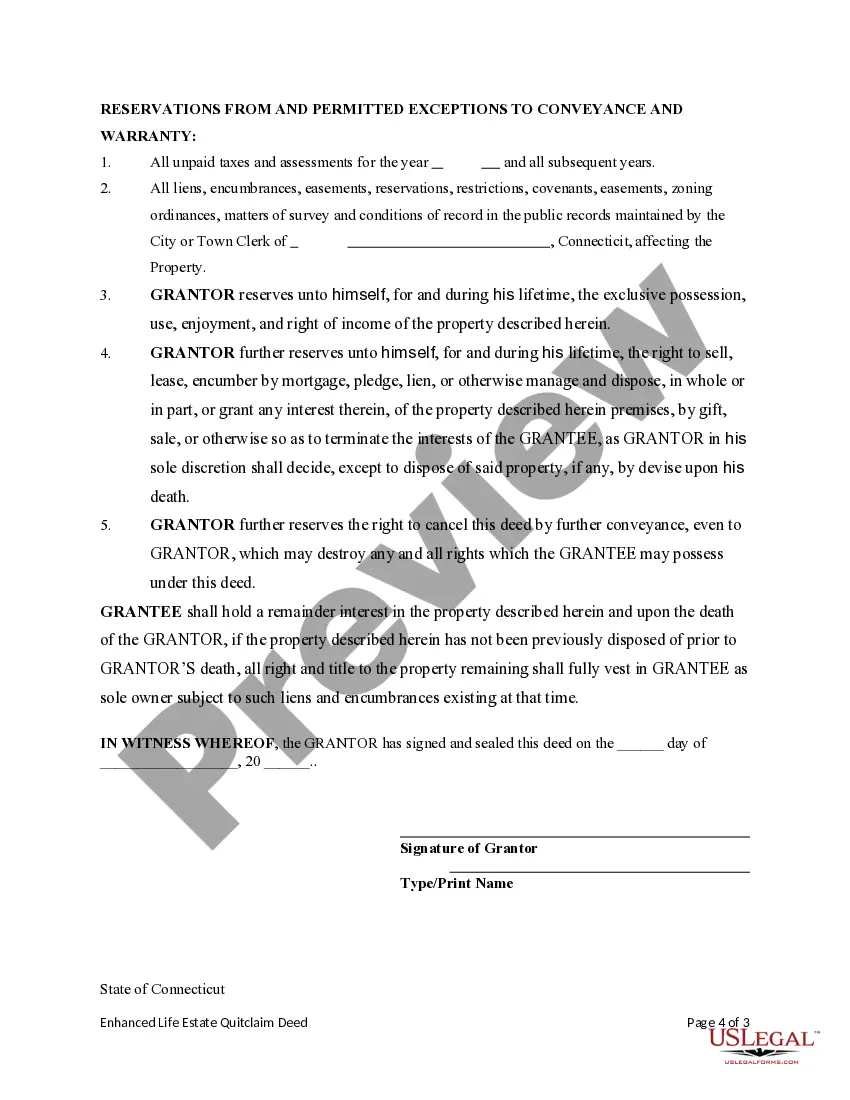

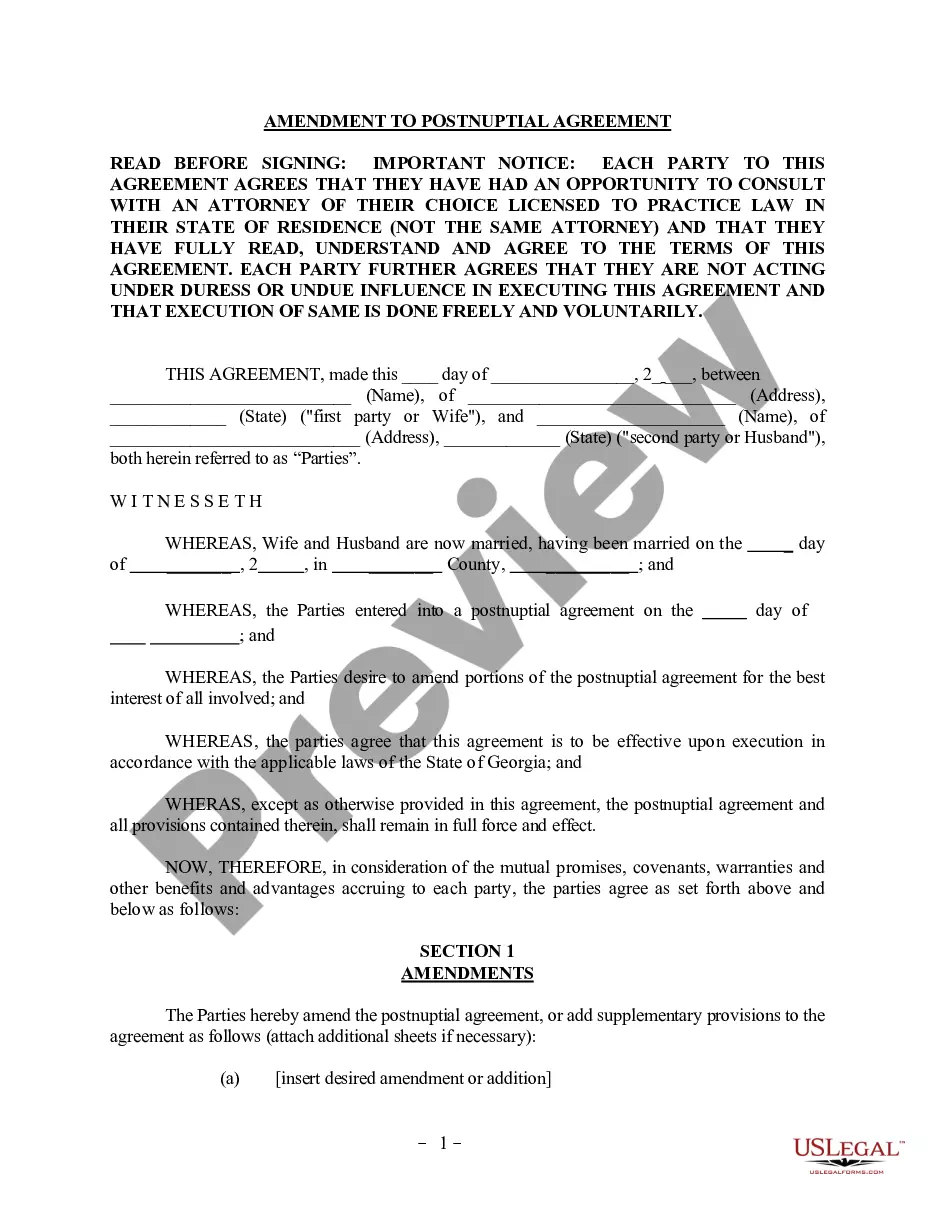

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Lady Bird Deed Connecticut Without An Attorney

Description

How to fill out Connecticut Enhanced Life Estate Or Lady Bird Quitclaim Deed - Individual To Individual?

Locating a reliable resource for acquiring the latest and most suitable legal documents is a significant part of navigating bureaucracy.

Securing the appropriate legal materials demands precision and careful consideration, which is why it is crucial to obtain samples of Lady Bird Deed Connecticut Without An Attorney solely from trustworthy providers, such as US Legal Forms. An incorrect document will squander your time and postpone your situation.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in manually. Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms library where you can discover legal templates, verify their suitability for your situation, and download them instantly.

- Utilize the catalog navigation or search feature to find your template.

- Review the form’s description to determine if it meets your state and area requirements.

- Access the form preview, if available, to confirm that the template is the one you are seeking.

- Return to the search to find the correct document if the Lady Bird Deed Connecticut Without An Attorney does not align with your needs.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing plan that suits your needs.

- Proceed to register to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Lady Bird Deed Connecticut Without An Attorney.

Form popularity

FAQ

