Living Truss

Description

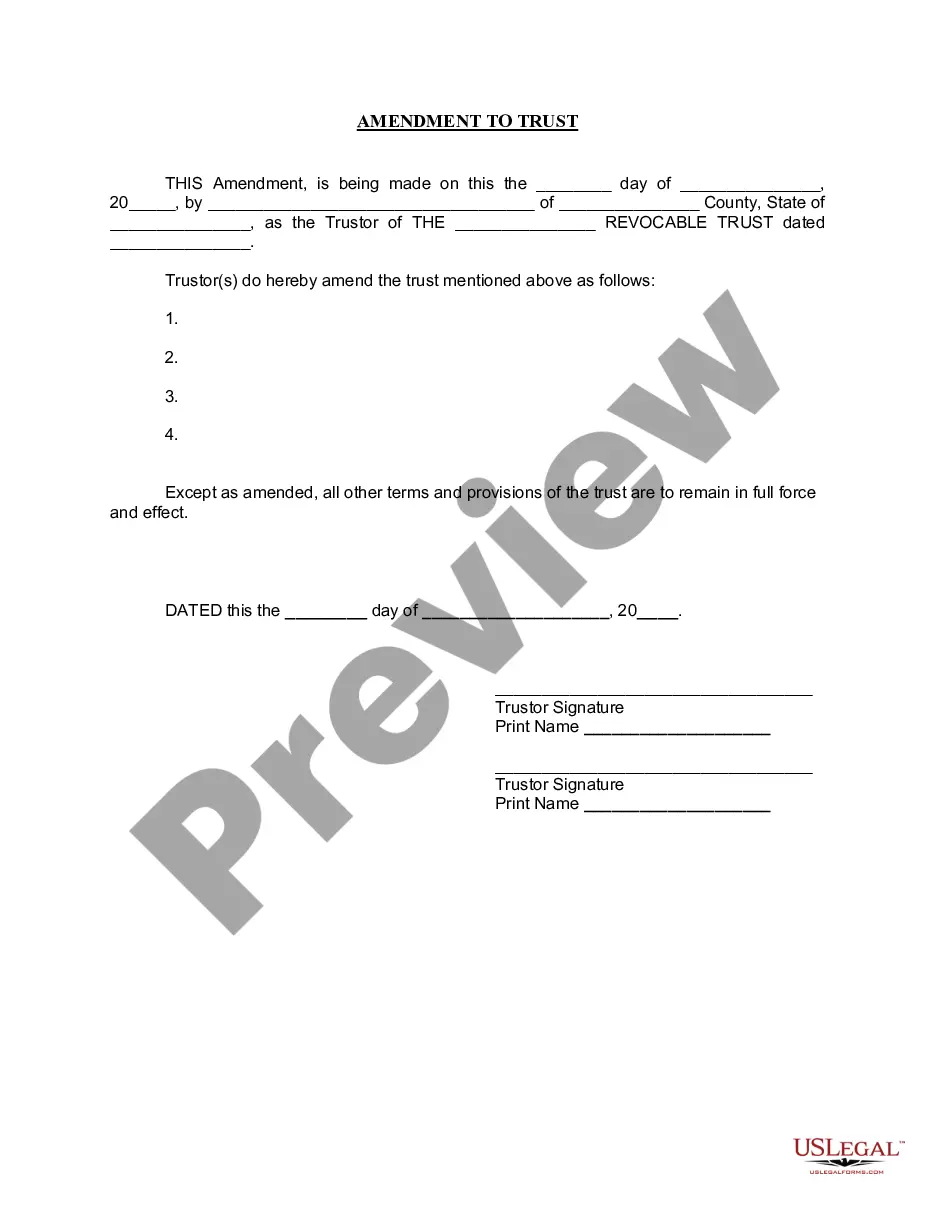

How to fill out Connecticut Amendment To Living Trust?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; if not, consider renewing it based on your selected payment plan.

- For new users, begin by browsing the Preview mode and reading the description of the desired form to confirm it fits your needs and complies with local laws.

- If the selected form contains discrepancies or doesn't meet your requirements, utilize the Search feature to find the most suitable alternative.

- Once you have identified the correct document, proceed to purchase it by clicking the Buy Now button and selecting your preferred subscription plan. Registration is essential to access their extensive library.

- Complete your purchase using your credit card or PayPal for a smooth transaction.

- Finally, download your chosen legal form directly to your device. You can always revisit it through the My Forms section of your account.

By leveraging US Legal Forms, you gain access to a comprehensive array of over 85,000 legal documents, each designed to be easily fillable and editable. This platform empowers you to manage legal matters with confidence and accuracy.

Don't hesitate to start your legal journey with US Legal Forms today! Access premium support for document completion and ensure your legal needs are met seamlessly.

Form popularity

FAQ

A revocable trust, while flexible, has certain downsides to consider. Primarily, it does not provide protection from creditors or legal judgments, as assets within the trust remain part of your estate. Moreover, depending on your state's laws, a revocable trust may not reduce estate taxes. It’s essential to weigh these factors carefully when deciding if a revocable trust is the right choice for your estate planning.

While a living trust offers many benefits, it does have some downsides. One key drawback is that assets transferred into a living trust may incur upfront costs and require ongoing management. Additionally, creating a living trust may not protect assets from creditors or lawsuits as effectively as other estate planning methods. Understanding these limitations can help you make more informed decisions about your estate planning.

A living truss is a legal arrangement that allows individuals to manage their assets during their lifetime and designate their beneficiaries after they pass away. It serves as a valuable estate planning tool, ensuring that your wishes are honored. With a living truss, you maintain control over your property while simplifying the process for your heirs. If you're looking for a straightforward way to set up a living truss, consider using US Legal Forms to get started.

Filling a living trust involves several essential steps. First, you need to gather important information, such as details about your assets and beneficiaries. Next, you can use tools like the US Legal Forms platform to find templates and guidelines that simplify the process. Finally, follow the instructions to complete the document, ensuring that it captures your wishes accurately regarding your living trust.

Whether your parents should place their assets in a living trust largely depends on their individual goals and financial circumstances. A trust can offer benefits like avoiding probate and providing control over asset distribution. However, they should weigh these advantages against the costs and responsibilities involved. Exploring solutions from US Legal Forms can assist them in determining the best course of action.

Having a living trust can sometimes lead to misunderstandings among family members about how assets should be managed and distributed. This lack of communication can foster conflict, especially if expectations are not communicated clearly. It's essential to engage in open discussions about your trust to prevent any surprises in the future. Tools from US Legal Forms can also help clarify these details.

One downside of transferring assets to a living trust is the initial complexity involved in the transition. This can require considerable time and effort to ensure all assets are properly transferred and documented. Additionally, you might incur legal fees during the setup. However, using US Legal Forms can simplify this process, making it easier to manage your living trust efficiently.

A family trust can sometimes limit flexibility in managing assets. When you place assets in a living trust, you may face restrictions on how and when you access them. Moreover, the costs associated with setting up and maintaining a trust may outweigh the benefits for some families. By understanding these disadvantages, you can make an informed choice, possibly using US Legal Forms to streamline the process.

One significant mistake parents often make when establishing a living trust is not clearly defining their wishes for asset distribution. This can lead to confusion among beneficiaries and potential disputes. Additionally, failing to fund the trust with the intended assets can render it ineffective. To avoid these pitfalls, consider consulting tools offered by US Legal Forms to ensure your living trust aligns with your goals.