Notice Lien About With The Future

Description

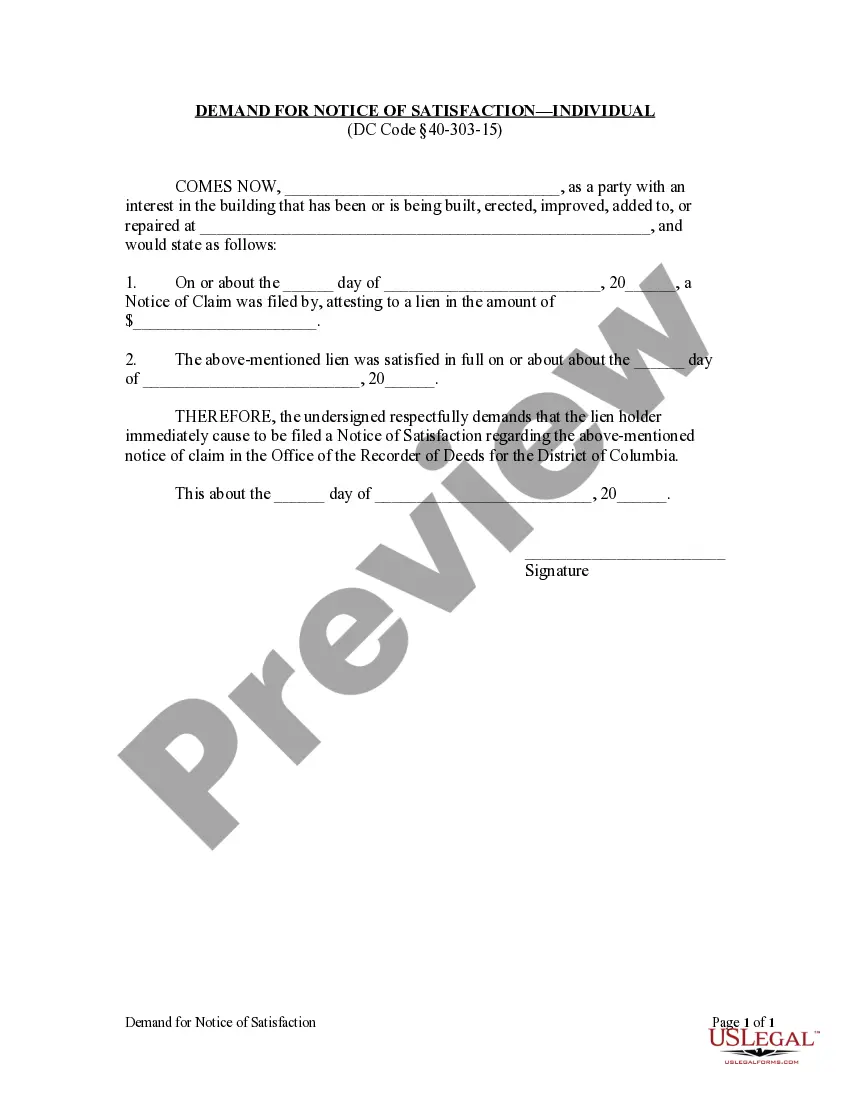

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- Log in to your US Legal Forms account if you have previously registered. Verify the validity of your subscription before downloading any forms.

- For new users, start by browsing the online library. Use the Preview mode to review form descriptions and ensure you select the appropriate document that adheres to local jurisdiction requirements.

- Should you find errors or inconsistencies, leverage the Search tab to locate the correct template. Once identified, proceed to the next step.

- Click the Buy Now button to purchase the document. Choose a subscription plan that aligns with your needs and create your account to access the legal resources.

- Complete your purchase with credit card or PayPal information, ensuring a smooth transaction.

- Finally, download your desired form onto your device. You can always revisit it in the My Forms section of your account whenever necessary.

US Legal Forms boasts a robust collection of over 85,000 forms, giving you access to more options than competitors at a similar cost. You can also consult premium experts to assist you in form completion, guaranteeing that your documents are precise and valid.

With US Legal Forms, managing legal documentation becomes straightforward and accessible. Don’t hesitate to start your journey today and streamline your legal processes.

Form popularity

FAQ

In most cases, a lien cannot be placed on your property without proper notice. Creditors typically must inform you of the intent to file a lien. Awareness of the notice lien about with the future is crucial, as early notification ensures you can address any disputes or debts before legal action is taken. For comprehensive guidance on handling such situations, consider resources available through US Legal Forms.

A lien is usually established to ensure a creditor receives payment for goods or services provided. It serves as a legal claim on property, allowing creditors to secure their interests in case of unpaid debts. Understanding the notice lien about with the future helps you grasp how liens protect financial transactions and promote responsible borrowing. Ultimately, liens are designed to maintain balance in contractual relationships.

There is typically no universal minimum amount required to file a lien, as this can differ by state and the type of lien. Some jurisdictions have specific thresholds, while others allow the filing of smaller amounts. To navigate this process effectively and understand the notice lien about with the future, it’s wise to consult your local laws or use US Legal Forms for accurate guidance. They can provide necessary information based on your situation.

Writing a letter of intent for a lien involves clearly stating your intentions and outlining the specifics of the debt. Start with a formal greeting, followed by a description of the agreement and your claim to the lien. When focusing on notice lien about with the future, include important details like due dates and payment terms. For a polished and compliant letter, consider using resources from US Legal Forms, which offers templates tailored for such documents.

The principle of lien involves a legal right that allows a creditor to claim an asset until a debt is satisfied. When you understand a notice lien about with the future, you see how it secures the creditor's interests in the event of non-payment. This principle offers protection for those who provide goods or services without immediate payment. Ultimately, it helps maintain fairness in financial transactions.

A notice of lien from the IRS indicates that the government has asserted a claim against your property due to unpaid taxes. This legal document serves to protect the government's interest and ensures they have a right to collect owed taxes. Dealing with a notice lien about with the future from the IRS can be complex, and seeking guidance can help you navigate your options effectively.

When a lien is placed against you, it means your property is encumbered until the debt is resolved. This can impact your ability to sell or refinance your property, as liens typically need to be settled first. Addressing concerns related to a notice lien about with the future promptly can help prevent prolonged complications.

A notice of lien serves as a public declaration that a creditor has a legal claim against a debtor's property. This document typically signifies that the creditor intends to enforce the lien due to unpaid debts. Understanding a notice lien about with the future helps property owners understand their rights and potential legal exposure.

Yes, it is possible for someone to put a lien on your house without your immediate knowledge. Creditors can file liens with the appropriate county office, often without notifying home or property owners prior. It’s essential to monitor property records, especially if you receive any notice lien about with the future, to safeguard your investment.

Georgia’s lien laws provide guidance on how creditors can secure their interests and the rights of property owners. Lien types include judgment liens, mechanic's liens, and tax liens. Knowing the specifics of these laws can help you navigate the complexities of a notice lien about with the future.