Lady Bird Deed Requirements

Description

How to fill out Connecticut Enhanced Life Estate Or Lady Bird Quitclaim Deed - Individual To Individual?

Legal oversight can be perplexing, even for seasoned experts.

When you are seeking information on a Lady Bird Deed Requirements and don’t have the time to invest in locating the appropriate and current version, the process can be overwhelming.

U.S. Legal Forms meets any obligations you may have, from personal to business paperwork, all in a single location.

Utilize advanced features to complete and oversee your Lady Bird Deed Requirements.

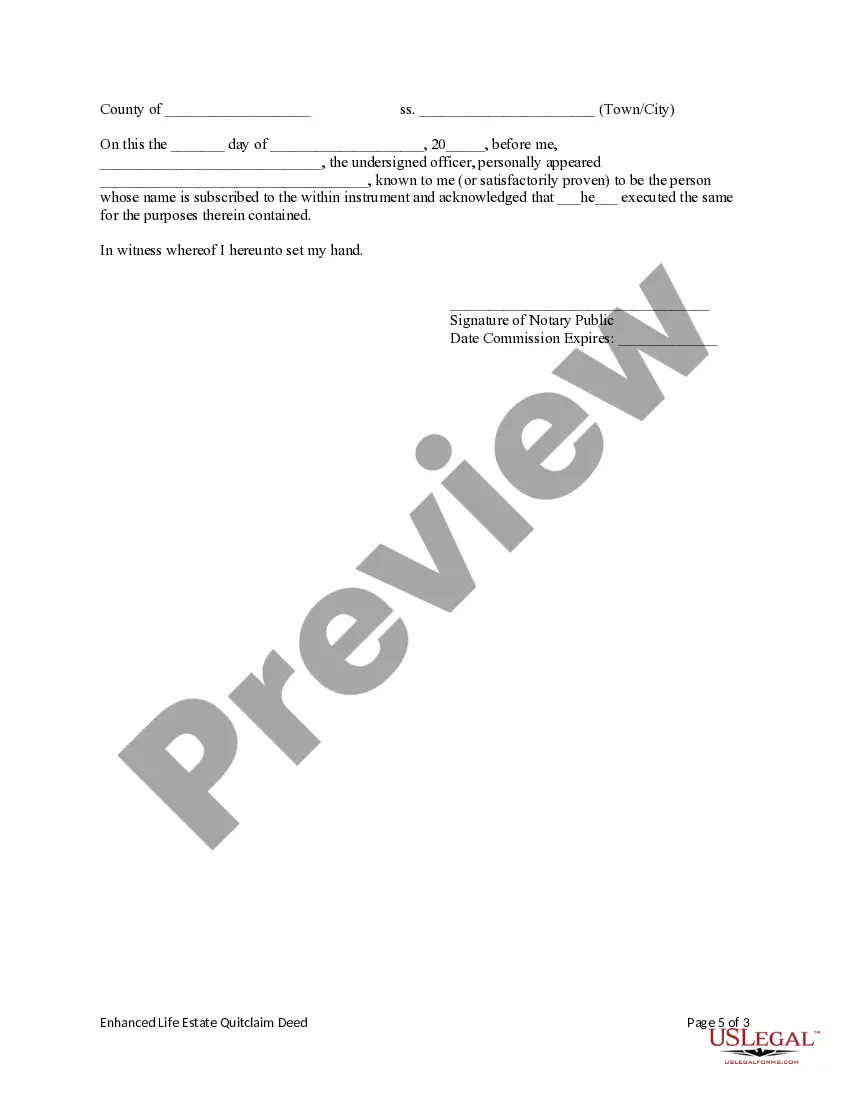

Here are the actions to take after securing the form you require: Verify it is the accurate document by previewing it and reviewing its description.

- Access a repository of articles, guides, handbooks, and resources related to your circumstances and requirements.

- Conserve time and energy searching for the documents you need, and leverage U.S. Legal Forms’ sophisticated search and Preview functionality to locate Lady Bird Deed Requirements and obtain it.

- If you hold a monthly subscription, Log In to your U.S. Legal Forms account, search for the document, and download it.

- Check the My documents section to review the documents you have previously saved and manage your folders as desired.

- If it is your initial experience with U.S. Legal Forms, establish an account and obtain unrestricted access to all benefits of the collection.

- A comprehensive online form database can be transformative for anyone who wishes to address these matters effectively.

- U.S. Legal Forms is a market frontrunner in digital legal documents, offering over 85,000 state-specific legal forms accessible at any moment.

