Power Of Attorney Irs

Description

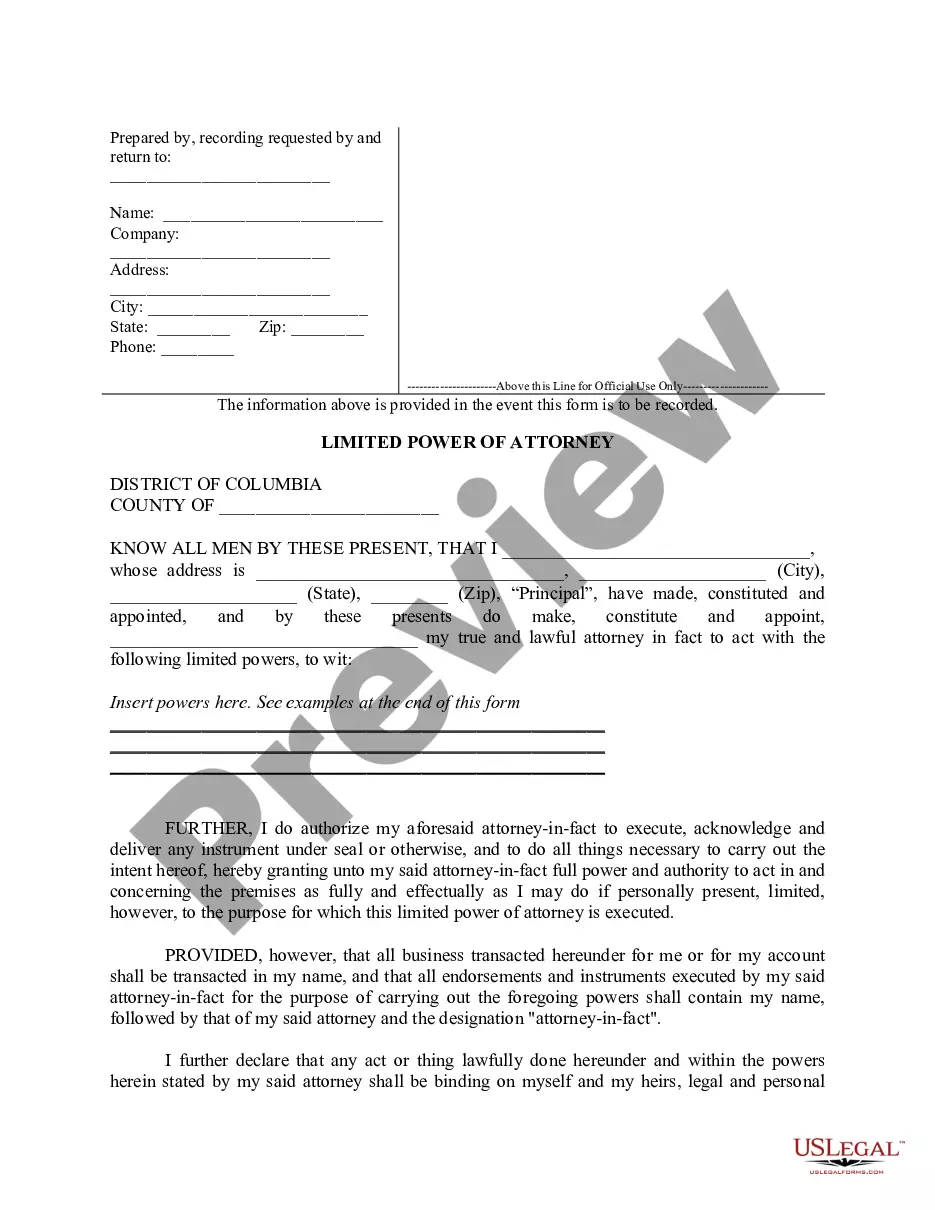

How to fill out District Of Columbia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active to access the necessary documents.

- For new users, start by exploring the extensive library to find the right power of attorney form that suits your specific needs and local jurisdiction requirements. Use the Preview mode to review the form description.

- If you need to refine your search, utilize the Search feature at the top of the page to locate alternative templates that may better fit your requirements.

- After selecting the correct document, proceed to purchase by clicking the 'Buy Now' button and choosing a suitable subscription plan. You will need to create an account for library access.

- Complete your transaction by entering your payment information via credit card or PayPal. This is necessary for your subcription.

