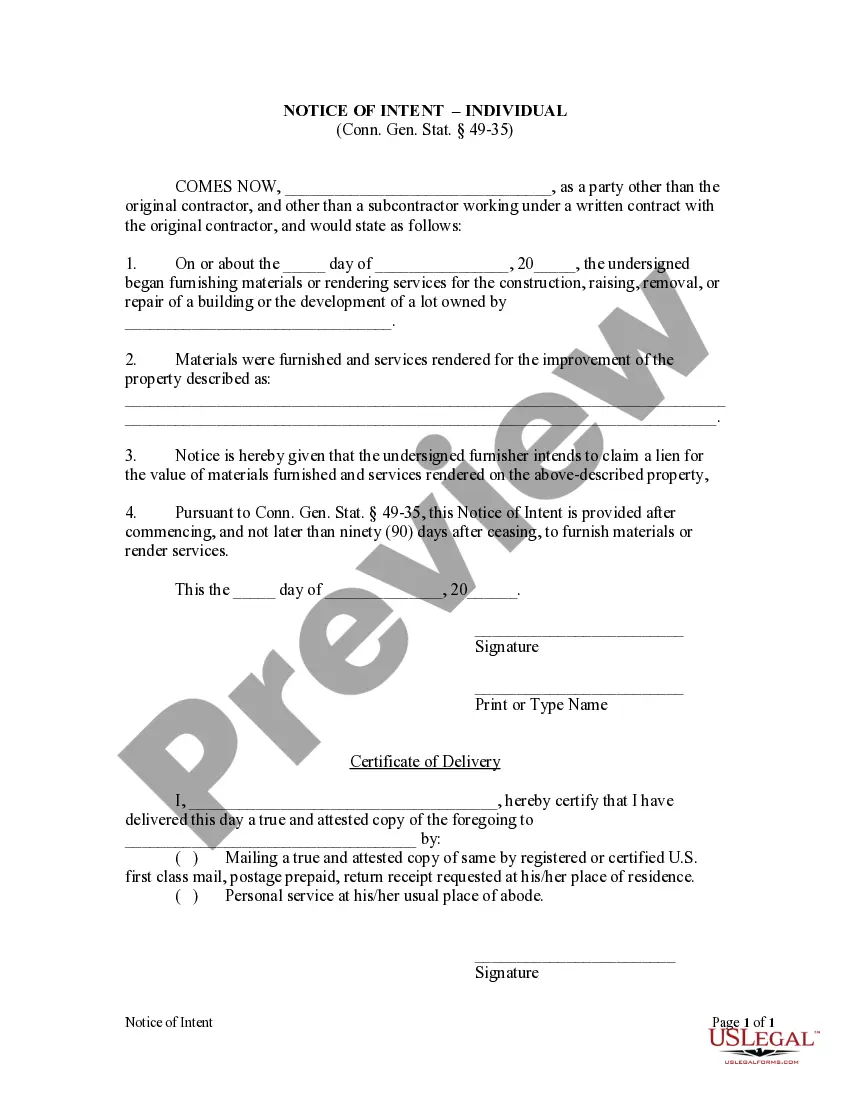

Connecticut Notice Of Intent To Lien Form Florida

Description

How to fill out Connecticut Notice Of Intent - Individual?

Dealing with legal documents and processes can be a lengthy addition to your routine.

Connecticut Notice Of Intent To Lien Form Florida and similar forms often require you to look for them and comprehend how to fill them out correctly.

Thus, if you are managing financial, legal, or personal issues, having a thorough and user-friendly online library of documents readily available will be beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and numerous resources to assist you in completing your forms swiftly.

Is this your first experience with US Legal Forms? Sign up and create your account in a few minutes, and you will gain access to the document library and Connecticut Notice Of Intent To Lien Form Florida. Then, follow the steps outlined below to fill out your form.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific templates available anytime for downloading.

- Protect your document management processes with excellent support that allows you to create any form within minutes without extra or concealed fees.

- Simply Log In to your account, locate Connecticut Notice Of Intent To Lien Form Florida, and obtain it immediately in the My documents section.

- You can also access previously stored forms.

Form popularity

FAQ

Restore Louisiana provides federal grant assistance to homeowners impacted by 2020-21 disasters.

Amended individual income tax returns can be file electronically using the Louisiana File Online application. If you filed your original tax return electronically, you may log in to your account and amend your original return.

To be placed in a phase, homeowners must have met the following criteria: Owned and occupied the damaged home as primary residence at the time of disaster and still own the damaged home. Meet low-to-moderate income qualifications. FEMA Individual Assistance Program determined a structural loss of $3,000 or greater*

The state has three years from December 31 of the year in which taxes are due in which to assess the tax, a limitation period set out in the 1974 Louisiana Constitution.

How does the Restore Louisiana affect my Louisiana state income tax? Pursuant to IRC Section 139, qualified disaster relief payments are excluded from gross income.

Economic Impact Payments The payments are refundable tax credits and are not considered taxable income for federal or state tax purposes. They are not subject to Louisiana state income tax.

The Restore Louisiana Homeowner Assistance Program provides grant funding to homeowners affected by 2020-21 Storms for home repairs, reconstruction and/or reimbursement for repairs already completed.

Most Requested Louisiana Tax Forms of Revenue will no longer distribute printed tax forms to public libraries. Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form.