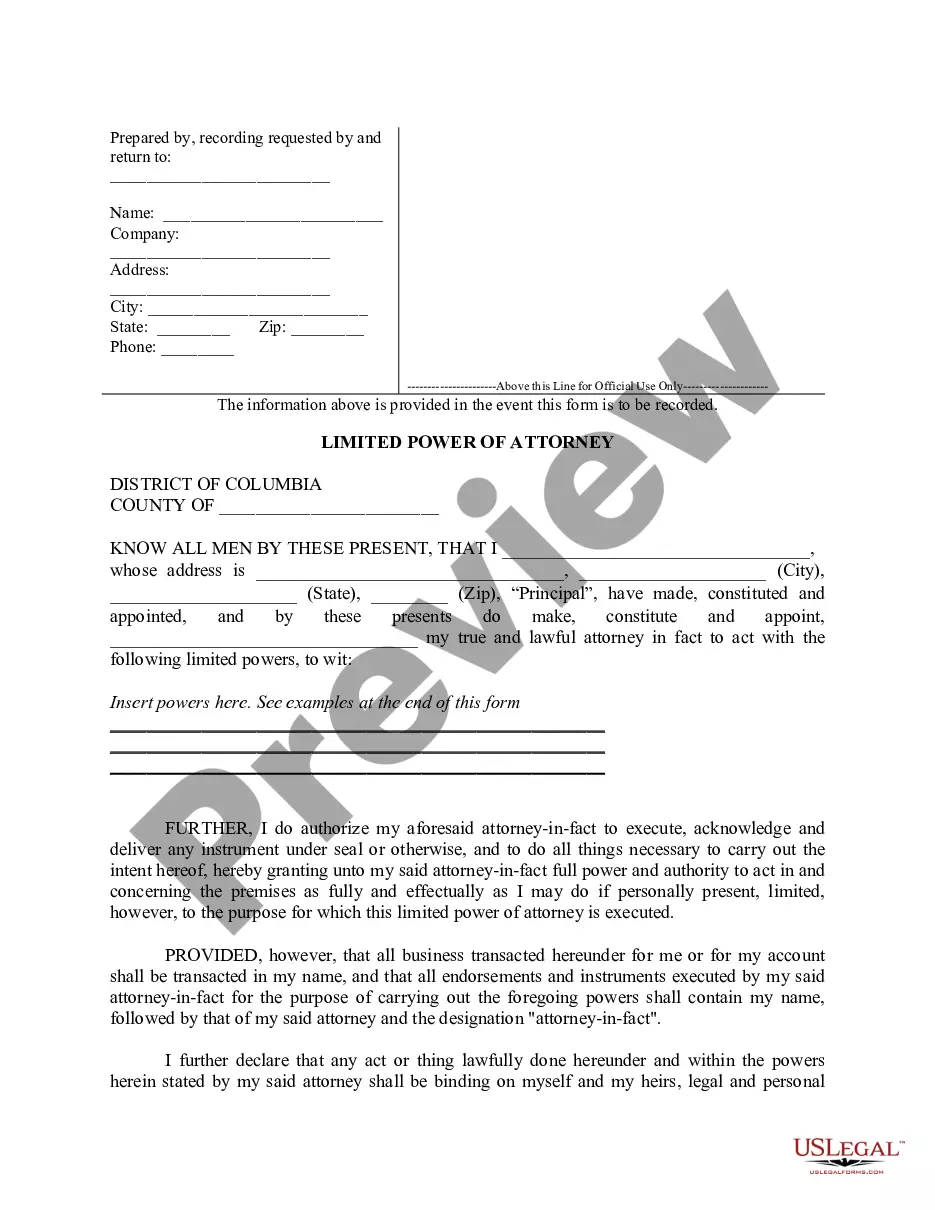

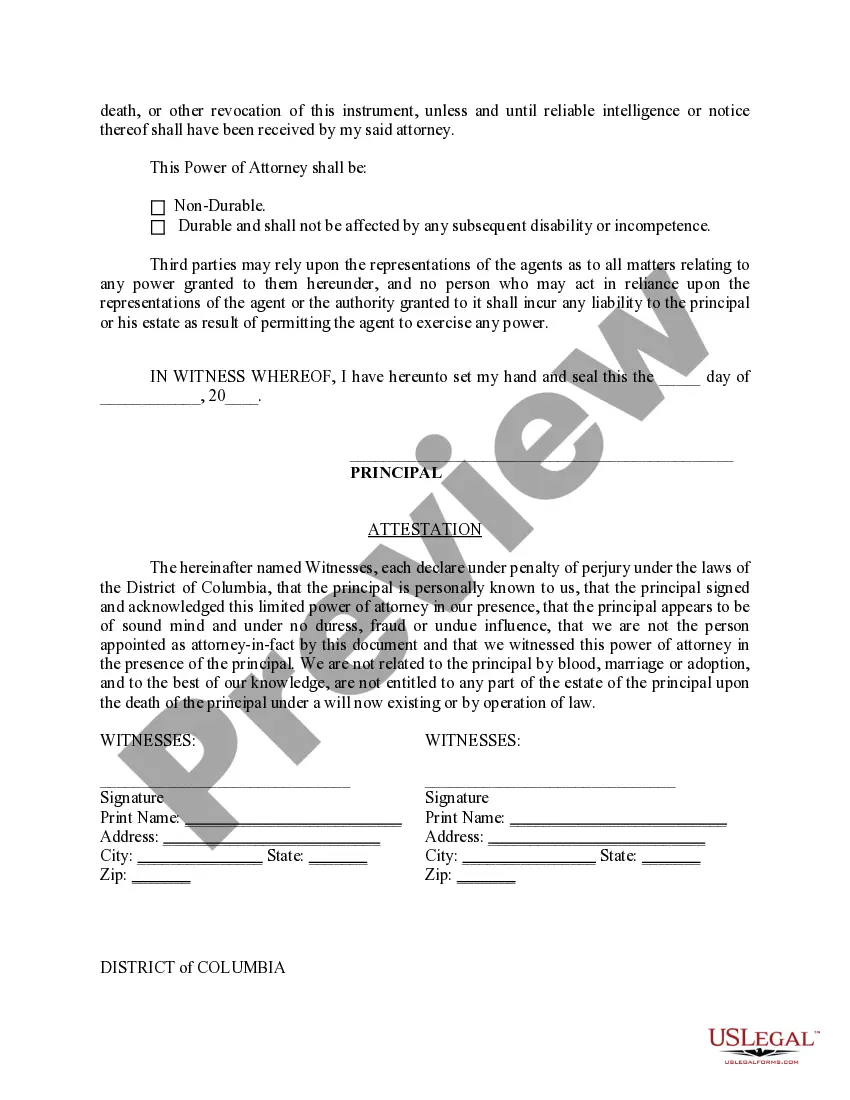

