Limited Companies

Description

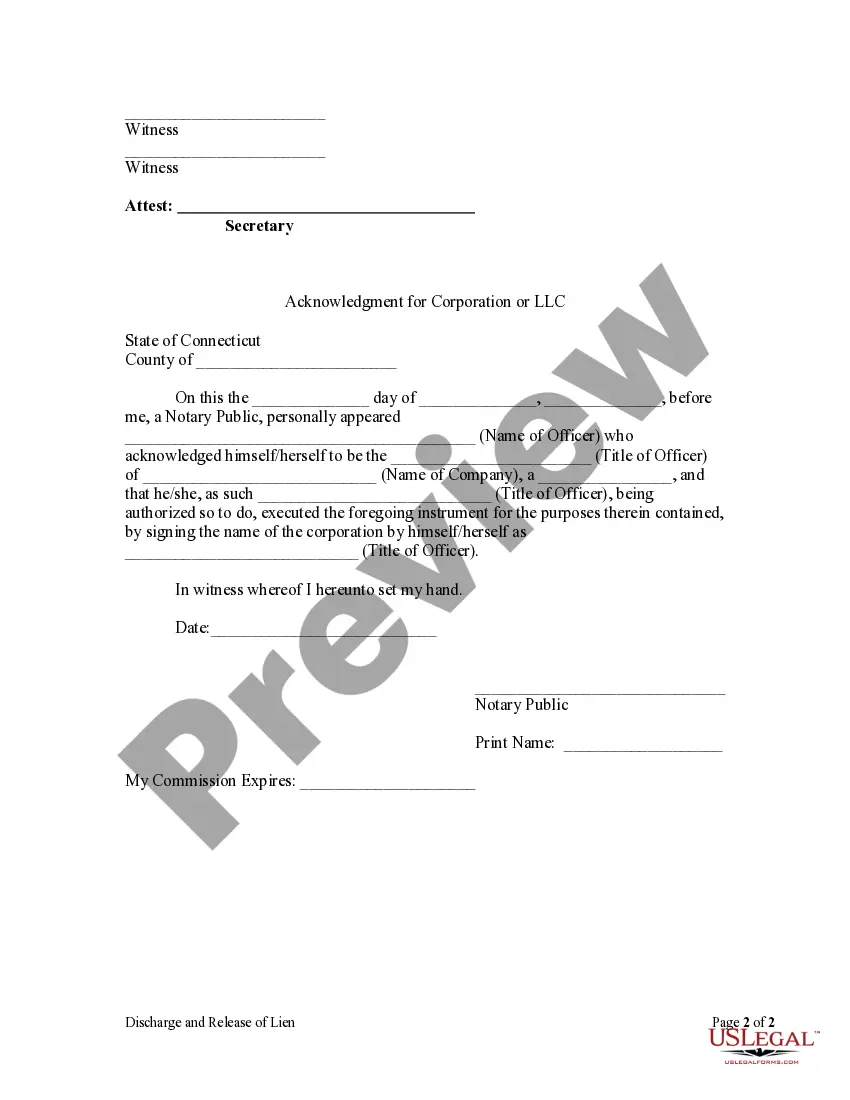

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

- If you're an existing user, simply log in to your account and select the required form template. Ensure your subscription is active; renew if necessary based on your plan.

- For first-time users, start by exploring the Preview mode and form description, verifying the selected template meets your local jurisdiction's requirements.

- Should you need a different template, utilize the Search tab above to locate the appropriate form.

- Proceed to purchase the document by clicking the Buy Now button. Choose the subscription plan that fits your needs and create an account for full access.

- Complete your transaction by entering your payment details or opting for PayPal for a smooth checkout.

- Download the completed form directly to your device. You can access it anytime through the My Forms section.

US Legal Forms empowers individuals and attorneys to quickly execute legal documents, boasting a robust collection of forms. With over 85,000 editable templates available at your fingertips, the platform stands out by providing premium expert assistance for form completion.

By leveraging US Legal Forms, you streamline your legal processes, ensure accuracy, and save time. Start exploring your options today and unlock the power of straightforward legal documentation!

Form popularity

FAQ

Limited companies can face several disadvantages, including the increased administrative burden and the potential for double taxation in certain situations. Owners must maintain proper records and file regular reports, which can take more time and resources. Moreover, some investors may prefer simpler business structures for their investments.

One major disadvantage of limited companies is the complexity of setup and maintenance. Establishing a limited company requires meeting specific legal regulations and ongoing reporting requirements. This can be time-consuming and may necessitate hiring professionals to ensure compliance.

Public limited companies face several disadvantages, such as increased scrutiny from shareholders and the public. They often deal with higher operational costs due to regulatory compliance, and they can experience pressure to meet short-term financial goals. These factors can impact decision-making and overall business strategy.

A limited company qualifies as a separate legal entity formed under state regulations. It must have at least one member and appropriate registrations filed with the state. Typically, such companies limit the liability of their owners to the amount they invest in the company, providing a layer of financial security.

Choosing to operate as a limited company can be a smart move for many entrepreneurs. Limited companies offer liability protection and may provide a more reputable image to clients. Additionally, this structure can allow for flexible profit distribution among members, which can be beneficial when planning for financial success.

The terms Ltd and LLC refer to different business structures. Ltd, or limited company, is common in several countries, and it focuses on shareholder ownership, while LLC, or limited liability company, is primarily used in the US and aims to protect owners from personal liability. Understanding these differences can help you choose the right structure for your business goals.

Whether you are classified as an S corporation or an LLC depends on how you elected to structure your business for tax purposes. An LLC can opt to be taxed as an S corporation, but they are fundamentally different entities. Take the time to review your formation documents and IRS filings to see how you are currently classified. If you need help, USLegalForms offers resources to assist you in understanding your business structure.

You can determine if your LLC is classified as a C corporation or S corporation by reviewing your tax filings and business structure. If you haven’t filed for S corporation status, your limited company is likely a C corp. It's important to discern your corporation type while considering the implications for tax treatment and operational compliance. For personalized guidance, seeking legal advice can be beneficial.

To identify whether your LLC is an S corp or a C corp, check your tax classification with the IRS. By default, limited companies are treated as C corps unless an S corporation election has been made. Understanding your classification is crucial, as it affects taxation and corporate responsibilities. Tools like USLegalForms can help clarify your LLC’s status and guide you through the necessary steps.

To classify your LLC as an S corporation, you need to file IRS Form 2553. This form must be completed within 75 days of formation or by the tax deadline for the previous year. Once classified as an S corp, your limited company can enjoy certain tax benefits. Consulting a tax advisor can provide valuable insights on this classification process.