- Once your purchase is confirmed, download the form to your device. You can revisit it anytime through the 'My Forms' section in your profile.

In conclusion, leveraging US Legal Forms dramatically streamlines the process of obtaining a power of attorney for IRS matters. Their user-friendly platform and extensive resource library equip you with the tools needed for success.

Get started on your legal documentation today!

Form popularity

FAQ

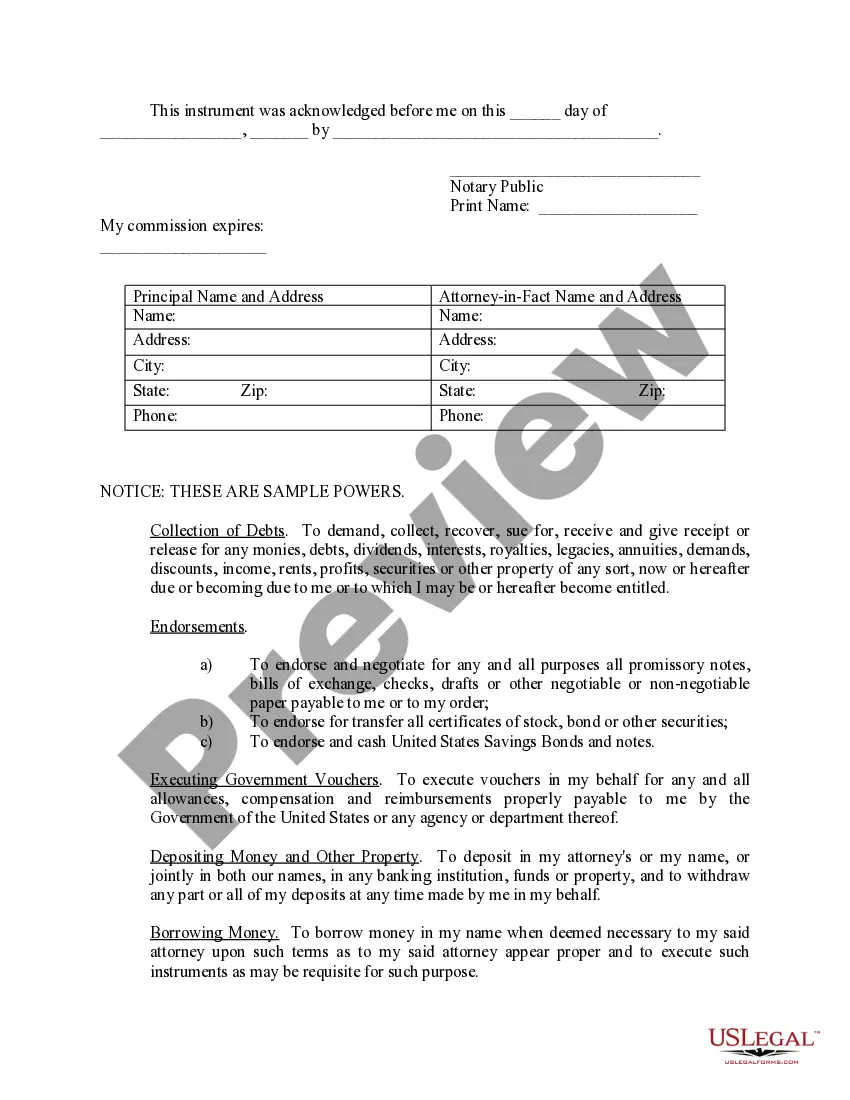

To submit a power of attorney to the IRS, you should complete Form 2848 and send it to the appropriate IRS address. You can also fax the form for quicker processing, but make sure to follow the latest IRS guidelines. Ensuring that your power of attorney is submitted correctly allows your appointed representative to act on your behalf effectively. For added convenience, use uslegalforms to access, fill out, and submit your documents seamlessly.

