Power Of Attorney Irs

Description

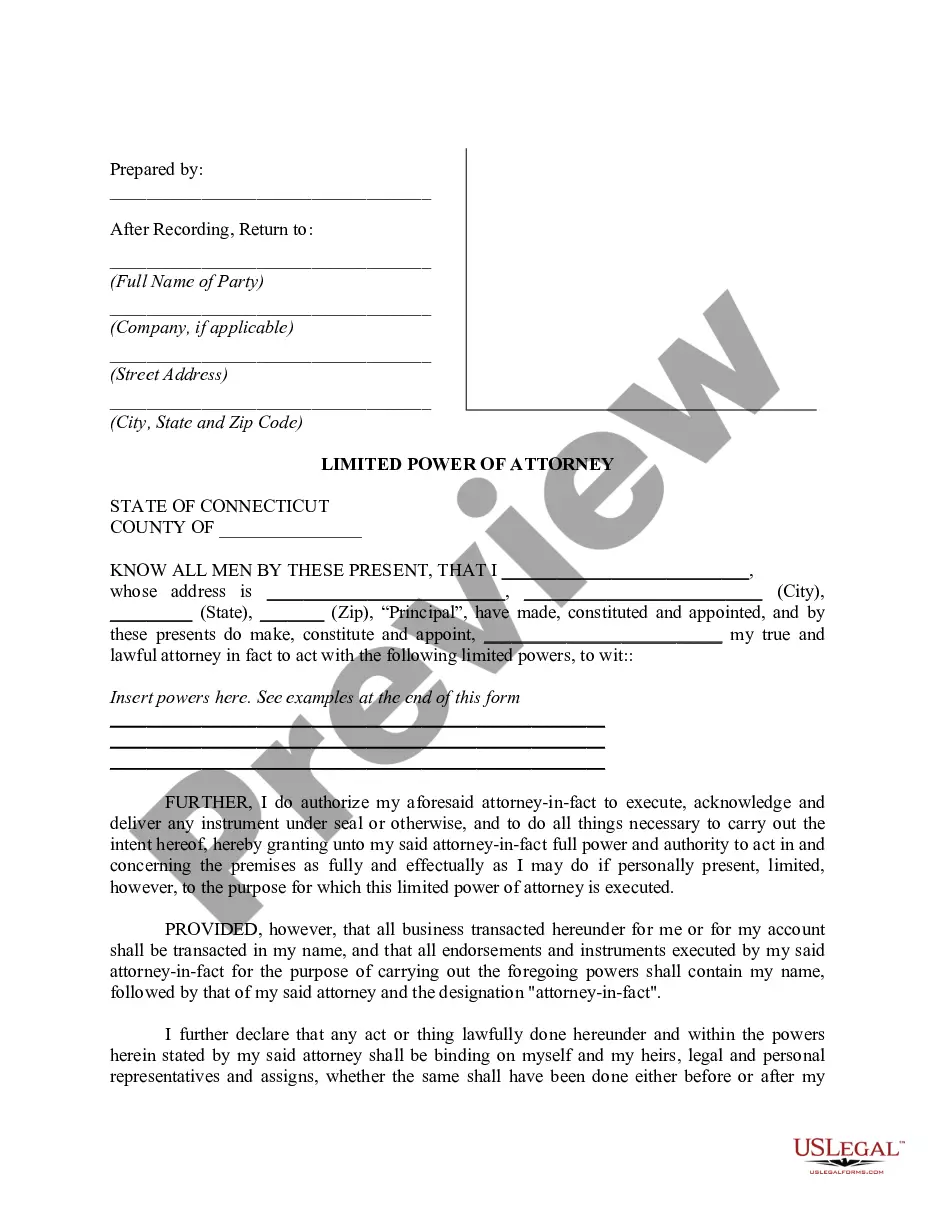

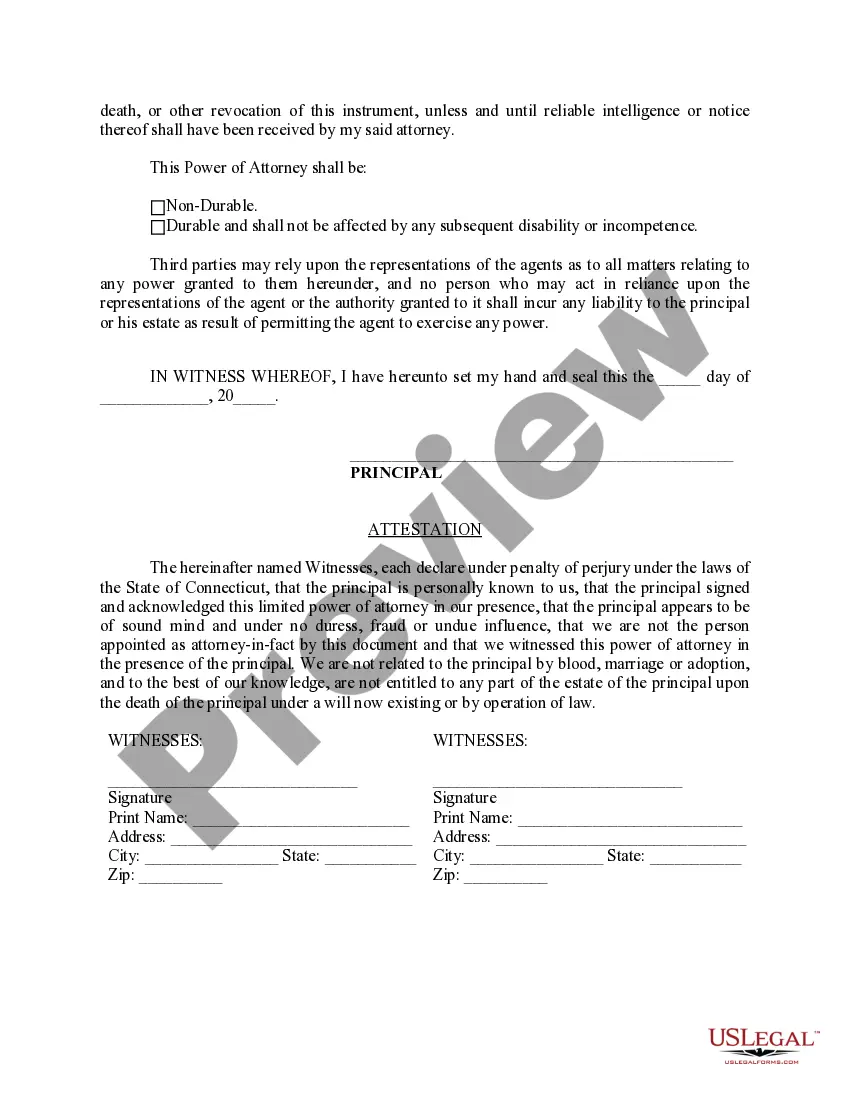

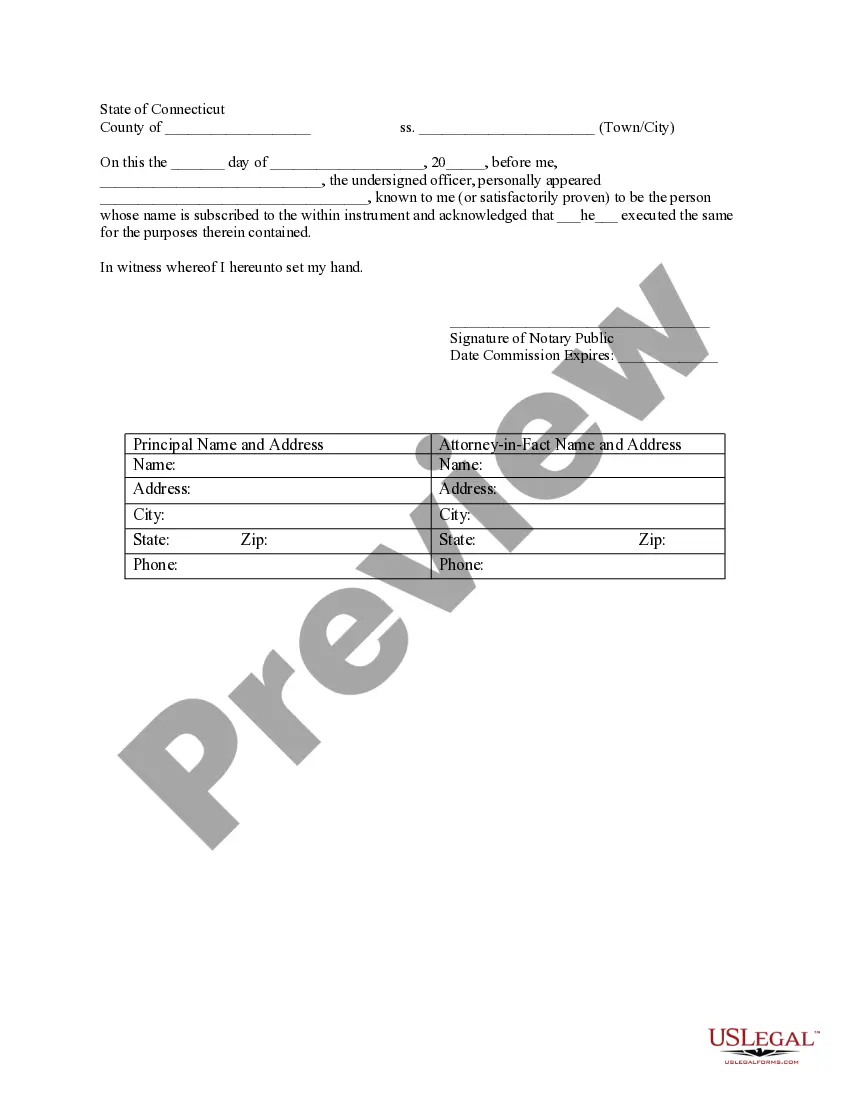

