Transfer Deed For Trust

Description

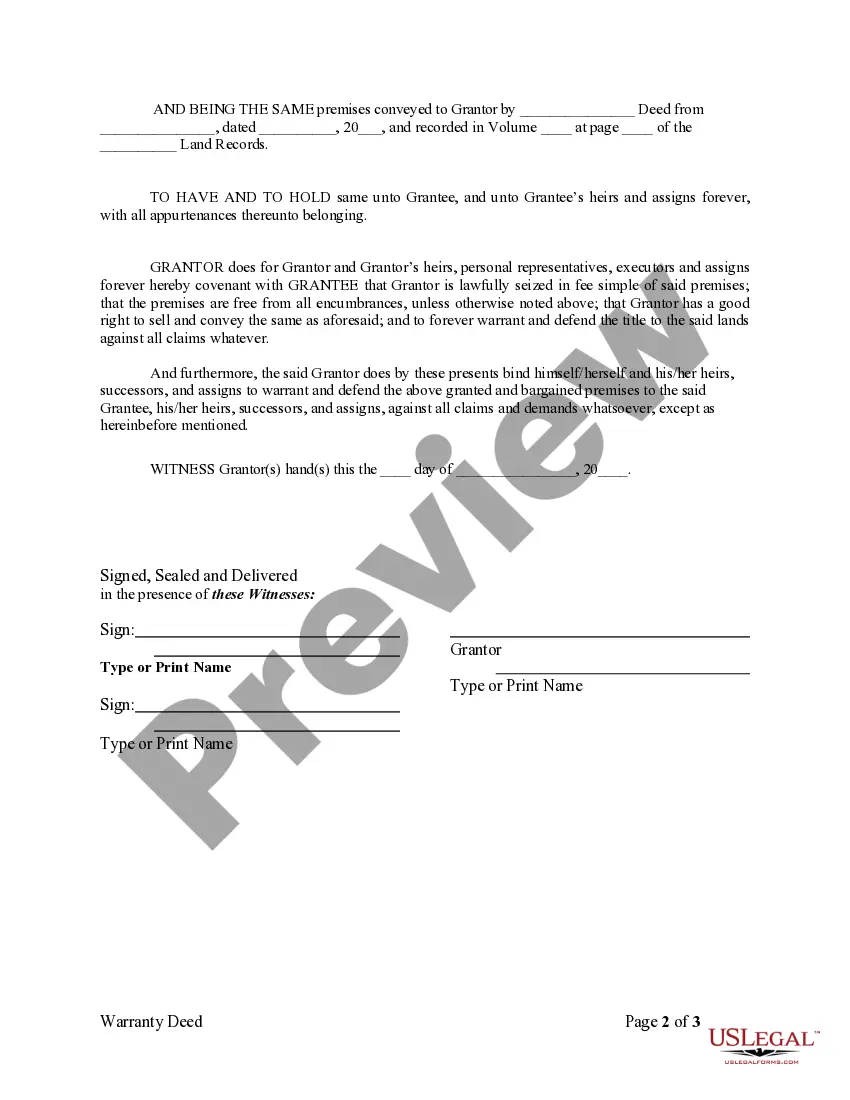

How to fill out Connecticut Warranty Deed From Individual To A Trust?

- If you're an existing user, log into your account and navigate to your dashboard. Ensure your subscription is active to access your documents.

- For first-time users, start by reviewing the Preview mode and form descriptions to select the appropriate transfer deed for your needs.

- If necessary, use the Search tab to locate additional templates that align with your jurisdiction's requirements.

- Once you find the correct document, click the Buy Now button and choose your desired subscription plan. You will need to create an account to gain full access.

- Complete your purchase by entering your payment information, using either a credit card or PayPal.

- Finally, download the form to your device and find it again anytime in the My Forms section of your account.

With US Legal Forms, you benefit from a vast library of forms more extensive than competitors at a similar price point, along with the option to consult with legal professionals.

Start streamlining your legal document preparations today. Explore how easy it is to secure your transfer deed for trust with US Legal Forms!