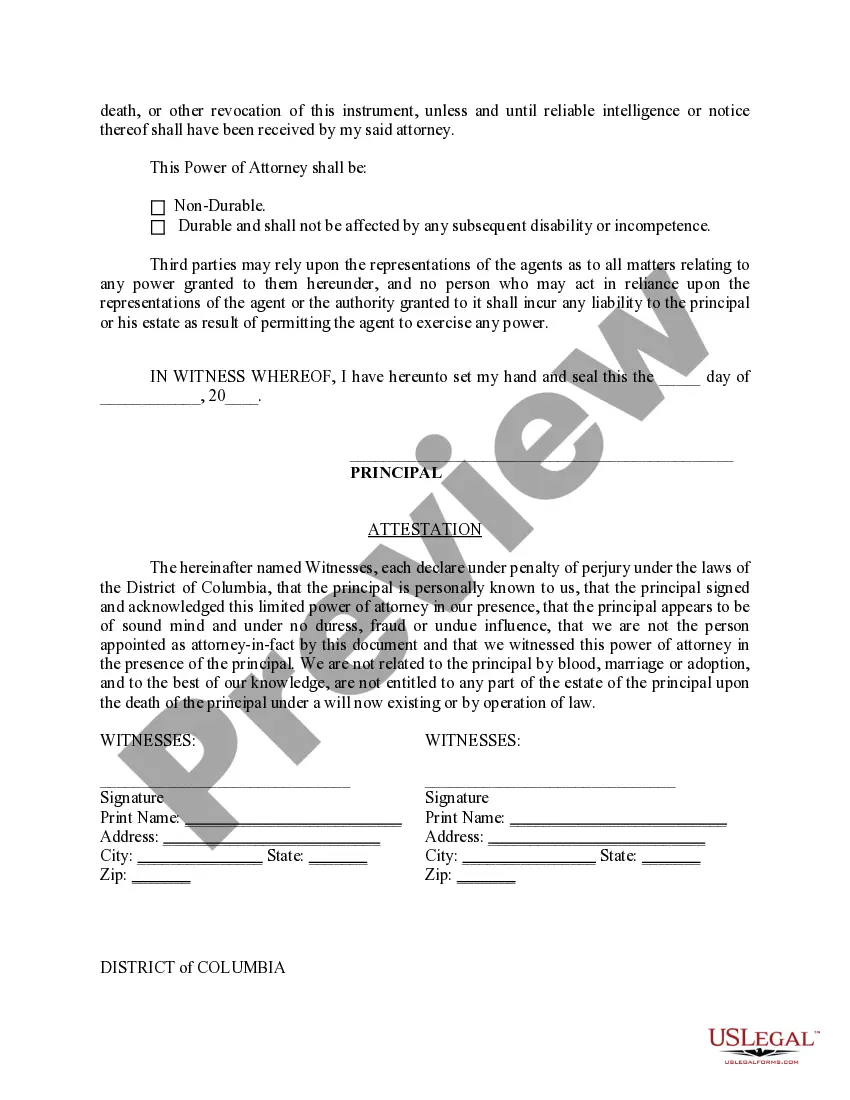

Filling out a power of attorney form involves providing essential details such as your name, the name of the person you are appointing, and the scope of their authority. It's crucial to ensure all information is accurate and complete to prevent any future issues. For assistance, uslegalforms offers user-friendly templates that guide you through the process efficiently. This can make completing your power of attorney form much easier.

Yes, you can sign an IRS power of attorney electronically, provided it meets specific requirements. The IRS accepts electronic signatures on certain forms, including the power of attorney, as long as the proper protocols are followed. This feature streamlines the submission process and helps you manage your tax affairs conveniently. To ensure compliance with IRS guidelines, check the information available through uslegalforms.

Yes, the IRS does recognize a power of attorney (POA). When you appoint someone as your POA, you allow them to act on your behalf regarding your tax matters. This is particularly helpful if you cannot handle your tax affairs due to absence or illness. For managing IRS-related tasks effectively, consider utilizing uslegalforms to create your POA.

The time it takes for the IRS to process paperwork can vary, often taking anywhere from 4 to 6 weeks or longer during peak tax seasons. Keeping track of your submission and following up if needed can help manage your expectations. It's worthwhile to ensure that all your documentation, including your power of attorney, is correctly filed to reduce delays. Utilizing a solution like USLegalForms can help ensure that your documents are accurate and ready for submission.

The best way to submit a power of attorney to the IRS is to complete Form 2848, which grants authority to your representative. This form can be submitted by mail or fax, depending on your specific situation. It’s important to follow the IRS guidelines to ensure proper submission and acceptance. Using services like USLegalForms can help streamline this process by providing detailed instructions and templates.

