Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Release Of Lien Letter

Description

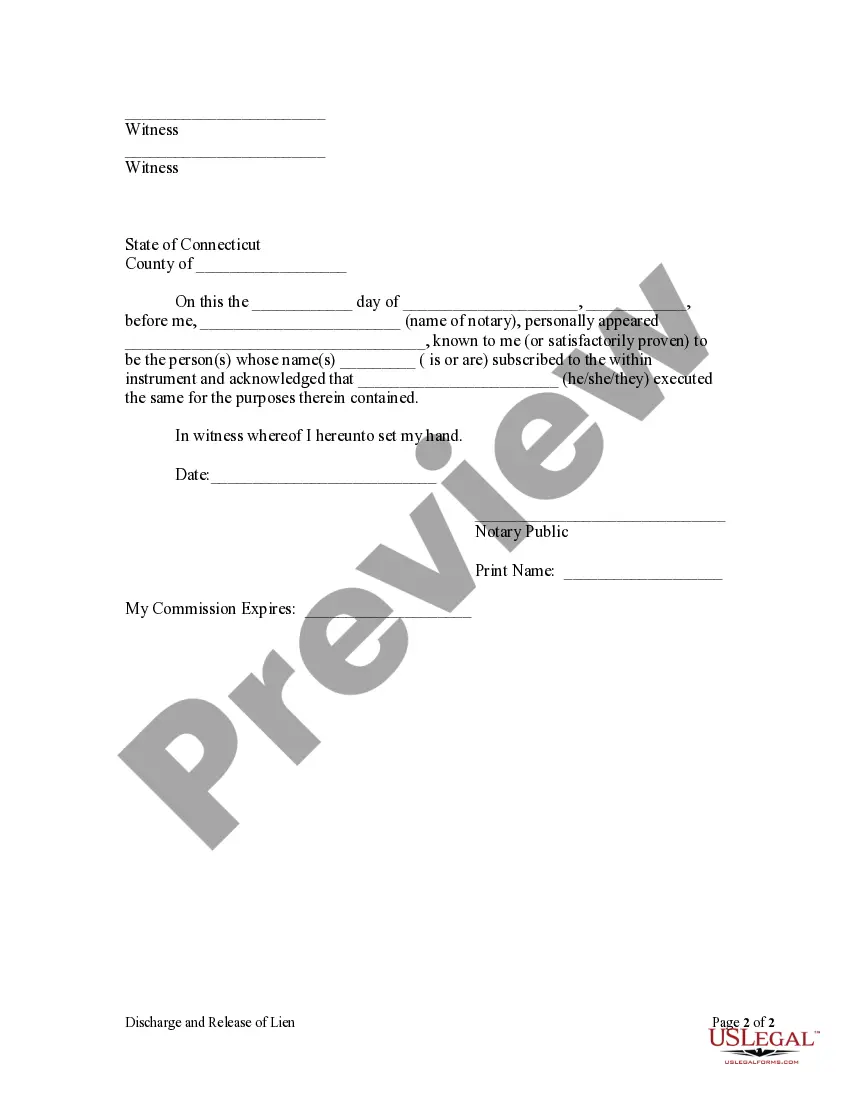

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- If you're a returning user, log in to access your account and locate the release of lien letter template. Ensure your subscription is active; renew if necessary.

- For first-time users, begin by exploring the Preview mode for the release of lien letter. Ensure it fits your needs and complies with your local jurisdiction.

- If the initial template isn't suitable, use the search feature to find the correct form that meets your requirements.

- Next, purchase the document by clicking the Buy Now button and selecting your desired subscription plan. Create an account to gain access to the full library.

- Complete your purchase using a credit card or PayPal option for easy payment.

- Finally, download your form directly to your device. You can revisit and manage your documents anytime through the My Forms section.

By utilizing US Legal Forms, individuals and attorneys alike can quickly execute legal documents with ease. The extensive form collection ensures users find the template that best fits their needs.

Start navigating the legal document world with confidence. Explore our resources today and get your release of lien letter effortlessly!

Form popularity

FAQ

To get your lien release letter, start by reaching out to the party that holds the lien and request the release directly. Ensure that you have all relevant information on hand, such as proof of payment. Upon fulfilling any necessary requirements, you will receive the release of lien letter, which you should keep for your records.

To obtain a copy of a lien release letter from the IRS, you should contact the IRS directly by calling their customer service line or visiting their website. Prepare to provide your taxpayer identification information and details about the lien. After verifying your identity, they will guide you through the process of obtaining your release of lien letter.

When writing a letter for a lien release, clearly state your intent to request the release of lien letter. Include your name, contact information, and details about the lien, such as account number and property address. Be polite and concise, ensuring you express that the debt is satisfied, and request confirmation in the form of a release letter.

The speed at which you can obtain a lien release varies depending on several factors, including the lien holder's response time. Typically, if you provide all required documentation promptly, you can receive the release of lien letter within a few days to a couple of weeks. By using platforms like US Legal Forms, you can expedite this process by accessing the necessary forms and guidance.

Yes, you can look up liens in California through the county recorder's office where the property is located. Many counties provide online databases to make this search easier and more accessible. By entering pertinent information such as property address or owner's name, you can find any active liens and relevant release of lien letters.

To request a lien removal, you should begin by obtaining the release of lien letter from the relevant lien holder. This typically involves contacting them directly and providing any necessary documentation that proves the debt has been satisfied. Once you receive the release letter, file it with your local recorder's office to officially remove the lien from public records.

To fill out a lien affidavit, gather necessary information such as the lien holder's details, the debtor's information, and specifics about the debt. Clearly state the reason for the affidavit and include supporting documentation when possible. You may find templates and guidance on platforms like US Legal Forms, which can streamline the process and ensure you complete the affidavit correctly.

Selling a car while waiting for the title can be tricky, but a lien release letter can aid the process. It demonstrates that you are the rightful owner and have settled any debts related to the vehicle. It's important to communicate openly with potential buyers about the situation and provide reassurance of your ownership.

You can sell a car with a lien release letter. This letter indicates that the financial obligation has been resolved, which can facilitate the transfer of ownership. However, ensure that potential buyers understand the status of the title and any necessary steps to complete the sale.

Yes, you can sell a car with a lien release letter, even if you do not have the title yet. The lien release letter serves as proof that you have cleared any debt related to the vehicle, which can make the transaction smoother. While it is recommended to secure the title, many buyers will accept a lien release letter as valid documentation.