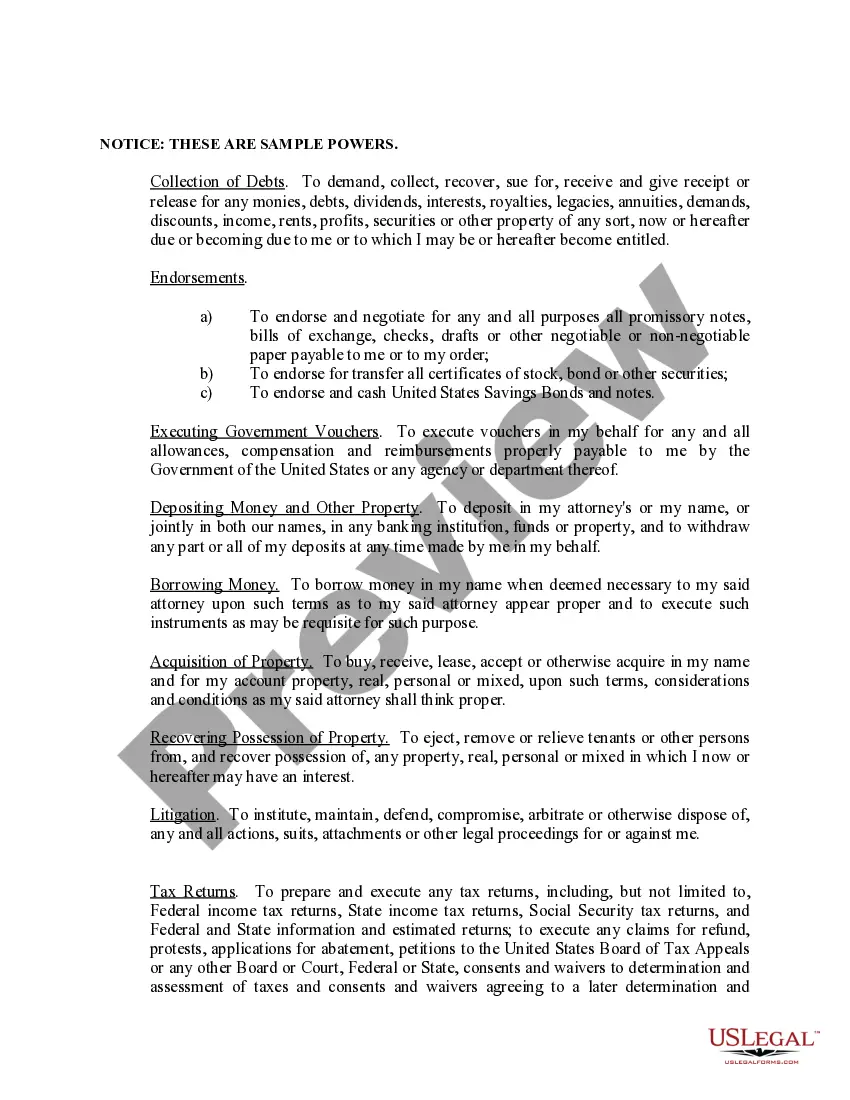

How to fill out Connecticut Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your existing US Legal Forms account if you're a returning user. Confirm your subscription status and click the Download button to retrieve the necessary template.