While it’s not mandatory to have a power of attorney for taxes, it can be very beneficial. If you want someone to manage your tax matters effectively, a POA allows them to act on your behalf. This can prevent misunderstandings and facilitate smoother communication with the IRS. If you're considering this option, resources from USLegalForms can guide you in preparing the necessary paperwork correctly.

Yes, the IRS accepts power of attorney documents, allowing your designated representative to manage your tax affairs. This authority can be granted for specific tax matters or for broader access to your financial information. It is essential to ensure that the form you use meets IRS requirements, which can often be achieved through platforms like USLegalForms. This service provides you with resources to ensure compliance.

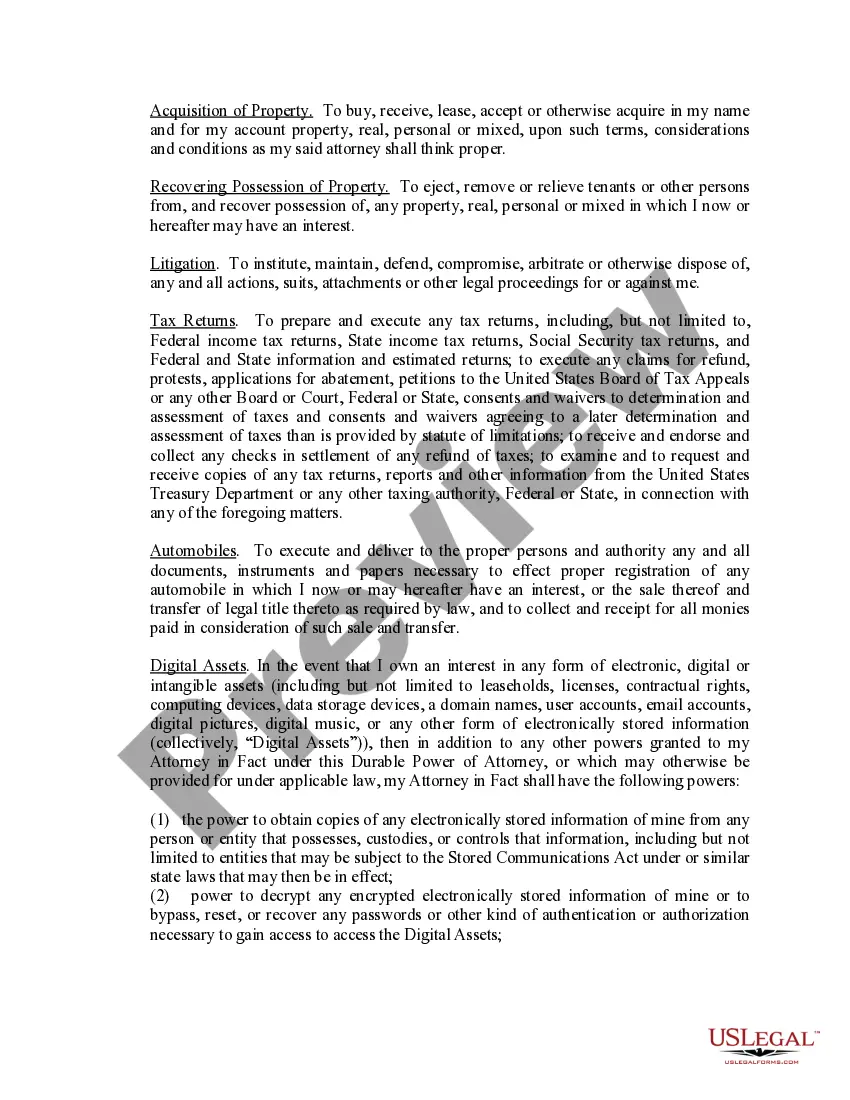

A power of attorney for the IRS, often referred to as POA, allows someone to represent you in tax matters. This can include handling tax returns, receiving confidential information, and communicating directly with the IRS on your behalf. This document helps streamline interactions with the IRS and ensures your interests are represented effectively. Utilizing resources like USLegalForms can simplify this process.

Getting power of attorney paperwork can vary in time depending on the method you choose. If you use a service like USLegalForms, you can often download the documents almost immediately. Alternatively, if you choose to draft the paperwork yourself, it may take longer as you will need to ensure all legal requirements are met. In any case, having the proper paperwork ready speeds up the process.