Trust Deed For Mortgage

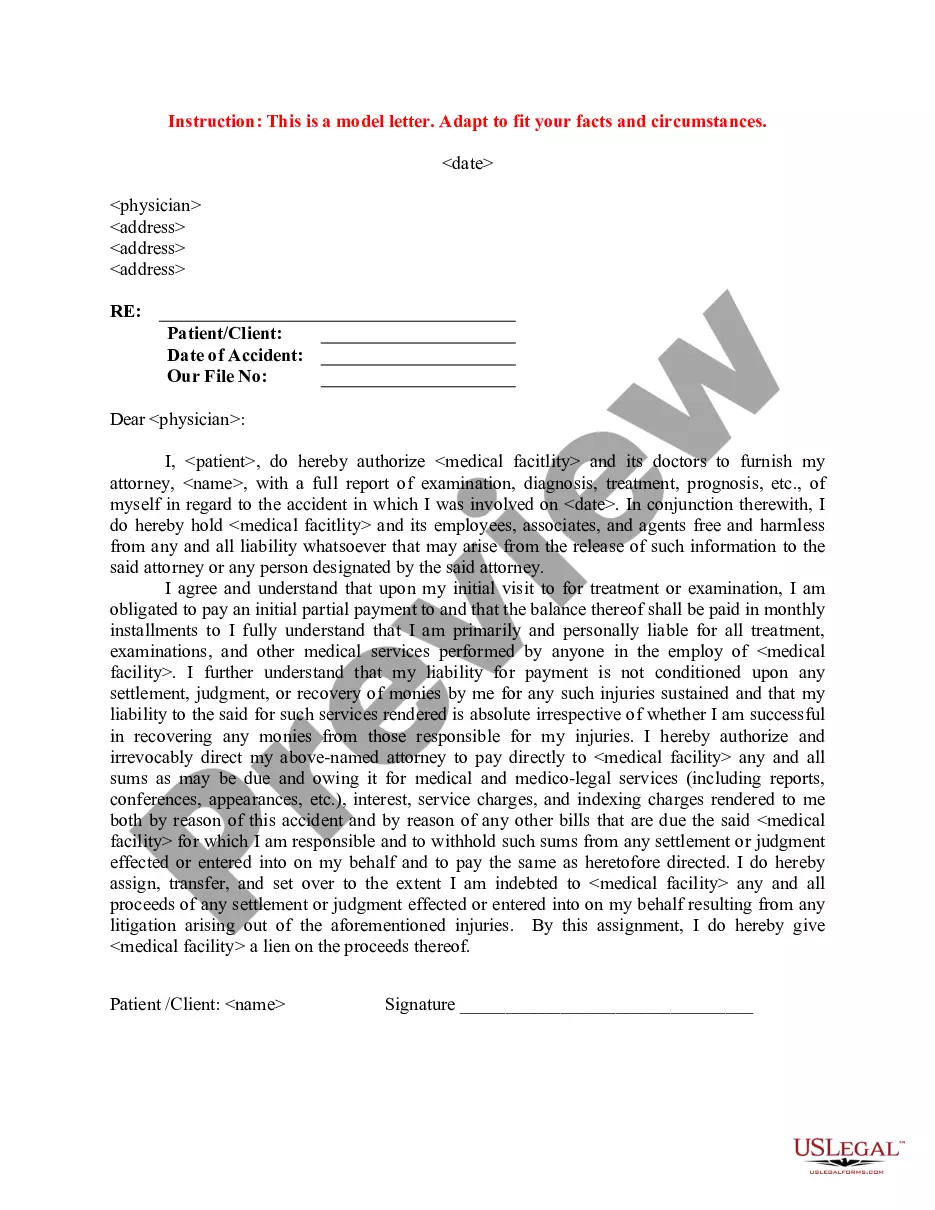

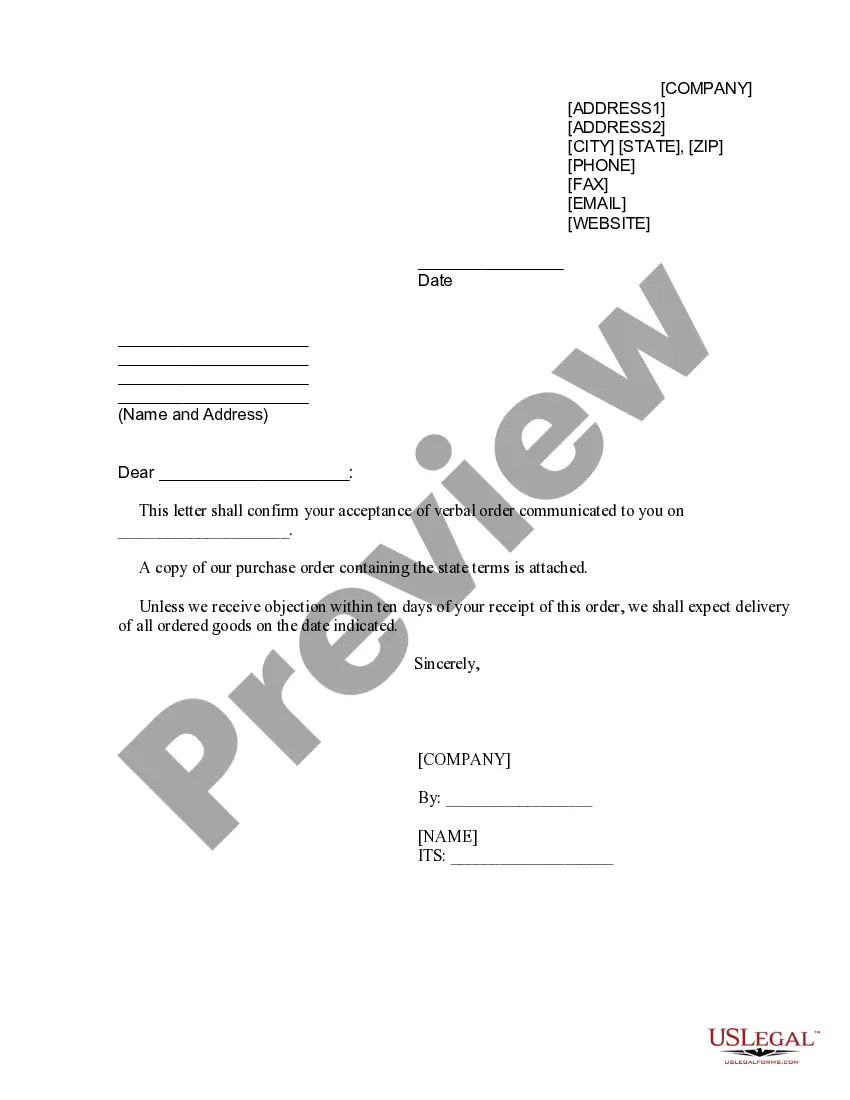

Description

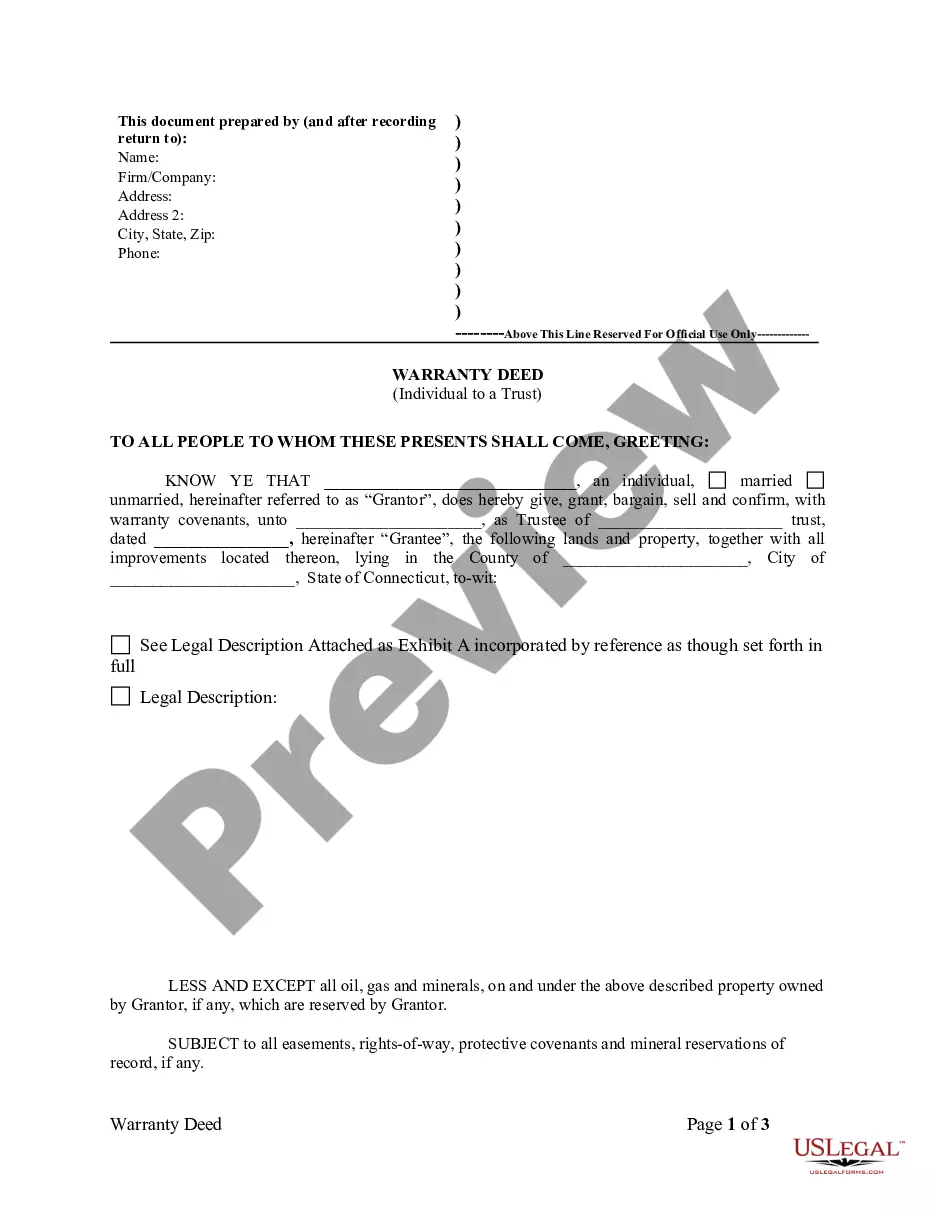

How to fill out Connecticut Warranty Deed From Individual To A Trust?

- Log in to your existing US Legal Forms account and ensure your subscription is active. If it’s not, renew it according to your plan.

- Preview the trust deed form and read the description to confirm it meets your needs and complies with your local jurisdiction.

- If necessary, search for other document templates using the search bar to find the perfect match for your requirements.

- Select the 'Buy Now' button and choose the subscription plan that fits you best. You will need to register for an account to access the full library.

- Fill in your payment information, either through credit card or PayPal, to complete the subscription purchase.

- Download the completed trust deed form to your device and access it anytime from the 'My Forms' section of your profile.

In conclusion, US Legal Forms streamlines the legal document process, providing users with access to a vast library of forms and expert assistance. By following these straightforward steps, you can easily obtain a trust deed for mortgage that meets your needs.

Get started today and simplify your legal documentation process!

Form popularity

FAQ

Lenders often prefer a deed of trust over a mortgage due to its simplicity in the foreclosure process. When a borrower defaults, the lender can initiate a non-judicial foreclosure, which is generally faster and cheaper. Furthermore, the trust deed for mortgage sets clear guidelines, reducing ambiguity and protecting the lender's interests.