- For new users, begin by exploring the Preview mode and description of the Power of Attorney IRS form. Ensure it aligns with your legal needs and complies with local jurisdiction.

- If you discover discrepancies, utilize the Search tab above to find an alternative template that fits your specific requirements.

- Proceed to purchase the document by clicking on the Buy Now button. Select your preferred subscription plan, then create an account for full access.

- Complete your purchase by providing payment details either via credit card or PayPal.

- Once your transaction is confirmed, download the form to your device for completion. You can also access it later in the My Forms section of your account.

The Power of Attorney IRS form is essential for ensuring your financial matters are handled appropriately, and US Legal Forms makes the process simple and hassle-free.

Take advantage of our extensive library today to secure your essential legal documentation and experience the benefits of expert assistance. Start your journey with us now!

Form popularity

FAQ

The IRS does accept electronic signatures on Form 8655, which is used for the appointment of an agent. This acceptance streamlines the process, but be sure to use secured systems that meet IRS standards for electronic submissions. Using platforms like US Legal Forms can help ensure your documents are completed and signed correctly.

Yes, the IRS does accept electronic signatures for power of attorney submissions in accordance with their guidelines. However, not all types of documents may qualify, so review the IRS specifications before proceeding. If you are unsure, consider using a trusted service to assist with your power of attorney for IRS matters.

The IRS does allow certain forms, like power of attorney documents, to be signed electronically under specific circumstances. Utilizing designated electronic filing systems can facilitate this process, provided you follow IRS guidelines. Verify that your electronic signature complies with IRS requirements to ensure your power of attorney is accepted.

To fill out a power of attorney form, start by providing your personal information, including your name, address, and Social Security number. Then, detail the powers you are granting to your designated representative, ensuring you specify any limitations. For specific guidance on the IRS Form 2848, consider using platforms like US Legal Forms to access templates and find further instructions.

Generally, the IRS does not require a power of attorney to be notarized. However, some states may have specific laws requiring notarization for such documents. It's important to confirm local requirements to ensure your power of attorney is valid when dealing with the IRS.

Yes, a power of attorney can be signed virtually if the appropriate measures are taken to ensure its validity, particularly regarding the IRS. Using online legal services can simplify the process by providing secure platforms for virtual signatures and document submissions. Just ensure that the virtual process aligns with IRS requirements for power of attorney.

To submit a power of attorney to the IRS, you need to complete Form 2848, which is the official Power of Attorney and Declaration of Representative form. After filling it out, you can mail or fax it to the IRS office, depending on your location and the specific instructions provided by the IRS. Ensure that all necessary signatures are included for a valid submission, making it easier for you to manage your tax affairs.

To get power of attorney for the IRS, you need to complete IRS Form 2848, which grants authorization to act on your behalf. Make sure to provide accurate and complete information to avoid delays. After filling out the form, submit it either by mail or fax to the appropriate IRS office. Trusting USLegalForms can help you automate this process with easy-to-follow templates and guidance tailored for the IRS.

Obtaining a power of attorney can be a straightforward process, usually taking just a few days to a couple of weeks. This timeframe depends on how quickly you gather necessary documents and if you face any complications during the process. It's essential to draft the documents properly to avoid delays related to legal verification. If you want to simplify the process, consider utilizing USLegalForms to create a valid POA quickly.

The most effective way to submit your power of attorney (POA) to the IRS is by mailing it directly to the IRS office handling your case. You can also fax the POA if you have access to the appropriate mailing address or fax number for your jurisdiction. Ensure all forms are filled out completely, as incomplete submissions can delay processing. Using USLegalForms can streamline this submission by providing you expert guidance and customizable templates.