Lien Release Form For Car Title

Description

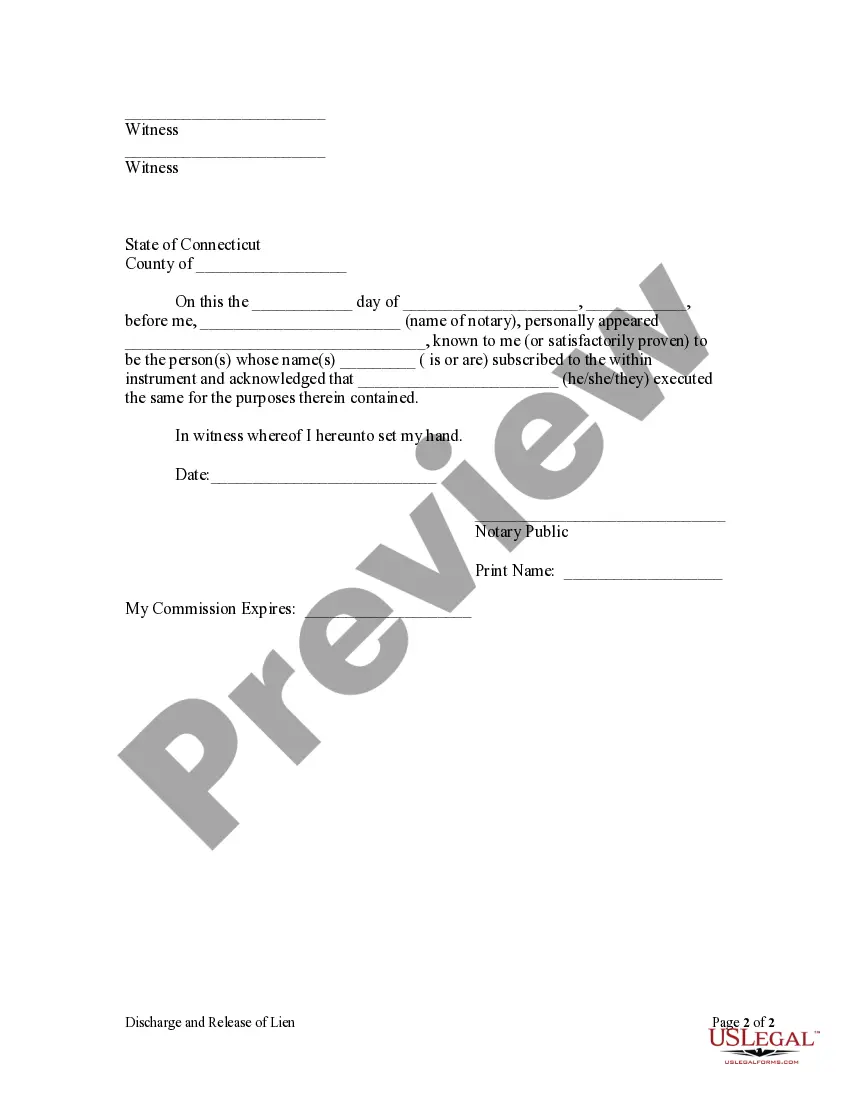

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- Log in to your US Legal Forms account if you are an existing user, ensuring your subscription is active. If it’s expired, renew it according to your payment plan.

- Browse through the form collection. Utilize the Preview mode and check the form descriptions to verify you have selected the correct lien release form for your state regulations.

- If necessary, use the Search feature to find alternate templates that might better suit your needs.

- Select the form you need and click the Buy Now button. Choose the subscription plan that aligns with your requirements and create an account to access the library's resources.

- Complete your purchase by entering your payment details, using either your credit card or PayPal account.

- Download the completed form and save it to your device. You can easily access it later from your profile under the My Forms section.

In conclusion, US Legal Forms empowers users with an extensive collection of legal documents, ensuring you can easily navigate the bureaucratic landscape of car titles. With professional guidance available and a user-friendly interface, obtaining your lien release form has never been simpler.

Start accessing legal forms today by visiting US Legal Forms and completing your lien release process with ease!

Form popularity

FAQ

The time it takes to receive a lien release can vary based on the lender’s processes. Typically, it may take anywhere from a few days to several weeks. To expedite this, ensure you communicate promptly and follow up, particularly after submitting necessary payments in full. Once you have the lien release form for car title, you can proceed to update your vehicle ownership.

In Rhode Island, after paying off your car, request your title from the lender. They will provide you with a lien release form for car title. You will then need to submit this form to the Rhode Island DMV along with any applicable fees to officially receive your title.

After receiving a release of lien, you should immediately update your car title with your state's DMV. This involves submitting the lien release form for car title along with any required fees or documentation. Doing this ensures that you are the unencumbered owner of the vehicle moving forward.

To complete a lien release, first, ensure that all financial obligations tied to the vehicle are met. Then, obtain a lien release form from your lender or use an online service like uslegalforms. After filling out the necessary details, both the lender and borrower should sign to make it official. Finally, submit it to your local motor vehicle department to update the car title.

To put a lien on a car title, you need to file a lien statement with your state’s motor vehicle agency. This involves providing documentation that outlines the debt secured by the vehicle, including details of the borrower and lender. Once approved, the lien will be noted on the title, indicating that the vehicle is part of a financial agreement. Using a lien release form for car title can later aid in the removal of that lien once the obligation has been fulfilled.

Selling a car with a lien release letter and no title can be challenging, but it is possible. The lien release letter can demonstrate that you have fulfilled your financial obligation. However, be prepared to explain the situation to buyers and provide them with all other relevant documentation. Utilizing uslegalforms can help you obtain all necessary paperwork for a smoother selling process.

If you purchased a car without a title, you should first contact the seller to resolve the issue. If the seller cannot provide the title, you might need to apply for a duplicate title through your state's Department of Motor Vehicles. In some cases, a lien release letter may be necessary to prove that no financial claims exist on the vehicle. Using a lien release form for car title can pave the way for securing your ownership.

Yes, in some cases, you can obtain a duplicate car title the same day in Tennessee by visiting your local county clerk's office. Be sure to bring the required documents, including identification and a completed application. Adding the lien release form for car title to your paperwork can expedite the process, especially if there is an existing lien.

If you do not have the title, you can still prove ownership by gathering other documents, such as the bill of sale, registration papers, or insurance documents. These items often serve as acceptable proof of ownership. In some cases, you may need to apply for a new title using a lien release form for car title if a lien exists.

The easiest way to obtain a title is to ensure that all paperwork is completed accurately and submitted to the appropriate state agency. Whether you are applying for a new title or a duplicate, having the lien release form for car title prepared in advance can simplify the process. You can also consult platforms like uslegalforms to access templates that can guide you through these requirements.