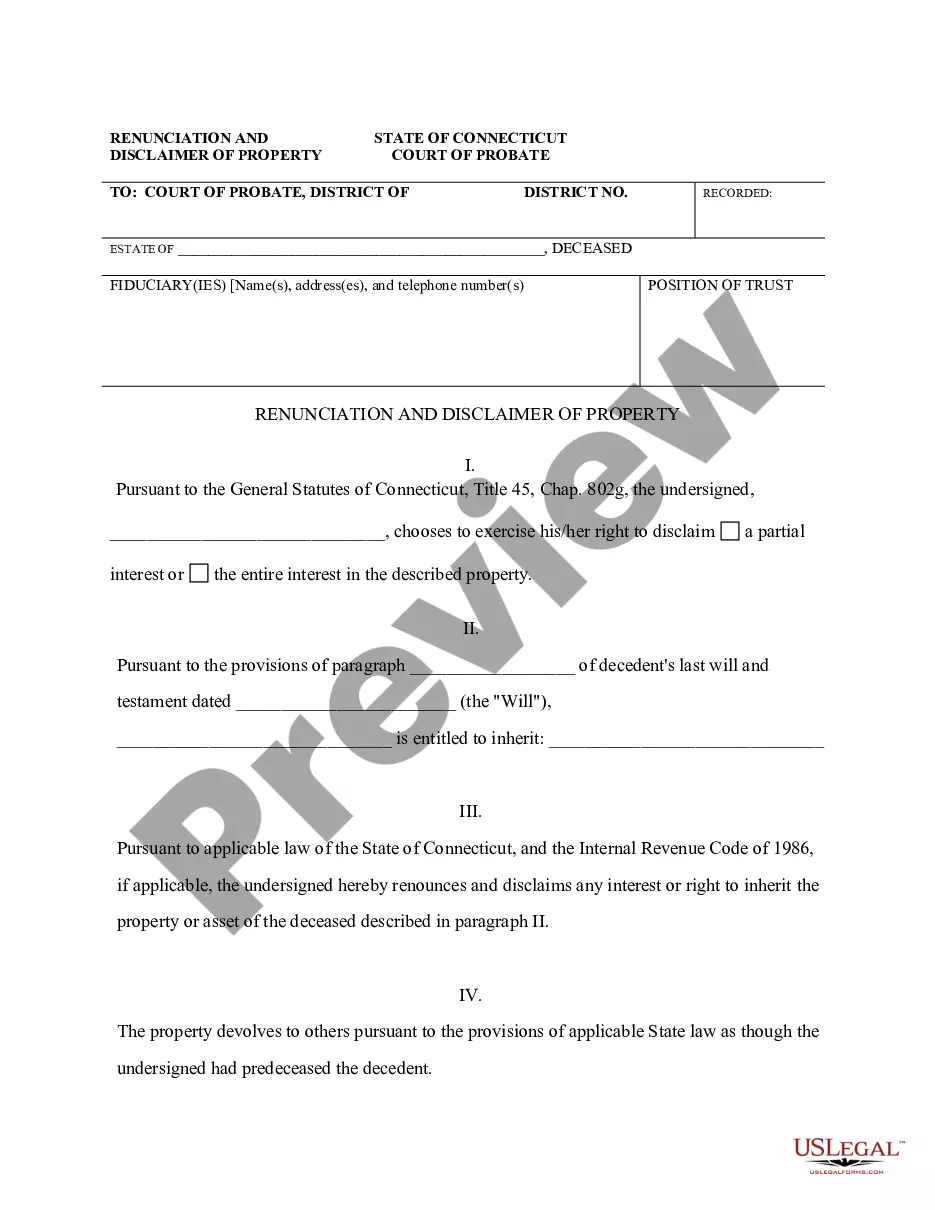

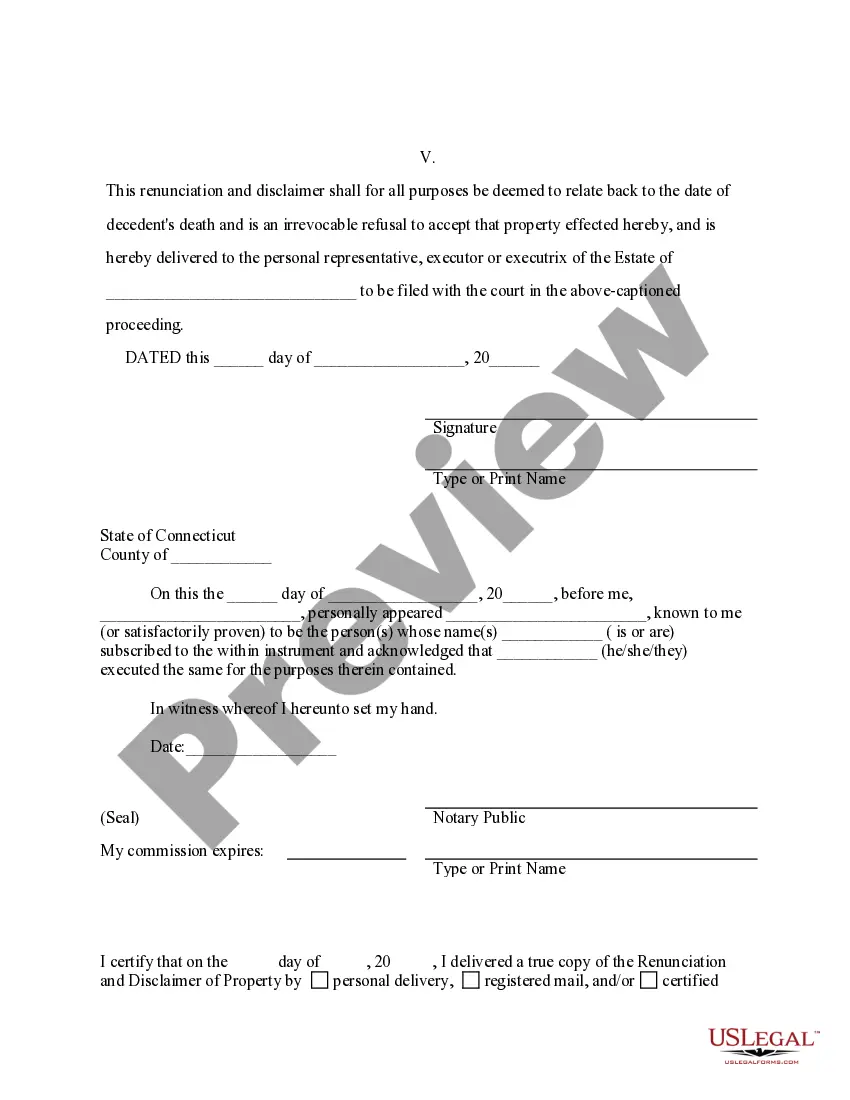

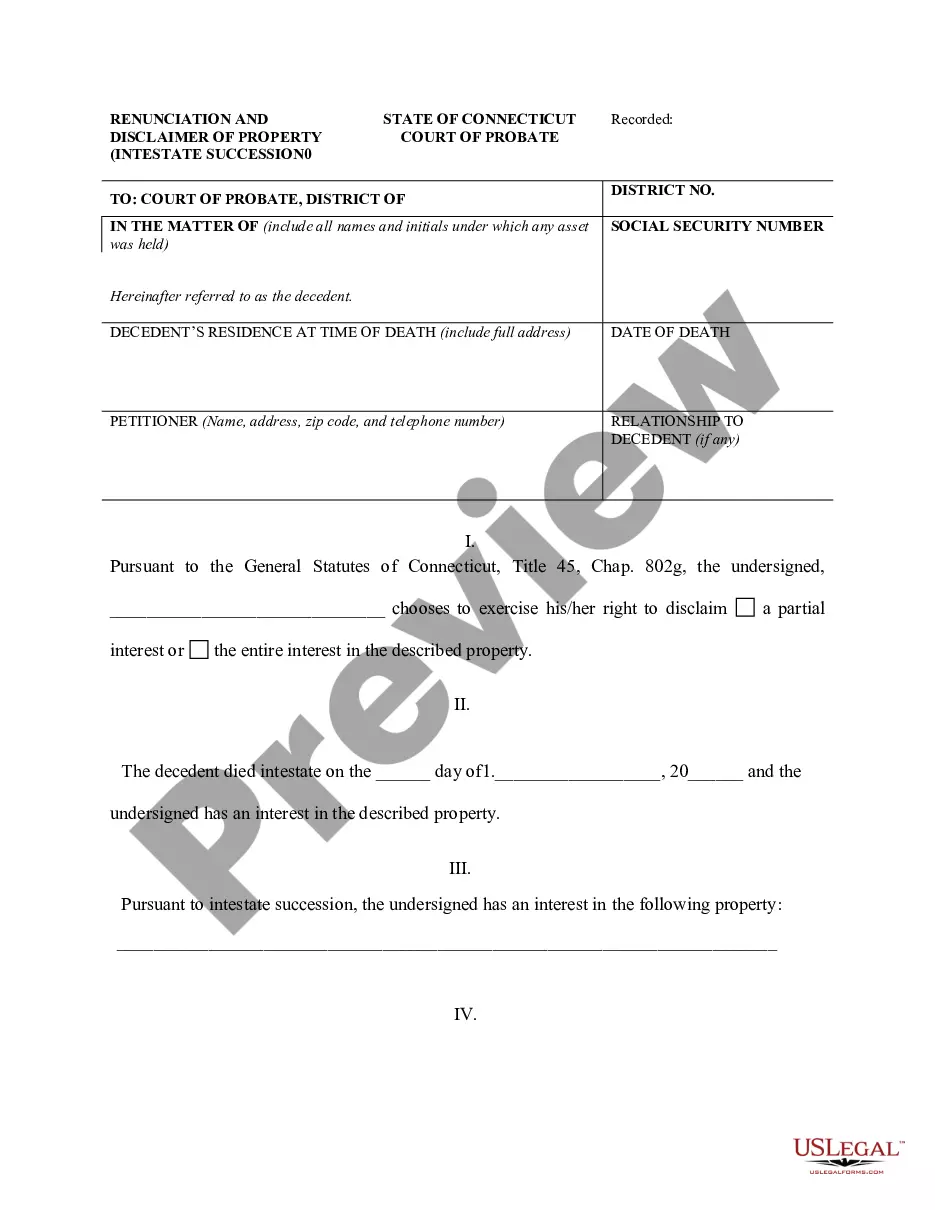

Connecticut Renunciation And Disclaimer of Property from Will by Testate

GENERAL STATUTES OF CONNECTICUT

TITLE 45a PROBATE COURTS AND PROCEDURE

CHAPTER 802g* DISCLAIMER OF PROPERTY

Construction of chapter. Definitions.

(a) The provisions of sections 45a-578 to 45a-585, inclusive,

shall be liberally construed to promote their underlying purpose and policy

of readily permitting the disclaimer of interests.

(b) As used in said sections, (1) the term "nontestamentary instrument"

includes, but is not limited to, a trust other than a trust created under

a will, an annuity, a policy of life, health or accident insurance, a bank

account or any contract or other document naming another party as beneficiary

thereof whether such beneficiary takes by survivorship, payment on death

or outright grant, but does not include a will; (2) the term "interest"

means any interest in property, real or personal, including any power whether

granted by instrument or by law, even if held in a fiduciary capacity;

(3) the term "will" includes all codicils thereto; and (4) the terms "joint

tenancy", "joint tenant" and "joint tenants" have the same meaning and

effect as provided in sections 47-14a to 47-14k, inclusive.

(c) A disclaimer which complies with the requirements of said sections

