Power Attorney For Property

Description

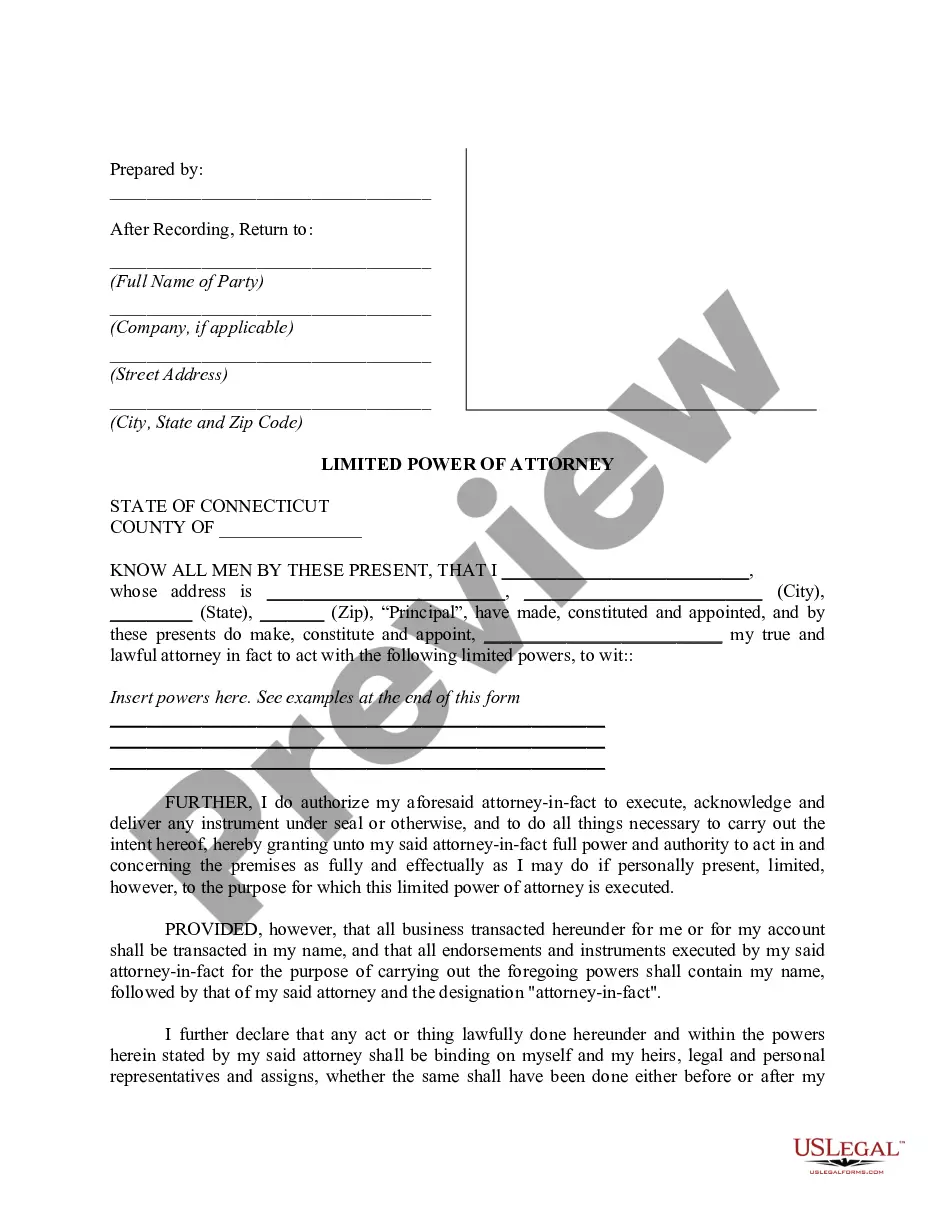

How to fill out Connecticut Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you’re an existing user, or create a new account for first-time users.

- Browse the library for the power attorney for property form. Utilize the Preview mode to ensure it meets your local jurisdiction requirements.

- If the form doesn’t meet your needs, use the Search feature to find a more suitable template.

- Once you find the appropriate document, click the 'Buy Now' button and select a subscription plan that fits your requirements.

- Complete the purchase by entering your payment information via credit card or PayPal.

- Download the completed form to your device and access it anytime from the 'My Forms' section in your account.

In conclusion, US Legal Forms offers a robust solution for anyone seeking a power attorney for property. With an extensive library and expert assistance, you can ensure your documents are not just filled out, but filled out correctly.

Start your journey with US Legal Forms today and make the legal process simpler!

