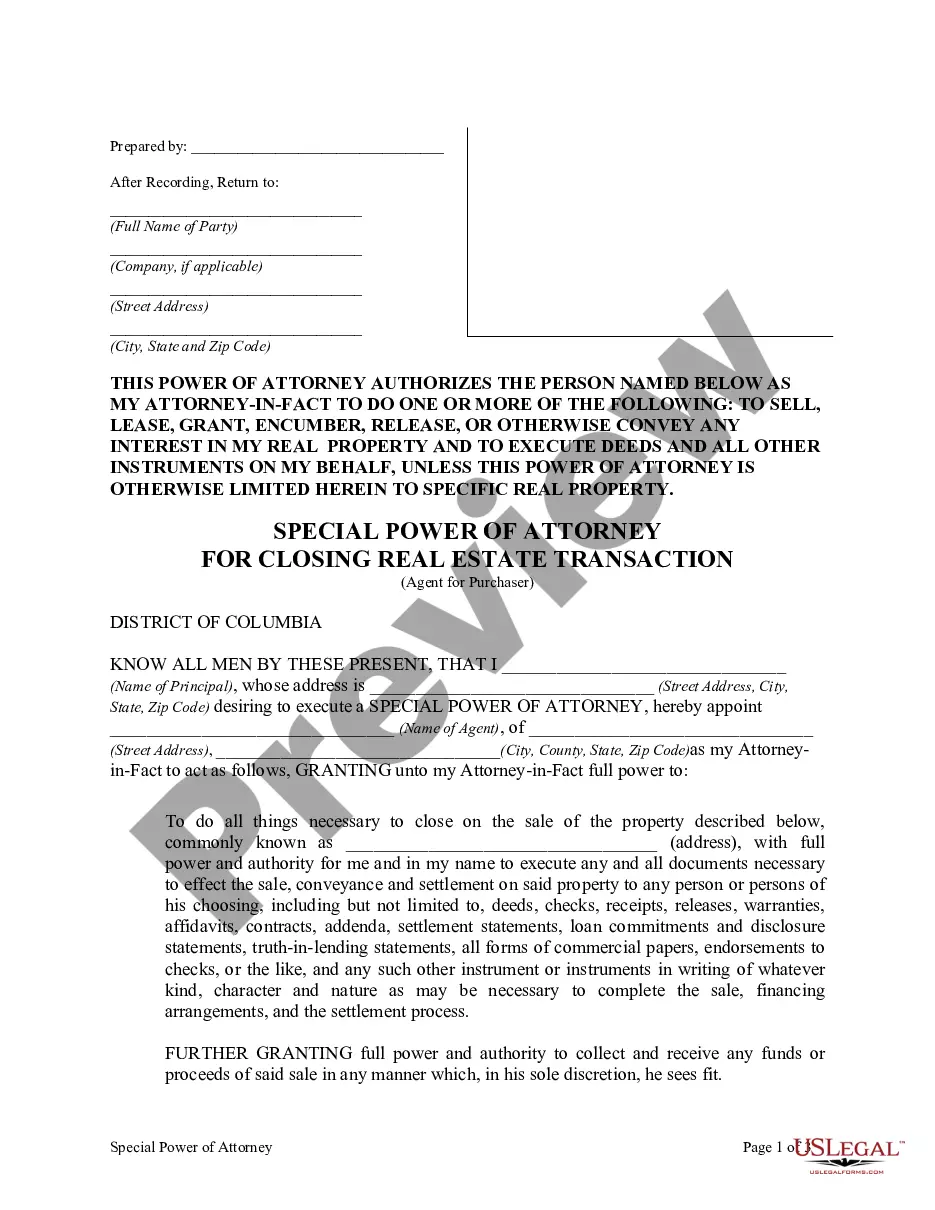

What is Power of Attorney?

