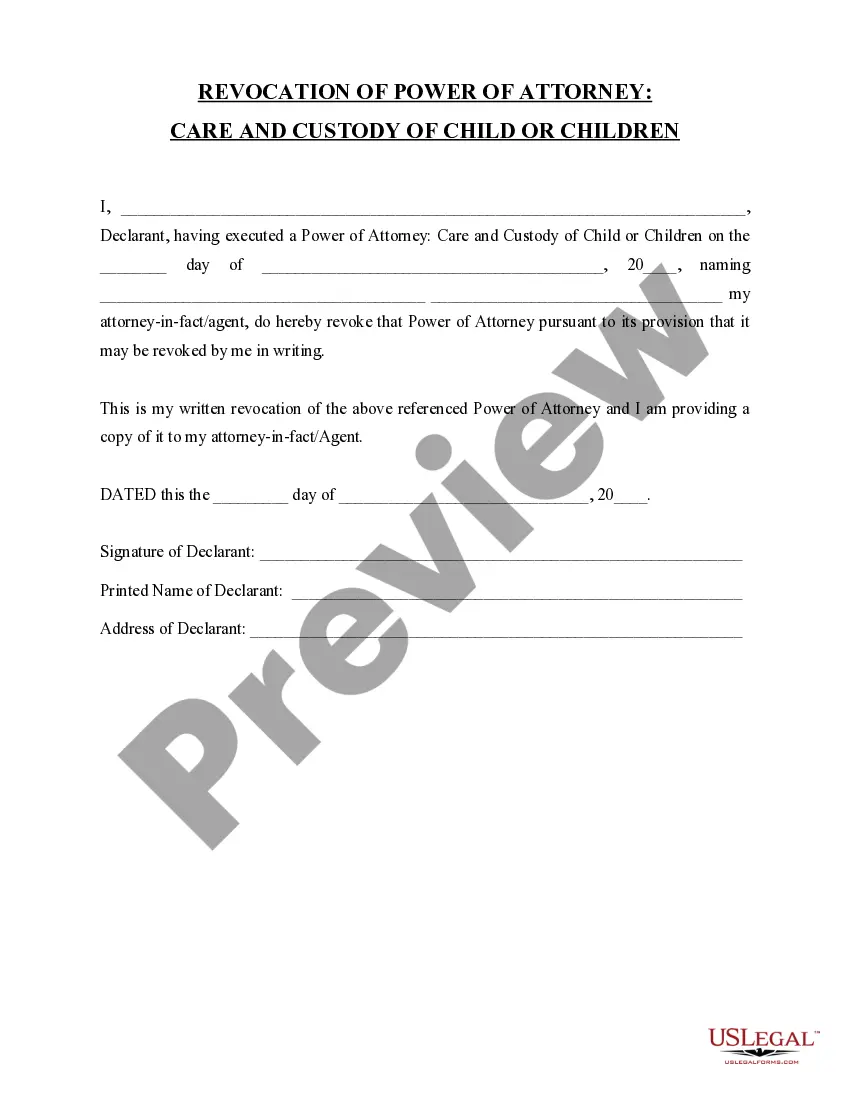

Revocation Power Of Attorney Template

Description

How to fill out Colorado Revocation Of Power Of Attorney For Care Of Child Or Children?

- If you're an existing user, log in to your account and access the Download button for your desired template. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, begin by checking the Preview mode alongside the form description to confirm you've selected the correct document compliant with your local jurisdiction.

- If discrepancies arise, utilize the Search tab above to find the appropriate template.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to unlock full access.

- Complete your purchase by entering your credit card information or logging into your PayPal account for payment.

- Finally, download your form and save the template on your device, allowing you easy access via the My Forms menu whenever needed.

In conclusion, US Legal Forms empowers users with not just a vast selection of legal documents, but also offers assistance from premium experts to ensure accuracy in completion. By following these steps, you can effortlessly obtain your revocation power of attorney template today.

Don't wait—visit US Legal Forms now to start empowering yourself with the right legal tools!

Form popularity

FAQ

Yes, you can fax a Power of Attorney to the IRS, including a revocation. When faxing, ensure that the document is complete and clearly lists your intent to revoke if applicable. Double-check the IRS fax number to avoid delays. Faxing can be a quick way to communicate your wishes while maintaining documentation of your submission.

To revoke Form 2848 online, you can submit a revocation power of attorney template directly through the IRS online services where applicable. Make sure to follow the instructions for online submissions carefully, noting any requirements for electronic signatures. If online options are limited, consider mailing a physical revocation to the IRS for processing. This ensures your request is documented correctly.

The validity of a Power of Attorney with the IRS typically remains until you revoke it or the purpose it served is fulfilled. However, using a revocation power of attorney template is essential for ending its authority effectively. If you're unsure when it can be revoked, consult a legal professional for guidance tailored to your specific circumstances. This ensures all aspects are addressed properly.

To revoke a Power of Attorney with the IRS, you need to submit Form 2848, marking it with ‘Revocation’ in the appropriate section. Additionally, you can create a revocation power of attorney template to formally notify the IRS of your decision. Make sure to include all necessary details and submit the form to the appropriate IRS address. Once processed, your revocation will take effect.

To write a revocation, start by clearly stating your intention to revoke the existing Power of Attorney. Use a revocation power of attorney template to include essential details like your name, the agent's name, and the original Power of Attorney date. Be sure to sign the document and provide copies to all relevant parties, including the agent and any institutions that had a copy on file.

Verbal revocation of a Power of Attorney can be risky and is generally not advisable. While you may express your desire to revoke verbally, creating a written revocation power of attorney template is crucial for clarity. A formal document protects your interests by preventing disputes or misinterpretations later. Always ensure that you inform the agent and relevant parties of your decision.

Removing Power of Attorney without a formal letter can be tricky, but it is possible. You should verbally inform the person holding the Power of Attorney about your decision. However, it’s wise to follow up with a written revocation power of attorney template to ensure there is a clear record of your wishes. Documentation helps prevent any misunderstandings in the future.

To withdraw a Power of Attorney from the IRS, you need to file a specific form, Form 8843 if applicable. For a revocation power of attorney template, clearly indicate your intention to revoke the authority you granted. Make sure to provide all required information, including your details and the details of the representative. Once submitted, the IRS will process your request, and the revocation will take effect.

To revoke a power of attorney in Texas, you can use a Revocation power of attorney template. Start by completing the template, which outlines your intent to cancel the existing power of attorney. After filling it out, you should sign the revocation and notify the agent named in the original document. It is wise to inform any relevant parties, such as banks or healthcare providers, to ensure they recognize that the power of attorney has been revoked.

A new power of attorney can override an old one if it is properly executed and states that it revokes previous documents. It’s essential to communicate this clearly in the new document to avoid confusion. Make sure to inform all relevant parties of the new designation. Incorporating a revocation power of attorney template can simplify the process, ensuring that everyone understands the change.