is irrevocable.

Title 45a, Chap. 802g*, Sec. 45a-578. (Formerly Sec. 45-299).

(1972, P.A. 62, S. 13; P.A. 81-396, S. 7; P.A. 97-189, S. 1; 97-246,

S. 98, 99.)

History: P.A. 81-396 added provision requiring liberal construction,

amended definition of "nontestamentary instrument" as trust "other than

a trust created under a will" or outright grant, added definition of "interest"

and provided that disclaimer in compliance with requirements of chapter

is irrevocable; Sec. 45-299 transferred to Sec. 45a-578 in 1991; P.A. 97-189

amended Subsec. (b) by redefining "interest" and defining "will", "joint

tenancy", "joint tenant" and "joint tenants"; P.A. 97-246 made P.A. 97-189

effective October 1, 1997 and applicable to disclaimers delivered on or

after said date and transfers affected by such disclaimers, effective June

27, 1997. Annotation to former section 45-299: Subsec. (a): Cited. 211

C. 323, 329, 330.

Disclaimer of property in decedent's estate. Time limitation.

Effect of disclaimer.

(a) An heir, next of kin, devisee, legatee, person succeeding

to a disclaimed interest, beneficiary under a will, trustee, donee of a

power of appointment granted by a will, appointee under a power of appointment

exercised by a will, or any other recipient of an interest, may disclaim

in whole or in part any interest under a will or any interest passing by

intestacy by delivering a written disclaimer in the manner hereinafter

provided.

(b)

(1) A guardian or conservator of the estate of a minor

or incapable person, an executor, administrator or other personal representative

of the estate of a decedent, if such fiduciary is not authorized by will

to disclaim, or a trustee under a will or nontestamentary trust instrument

which does not authorize such trustee to disclaim, may with approval of

any probate court having jurisdiction under subdivision (3) of this subsection,

disclaim on behalf of such minor, incapable person, decedent, decedent's

estate, or trust, within the same time and in the same manner as could

a capable person.

(2) If the will under which an executor, administrator or other

personal representative of the estate of a decedent or the will or trust

instrument under which a trustee of a testamentary or nontestamentary trust

is acting authorizes such fiduciary to disclaim and does not expressly

require Probate Court approval of a disclaimer, such fiduciary may disclaim

on behalf of such decedent, estate or trust within the same time and in

the same manner as could a capable person and need not seek approval of

the Probate Court for such disclaimer, provided such fiduciary may petition

any probate court having jurisdiction under subdivision (3) of this subsection

for authority to disclaim.