A Transfer on Death (TOD) deed functions similarly to a lady bird deed, but it does not allow the property owner to retain control over the property during their lifetime. With a lady bird deed, the original owner maintains control and can sell or change the property without loss. This distinction makes the lady bird deed popular among those in Connecticut who prefer to manage their real estate without an attorney.

Disadvantages. The downside is that property transferred via a lady bird deed will be subject to a new tax assessment that could (and often does) result in higher property taxes generally.

Like a Lady Bird Deed, a trust avoids probate. Unlike a Lady Bird Deed, however, the assets that can be in a trust are more than just the family home. So, for those who have extensive assets or want to protect more than just the family home, a trust can be a good estate planning tool to use.

The original owner retains complete control over the property. Using a Lady Bird deed, the homeowner retains control over their property until they sell it, gift it, or die. The remainder beneficiary receives the property if the grantor owns the property at the owner's death.

Ladybird deeds allow homeowners to transfer their interest in the property with warranties, whereas the Texas Transfer on Death Deed statute specifically states that the interest in the property transfers without covenant of warranty of title, even if the deed contains a contrary provision.

Disadvantages of a Lady Bird deed If you plan to apply for a mortgage on the property, some title insurance companies may be reluctant to provide title insurance on property subject to a Lady Bird deed. You want to leave the property to more than one grantee. There is a fairly large mortgage balance on the property.