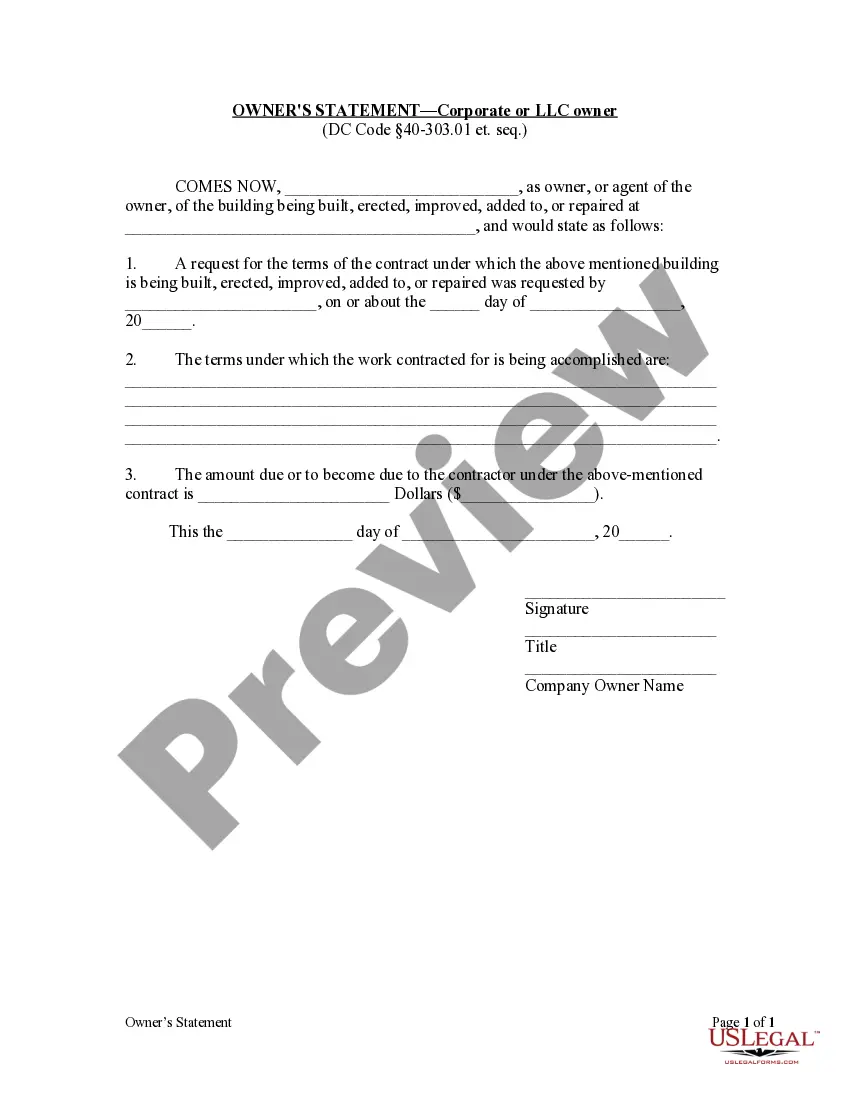

District of Columbia statutes permit a subcontractor or other party to demand from the owner a statement of the terms of the contract under which the owner and contractor are operating. This form is used by the corporate owner to respond to this demand and supply the required information.

Limited Liability Company With The Ability To Establish Series

Description

How to fill out District Of Columbia Owner's Statement By Corporation?

- If you're a returning user, simply log in to your account and tap the Download button to get your requisite form. Ensure your subscription remains active; renew if necessary.

- For first-time users, begin by previewing the form descriptions and checking that the selected template adheres to your local regulations.

- If you require a different form, utilize the Search feature to find the appropriate template that meets your specifications.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You will need to create an account to access the complete library of resources.

- Finalize your transaction by entering your payment details, either through credit card or PayPal.

- Once your purchase is complete, download the form to your device. You can access it anytime later from the My Forms section in your profile.

In conclusion, US Legal Forms provides a robust solution for obtaining essential legal documents effortlessly. With their extensive library and expert support, your journey to establishing a Limited Liability Company with series capabilities is streamlined and efficient.

Don’t hesitate! Start today by visiting US Legal Forms and take the first step towards securing your legal needs.

Form popularity

FAQ

Yes, you can change your existing LLC to a Limited liability company with the ability to establish series. The process involves filing the appropriate paperwork with your state and may require an amendment to your original LLC's formation documents. Engaging with a service like uslegalforms can simplify this transition, ensuring you meet all necessary legal requirements smoothly.

Filing taxes for a Limited liability company with the ability to establish series involves specific considerations. Each series may need to file separate tax returns depending on its income and activities. It's crucial to work with a tax professional who understands the nuances of Series LLCs to ensure accurate reporting and compliance at both federal and state levels.

The primary purpose of a Limited liability company with the ability to establish series is to provide flexibility in organizing and protecting different business ventures. Each series operates independently, allowing for individualized asset protection and segregation of liabilities. This structure can save time and costs as multiple businesses can be managed under one LLC framework, streamlining administrative tasks and compliance.

A Limited liability company with the ability to establish series can have downsides. One concern is the complexity in its structure, which may lead to confusion during management and operation. Additionally, certain states have less clear regulations regarding Series LLCs, potentially complicating legal protection. It's essential to consult with a legal expert to ensure compliance and adequacy of protection.

A limited liability company with the ability to establish series is typically taxed as pass-through entities, meaning profits pass directly to the owners. Each series can file its own tax return if it chooses to treat itself as a separate entity. However, tax regulations can vary by state, so it is wise to consult a professional for specific guidance.

For many entrepreneurs, a limited liability company with the ability to establish series is a good idea, especially if they wish to operate distinct businesses under one entity. This structure facilitates easier management of assets while providing liability protection. It simplifies the organizational framework, catering to innovative business strategies.

Yes, maintaining separate bank accounts for each series in a limited liability company with the ability to establish series is essential for financial clarity. Each series should have its own account to ensure accurate tracking of income and expenses. This practice helps preserve the legal protections that series LLCs provide.

A limited liability company with the ability to establish series can be highly beneficial for business owners managing multiple assets or ventures. By using a series LLC, you create separate divisions under one umbrella, which can save on administrative costs. Additionally, each series can have its own liability protection, reducing risk for your overall operations.

Each series within a series LLC generally does not need its own Employer Identification Number (EIN), as the entire series LLC can often use a single EIN. However, if a series engages in distinct business activities or hires employees, it might require its own EIN for tax purposes. To navigate these tax implications effectively, consider utilizing resources and guidance from uslegalforms to clarify your requirements.

Yes, you can change your current LLC to a series LLC, but it involves following specific legal procedures based on your state’s requirements. You’ll need to amend your operating agreement and possibly file additional documents with the appropriate state agency. Seeking guidance through platforms like uslegalforms can help ensure that you complete this transformation correctly and efficiently.