(3) A guardian or conservator of the estate of a minor or incapable

person, an executor, administrator or other personal representative of

the estate of a decedent, or a trustee under a will or a nontestamentary

trust instrument may file a petition requesting authority to disclaim an

interest under a will or passing by intestacy in the probate court having

jurisdiction over such disclaiming fiduciary, and if there is no such court

in this state, in the probate court for any district (A) having jurisdiction

over the estate or trust from which the interest to be disclaimed is derived,

(B) where such disclaiming fiduciary, if not a natural person, has a place

of business, (C) where the testator or intestate person from whom the interest

to be disclaimed derives resided at the time of death, (D) where the settlor

of the disclaiming trust resided at the time of its creation, resided at

the time of such settlor's death or resides at the time of such petition

or, (E) where the disclaiming fiduciary or any beneficiary of the disclaiming

estate or trust resides. The Probate Court shall have jurisdiction over

proceedings for authority to disclaim as provided for in this subdivision.

A petition requesting authority to disclaim by a fiduciary of an estate

or trust not otherwise subject to the jurisdiction of the Probate Court

shall not subject such estate or trust or its fiduciary to the continuing

jurisdiction of the Probate Court.

(c) The disclaimer shall (1) describe the interest disclaimed, (2)

be executed by the disclaimant in the manner provided for the execution

of deeds of real property either by the laws of this state or by the laws

of the place of execution, and (3) declare the disclaimer and the extent

thereof.

(d) A disclaimer under this section shall be effective if made in

the following manner:

(1) A disclaimer of a present interest shall be delivered

not later than the date which is nine months after the later of: (A) The

death of the decedent or the donee of the power or, (B) if the disclaimer

is made by or on behalf of a natural person, the day on which such person

attains the age of eighteen years, or, if such person does not survive

to the age of eighteen years, the day on which such person dies;

(2) a disclaimer of a future interest shall be delivered not later

than the date which is nine months after the later of:

(A) The event that determines that the taker of the

interest is finally ascertained and such interest is indefeasibly vested

or,

(B) if the disclaimer is made by or on behalf of a natural person,

the day on which such person attains the age of eighteen years, or, if

such person does not survive to the age of eighteen years, the day on which

such person dies;

(3) the disclaimer shall be delivered to the legal representative of

the estate of the decedent or deceased donee of the power or the holder

of the legal title to the property to which the interest relates; and

(4) if an interest in real property is disclaimed, a copy of such

disclaimer shall also be recorded in the office of the town clerk of the

town in which the real property is situated within such nine-month period,

and, if a copy of such disclaimer is not so recorded, it shall be ineffective

against any person other than the disclaimant, or the person on whose behalf

such disclaimer is made, but only as to such real property interest. Although

not a condition to disclaimer, if within such nine-month period, a copy

of such disclaimer and a receipt therefor, executed by such legal representative

or such holder of legal title in the same manner as provided for the disclaimer,

are filed in the probate court having jurisdiction over the estate of the

decedent or deceased donee, such action shall constitute conclusive evidence

of timely disclaimer.

(e) If a disclaimer is made pursuant to this section, the interest

disclaimed shall devolve as follows:

(1) If the deceased owner or donee of a power of appointment

has provided for another disposition in the event of a disclaimer, the

interest disclaimed shall devolve as provided in the will in the event

of a disclaimer.

(2) If the deceased owner or donee of a power of appointment has

not provided for another disposition in the event of a disclaimer,

the interest disclaimed shall devolve as follows:

(A) If the disclaimant is a natural person acting for himself

or herself, the interest disclaimed shall devolve as if the disclaimant

had predeceased the deceased owner or the donee of the power of appointment,

as the case may be.

(B) If the disclaimant is acting on behalf of a natural person,

as attorney-in-fact, guardian, conservator or other personal representative,

the interest disclaimed shall devolve as if the person on whose behalf

the disclaimer is made had predeceased the deceased owner or the donee

of the power of appointment, as the case may be.

(C) If the disclaimant is an executor, administrator or other personal

representative acting on behalf of a deceased person, the interest disclaimed

shall devolve as if the deceased person on whose behalf the disclaimer

is made had predeceased the deceased owner or the donee of the power of

appointment, as the case may be.

(D) If the disclaimant is an executor, administrator or other personal

representative acting on behalf of an estate, the disclaimed interest,

other than an interest that is a fiduciary power, shall devolve as if the

disposition to the estate were ineffective.

(E) If the disclaimant is the trustee of a trust or is a corporation,

partnership, limited liability company, foundation, or other entity, the

disclaimed interest, other than an interest that is a fiduciary power,

shall devolve as if the disposition to the trust or entity were ineffective.

(F) If the disclaimant is an executor, administrator, trustee, or

other personal representative and the interest disclaimed is a fiduciary

power, the effect of such disclaimer shall be as follows: (i) If the disclaimer

is made by all of the acting fiduciaries for themselves and on behalf of

all successor fiduciaries, then the disclaimed fiduciary power shall be

treated, for all current acting fiduciaries and for all successor fiduciaries,

as if such fiduciary power never existed; (ii) if the disclaimer is made

by a fiduciary for such fiduciary alone but not on behalf of other or successor

fiduciaries, then the disclaimed fiduciary power shall be treated, as to

such disclaiming fiduciary, as if such fiduciary power never existed; however,

such fiduciary power shall continue to be exercisable by any fiduciary

who has not disclaimed such power and by all successor fiduciaries.

