Life Estate Deed Without Powers

Description

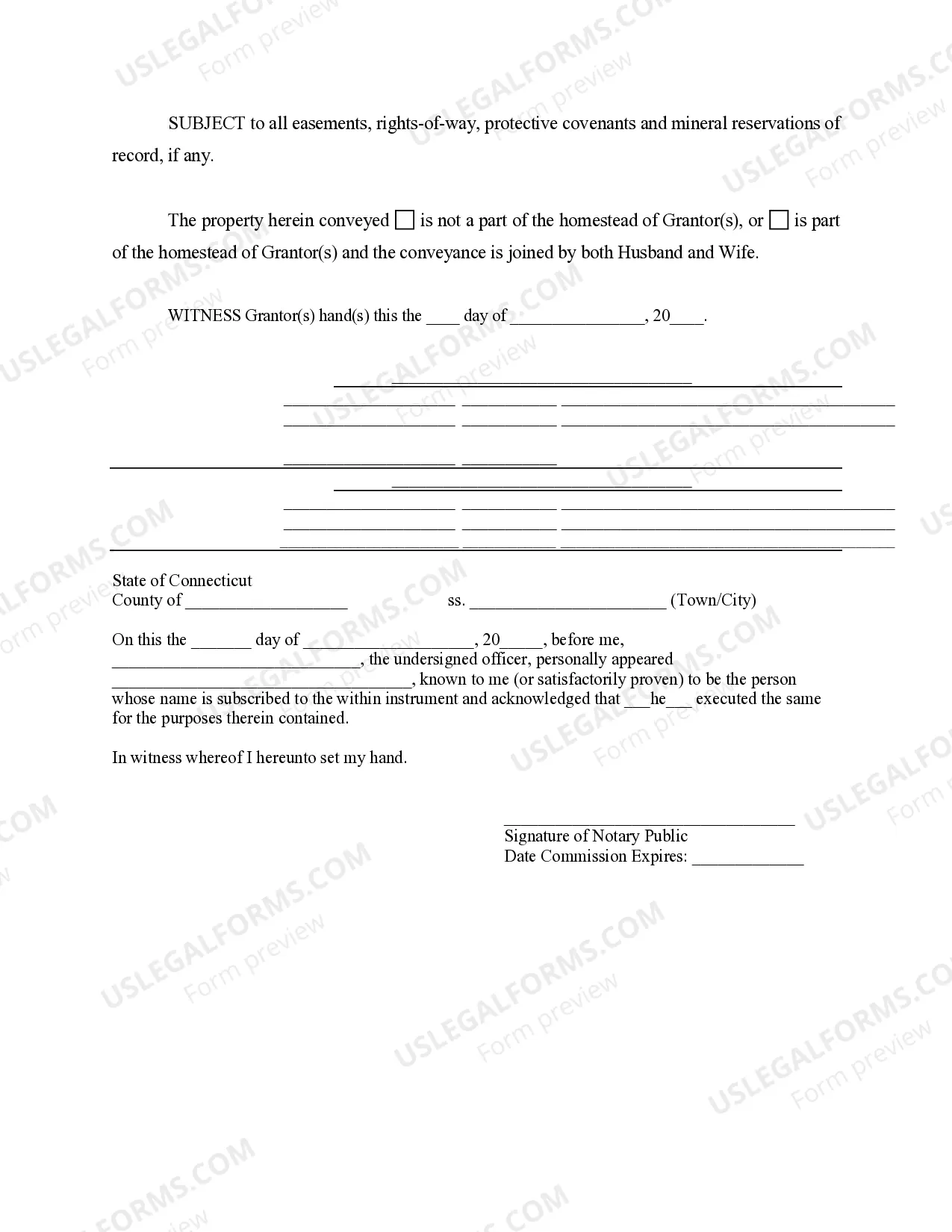

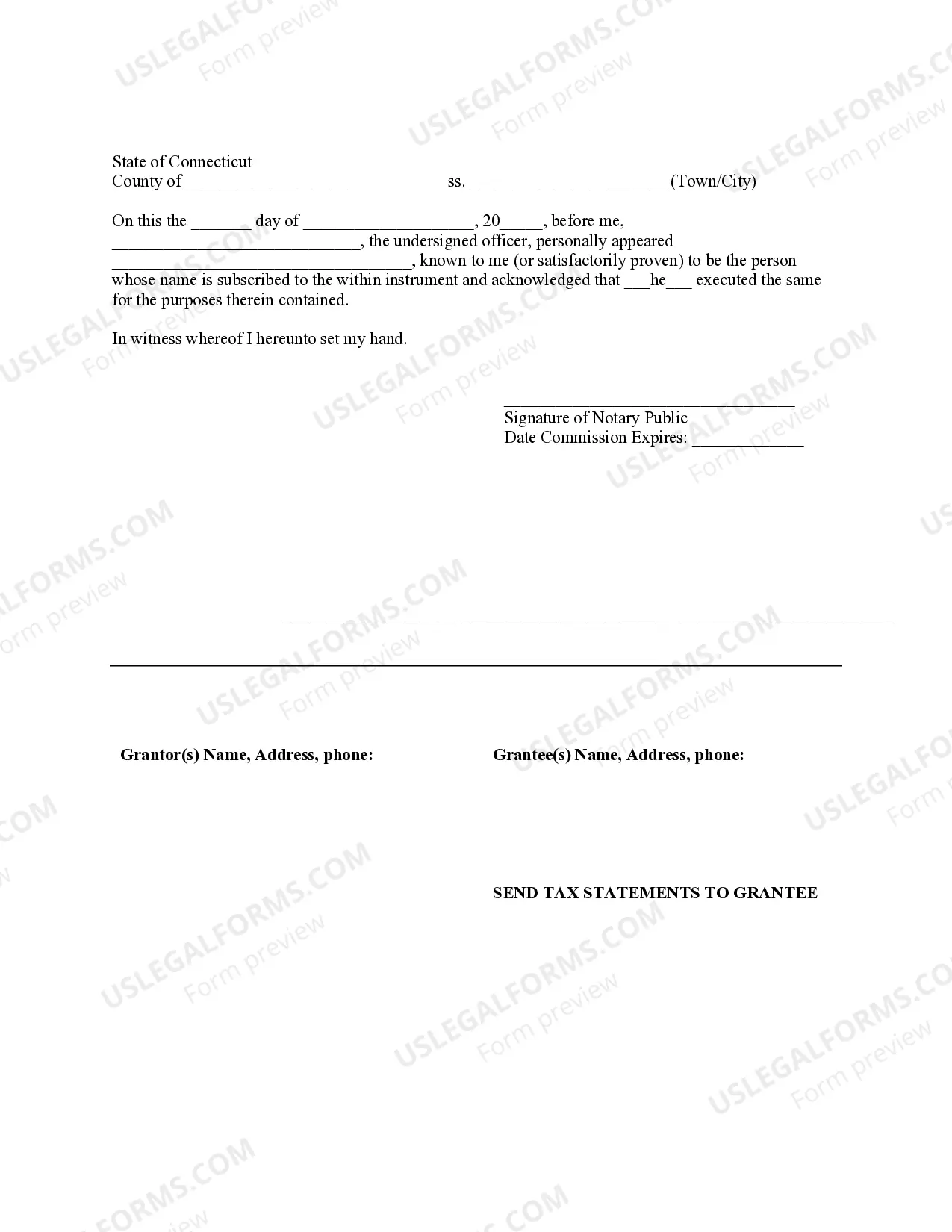

How to fill out Connecticut Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether you manage documents frequently or you occasionally need to send a legal report, it is crucial to secure a valuable resource where all the samples are relevant and current.

The first step to take with a Life Estate Deed Without Powers is to confirm that it is the most recent version, as it determines whether it can be submitted.

If you desire to simplify your quest for the latest examples of documents, seek them out on US Legal Forms.

To obtain a form without creating an account, follow these steps: Use the search menu to locate the form you need. Review the Life Estate Deed Without Powers preview and outline to confirm it is precisely what you are seeking. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Either register a new account or Log In to your existing one. Provide your credit card information or PayPal account to complete the transaction. Select the file format for download and confirm your choice. Eliminate confusion when dealing with legal documents; all your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms that encompasses nearly any document example you may need.

- Look for the templates you require, assess their relevance immediately, and learn more about how to utilize them.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Find the Life Estate Deed Without Powers samples in just a few clicks and store them in your profile at any time.

- A US Legal Forms profile will enable you to access all the samples you need with added convenience and reduced effort.

- You simply have to click Log In in the site header and navigate to the My documents section where all the forms you require are readily available.

- You will not have to spend time searching for the ideal template or verifying its authenticity.

Form popularity

FAQ

If there is no Will -- the legal owner died intestate, legal heirs will also need to submit no-objection certificates depending on the settlement. If the beneficiaries pay other legal heirs to obtain their shares, it should be mention in the transfer paper.

How Does a Life Estate Deed Work? The life tenant does not have the right to sell the property or take out a mortgage on it without the agreement of the remainderman. The remainderman becomes a co-owner of the property but has no legal rights to live in it or use it until the death of the life tenant.

When someone dies without a Will, they leave behind an intestate estate. In these cases, a personal representative will be appointed by the probate court to transfer ownership of the decedent's property in accordance with Florida law known as intestate succession.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

Life Estate WITH Powers. Under this type of Deed, the Life Tenant is not restricted from doing anything the Life Tenant would like to do with the property including selling, gifting, leasing, conveyancing or mortgaging the property.