Form popularity

FAQ

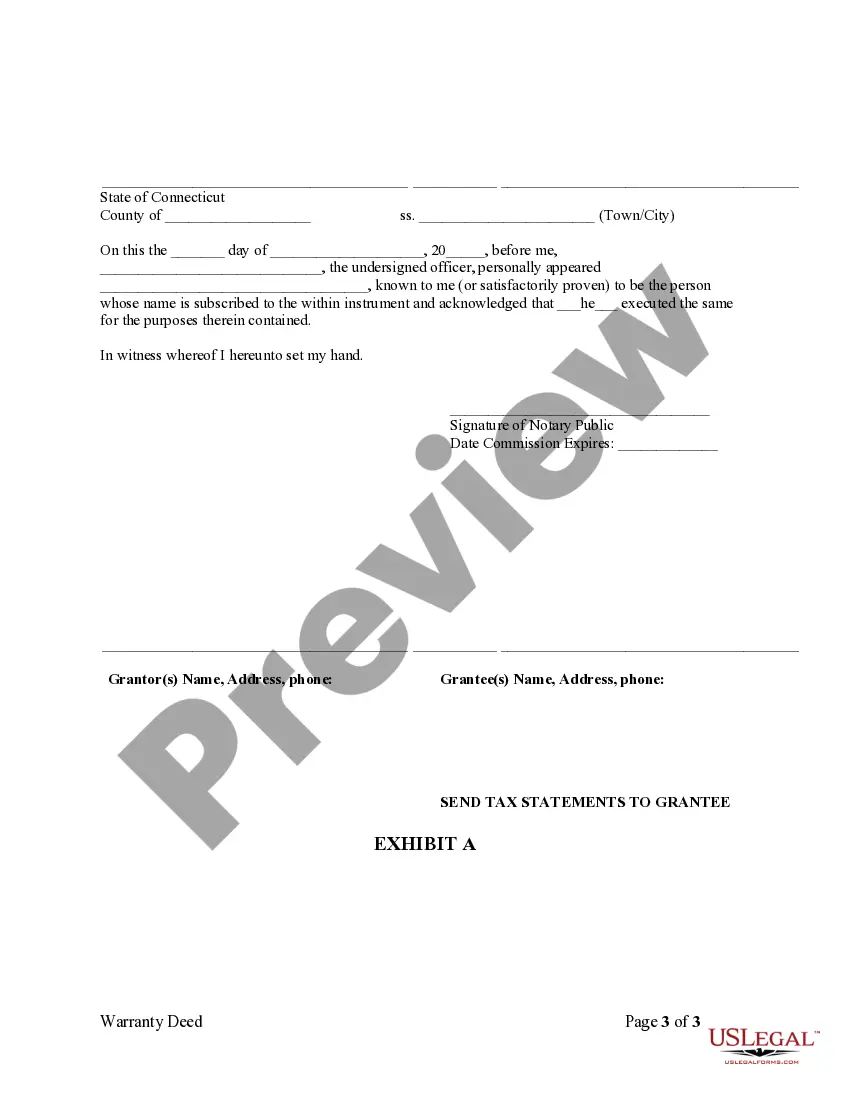

To obtain a transfer deed for trust, start by identifying the property you wish to transfer into the trust. Then, you can generate the necessary documents through a reliable legal forms platform like US Legal Forms. They offer many options to create a transfer deed tailored to your specific needs. Once completed, ensure you have it signed and notarized to finalize the transfer process.

Transferring property from one trust to another is possible and involves executing a new transfer deed for trust. You will need to follow specific steps, including notifying all relevant parties and possibly revising trust documents. Additionally, understanding the tax implications is key to ensuring a smooth transition. For detailed guidance, considering a legal service like USLegalForms can streamline the process.

Yes, a home with a mortgage can be transferred to a trust using a transfer deed for trust. However, it's crucial to review your mortgage terms, as some lenders may require notification or approval. This transfer can also offer benefits like asset protection and streamlined estate management for your heirs. Consulting with a legal expert can help clarify the process.

The best approach to leave a house to your child is often through a trust. Utilizing a transfer deed for trust allows you to specify your wishes clearly and avoid probate delays. This method also protects the property from potential creditors and can provide tax advantages. Sharing this plan with your child can help ensure they understand and appreciate your intentions.

One significant disadvantage of placing your house in trust involves the initial setup costs and ongoing administration. A transfer deed for trust may add complexity to your estate plan, which requires careful management. Additionally, once in trust, you may have restricted control over the asset in case of urgent financial needs. It is essential to weigh these factors before proceeding.

Generally, transferring assets to a trust, including a home, is not considered a taxable event. When you execute a transfer deed for trust, you retain ownership rights, which helps avoid taxes at the time of transfer. However, it's vital to consult with a tax professional, as future transactions or income generated by the trust may have tax implications.

Choosing between gifting a house or placing it in a trust depends on your long-term goals. A transfer deed for trust may provide you more control over the property and its use after your passing. Once in a trust, the asset avoids probate and can simplify the transfer process. However, gifting may have immediate personal benefits but can lead to complications later.

An example of a trust deed is one that establishes a family trust, detailing how assets should be managed and distributed among family members. This document provides a clear outline of the trustee's responsibilities and the beneficiaries' rights. The transfer deed for trust ensures that specific assets, like real estate or bank accounts, are properly included. You can find various examples and templates online, including those offered by US Legal Forms, to guide you in drafting your own.

Yes, you can write your own deed, but understanding the legal language and requirements is crucial for its validity. A poorly drafted deed may lead to confusion or disputes later. Make sure to include key elements such as the purpose and beneficiaries in your transfer deed for trust. Using resources like US Legal Forms can provide templates and instructions to help you draft your deed accurately.

To write a trust deed, start by identifying the grantor, trustee, and beneficiaries. Clearly state the purpose of the trust, and specify the assets included in the transfer deed for trust. It’s important to use plain language to clearly articulate your wishes while adhering to legal requirements. Consider leveraging resources from US Legal Forms to guide you in creating an effective and compliant trust deed.