(3) If a disclaimer is addressed to an interest disposed of by a particular

provision of a will, then the interest disclaimed shall devolve pursuant

to subdivisions (1) and (2) of subsection (e) of this section, but only

for purposes of such provision, and such interest may devolve to or for

the benefit of the disclaimant, or the person, estate, trust, corporation,

partnership, limited liability company, foundation, or other entity on

whose

behalf the disclaimer is made, under other provisions of such will, by

intestacy or otherwise.

(4) Any future interest that takes effect in possession or enjoyment

at or after the termination, whether by death or otherwise, of the interest

disclaimed shall, unless otherwise provided in the will, take effect, (A)

in the case of a disclaimer by or on behalf of a natural person,

as if the disclaimant or the person on whose behalf the disclaimer is made

had predeceased the deceased owner or the donee of the power, as the case

may be, or, (B) in the case of a disclaimer on behalf of a trust, estate,

corporation, partnership, limited liability company, foundation, or other

entity, as if the disposition to such entity were ineffective.

(5) A disclaimer shall relate back for all purposes to the date

of death of the deceased owner or of the donee of the power of appointment.

(f) In a case in which the estate of a decedent receives a settlement

in a wrongful death action and a beneficiary of the estate dies intestate

within seven months of the prior decedent, and such beneficiary's estate

receives some part of such settlement, subsection (d) shall be waived,

and the interest of the beneficiary may be disclaimed without being subject

to a nine-month disclaimer period, provided such disclaimer is made on

or before December 1, 1997.

Title 45a, Chap. 802g*, Sec. 45a-579. (Formerly Sec. 45-300).

(1972, P.A. 62, S. 1; P.A. 80-476, S. 340; P.A. 81-396, S. 8; P.A.

82-472, S. 126, 183; P.A. 97-189, S. 2; 97-243, S. 65, 67; 97-246, S. 98,

99.)

History: P.A. 80-476 rearranged provisions and divided section

into Subsecs.; P.A.

81-396 rephrased Subsecs. (a) to (c) and added Subsecs. (d) and

(e) containing requirements for effective disclaimer and provisions governing

disposition of disclaimer upon decease of owner or donee of power of appointment;

P.A. 82-472 made technical change in Subsec. (d); Sec. 45-300 transferred

to Sec. 45a-579 in 1991; P.A. 97-189 rephrased section; P.A. 97-243 added

new Subsec. (f) re waiver when beneficiary dies intestate within seven

months of prior decedent, effective June 24, 1997; P.A. 97-246 made P.A.

97-189 effective October 1, 1997, and applicable to disclaimers delivered

on or after said date and transfers affected by such disclaimers, effective

June 27, 1997. Annotations to former section 45-300:

Subsec. (b): Cited. 211 C. 323?325. Subsec. (e): Cited. 211

C. 323, 325.

Right to disclaim barred, when. Binding effect of disclaimer

or waiver.

(a) The right to disclaim an interest is barred by any:

(1) Assignment, conveyance, encumbrance, pledge or transfer of the interest

or any part thereof, (2) written waiver of the right to disclaim such interest,

(3) acceptance of such interest or any of its benefits, provided for such

purpose a fiduciary power shall not be deemed accepted unless it has been

exercised, (4) sale of such interest under judicial sale, made before the

disclaimer is effected, or (5) failure by the owner of the equity of redemption

in such interest in real property to redeem pursuant to a judgment of strict

foreclosure.

(b) The right to disclaim shall exist notwithstanding any limitation

on the interest of the disclaimant in the nature of a spendthrift provision

or similar restriction.

(c) A disclaimer or a written waiver of the right to disclaim, shall

be binding upon the disclaimant or person waiving and all parties claiming

by, through or under such disclaimant or person.

Title 45a, Chap. 802g*, Sec. 45a-580. (Formerly Sec. 45-303).

(1972, P.A. 62, S. 4; P.A. 80-476, S. 342; P.A. 81-396, S. 10;

P.A. 97-189, S. 3; 97-246, S. 98, 99.)

History: P.A. 80-476 divided section into Subsecs., revising Subdiv.

indicators accordingly and substituted "chapter" for "section" in Subsec.

(c); P.A. 81-396 restated previous provisions in simpler language; Sec.

45-303 transferred to Sec. 45a-580 in 1991. P.A. 97-189 amended Subsec.

(a) by adding provision to Subdiv. (3) re fiduciary power not deemed accepted

unless exercised and added new Subdiv. (5) re failure of owner to redeem

pursuant to judgment of strict foreclosure; P.A. 97-246 made P.A. 97-189

effective October 1, 1997, and applicable to disclaimers delivered on or

after said date and transfers affected by such disclaimers, effective June

27, 1997. Annotations to former section 45-303: Cited. 179 C. 463,

466?468. Is not exclusive list of bars to disclaimers. 211 C. 323, 329,

330.

