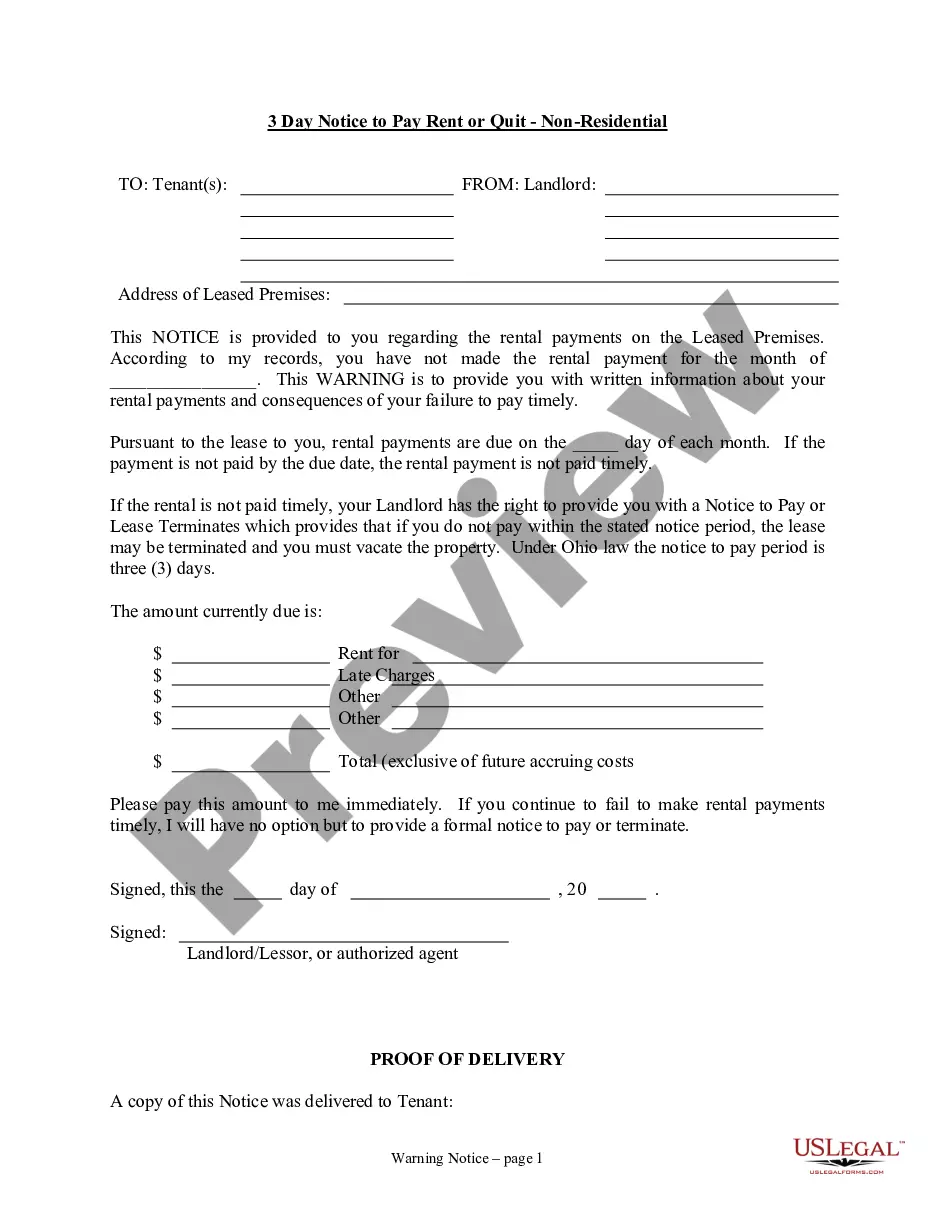

This is an official form of the District of Columbia court system. This form is used by the court to command the clerk of court to take a certain action in a civil matter, such as issuing a writ of possession in an eviction case.

Civil Court Cases For Credit Card Debt

Description

How to fill out District Of Columbia Praecipe For Use In Civil Court Case?

Navigating through the red tape of official documents and templates can be daunting, particularly if one does not engage in such matters professionally.

