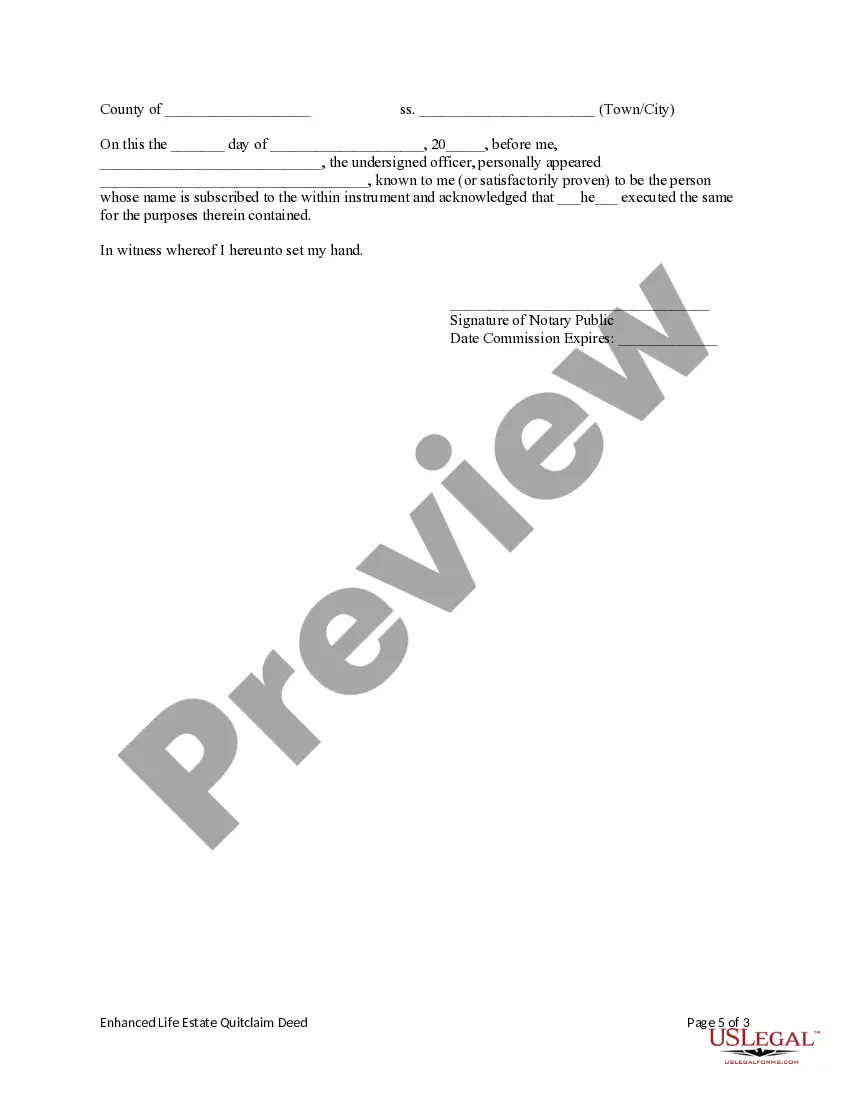

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Life Estate Deed Connecticut With Full Powers

Description

How to fill out Connecticut Enhanced Life Estate Or Lady Bird Quitclaim Deed - Individual To Individual?

Handling legal documents and processes can be a lengthy addition to your day.

Life Estate Deed Connecticut With Full Powers and similar forms typically necessitate that you search for them and figure out how to complete them efficiently.

Consequently, if you are managing financial, legal, or personal affairs, utilizing a detailed and user-friendly online directory of forms at your disposal will greatly assist.

US Legal Forms is the leading online service for legal documents, showcasing over 85,000 state-specific forms and a variety of tools to facilitate your document completion swiftly.