- With U.S. Legal Forms, you can gain entry to state- or county-specific legal and business documents.

Form popularity

FAQ

While it is not mandatory to use a lawyer for a lady bird deed in Florida, consulting one can be beneficial. A legal professional can guide you through the lady bird deed requirements and ensure your documents comply with state laws. If you feel confident, you can complete the process on your own using the right resources.

It's generally not advisable to do this without legal expertise. The preparation of a Lady Bird deed requires a precise understanding of Florida property law and estate planning law.

Disadvantages of a lady bird deed Available in only five states. Lady bird deeds are currently used only in Florida, Texas, Michigan, Vermont and West Virginia. ... Property taxes may be higher for the beneficiary. States may increase the taxable value of a property when it transfers to your beneficiary when you die.

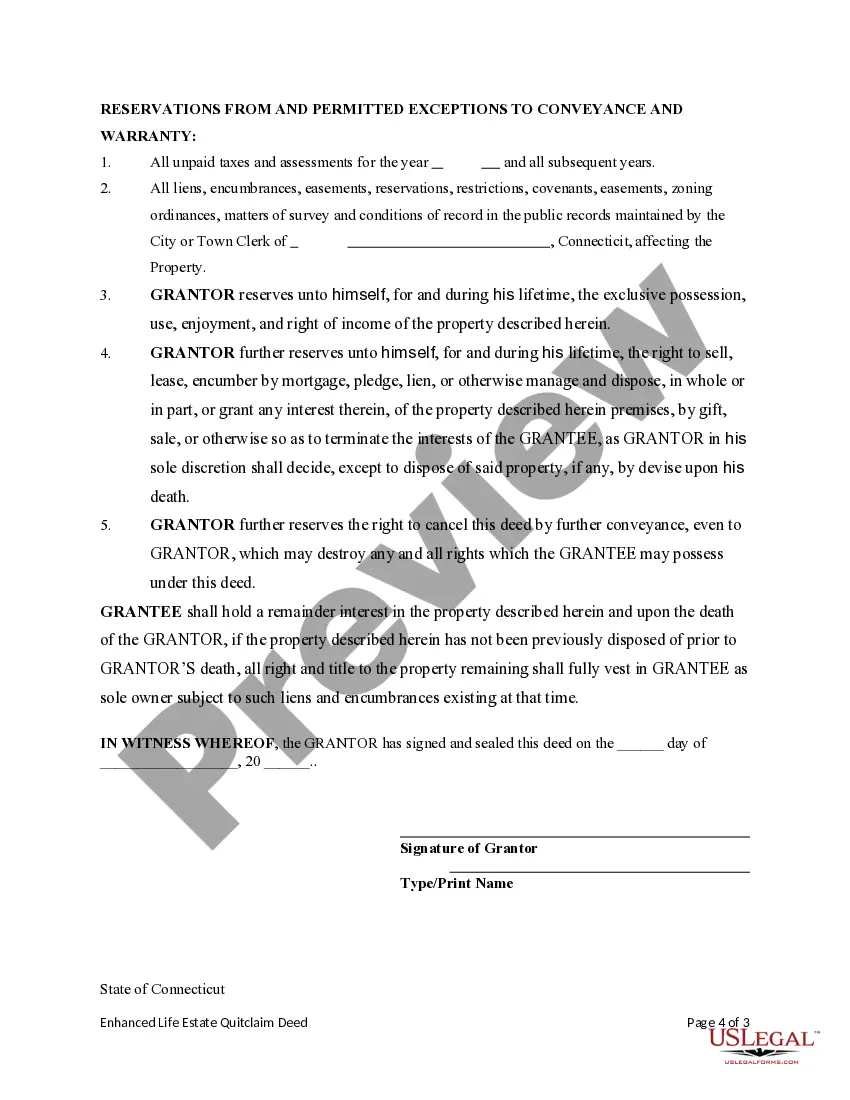

Transfer on death deeds cannot be signed by anyone other than the property owner. But as long as the Lady Bird deed form is signed in the presence of a licensed notary, Lady Bird deeds can be signed by the owner or the owner's agent under power of attorney.

Tips for filing a Lady Bird deed form Make sure the deed is recorded in the county you live in (where the property is located). There are many clerk offices in Texas that are close in proximity but serve different counties. ... Use the right form. ... Fill out the form carefully. ... Work with an estate planning attorney.

In order for a Transfer on Death Deed to be valid, it must be signed, notarized, and recorded in the property records of the county where the property is located. In contrast, a Lady Bird Deed does not have a recording requirement. All that is required for a deed to be valid in Texas is delivery to the Grantee.