Lien Release Letter For Mortgage

Description

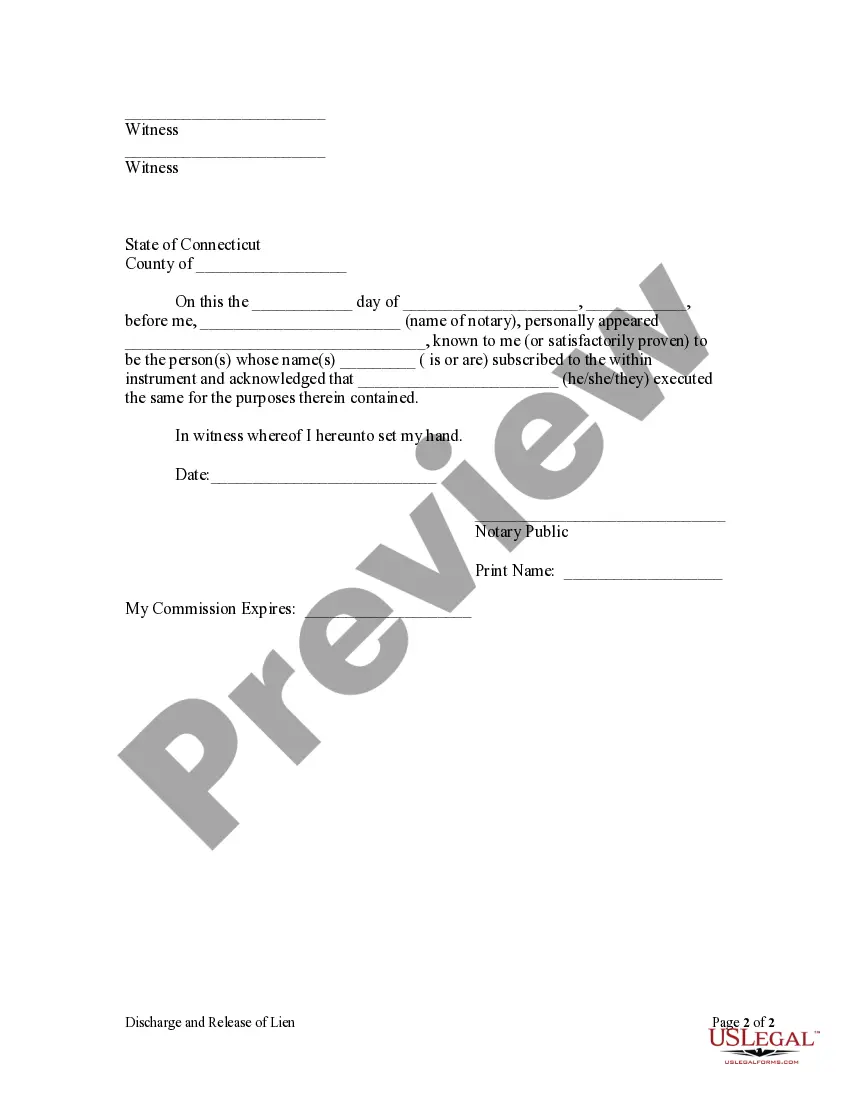

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- If you're a returning user, log in to your account and download the lien release letter template. Ensure your subscription is active; if not, renew it as per your plan.

- For new users, start by previewing the form description to confirm it's suitable for your needs and compliant with local laws.

- If the selected form doesn't meet your requirements, utilize the Search tab to find a more fitting template.

- Once satisfied with your selection, click the Buy Now button to choose a subscription plan and create an account for full access to the legal library.

- Complete your purchase by entering your credit card details or using PayPal.

- Download your lien release letter and save it on your device. Access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust selection of over 85,000 legal forms, making it easier for individuals and attorneys alike to create necessary documents efficiently. With premium expert assistance available, you can ensure that your lien release letter is accurate and compliant.

Start your legal journey today with US Legal Forms and get the documents you need swiftly!

Form popularity

FAQ

Someone needs a lien release to eliminate any claims that a lender may have against their property after paying off a mortgage. Receiving a lien release letter for mortgage allows homeowners to establish clear ownership, which is crucial for selling or refinancing. Additionally, this document protects against potential future complications that may arise from unresolved debts. Therefore, obtaining a lien release is essential for anyone looking to secure their property rights.

Lien releases are vital because they clear the title of a property, ensuring that no lender has a financial interest in it after the mortgage is settled. When you receive a lien release letter for mortgage, it provides peace of mind and facilitates future transactions. Without a lien release, you could face complications during the sale or refinancing of your property. Thus, obtaining a lien release is an essential step after paying off your mortgage.

Writing a release of lien involves drafting a document that states you are releasing the lien on the property. Start with detailing the parties involved, the property information, and clearly state your intention to revoke the lien. Ensure proper signatures are included for validity.

Completing a lien release requires filling out the appropriate forms, including the lien release letter for mortgage. Ensure that all relevant details are accurately provided. Once the forms are filled out, they should be signed by the appropriate parties before submitting them to the local government office or county clerk.

The process of releasing a lien is typically called 'lien satisfaction' or 'lien release.' It involves the creditor formally acknowledging that the obligation tied to the property has been fulfilled. This essential step helps clear the title for future transactions.

To request a lien removal, create a formal request, often in the form of a lien release letter for mortgage. Send this request to your lender, along with any necessary documentation. It’s also important to follow up, ensuring your request is being processed appropriately.

The speed at which you can obtain a lien release varies based on how quickly the debt is settled and the turnaround time of the creditor. Typically, once the payment is made, it may take a few days to a couple of weeks to receive your lien release letter for mortgage. Be proactive by following up with the creditor to ensure you receive this important document in a timely manner.

To obtain your lien release letter, you need to contact the lender or creditor to confirm that the debt has been settled. After the payment is processed, request the lien release letter for mortgage directly from them. Ensure that you provide any necessary information they need to process your request. If you encounter issues, consider using resources from US Legal Forms to help facilitate communication.

To remove a lien, you need to settle the debt associated with it, either by payment or negotiation. Once the lien is settled, request a lien release letter for mortgage from the creditor. This document is crucial, as it proves that the lien has been officially released. If challenges arise, consider using platforms like US Legal Forms to guide you through the process.

To obtain a lien release letter for mortgage, you typically need to provide proof of payment for the mortgage, which includes the final payment receipt or closing statement. Additionally, you may need to fill out a lien release form that your lender will provide. It's essential to contact your lender for specific requirements, as they may vary. Utilizing platforms like US Legal Forms can simplify this process by guiding you through the necessary documentation.