Even selecting the appropriate template for the Civil Court Cases For Credit Card Debt will require considerable time, as it must be accurate and specific to the last detail.

However, you will invest significantly less time selecting a suitable template from a trusted resource.

Acquire the correct form in a few easy steps: Enter the document title in the search field. Select the appropriate Civil Court Cases For Credit Card Debt from the generated results list. Review the description of the sample or open its preview. If the template meets your needs, click Buy Now. Choose your subscription plan. Use your email to create a secure password for registering an account with US Legal Forms. Select a credit card or PayPal payment method. Download the template file to your device in your chosen format. US Legal Forms can spare you extensive time on research to determine if the form you found online is suitable for your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of finding the right forms online.

- US Legal Forms serves as a one-stop shop for the latest document samples, checking their use, and downloading these samples to complete.

- It is a repository with over 85K forms applicable in various fields.

- When searching for a Civil Court Cases For Credit Card Debt, you will not need to question its validity as all forms are verified.

- Creating an account at US Legal Forms will ensure you have all the necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by simply clicking Log In on the library site.

- If you do not yet have an account, you can always re-search for the template you require.

Form popularity

FAQ

Simply stopping payments on credit cards is not advisable. It can lead to collections and civil court cases for credit card debt, drastically impacting your credit score. Instead, explore options such as payment plans or working with creditors. US Legal Forms can assist you in understanding your rights and finding solutions to manage your debt effectively.

Getting rid of credit card debt without paying it off completely is challenging. Some options, like debt settlement, involve negotiating a lower payment. Alternatively, consider bankruptcy, but be aware it can lead to civil court cases for credit card debt and significant long-term effects on your credit. Consult professionals or platforms like US Legal Forms to explore your options.

The idea that your credit is clear after seven years is partially true. Negative information, like missed payments, typically stays on your report for this duration. However, civil court cases for credit card debt can remain on your credit report longer if they result in a judgment. Be proactive about your credit health by reducing debt and staying informed.

Walking away from credit card debt may seem appealing, but it has consequences. When you stop paying, creditors often pursue civil court cases for credit card debt. This can lead to a judgment against you, resulting in wage garnishment or liens on your property. It's essential to consider alternatives, such as negotiating with creditors or seeking help from professionals.

The maximum percentage for a credit card settlement can vary significantly, but it usually peaks between 60% to 80% of the total debt. Many creditors aim to recover as much as possible, leading them to accept higher settlements. However, achieving a settlement close to the maximum percentage is rare and requires negotiation skills and an understanding of the creditor's flexibility. Consulting with platforms such as US Legal Forms can equip you with the necessary knowledge and tools for successful negotiations.

A common approach is to begin negotiations at around 30% to 50% of the total debt in civil court cases for credit card debt. This starting point gives you room to negotiate while demonstrating your willingness to settle. Remember, creditors often expect some negotiation, so offering less than they may initially demand can work in your favor. Utilizing tools from platforms like US Legal Forms can help you craft your offer strategically.

In civil court cases for credit card debt, settlements typically range from 40% to 60% of the total outstanding amount. Factors influencing the settlement amount include your financial situation and the creditor's willingness to negotiate. Some settlements may even go lower if you face severe financial difficulties. It's important to strategize and consider seeking assistance from platforms like US Legal Forms to navigate the process effectively.

To legally stop paying credit cards, consider exploring options like credit counseling or debt settlement. These methods can help you manage or reduce your debt while complying with the law. If debt settlement is viable, your credit card company may agree to a reduced payment plan. Remember that understanding civil court cases for credit card debt is crucial as you navigate legal options, and platforms like uslegalforms can guide you through the process.

When asking for a credit card settlement, start by outlining your current financial situation. Contact your credit card company and clearly state that you are willing to settle your debt for a lower amount. It helps to have a specific figure in mind and a timeline for payment. Engaging with experts in civil court cases for credit card debt can also provide you with additional strategies to strengthen your request.

You can absolutely request a settlement amount on your credit card debt. Reach out to your card issuer and express your desire to settle for a lower amount. Be prepared to explain your financial situation and provide any necessary documentation. Professionals familiar with civil court cases for credit card debt can offer valuable support during this negotiation process.