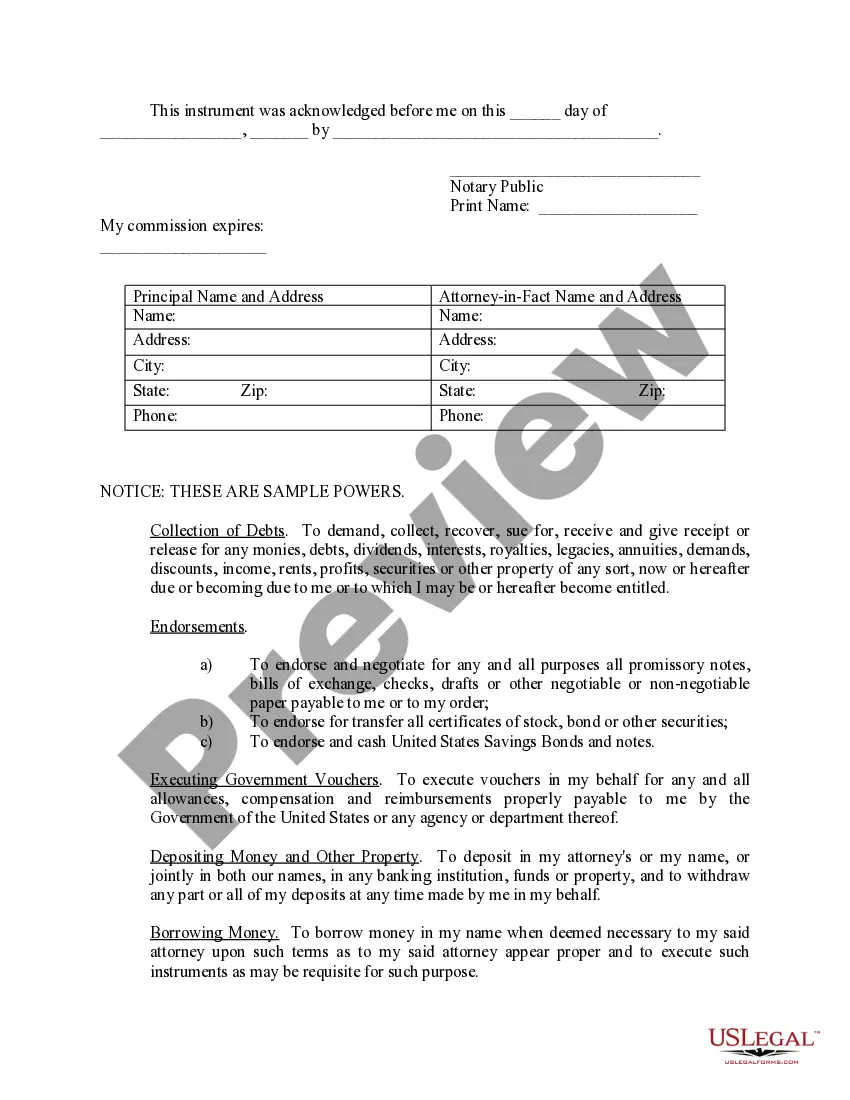

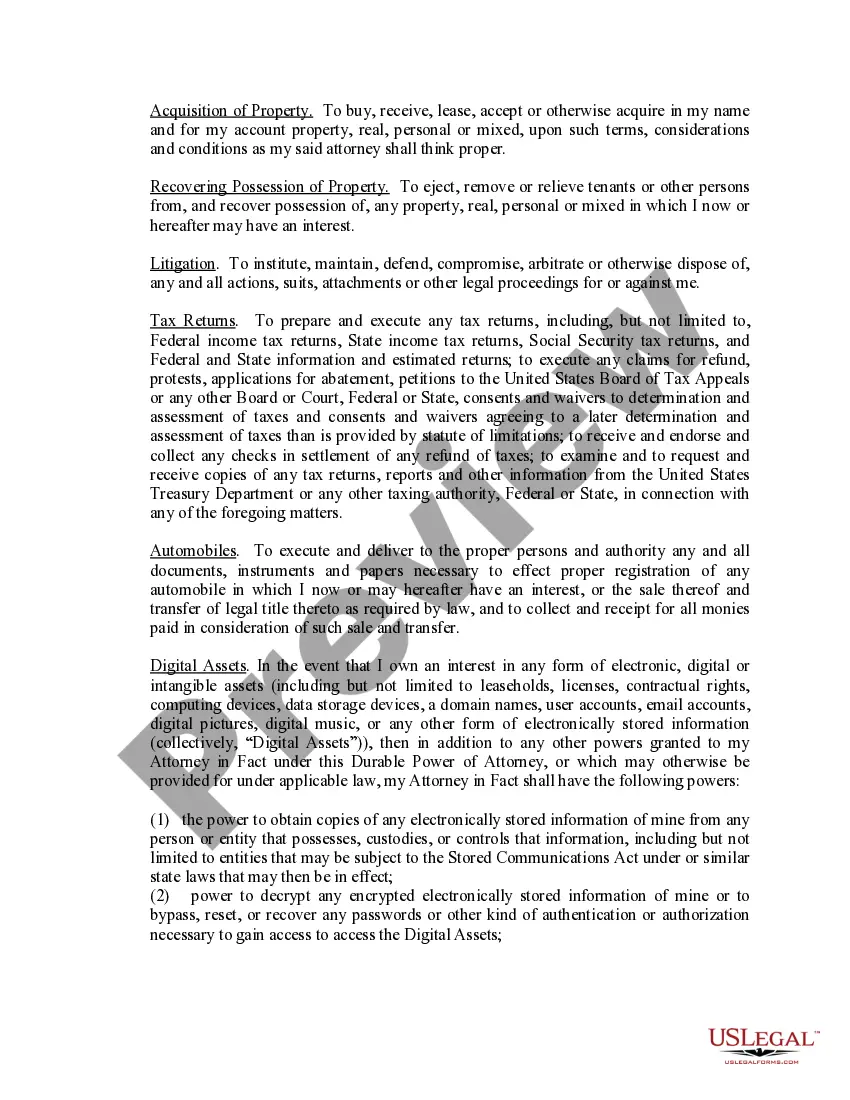

This is a limited power of attorney for the District of Columbia. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

