Como Endosar Una Factura Withholding Tax

Description

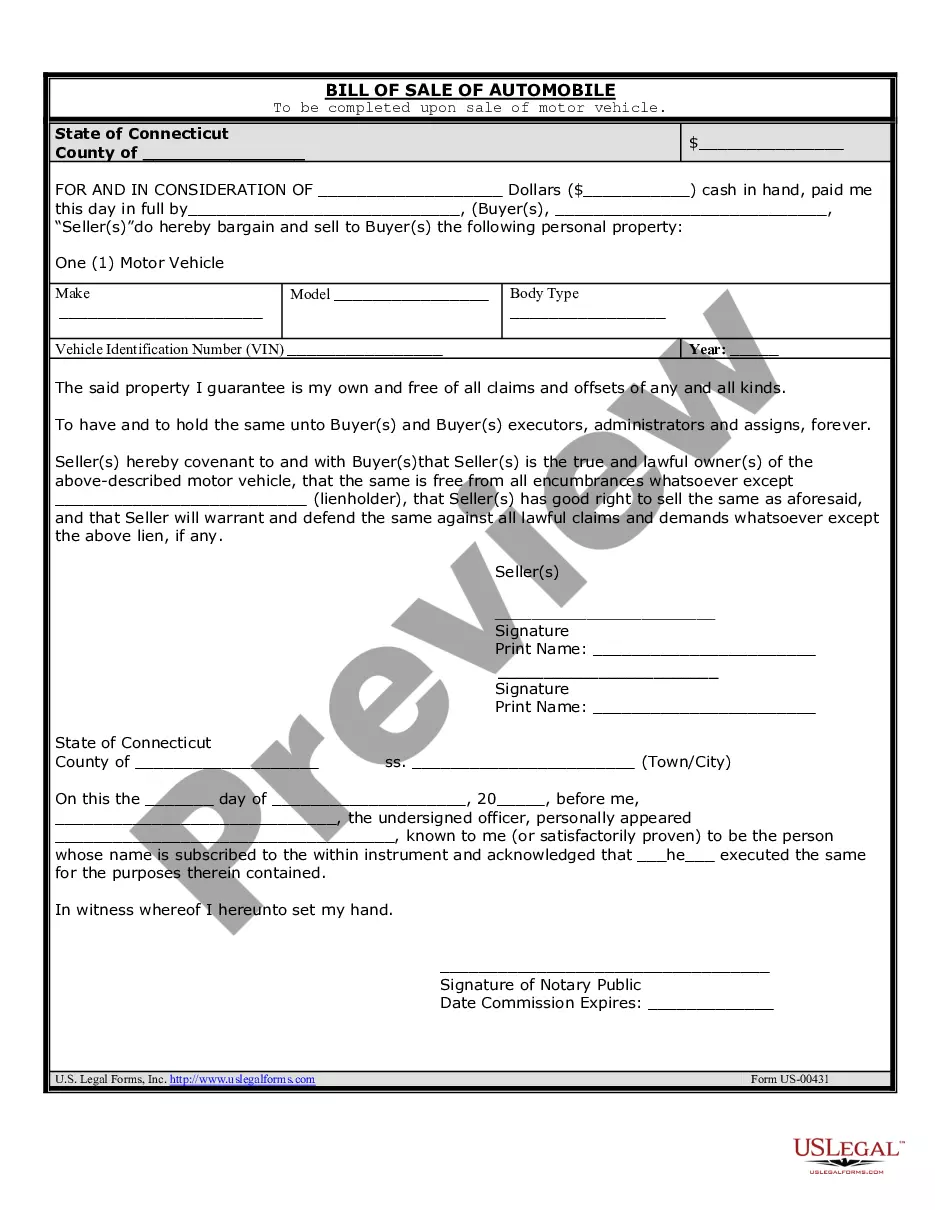

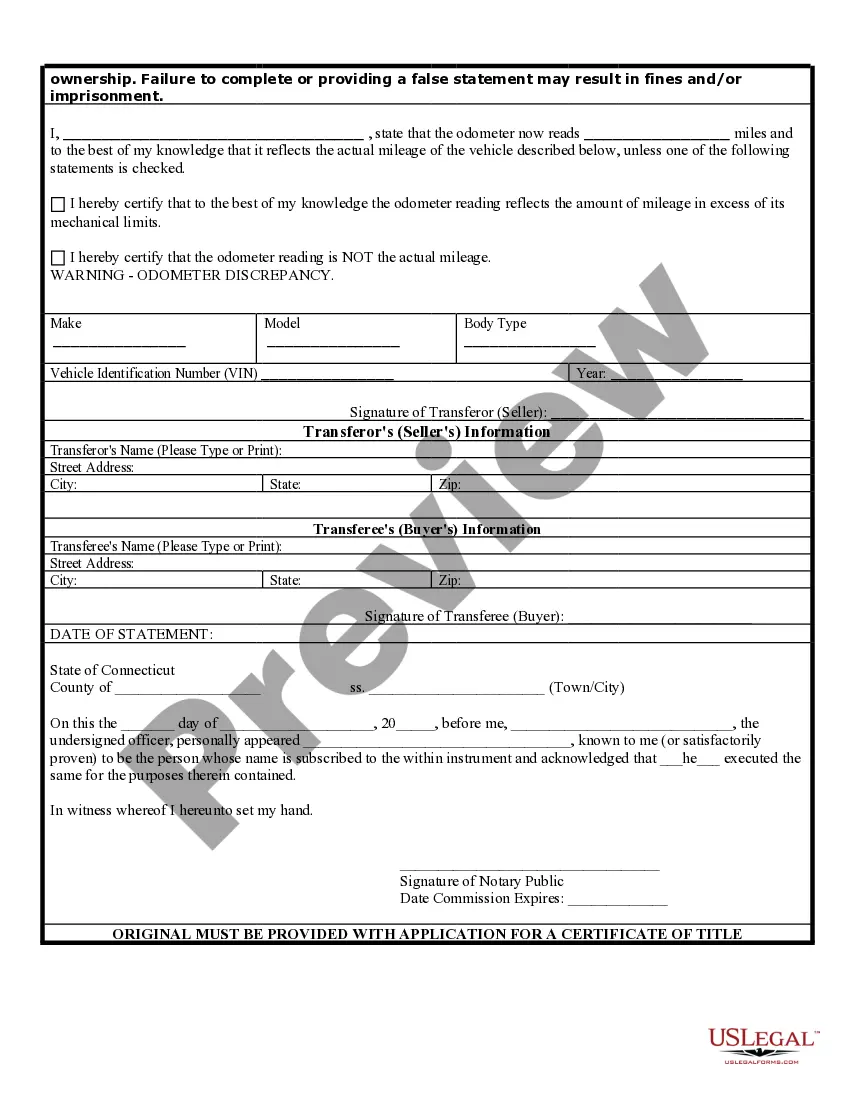

How to fill out Connecticut Bill Of Sale Of Automobile And Odometer Statement?

Handling legal document management can be vexing, even for seasoned professionals.

When searching for a Como Endosar Una Factura Withholding Tax and lacking the time to find the correct and current version, the procedures can become overwhelming.

With US Legal Forms, you are able to.

Access a valuable repository of articles, guides, and resources pertinent to your situation and needs.

Confirm that it’s the appropriate form by previewing it and reviewing its details.

- Minimize time and energy spent searching for necessary documents, and utilize US Legal Forms' sophisticated search and Review tool to locate Como Endosar Una Factura Withholding Tax and download it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to review the documents you've previously downloaded and manage your folders as you wish.

- If this is your first visit to US Legal Forms, create an account to gain unrestricted access to all features of the platform.

- The following steps outline what to do after downloading the desired form.

- Leverage an advanced online form library that can revolutionize how individuals confront these challenges.

- US Legal Forms is a premier provider in digital legal forms, boasting over 85,000 state-specific legal documents accessible at any moment.

- Utilize innovative resources to accomplish and govern your Como Endosar Una Factura Withholding Tax.

Form popularity

FAQ

The short answer is yes, a beneficiary can also be a trustee of the same trust?but it may not always be wise, and certain guidelines must be followed.

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it. A living trust is an effective tool that can provide you with the flexibility and privacy you seek.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.

There is no way the trustee can refuse to provide you with accounting information or financial information. They can also speak with you. Nevertheless, many beneficiaries are struggling with these horror stories.

Summary of Registration Requirements Within four months of its inception, a charitable trust must file the Application for Registration as a Charitable Trust, a copy of the trust instrument, and a $25 dollar filing fee made payable to the Secretary of State.

The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.

With limited exceptions, a newly-appointed trustee must notify beneficiaries of becoming trustee within sixty days of accepting that role. The details of what notice must be given are contained in the statute. The creator of a trust may waive the trustee's duty of notice (RCW 11.98. 072).

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

As a beneficiary, you have the right to: Receive Information: Beneficiaries have the right to be informed about the estate and its administration. This includes a detailed list of the property and assets, an accounting of debts and liabilities, and a timeline for when distributions will be made.