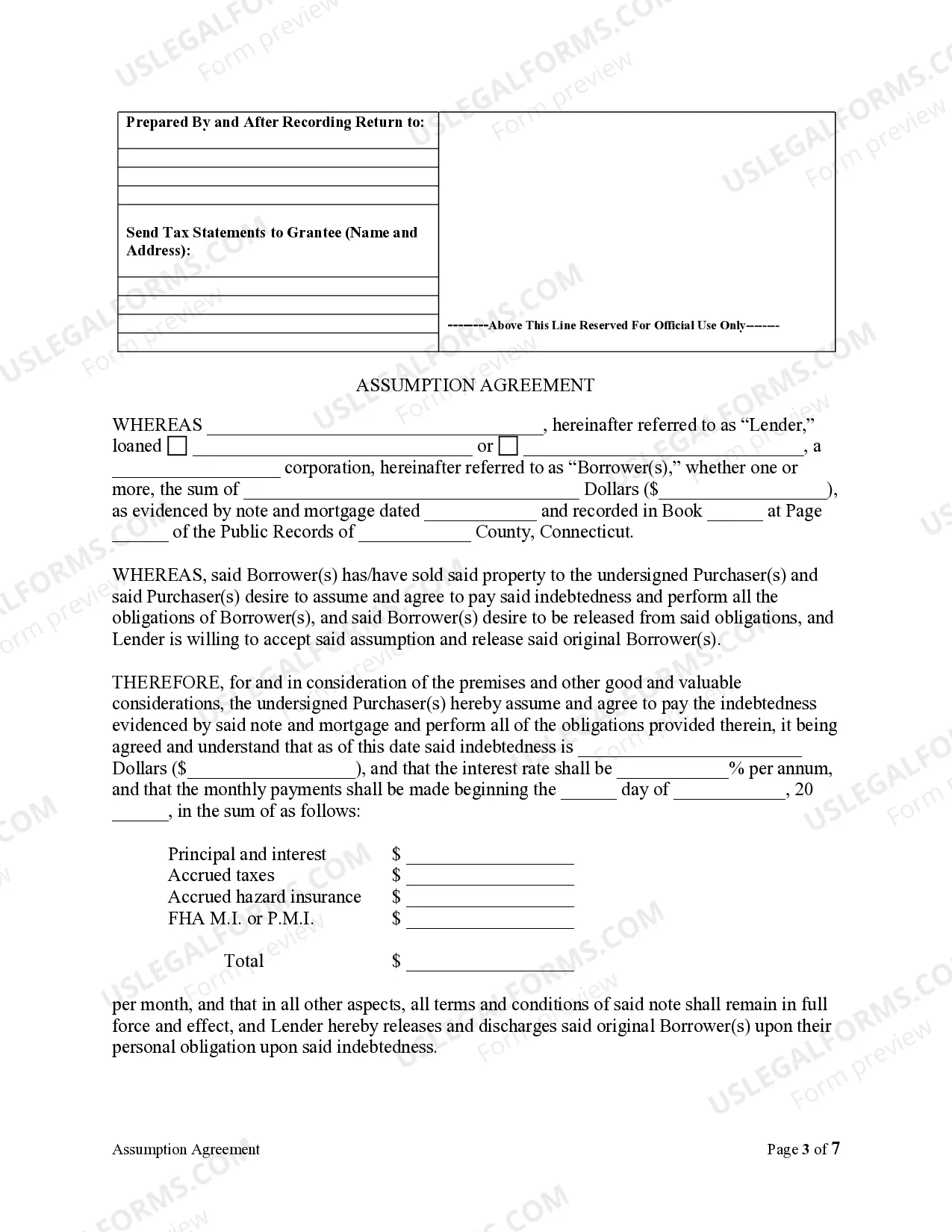

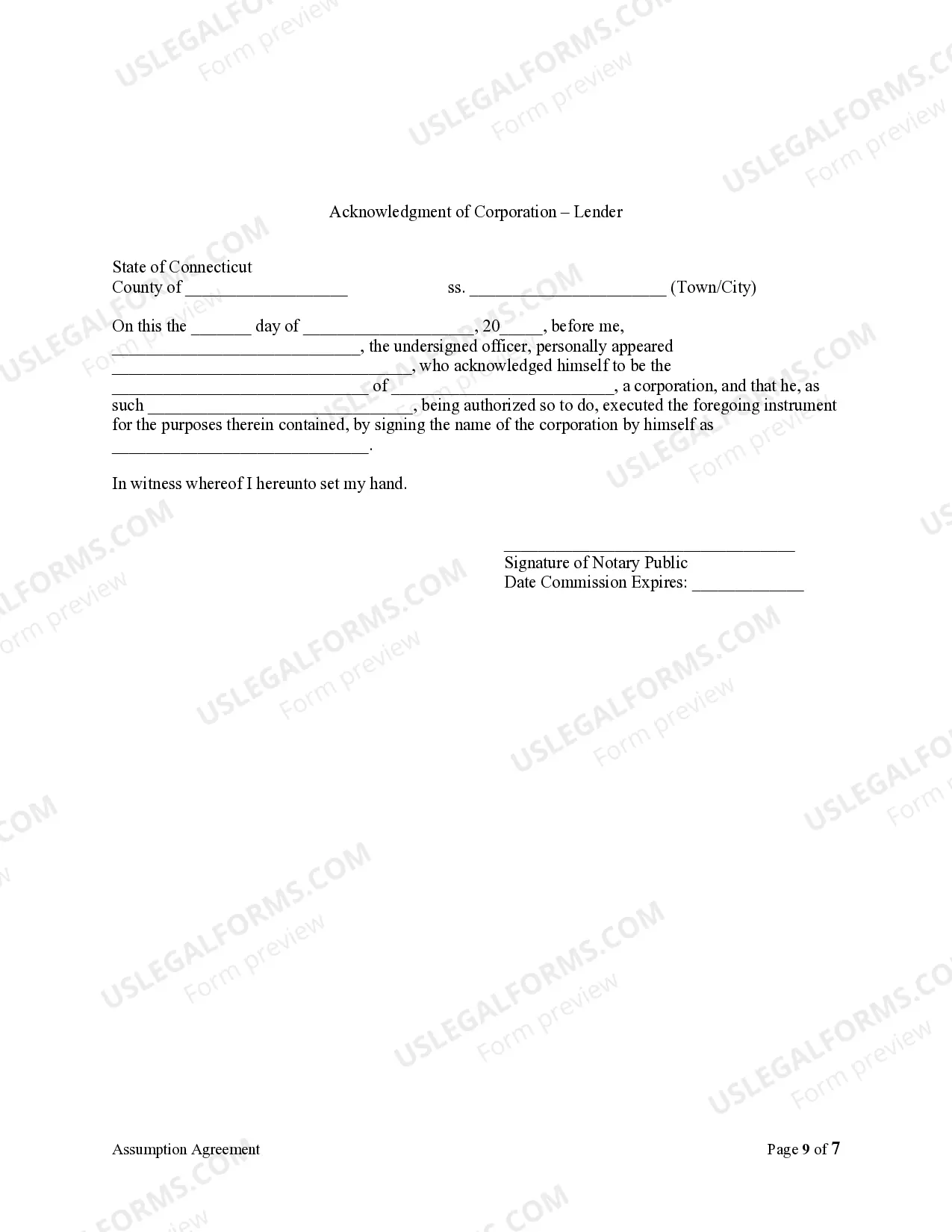

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Assumption Language In Connecticut Mortgage Deed Form

Description

How to fill out Assumption Language In Connecticut Mortgage Deed Form?

When you need to finalize Assumption Language In Connecticut Mortgage Deed Form that adheres to your local state's statutes and regulations, there can be numerous options to choose from.