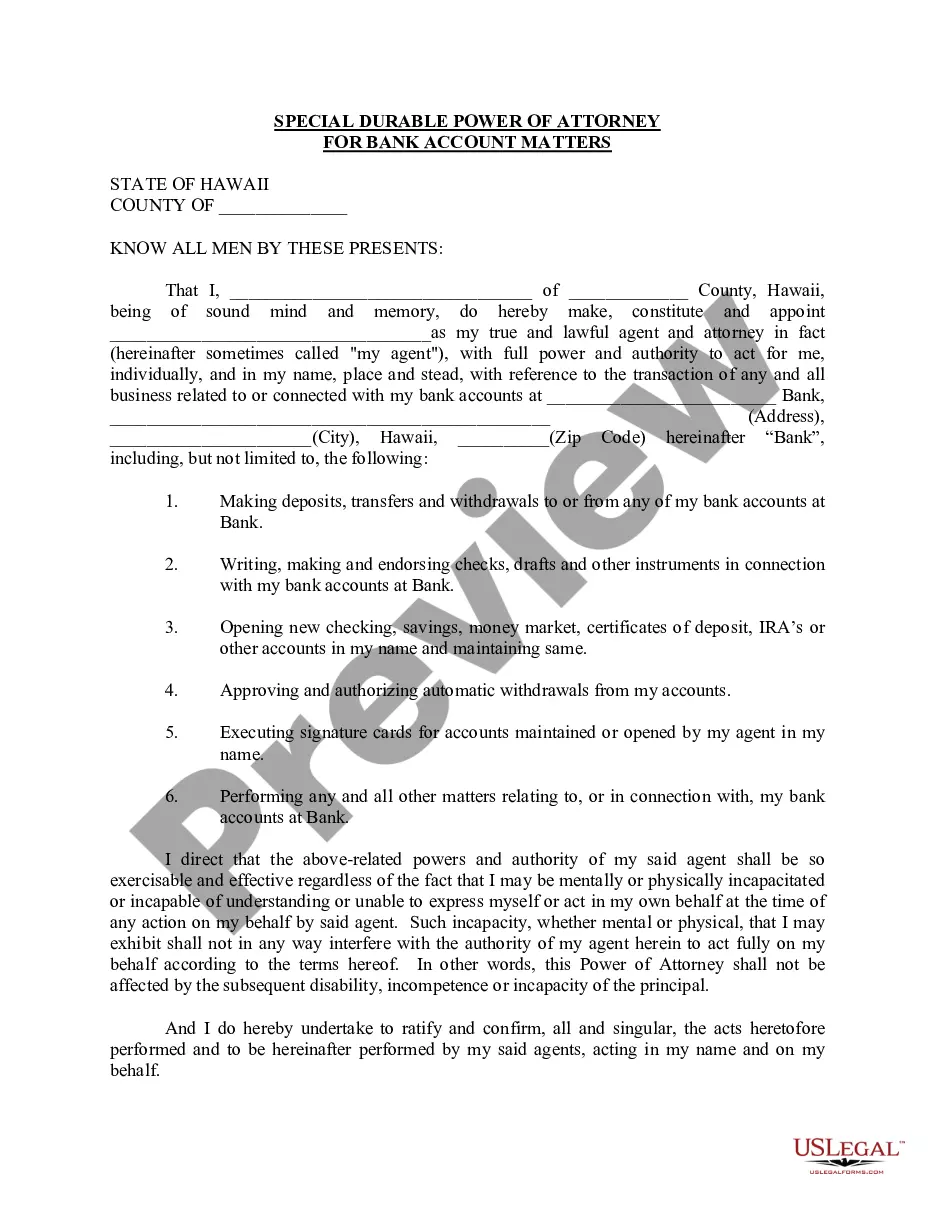

Power Attorney For Bank Account

Description

How to fill out District Of Columbia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you're already a user. Ensure your subscription is active, or renew it as needed.

- In the library, search for 'Power attorney for bank account' and check the preview and description to confirm it meets your requirements.

- If you need a different template, use the search function to find one that better fits your needs.

- Select the appropriate form and click 'Buy Now' to choose your preferred subscription plan. You will need to create an account for access.

- Complete your purchase using your credit card or PayPal to acquire the document.

- Download the form onto your device for completion, and access it anytime through 'My documents' in your profile.

US Legal Forms provides a vast collection of over 85,000 editable legal forms, empowering you to create precise documents with ease. Their extensive resources and expert assistance ensure that you maintain control over your financial responsibilities without the hassle.

Don't hesitate—visit US Legal Forms today to secure your power attorney for your bank account and manage your finances effortlessly.