Right to disclaim under other law.

The a-585, inclusive, shall not abridge the

right of any person to assign, convey, release, renounce or disclaim under

any other statute or under common law. The enactment of said sections shall

not be construed as an impairment of the validity of a partial or complete

disclaimer, (1) whether or not such disclaimer was made prior to October

1, 1981, or (2) with respect to a disclaimer of an interest in joint tenancy

real property, whether such disclaimer was or is made under any other statute

or common law before, on or after October 1, 1997.

Title 45a, Chap. 802g*, Sec. 45a-581. (Formerly Sec. 45-304).

(1972, P.A. 62, S. 5; P.A. 81-396, S. 12; P.A. 97-189, S. 4; 97-246,

S. 98, 99.)

History: P.A. 81-396 deleted provisions re right of person to renounce

property and disclaimers under a testamentary instrument and substituted

"October 1, 1981" for "April 20, 1972"; Sec. 45-304 transferred to Sec.

45a-581 in 1991; P.A. 97-189 deleted "any interest arising" and substituted

"or disclaim", designated existing provision re disclaimer made prior to

October 1, 1981, as Subdiv. (1) and added Subdiv. (2) re disclaimer of

interest in joint tenancy made before, on or after October 1, 1997; P.A.

97-246 made P.A. 97-189 effective October 1, 1997 and applicable to disclaimers

delivered on or after said date and transfers affected by such disclaimers,

effective June 27, 1997.

Prior interests.

An interest that exists on October 1, 1981,

as to which, if a present interest, the time for delivering a disclaimer

under section 45a-562, subsections (3) and (35) of section 45a-234, subsections

(4) and (19) of section 45a-235, and sections 45a-578 to 45a-584, inclusive,

has not expired or, if a future interest, the interest has not become indefeasibly

vested or the taker finally ascertained, may be disclaimed within nine

months after October 1, 1981.

Title 45a, Chap. 802g*, Sec. 45a-582. (Formerly Sec. 45-305).

(1972, P.A. 62, S. 6; P.A. 80-476, S. 343; P.A. 81-396, S. 11;

P.A. 95-117, S. 26.) History: P.A. 80-476 made minor changes in wording

but made no substantive changes; P.A. 81-396 replaced previous provisions;

Sec. 45-305 transferred to Sec. 45a-582 in 1991; P.A. 95-117 deleted reference

to Subsec. (d) of Sec. 45a-549.

Disclaimer of property passing under nontestamentary instrument.

Time limitation. Effect of disclaimer.

(a) A grantee, donee, joint-tenant of personal property

or real property, person succeeding to a disclaimed interest, beneficiary

under a nontestamentary instrument, trustee, donee of a power of appointment

granted by a nontestamentary instrument, or an appointee under a power

of appointment exercised by a nontestamentary instrument or any other recipient

of an interest may disclaim in whole or, except as provided in subsection

(f) of this section, in part any interest under a nontestamentary instrument

by delivering a written disclaimer in the manner hereinafter provided.

(b)

(1) A guardian or conservator of the estate of a minor

or incapable person, an executor, administrator or other personal representative

of the estate of a decedent, if such fiduciary is not authorized by will

to disclaim, or a trustee under a will or nontestamentary trust instrument

which does not authorize such trustee to disclaim, may, with approval of

any probate court having jurisdiction under subdivision (3) of this subsection,

disclaim on behalf of such minor, incapable person, decedent, decedent's

estate, or trust, within the same time and in the same manner as could

a capable person.

(2) If the will under which an executor, administrator or other

personal representative of the estate of a decedent or the will or trust

instrument under which a trustee of a testamentary or nontestamentary trust

is acting authorizes such fiduciary to disclaim and does not expressly

require Probate Court approval of a disclaimer, such fiduciary may disclaim

on behalf of such decedent, estate or trust within the same time and in

the same manner as could a capable person and need not seek approval of

the Probate Court for such disclaimer, provided such fiduciary may petition

any probate court having jurisdiction under subdivision (3) of this subsection

for authority to disclaim.

(3) A guardian or conservator of the estate of a minor or incapable

person, an executor,administrator or other personal representative of the

estate of a decedent, or a trustee under a will or a nontestamentary trust

instrument may file a petition requesting authority to disclaim an interest

under a nontestamentary instrument in the probate court having jurisdiction

over such disclaiming fiduciary, and if there is no such court in this

state, in the Probate Court for any district, (A) where such disclaiming

fiduciary, if not a natural person, has a place of business, (B) where

the creator of the interest resided at the time of its creation, resided

at the time of such creator's death or resides at the time of such petition,

(C) where the settlor of the disclaiming trust resided at the time of its creation, resided at the time of such settlor's death

or resides at the time of such petition, or (D) where the disclaiming fiduciary

or any beneficiary of the disclaiming estate or trust resides. The Probate

Court shall have jurisdiction over proceedings for authority to disclaim

as provided for in this subdivision. A petition requesting authority to

disclaim by a fiduciary of an estate or trust not otherwise subject to

the jurisdiction of the Probate Court shall not subject such estate or

trust or its fiduciary to the continuing jurisdiction of the Probate Court.