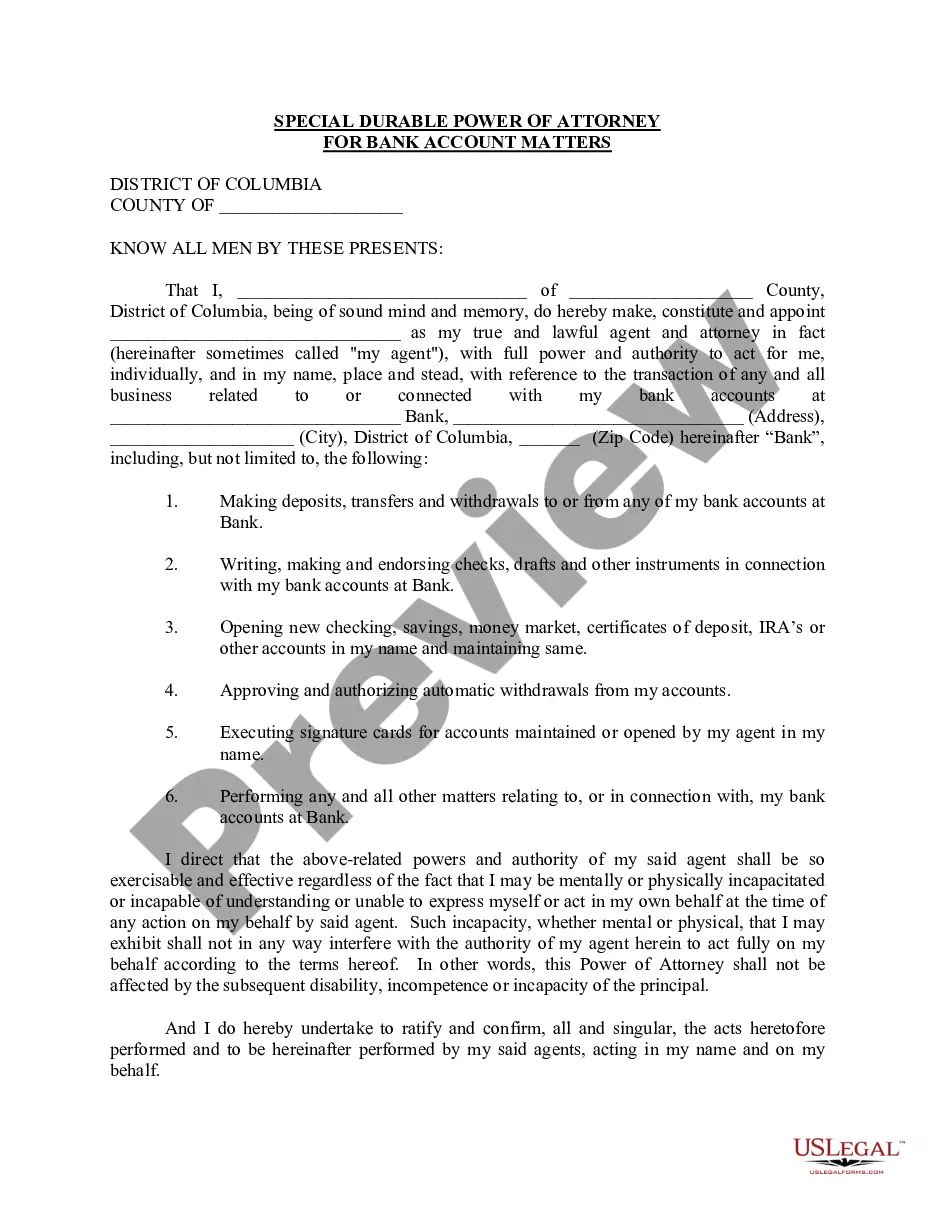

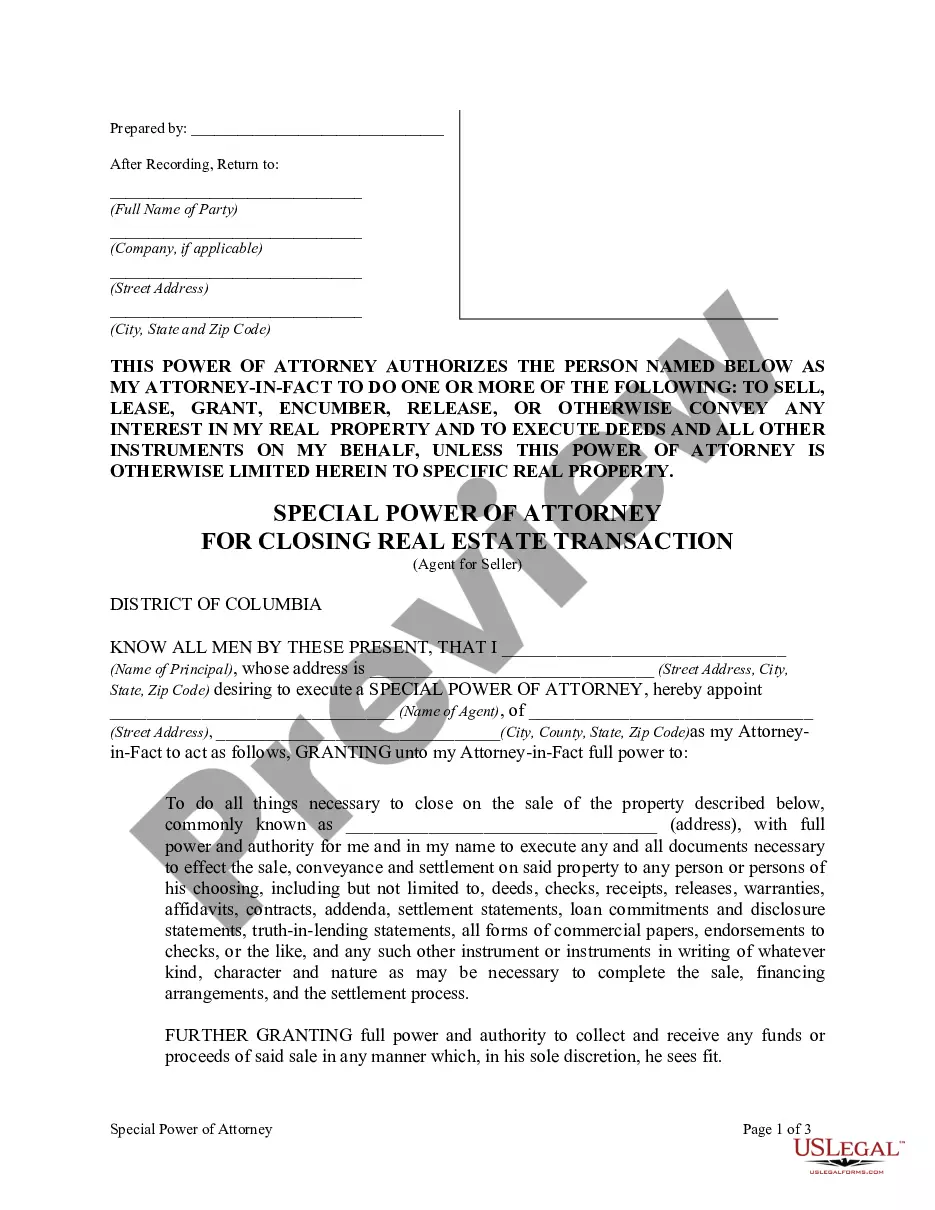

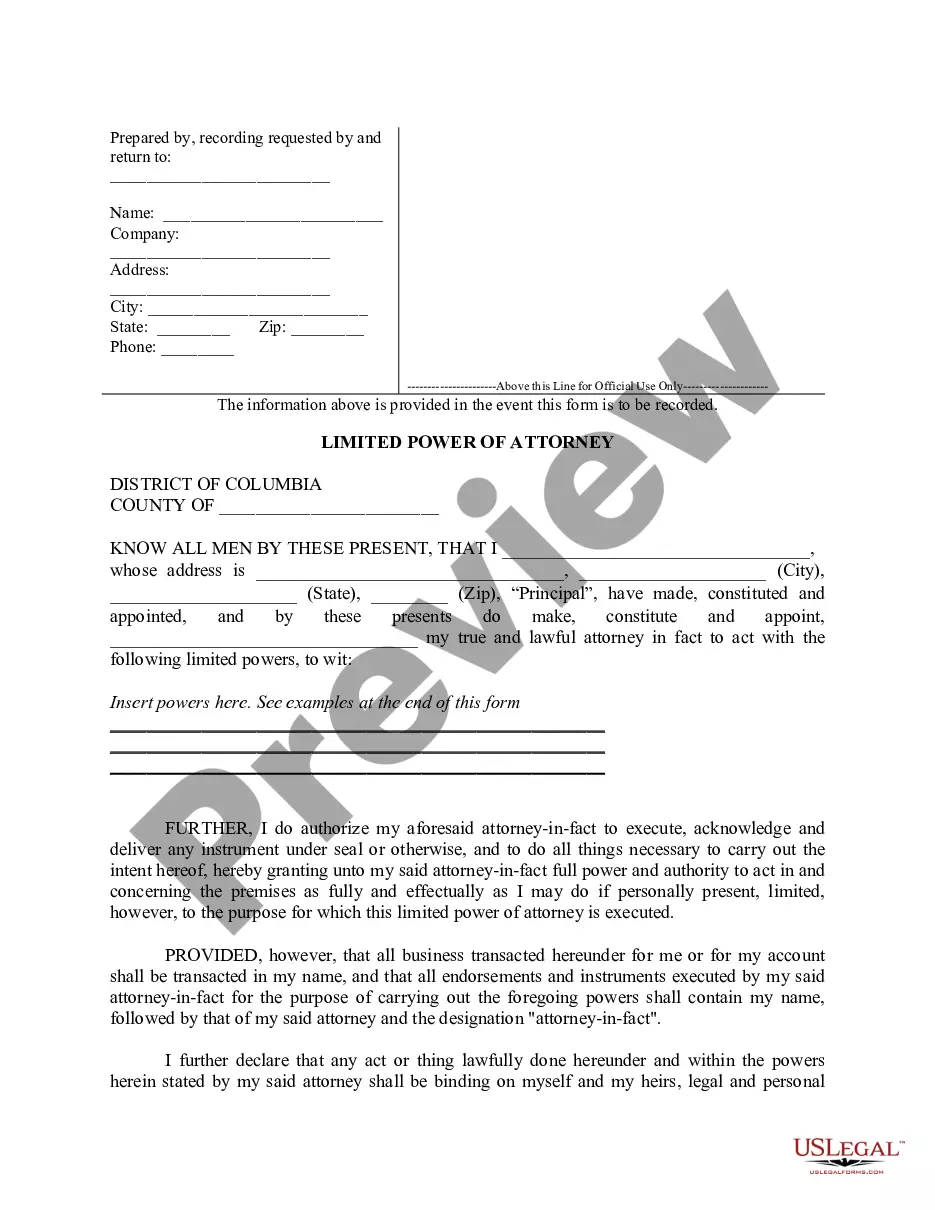

A Power of Attorney allows one person to authorize another to make decisions on their behalf. These documents are often used in situations involving financial or healthcare matters. Explore state-specific templates for your needs.