Is it your first time using US Legal Forms? Register and set up your account in a few moments and you’ll gain access to the form catalog and Life Estate Deed Connecticut With Full Powers. Then, follow these steps to complete your form: Ensure you have the correct form using the Review option and reading the form details. Select Buy Now when ready, and choose the subscription plan that suits you. Click Download then complete, sign, and print the form. US Legal Forms has twenty-five years of experience assisting customers with their legal documents. Find the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific documents that can be downloaded at any time.

- Protect your document management tasks with a reliable service that allows you to create any form in a matter of minutes without extra or hidden charges.

- Simply Log In to your account, locate Life Estate Deed Connecticut With Full Powers, and obtain it immediately from the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

A life estate deed provides significant benefits, especially in estate planning. With a life estate deed in Connecticut with full powers, you can maintain control of your property while ensuring it passes directly to your beneficiaries upon your death, avoiding probate. This arrangement simplifies the transfer process and can contribute to effective tax planning. Furthermore, you continue to enjoy the benefits of property ownership during your lifetime.

Yes, you can sell a home with a life estate deed in Connecticut. When you have a life estate deed with full powers, you retain the right to sell, lease, or mortgage the property during your lifetime. However, keep in mind that the new owner will have to respect the original life estate arrangement. It is wise to consult with a legal expert to navigate the details of such transactions.

Yes, there is a step-up in basis on inherited real estate, including properties transferred through a life estate deed. This means that the property's tax basis is adjusted to its market value at the time of the original owner's death. For individuals receiving property in Connecticut, this can be a strategic advantage, allowing them to sell with minimal capital gains tax exposure. Knowing about the step-up in basis is important for your financial future.

While a life estate deed offers benefits, it also comes with disadvantages. One key issue is that once established, the terms cannot easily be changed without the consent of all parties involved. Additionally, the property can be subject to creditors' claims against the life tenant during their lifetime. Life estate deeds in Connecticut come with various legal implications, so it’s important to look into these factors before proceeding.

A life estate deed in Connecticut is a legal document that allows an individual to live in a property for their lifetime, with the property passing seamlessly to designated beneficiaries after their death. This arrangement provides the current owner with rights to use the property while ensuring that the future ownership is predetermined. In Connecticut, these deeds can simplify estate management and help avoid lengthy probate processes. Understanding how a life estate deed with full powers works can be beneficial for effective estate planning.

The step-up basis of the life estate deed is similar to the regular step-up basis, where inherited properties adjust to their market value at the time of the owner's death. This means that, in Connecticut, if you inherit a property through a life estate deed with full powers, your tax liability can be lowered when you sell. By understanding the step-up basis, you can navigate potential capital gains taxes more effectively. This knowledge is key to financial planning.

A life estate deed with full powers allows the owner to retain the right to use and manage the property during their lifetime. This means they can sell, rent, or mortgage the property, giving them significant control. Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate. This arrangement offers both flexibility and security for property owners in Connecticut.

The step-up basis in a life estate deed refers to how the value of the property is adjusted for tax purposes when the owner passes away. In Connecticut, when you inherit a property through a life estate deed with full powers, the property's value is updated to its fair market value at the time of death. This can significantly reduce capital gains taxes if the heir decides to sell the property later. Understanding this concept is crucial for effective estate planning.

A life estate in Connecticut is a legal arrangement where an individual retains the right to use and occupy a property for their lifetime. Upon their death, the property automatically transfers to a designated beneficiary named in the deed. This type of arrangement offers significant benefits, such as avoiding probate and maintaining control over the property during the life tenant's lifetime. To explore how a life estate deed in Connecticut with full powers works, consider utilizing US Legal Forms for comprehensive resources and forms.

Generally, a will cannot override a life estate deed in Connecticut. A life estate deed gives an individual the right to use and benefit from a property during their lifetime, while the ownership of the property passes to another party upon their death. This means that even if a will specifies a different distribution of the property, the life estate's terms remain in effect. It's essential to consult a legal professional to understand how a life estate deed in Connecticut with full powers impacts your estate planning.