(c) The disclaimer shall (1) describe the interest therein disclaimed,

(2) be executed by the disclaimant in the manner provided for the execution

of deeds of real property either by the laws of this state or by the laws

of the place of execution, and (3) declare the disclaimer and the extent

thereof.

(d) A disclaimer under this section shall be effective if made in

the following manner:

(1) A disclaimer of a present interest shall be delivered

not later than the date which is nine months after the later of (A) the

effective date of the nontestamentary instrument or, (B) if the disclaimer

is made by or on behalf of a natural person, the day on which such person

attains the age of eighteen years or, if such person does not survive to

the age of eighteen years, the day on which such person dies.

(2) A disclaimer of a future interest shall be delivered not later

than the date which is nine months after the later of (A) the event determining

that the taker of the interest is finally ascertained and such interest

is indefeasibly vested or (B) if the disclaimer is made by or on behalf

of a natural person, the day on which such person attains the age of eighteen

years or, if such person does not survive to the age of eighteen years, the

day on which such person dies.

(3) If the disclaimant, or the person on whose behalf the disclaimer

is made, does not have actual knowledge of the existence of the interest,

the disclaimer shall be delivered not later than the date which is nine

months after the later of (A) the date on which the disclaimant, or the

person on whose behalf the disclaimer is made, first has actual knowledge

of the existence of the interest or (B) if the disclaimer is made by or

on behalf of a natural person, the day on which such person attains the

age of eighteen years or, if such person does not survive to the age of

eighteen years, the day on which such person dies.

(4) The disclaimer shall be delivered to the transferor of the interest,

his legal representative or the holder of the legal title to the property

to which such interest relates.

(5) If an interest in real property is disclaimed, a copy of such

disclaimer shall also be recorded in the office of the town clerk in which

the real property is situated within such nine-month period, and if a copy

of such disclaimer is not so recorded, it shall be ineffective against

any person other than the disclaimant, or the person on whose behalf

such disclaimer is made, but only as to such real property interest. For

the purposes of this section, the effective date of a nontestamentary instrument

is the date on which the maker no longer has power to revoke it or to transfer

to the maker or another the entire legal and equitable ownership of the

interest.

(e) Except as otherwise provided in subsection (f) of this section,

if a disclaimer is made pursuant to this section, the interest disclaimed

shall devolve as follows:

(1) If the nontestamentary instrument provides for another

disposition in the event of a disclaimer, the interest disclaimed shall

devolve as provided in the nontestamentary instrument in the event of a

disclaimer.

(2) If the nontestamentary instrument does not provide for another

disposition in the event of a disclaimer, the interest disclaimed shall

devolve as follows:

(A) If the disclaimant is a natural person acting for himself

or herself, the interest disclaimed shall devolve as if the disclaimant

had died immediately before the effective date of such nontestamentary

instrument.

(B) If the disclaimant is acting on behalf of a natural person,

as attorney-in-fact, guardian, conservator or other personal representative,

the interest disclaimed shall devolve as if the person on whose behalf

the disclaimer is made had died immediately before the effective date of

such nontestamentary instrument.

(C) If the disclaimant is an executor, administrator or other personal

representative acting on behalf of a deceased person, the interest disclaimed

shall devolve as if the deceased person on whose behalf the disclaimer

is made had died immediately before the effective date of such nontestamentary

instrument.

(D) If the disclaimant is an executor, administrator or other personal

representative acting on behalf of an estate, the interest disclaimed shall

devolve as if the disposition to the estate were ineffective.

(E) If the disclaimant is the trustee of a trust or is a corporation,

partnership, limited liability company, foundation, or other entity, the

disclaimed interest, other than an interest that is a fiduciary power,

shall devolve as if the disposition to the trust or entity

were ineffective.

(F) If the disclaimant is a trustee and the interest disclaimed

is a fiduciary power, the effect of such disclaimer shall be as follows:

(i) If the disclaimer is made by all of the acting trustees for themselves

and on behalf of all successor trustees, then the disclaimed fiduciary

power shall be treated, for all current acting trustees and for all successor

trustees, as if such fiduciary power never existed; (ii) if the disclaimer

is made by a trustee for such trustee alone but not on behalf of other

or successor trustees, then the disclaimed fiduciary power shall be treated,

as to such disclaiming trustee, as if such fiduciary power never existed;

however, such fiduciary power shall continue to be exercisable by any trustee

who has not disclaimed such power and by all successor trustees.