Form popularity

FAQ

While a power of attorney for property offers many advantages, it also carries some risks. One potential disadvantage is the risk of misuse, as the appointed agent could make decisions that do not align with your best interests. Additionally, revoking or changing a power of attorney can be complex and may require legal assistance if disputes arise. Therefore, choosing a trustworthy agent is crucial for your peace of mind.

The easiest way to establish a power of attorney for property is to use an online service like UsLegalForms, which provides user-friendly templates tailored to your needs. These templates guide you through the process, ensuring you include all necessary information while allowing you to customize your document. Moreover, having an attorney review your completed document can help confirm its validity and clarity.

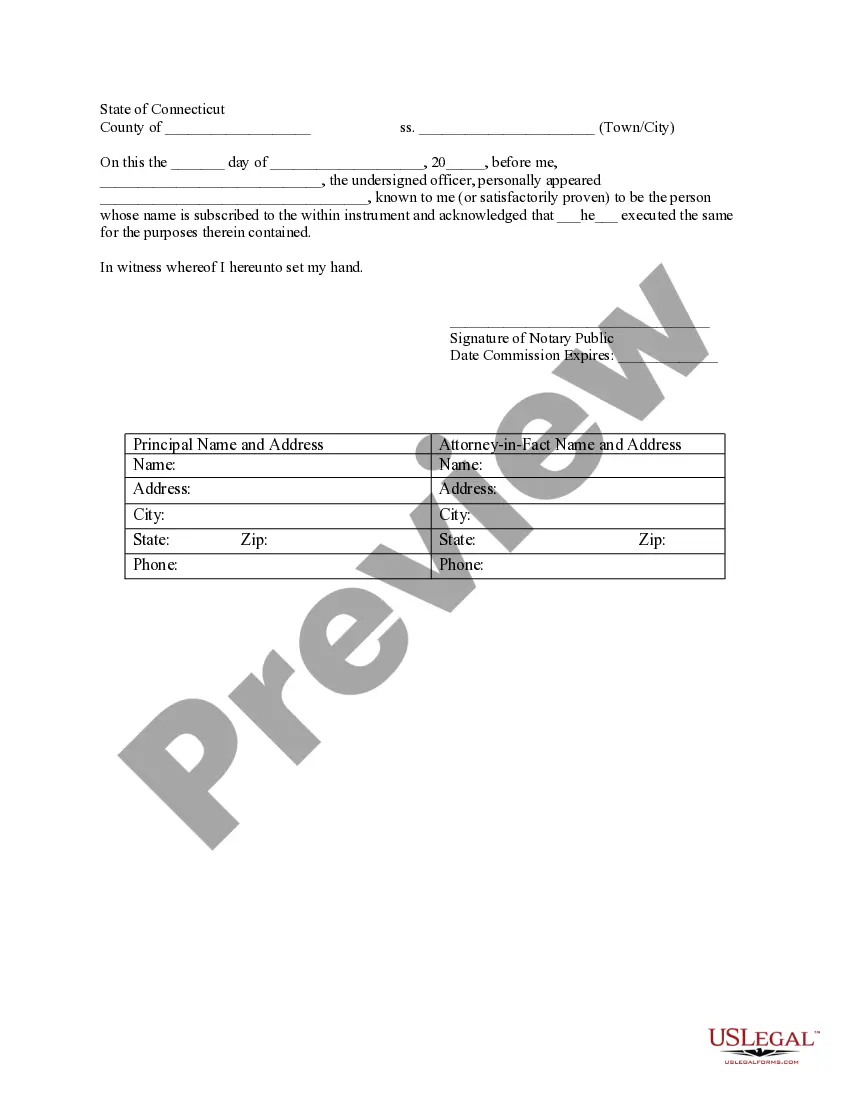

In New Jersey, creating a valid power of attorney for property requires you to sign a written document that clearly states your intention to appoint an agent. The document must include your name, your agent's name, and the specific powers being granted. Additionally, it should be signed in the presence of a notary public and witnessed by at least one other person to ensure enforceability.

To write a letter granting power of attorney for property, start by clearly identifying yourself and the person you are designating as your attorney in fact. Include your full names, addresses, and a concise statement expressing your intent to grant them power of attorney for property matters. It is vital to specify the powers you are providing and to sign the document in front of a notary public to ensure its legality.

In South Carolina, the rules for power of attorney for property state that the document must be in writing and signed by the principal. It should specify the powers granted, and if the powers include real estate transactions, it must be notarized. It's advisable to seek legal advice to ensure compliance with local laws and to understand any potential implications for your property.