There's no requirement to verify each form to ensure it fulfills all the legal prerequisites if you are a US Legal Forms member. It is a dependable source that can assist you in obtaining a reusable and current template on any subject.

US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

Acquiring professionally prepared formal documents becomes seamless with US Legal Forms. Additionally, Premium users can also benefit from the robust integrated tools for online document editing and signing. Give it a try today!

- All templates are validated to meet each state's regulations.

- Consequently, when downloading Assumption Language In Connecticut Mortgage Deed Form from our platform, you can trust that you possess a valid and current document.

- Obtaining the necessary template from our site is incredibly simple.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the chosen file.

- Afterward, you can access the My documents section in your profile and maintain access to the Assumption Language In Connecticut Mortgage Deed Form at any time.

- If it's your initial time using our library, please follow the instructions below.

- Review the suggested page and ensure it aligns with your requirements.

- Utilize the Preview mode and examine the form description if available.

Form popularity

FAQ

An assumption clause outlines the conditions under which a mortgage can be transferred to another party. For example, the assumption language in Connecticut mortgage deed form may state that the new borrower assumes responsibility for the mortgage payments, subject to lender approval. This clause can help protect both the lender's interests and the borrower's obligations. Clarity in such clauses is essential for all parties involved.

Assumable mortgages can be a great option, but due diligence is essential. When dealing with assumable mortgages, one should understand the terms outlined in the assumption language in Connecticut mortgage deed form. For instance, some lenders may require approval for the assumption, and you may be liable for previous owner's obligations if not properly structured. Always consult a legal professional to clarify your rights and responsibilities.

Connecticut operates as a mortgage state, meaning that traditional mortgages are commonly used for property financing. In this structure, the borrower retains ownership of the property while the lender holds the mortgage as security. Understanding this framework, especially when discussing the assumption language in Connecticut mortgage deed form, helps clarify the roles and responsibilities of both parties in the transaction.

The warranty deed is often considered the most powerful deed due to its strong protections for buyers. It not only ensures that the seller holds the clear title but also warrants against any future claims against the property. When incorporating assumption language in Connecticut mortgage deed form, using a warranty deed enhances the buyer's peace of mind about their investment.

The four common types of deeds are warranty deeds, quitclaim deeds, special warranty deeds, and bargain and sale deeds. Each type varies in terms of the guarantees provided about the property's title. Using assumption language in Connecticut mortgage deed form can transform a standard deed into a tool that offers additional security for all parties involved in the transaction.

To witness a mortgage deed in Connecticut, you typically need two witnesses present during the signing of the document. They must sign the deed to confirm that they have witnessed the signature of the person executing the deed. Including the assumption language in Connecticut mortgage deed form often requires adherence to these witnessing requirements, ensuring that the deed is valid and enforceable.

Connecticut utilizes various types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. Each serves a different purpose and offers varying levels of protection to the buyer. If you plan to incorporate assumption language in Connecticut mortgage deed form, understanding the distinctions between these deeds is essential for making informed decisions during the transaction.

In Connecticut, the most commonly used deed is the warranty deed. This type of deed guarantees that the title to the property is clear of any liens or encumbrances. When you consider the assumption language in Connecticut mortgage deed form, a warranty deed can ensure that the buyer has complete confidence in the property’s title. This adds trust to the transaction, promoting a smoother transfer process.

The costs of assuming a mortgage can vary, depending on lender fees, title searches, and potential closing costs. Buyers should also consider any outstanding amounts owed on the original mortgage. Ensuring clarity in the assumption language in the Connecticut mortgage deed form is crucial for anticipating these costs. Leveraging tools like those offered by USLegalForms can help you estimate expenses accurately.

Section 49-2 of the Connecticut General Statutes addresses the execution and recording of mortgage deeds. This law outlines the necessary procedures and legal implications involved in mortgage transactions, including assumptions. Understanding this section will clarify how the assumption language in the Connecticut mortgage deed form plays a role in legal enforcement. Familiarizing yourself with these statutes can save you time and prevent misunderstandings.