Limited Companies

Description

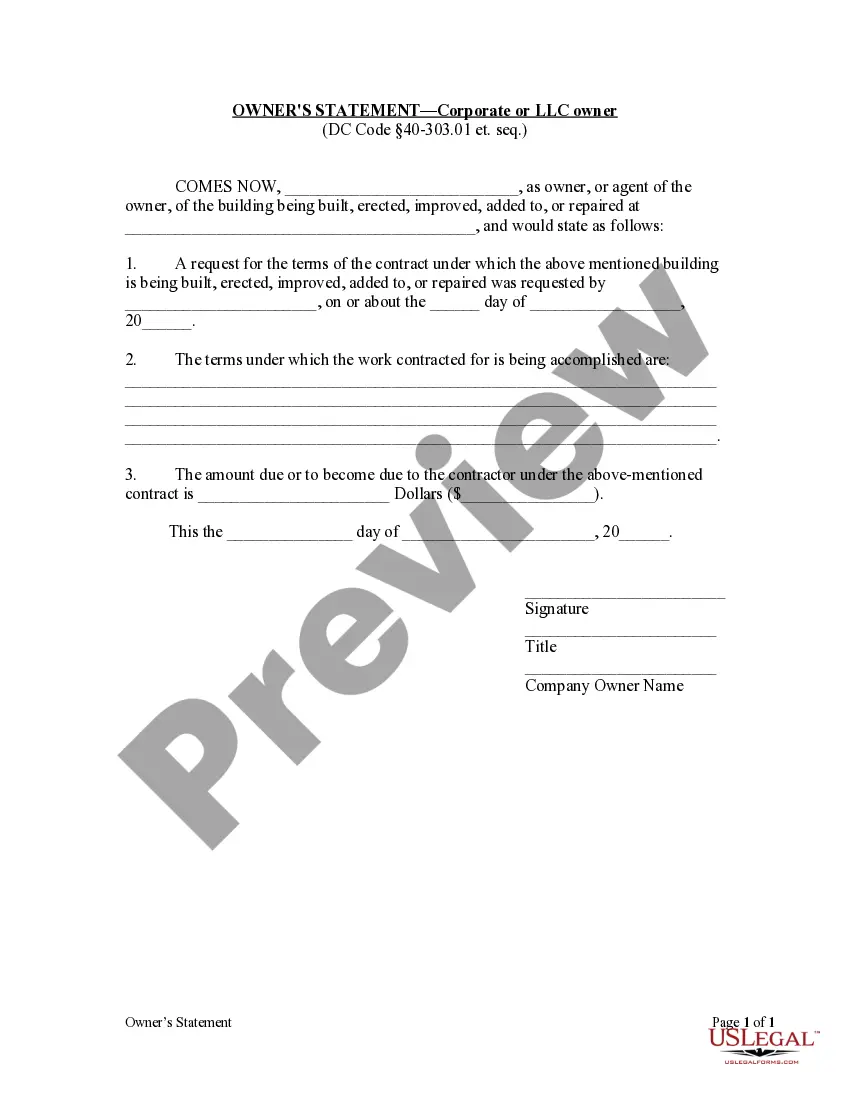

How to fill out District Of Columbia Owner's Statement By Corporation?

- If you are a returning user, log in to access your account. Check your subscription status and renew if necessary.

- For new users, begin by browsing our extensive form library. Use the Preview mode to ensure the chosen template meets your local jurisdiction requirements.

- If you need a different form, utilize the Search tab to find the appropriate document.

- Once ready, click the Buy Now button and select your desired subscription plan to gain access to our legal resources.

- Complete your purchase by entering your payment details or using your PayPal account.

- Download your form directly to your device, and access it anytime via the My Forms section in your profile.

With over 85,000 fillable legal documents available, US Legal Forms ensures that you have access to more forms than many competitors, making it the ideal choice for limited companies.

Don’t wait to start your legal journey! Visit US Legal Forms today and take the first step toward efficient document management.

Form popularity

FAQ

A practical example of a limited liability company (LLC) is Airbnb. This platform operates as an LLC to protect its owners from personal liability while facilitating its business operations. Limited companies like Airbnb benefit from flexible management structures and fewer compliance requirements. For those interested in forming an LLC, uslegalforms provides helpful resources for navigating the process.

A limited company is a specific type of business entity that limits the liability of its owners. It can be either a private limited company or a public limited company, providing varying degrees of access for investment and shareholder rights. Limited companies offer benefits such as tax advantages, credibility, and limited liability, making them a popular choice for entrepreneurs. You can use platforms like uslegalforms to start and manage your own limited company effectively.

Yes, Apple Inc. operates as a limited company. This structure allows it to protect its shareholders from personal liability for the company's debts. As limited companies, businesses like Apple can raise funds more easily and operate with specific legal protections. This helps them focus on innovation and growth while offering security to their investors.

Limited companies can encounter issues such as limited access to capital, especially when compared to corporations. They may face higher startup costs and more complex taxation processes. Also, shareholders often experience less control since decisions are made collectively, which can lead to conflicts or slower decision-making.

The biggest disadvantage of an LLC may be the self-employment tax, which can be significant for owners. Unlike some limited companies, LLC members might be subject to higher taxes on their profits. Therefore, while LLCs offer flexibility and liability protection, it's crucial to consider the overall tax implications before choosing this structure.

One of the main disadvantages of limited companies is the administrative burden they face. Running a limited company involves maintaining statutory records, filing annual returns, and undergoing regular audits. This added complexity can deter some entrepreneurs who prefer simpler business structures.

Limited companies (Ltd) and Limited Liability Companies (LLC) are both structures that offer limited liability but differ in their formation and operation. Ltd companies are often more formal and are governed by more stringent regulations, while LLCs provide more flexibility in management and taxation. Understanding these differences can help you choose the best structure for your business needs.

Being a limited company is often beneficial, as it provides personal liability protection for owners. This means that your personal assets are generally safe from business debts. Furthermore, limited companies may enjoy tax advantages and enhanced credibility, making it easier to secure funding or attract clients.

Limited companies, specifically public ones, face challenges like increased regulatory scrutiny, which requires substantial compliance efforts. They also deal with the pressure of short-term performance expectations from shareholders, potentially impacting long-term strategy. Additionally, public limited companies must disclose financial information, which could give competitors insights into their operations.

Limited companies primarily fall into two categories: private limited companies (Ltd) and public limited companies (PLC). Private limited companies do not sell shares to the public and restrict the number of shareholders, which helps maintain control. Public limited companies can sell shares openly, raising significant capital but also facing more regulatory scrutiny. Whether you choose a private or public route, uslegalforms can guide you in selecting the best type of limited company for your goals.