The function of a trust deed for mortgage is to serve as a security agreement between the borrower and the lender. It outlines what happens in the event of a default, allowing the property to be sold without going through the court system. This efficiency reduces delays and costs, making it an attractive option for lenders.

The purpose of a trust deed is to protect the lender’s investment by creating a legal instrument that secures real estate loans. It establishes clear terms for repayment and conditions under which the property can be reclaimed. Moreover, it provides peace of mind for both borrowers and lenders, ensuring that the process is handled lawfully.

The main objectives of a trust deed for mortgage include securing the creditor's interest in a property while providing a clear framework for property transfer in case of default. It outlines the responsibilities of all parties involved, ensuring transparency and clarity. Additionally, it helps streamline the foreclosure process, making it efficient and less time-consuming.

Not all mortgages require a deed of trust, but many do, especially in states that favor this method of securing loans. The deed of trust serves as a legal document that protects the lender's interest in the property. However, some mortgages may instead use a mortgage agreement, depending on local laws. Knowing the specifics of your situation can help you understand your rights and obligations.

The process related to a deed of trust is usually managed by a title company or an escrow agent. These professionals coordinate with the lender, borrower, and various stakeholders to ensure all documents are properly executed. Their role includes facilitating the closing, recording the deed, and ensuring that all legal requirements are met. Using a reliable service like US Legal Forms can simplify this process for you.

Some cons of a trust deed include the potential for limited borrower protections compared to traditional mortgages. If you encounter difficulties, the rapid foreclosure process can feel daunting. Additionally, if you are not familiar with the terms, a trust deed for mortgage may lead to confusion regarding your obligations and rights as a borrower.

Yes, declaring a trust deed is important for proper legal documentation and accountability. It is essential to record the trust deed with the appropriate authority in your state to ensure that the property interests are clearly defined and recognized. This step helps protect all involved parties and adds transparency to the mortgage process.

The main disadvantage of a trust deed is the potential for quicker foreclosure compared to traditional mortgages. If a borrower defaults on payments, the lender can proceed with foreclosure without going through court, which can be alarming. Furthermore, a trust deed for mortgage may also involve additional fees and costs that borrowers should consider before committing.

One of the biggest mistakes parents often make when establishing a trust fund is failing to clearly define the purpose and terms of the trust. This oversight can lead to misunderstandings and conflicts among beneficiaries. It is crucial to articulate your intentions and consult with professionals to ensure that your trust deed for mortgage aligns with your financial goals and family dynamics.