Release Of Lien Form Connecticut For Texas

Description

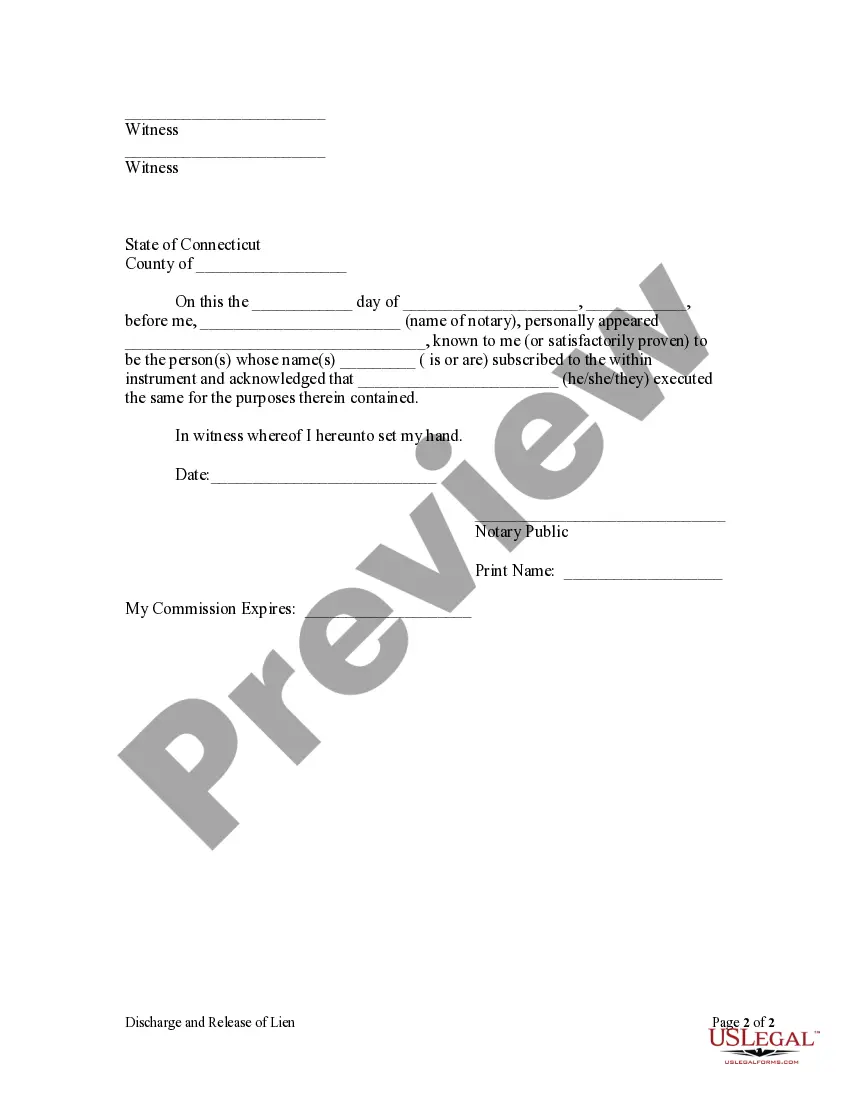

How to fill out Connecticut Discharge And Release Of Lien By Individual?

Whether for professional intentions or personal matters, everyone must handle legal circumstances at some point during their lifetime. Completing legal paperwork requires meticulous care, starting from selecting the correct template form. For example, if you select an incorrect version of a Release Of Lien Form Connecticut For Texas, it will be rejected upon submission. Therefore, it is crucial to obtain a reliable provider of legal forms such as US Legal Forms.

If you need to acquire a Release Of Lien Form Connecticut For Texas template, follow these straightforward steps.

With an extensive US Legal Forms catalog available, you won’t have to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate form for any circumstance.

- Obtain the template you require using the search bar or through catalog navigation.

- Review the form’s details to confirm it aligns with your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search feature to locate the Release Of Lien Form Connecticut For Texas template you need.

- Download the document when it satisfies your criteria.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not possess an account yet, you can download the form by clicking Buy now.

- Select the appropriate payment option.

- Fill out the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the desired file format and download the Release Of Lien Form Connecticut For Texas.

- Once it is saved, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

Release details: Provide a statement confirming that the borrower has fully repaid the debt and that the lienholder is relinquishing their legal claim on the property or asset. Include the date when the borrower paid off the debt.

To remove a lien recorded on a paper title, you will need: the vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

Remove a lienholder if you have an original or certified copy of your title Schedule a title transfer appointment with the tax office. Complete the Application for Texas Title (130-U) Provide your original release of lien letter or document and a valid photo ID. Pay the $33 application fee for a new title.

Ing to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.