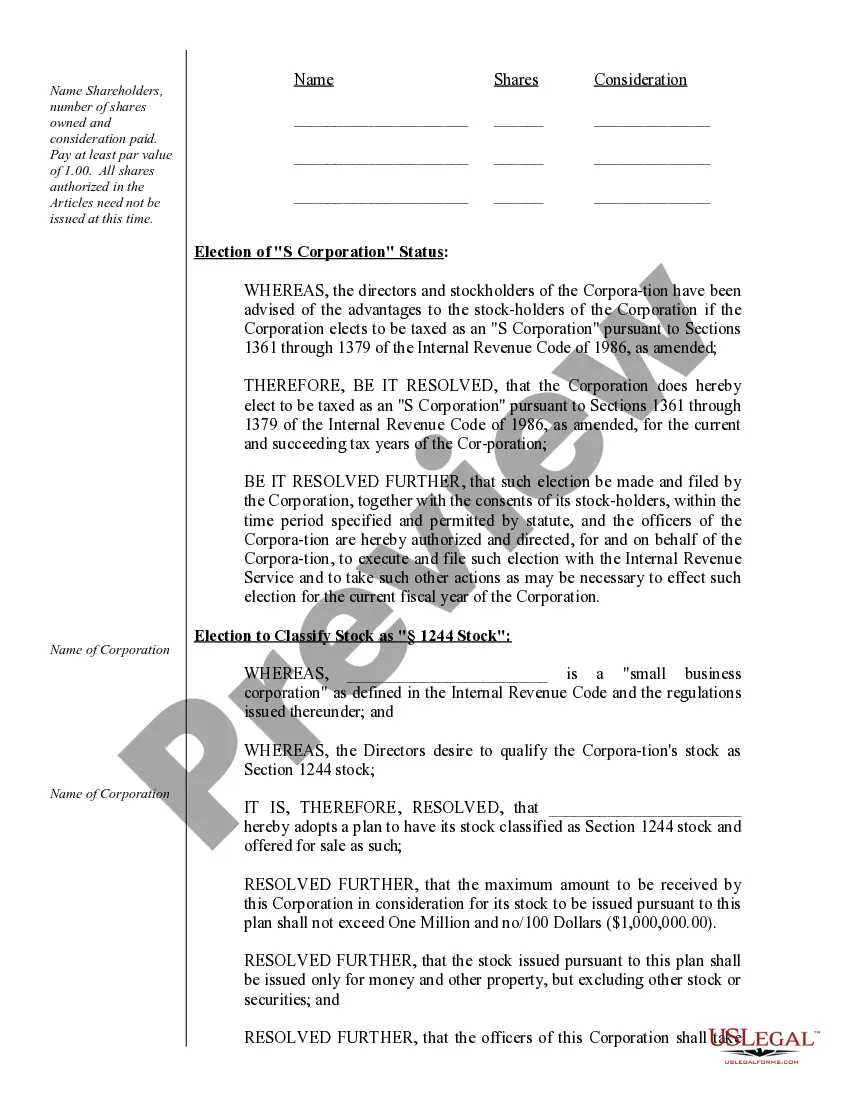

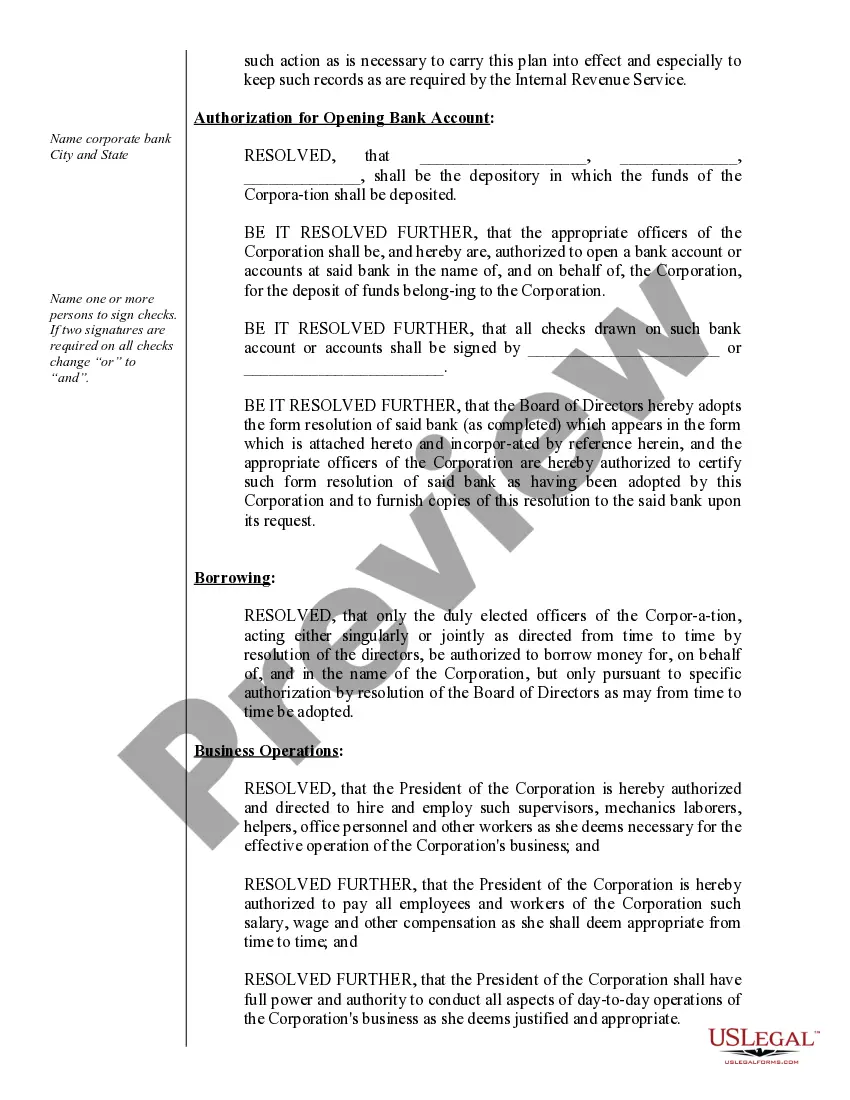

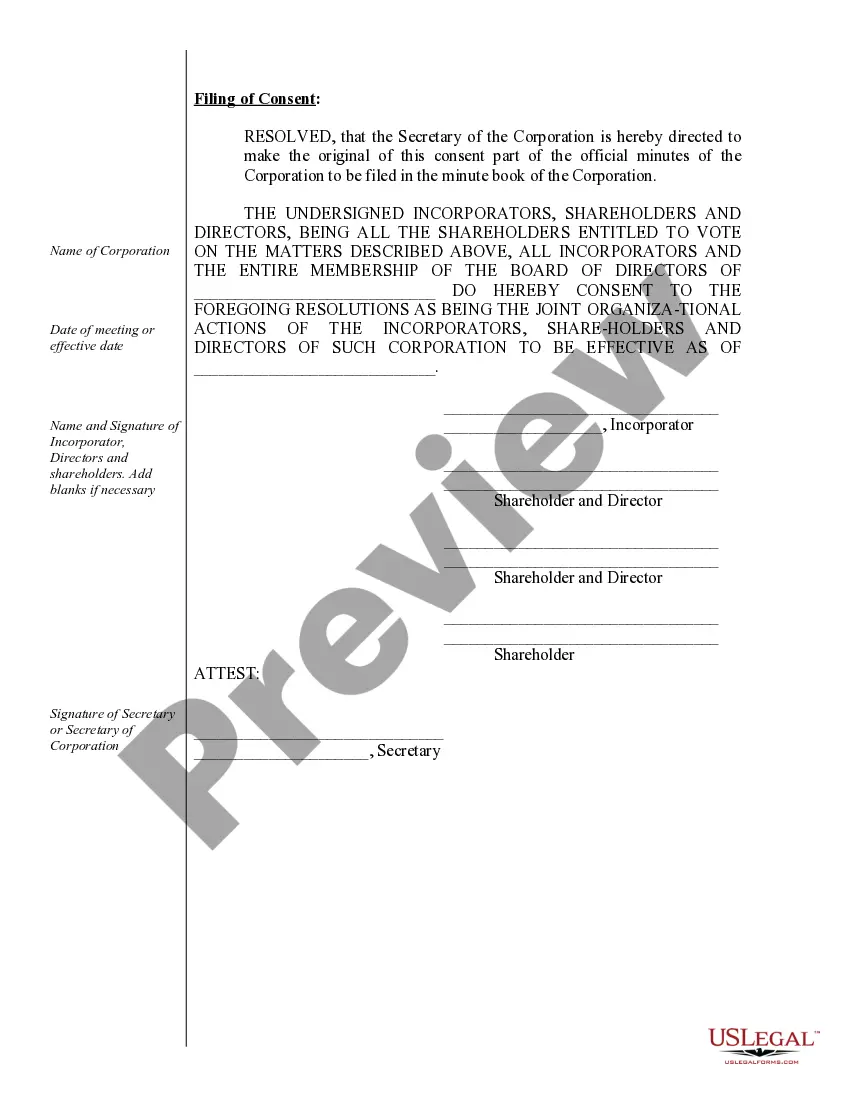

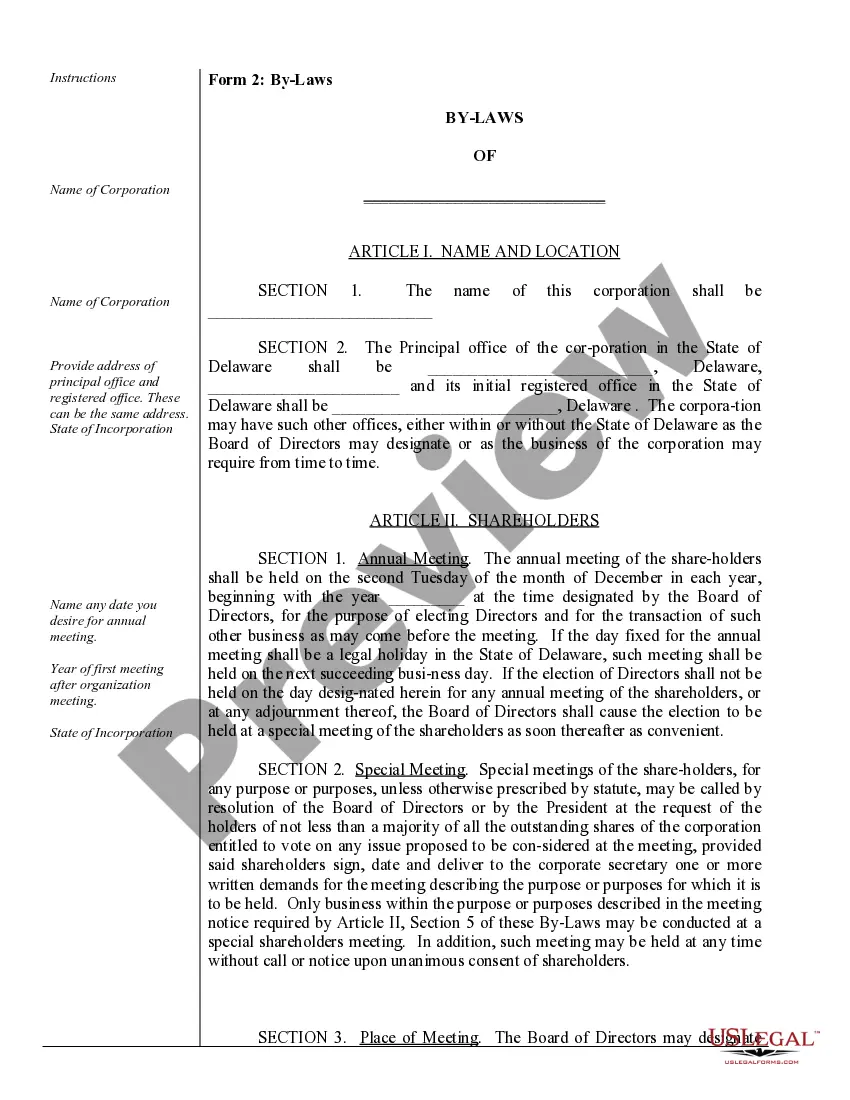

- After finding the form you need, confirm this is the correct document by previewing it and reviewing its description.

- Verify that the template is permissible in your region or county.

- Click Buy Now when you are ready.

- Select a monthly subscription option.

- Locate the format you require, and Download, fill out, eSign, print, and send your document.

- Access legal and organizational documents specific to your state or county.

- US Legal Forms addresses all requirements you might have, from personal to corporate documentation, all in one location.

- Use enhanced tools to prepare and oversee your Delaware Corporate Law needs.

Form popularity

FAQ

Absolutely, Delaware has built a reputation as a corporate-friendly state. The state boasts flexible laws that favor business operations. Many companies