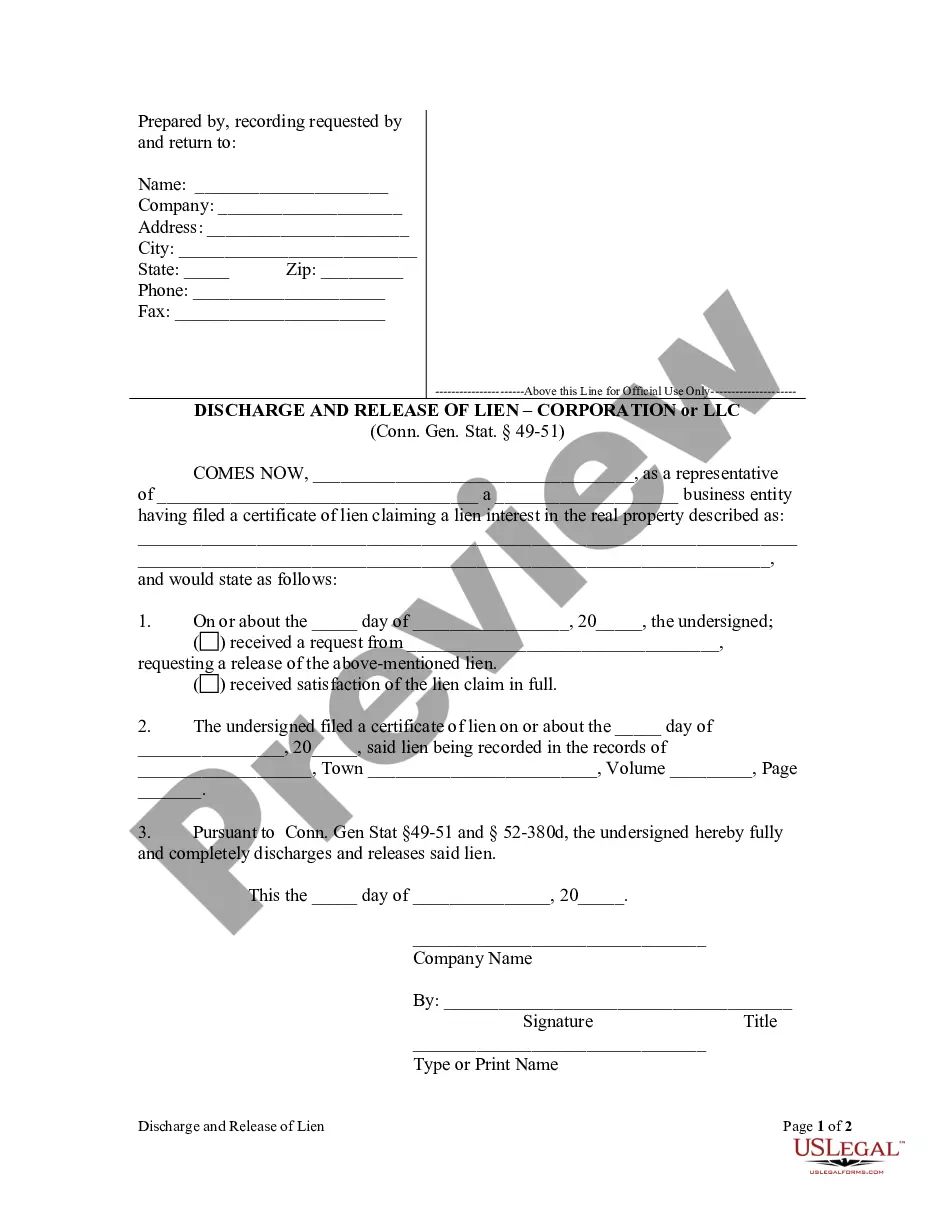

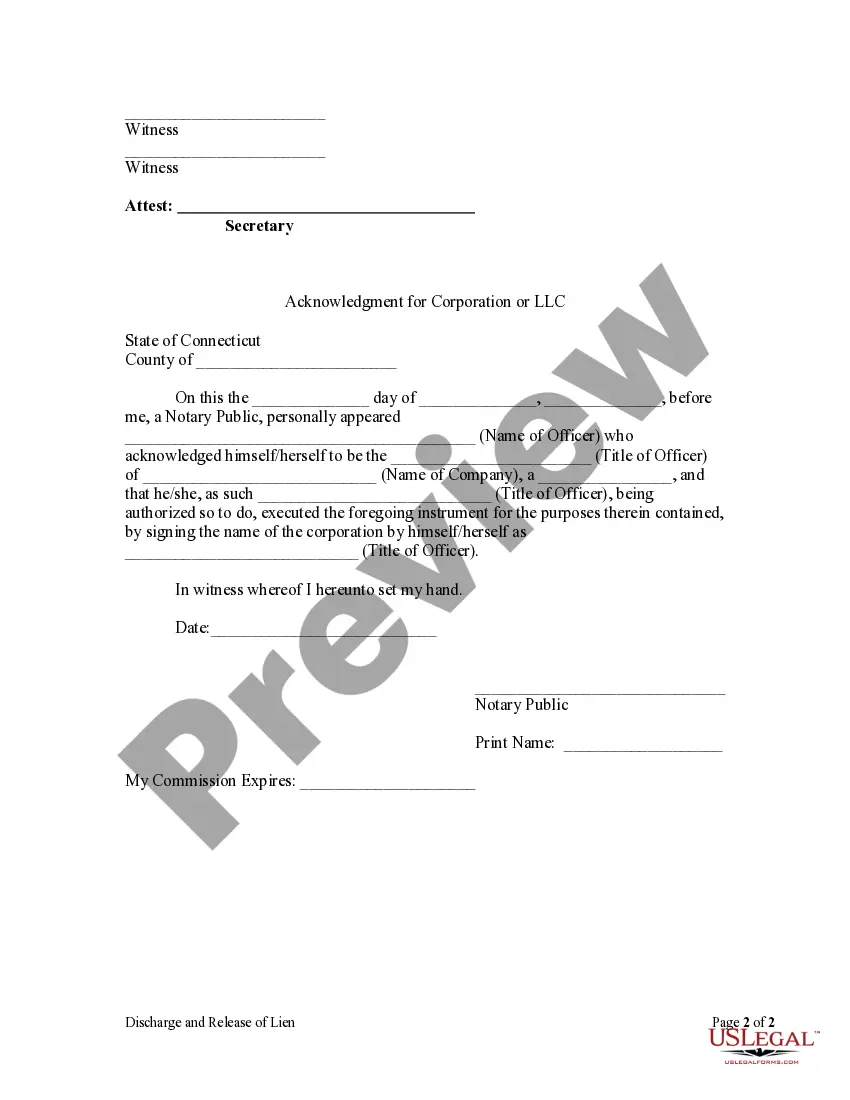

Release Lien Form Withdrawal

Description

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

How can you locate professional legal documents that comply with your state regulations and create the Release Lien Form Withdrawal without hiring a lawyer.

Numerous online services offer templates for various legal situations and formalities. However, it might require some time to determine which of the existing samples meet both your requirements and legal standards.

US Legal Forms is a trusted platform that assists you in finding official documents prepared according to the latest updates in state laws, helping you save on legal fees.

If you lack an account with US Legal Forms, follow this guide: Review the webpage you have opened to confirm the form meets your requirements. Use the form description and preview options if available. Seek another template in the header that provides your state if necessary. Click the Buy Now button upon discovering the correct document. Choose the most appropriate pricing plan, then sign in or establish an account. Select your payment method (credit card or PayPal). Modify the file format for your Release Lien Form Withdrawal and click Download. The purchased templates will remain yours; you can always access them in the My documents section of your profile. Join our library and create legal documents independently, just like a seasoned legal expert!

- US Legal Forms is not a conventional online library.

- It is a compilation of over 85k verified templates catering to diverse business and life situations.

- All documents are categorized by area and state to streamline your search process.

- It also incorporates powerful solutions for PDF editing and eSignature, allowing users with a Premium subscription to conveniently complete their paperwork online.

- Acquiring the essential documentation requires minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is current.

- Download the Release Lien Form Withdrawal using the appropriate button beside the filename.

Form popularity

FAQ

If you have failed to pay your tax debt after receiving a Notice and Demand for Payment from the IRS and are now facing a federal tax lien, you may be wondering when the lien will expire. At a minimum, IRS tax liens last for 10 years.

A lien withdrawal removes your tax lien from public record. You can request lien withdrawal: After you've paid your tax balance, or.

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

The document used to release a lien is Form 668(Z),Certificate of Release of Federal Tax Lien. Servicewide Delegation Order 5-4 lists those employees who have the authority to approve Federal tax lien releases and other lien related certificates.

The IRS will withdraw a tax lien if the lien was filed prematurely or not in accordance with IRS procedures (IRS Form 12277). In other words, the IRS will withdraw the lien if the tax that prompted the lien was assessed in error or if the lien was filed without giving the taxpayer proper notice in advance.