Form popularity

FAQ

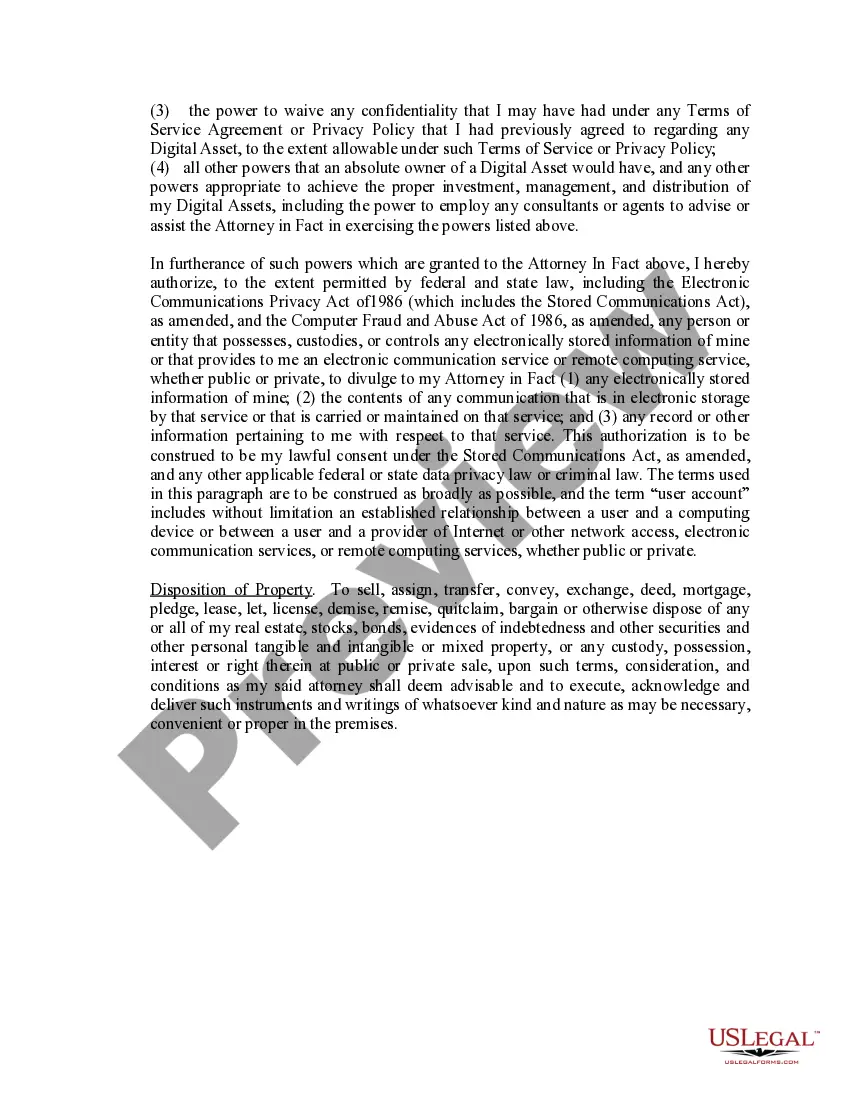

A power of attorney can facilitate adding someone to a bank account, but it depends on the specific powers granted in the document. The agent may need to work with the bank and submit required paperwork to authorize the addition. It's essential to ensure that all actions taken align with the wishes of the principal. For a seamless process, consider referring to US Legal Forms to help draft an appropriate power attorney for bank account.

A power of attorney for bank account transactions allows the agent to manage finances on behalf of the principal. However, the agent generally cannot add themselves as a joint owner to a checking account unless specifically authorized in the power of attorney document. This limitation is crucial to protect the interests of the principal, so be sure to review your legal documents. If you have questions about your power attorney for bank account, consult with a legal expert.

To add a joint owner to a bank account, both parties must visit the bank together. Typically, you will need to fill out a form and provide identification for the new account holder. It is important to understand that adding someone to a bank account gives them legal access to the funds. If you require assistance with this process, consider using tools like US Legal Forms to create the necessary documentation.

Writing a Power of Attorney letter for a bank involves creating a clear, legally sound document. Include the names of the principal and the agent, specify the powers granted, and have it notarized if required. Platforms like US Legal Forms provide templates that can help you draft a proper Power of Attorney for bank account to ensure compliance with legal standards.