benefit from the efficient court system, particularly the Delaware Court of Chancery, which specializes in corporate law disputes. This business-centric framework attracts corporations looking for a supportive legal environment.

On April 26, 2022, Georgia Governor Brian Kemp signed into law HB 1437, which replaces the current graduated personal income tax with a flat rate of 5.49% effective January 1, 2024, with gradual reductions each year until the flat rate reaches 4.99%, effective January 1, 2029.

The only way to change your Georgia registered agent is by filing an annual registration (like an annual report) with the Georgia Secretary of State, Corporations Division (SOS). The annual registration can be filed online or you can print the form from the Georgia SOS website (see link below).

Governor Kemp signed into law a one-time rebate for taxpayers who filed returns for 2021 and 2022 tax years, including full-time, part-time and nonresidents for the state of Georgia. The rebate will come in the amount of $250 for individual filers, $375 for heads of household and $500 for those married filing jointly.

Georgia Income Tax Brackets and Rates: Single Filers If your Georgia taxable income is over:But not over:Your tax is:$2,250$3,750$38 + 3% of the excess over $2,250$3,750$5,250$83 + 4% of the excess over $3,750$5,250$7,000$143 + 5% of the excess over $5,250$7,000?$230 + 5.75% of the excess over $7,0002 more rows

Business Meal Deductibility The Georgia Restaurant Association supports a permanent 100 percent federal tax deduction for business meals.

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

Standard deduction increase: For tax year 2023, the standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: Income tax brackets went up in 2023 to account for inflation.

An amended annual registration may be filed online at or filed by paper by submitting this completed form to our office. There is a $10.00 service charge for filing by paper.