(3) If a disclaimer is addressed to an interest disposed of by a particular

provision of a nontestamentary instrument, then the interest disclaimed

shall devolve pursuant to subdivisions (1) and (2) of this subsection,

but only for purposes of such provision, and such interest may devolve

to or for the benefit of the disclaimant, or the person, estate, trust,

corporation, partnership, limited liability company, foundation, or other

entity on whose behalf the disclaimer is made, under other provisions of

such nontestamentary instrument, by intestacy or otherwise.

(4) Any future interest that takes effect in possession or enjoyment

at or after the termination, whether by death or otherwise, of the interest

disclaimed shall, unless otherwise provided in the nontestamentary instrument,

take effect, (A) in the case of a disclaimer by or on behalf of a natural

person, as if the disclaimant or the person on whose behalf the disclaimer

is made had died immediately before the effective date of such nontestamentary

instrument or, (B) in the case of a disclaimer on behalf of a trust, estate,

corporation, partnership, limited liability company, foundation, or other

entity, as if the disposition to such entity were ineffective.

(5) A disclaimer shall relate back for all purposes to the effective

date of the nontestamentary instrument.

(f) The disclaimer of an interest in real property by a joint tenant

following the death of another joint tenant shall have the same effect

as if (1) before dying, the deceased joint tenant had severed his interest

by conveyance to, and receipt of, reconveyance from, a stranger, (2) such

severed interest of the deceased joint tenant, upon his death, had passed

in equal shares to any nondisclaiming joint tenant or joint tenants, and

(3) if there were no nondisclaiming joint tenants, as if such interest

had passed as part of the estate of the deceased joint tenant. If the disclaimed

interest is deemed to have passed to more than one surviving joint tenant,

such surviving joint tenants shall hold such disclaimed interest as tenants

in common. If two or more joint tenants survive the deceased joint tenant,

the joint tenancy interests they held prior to the death of the deceased

joint tenant shall remain joint tenancy interests as to each other. A partial

disclaimer of an interest in real property by a joint tenant shall be void.

Title 45a, Chap. 802g*, Sec. 45a-583. (Formerly Sec. 45-306).

(1972, P.A. 62, S. 7; P.A. 80-476, S. 344; P.A. 81-396, S. 9; P.A.

82-472, S. 127, 183; P.A. 97-189, S. 5, 6; 97-246, S. 98, 99.)

History: P.A. 80-476 rearranged provisions and divided section

into Subsecs.; P.A.81-396 rephrased previous provisions of Subsecs. (a)

to (c) and added Subsecs. (d) and (e) re requirements for effective disclaimer

and disposition in cases where interest devolves to disclaimant under nontestamentary

instrument; P.A. 82-472 made technical changes in Subsec. (d); Sec. 45-306

transferred to Sec. 45a-583 in 1991; P.A. 97-189 rephrased section and

added new Subsec. (f) re disclaimer of interest by joint tenant following

death of another joint tenant; P.A. 97-246 made P.A. 97-189 effective October

1, 1997, and applicable to disclaimers delivered on or after said date

and transfers affected by such disclaimers, effective June 27, 1997.

Taxation. Refund for overpayment.

Any interest, rights or powers in property,

real or personal, which have been duly disclaimed pursuant to the provisions

of sections 45a-578 to 45a-585, inclusive, shall be subject to the tax

imposed under chapter 216, and acts amendatory thereof, as if such interests

had originally passed to those receiving such interests as a result of

disclaimer. If an interest which may be disclaimed has not been disclaimed

prior to the computation or the decree provided for in subsection (b) of

section 12-367, such tax may be computed as if no possibility of disclaimer

existed. A refund for overpayment of such tax as a result of disclaimer

may be obtained if a claim for such refund is filed within the time limit

and in the manner specified in subsection (d) of section 12-367.

Title 45a, Chap. 802g*, Sec. 45a-584. (Formerly Sec. 45-312).

(1972, P.A. 62, S. 14; P.A. 81-396, S. 13.) History: P.A. 81-396

replaced provisions re computation of tax and added provision refund for

overpayment of tax; Sec. 45-312 transferred to Sec. 45a-584 in 1991. Annotations

to former section 45-312: Cited. 179 C. 463, 467. Cited. 211 C. 323, 329,

330.

Disclaimers made on or after October 1, 1981.

Validity of disclaimers made prior to October

1, 1981. The provisions of sections 45a-578 to 45a-584, inclusive, shall

apply to disclaimers made on or after October 1, 1981, provided disclaimers

respecting transfers of property made before and applicable to estates

of persons dying before October 1, 1981, shall be valid if made in accordance

with the provisions of said sections in effect on September 30, 1981, or

in accordance with other statutory or common law.

Title 45a, Chap. 802g*, Sec. 45a-585. (Formerly Sec. 45-311a).

(P.A. 83-520, S. 9.)