Writing a power of attorney letter for property requires clear identification of both parties—yourself and your agent. Start with a statement that grants your agent authority to manage your property affairs. Include details about the scope of powers and any limitations. Finally, sign the letter in the presence of a notary public to formalize the document and make it legally binding.

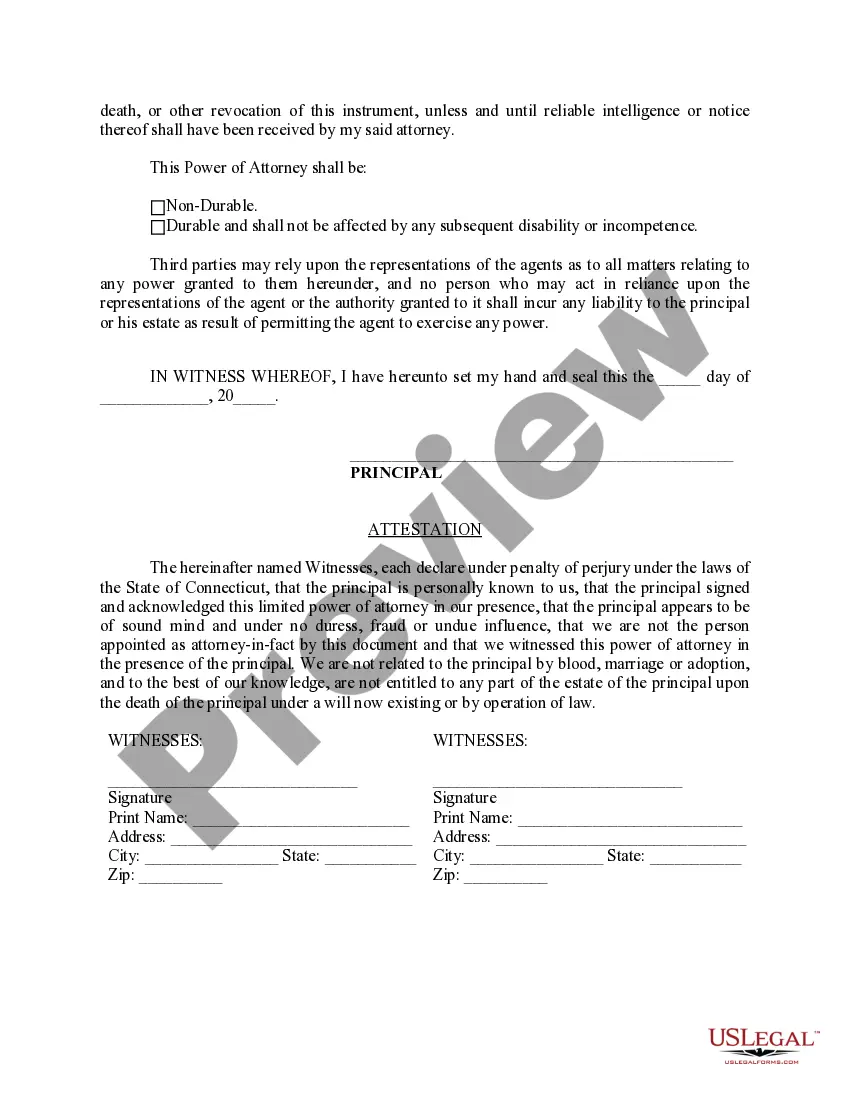

Filling up a power of attorney involves clearly stating your name, your agent’s name, and detailing the specific powers you wish to grant. It’s crucial to specify whether the power is limited to certain actions or if it is broad. After completing the form, ensure that you follow any state-specific regulations for signing and notarization, which may vary depending on where you reside.

To fill out power of attorney paperwork, start by gathering all necessary information, including your name, the name of your agent, and the powers you wish to grant them. Follow the form's instructions carefully to ensure accuracy. Once completed, the document often requires signing in the presence of a notary or witnesses, depending on state requirements, making it official and recognized.

When signing as power of attorney for property, the agent should write their name followed by 'as attorney in fact for Your Name'. For instance, if John Smith is your agent, he would sign as 'John Smith, as attorney in fact for Jane Doe'. This indicates that John is acting on behalf of Jane, highlighting the responsibilities of the agent in managing property.

The best person to act as your power of attorney for property is someone you trust implicitly. This could be a family member, a close friend, or a professional advisor. Ensure that the person understands your financial goals and is willing to act in your best interest. Selecting the right individual is crucial for effectively managing your property and financial affairs.