Limited Business

Description

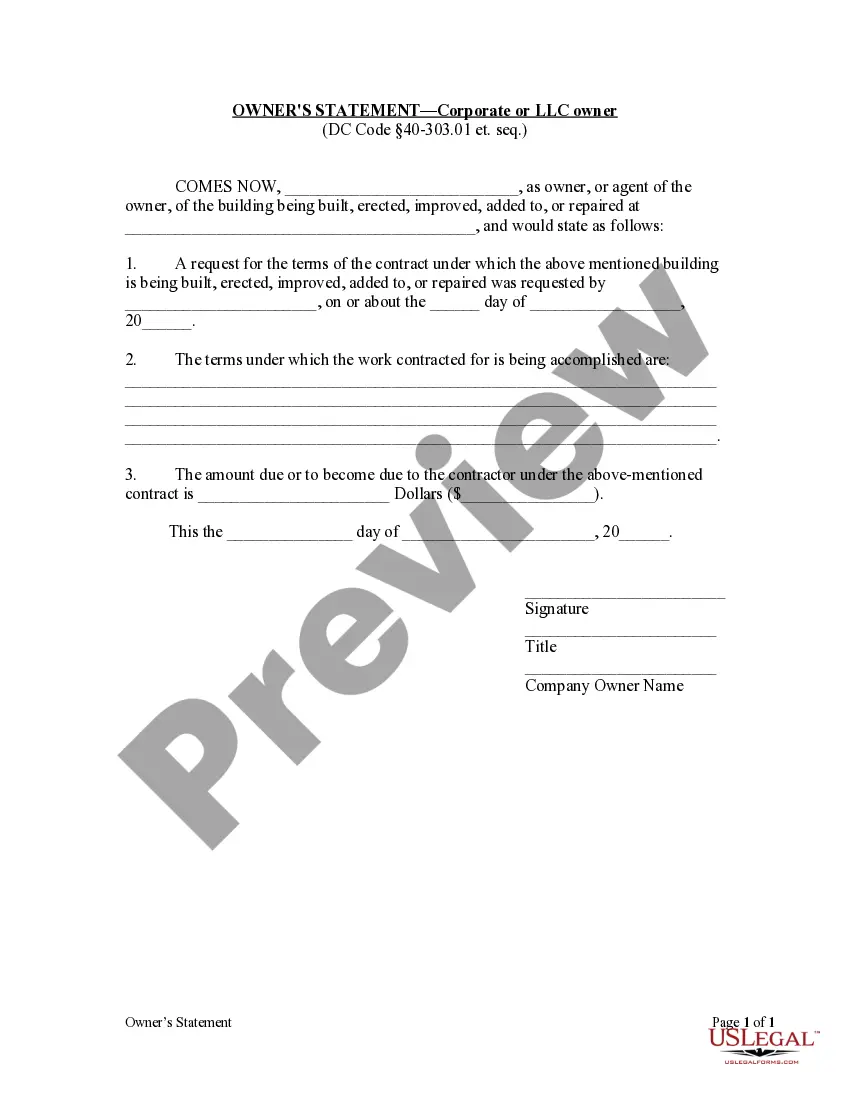

How to fill out District Of Columbia Owner's Statement By Corporation?

- Log in to your existing US Legal Forms account to access your previous documents or click on 'Create Account' if you are a new user.

- Use the Preview mode to carefully review the form description and ensure it meets your local jurisdiction’s requirements.

- If necessary, leverage the Search tab to locate a different template that better meets your legal needs.

- Select your preferred subscription plan by clicking the 'Buy Now' button and follow the prompts to create an account.

- Complete your purchase by providing the required payment information, including credit card details or PayPal account.

- Download the completed form to your device and find it later in the 'My Forms' section of your profile for future reference.

In conclusion, US Legal Forms provides an extensive library of over 85,000 editable legal forms that cater to various legal needs, ensuring you have access to comprehensive support. With premium expert assistance available, you can confidently finalize your documents.

Start your hassle-free legal documentation today with US Legal Forms!

Form popularity

FAQ

An example of a limited liability company, often abbreviated as LLC, is a business formed under state laws that provides financial protection for its members. For instance, a small online retail shop operating as an LLC limits the owner's personal financial exposure in case of debts or legal issues. This feature makes it an attractive option for many entrepreneurs who want to combine flexibility with personal asset protection. Platforms like uslegalforms can assist you in establishing your LLC easily and efficiently.

A limited business typically refers to a business structure that limits the liability of its owners. In this setup, owners are protected from personal financial risk related to business debts or legal actions. This structure allows for greater security, which encourages entrepreneurs to invest and innovate. By choosing a limited business structure, you can safeguard your personal assets while enjoying the benefits of running a company.

You are required to file taxes if your net earnings from self-employment exceed $400, regardless of your total income. Even if you made less than $5000 self-employed, reporting your income is still essential for compliance with tax laws. Maintaining accurate financial records for your Limited business can provide clarity and avoid any potential issues. Consider using USLegalForms for assistance in navigating the tax filing process.

Your LLC is required to file taxes if it has a net income of $400 or more. This is the same threshold applied to small businesses and Limited businesses. Even if your LLC does not meet this threshold, it is prudent to keep records of all income. This practice helps maintain clarity and compliance with IRS regulations.

Filing taxes for an LLC and personal taxes can depend on the type of LLC you choose. Single-member LLCs typically report income on the owner’s personal tax return, while multi-member LLCs file separately. It is essential to consult a tax professional or utilize resources like USLegalForms to ensure you meet all tax obligations efficiently. Understanding your unique tax situation is crucial for your Limited business.

Yes, you must report all business income, even if it's under $600. The IRS requires all income to be reported for tax purposes, regardless of the amount. This requirement applies to Limited businesses as well. Keeping accurate records can help you stay compliant and avoid potential issues down the road.

You do not need to form an LLC to operate a small business; however, forming one can provide personal liability protection and other benefits. An LLC is especially popular among Limited businesses for its flexibility in management and taxation. If you decide to form an LLC, USLegalForms can assist you with the setup process. Make sure to weigh the advantages and disadvantages before deciding.

As a small business owner, you are required to file taxes if your net earnings exceed $400. This applies to various business structures, including those classified as Limited businesses. Therefore, even if your income is low, it’s crucial to track earnings. Accurate documentation can guide you through the tax filing process.

In the United States, a small business must report income regardless of the amount. However, generally, businesses making over $400 in profit are required to file taxes. If your business falls under the Limited business classification, it’s important to keep accurate records to determine tax obligations. Utilizing platforms like USLegalForms can help streamline your tax filing process.

You are considered a limited company when your business structure is designed to limit the liabilities of its owners. This status is achieved through proper registration and adherence to regulatory frameworks. Being a limited company streamlines your legal obligations while offering you protection for personal assets. Using resources like uslegalforms can simplify the registration process to establish your limited business effectively.