The time it takes for a bank to approve a Power of Attorney can vary. Generally, it may take a few days to process the documents and verify the information provided. If everything is in order, approval can be relatively swift, allowing you to manage your financial matters quickly.

To add a Power of Attorney to your bank account, start by obtaining a valid Power of Attorney document. Once you have the document, visit your bank and present it to a bank representative. They will guide you through their specific procedures, which may include filling out forms or providing additional identification.

Banks are cautious with Powers of Attorney to protect their clients and safeguard against potential fraud. They want to ensure that the person acting on behalf of the account holder is authorized and that the document is legitimate. This cautious approach safeguards both the bank and their customers.

A Power of Attorney for bank account grants a selected individual the authority to manage financial transactions on your behalf. This can include making deposits, withdrawals, and handling account management tasks. To activate a Power of Attorney with your bank, you must provide the bank with a valid copy of the document.

Banks may deny a Power of Attorney due to several reasons. Commonly, the document might lack proper signatures or may not comply with state laws. Additionally, if the bank feels that the person holding the Power of Attorney is not acting in the best interest of the account holder, they may refuse to accept it.

Yes, a Power of Attorney can be denied by a bank. This usually occurs if the document does not meet specific legal requirements or if the bank suspects fraud or misuse. It is crucial to ensure that your Power of Attorney for bank account is properly drafted and includes all necessary information to avoid any issues.