Revocation Of Power

Description

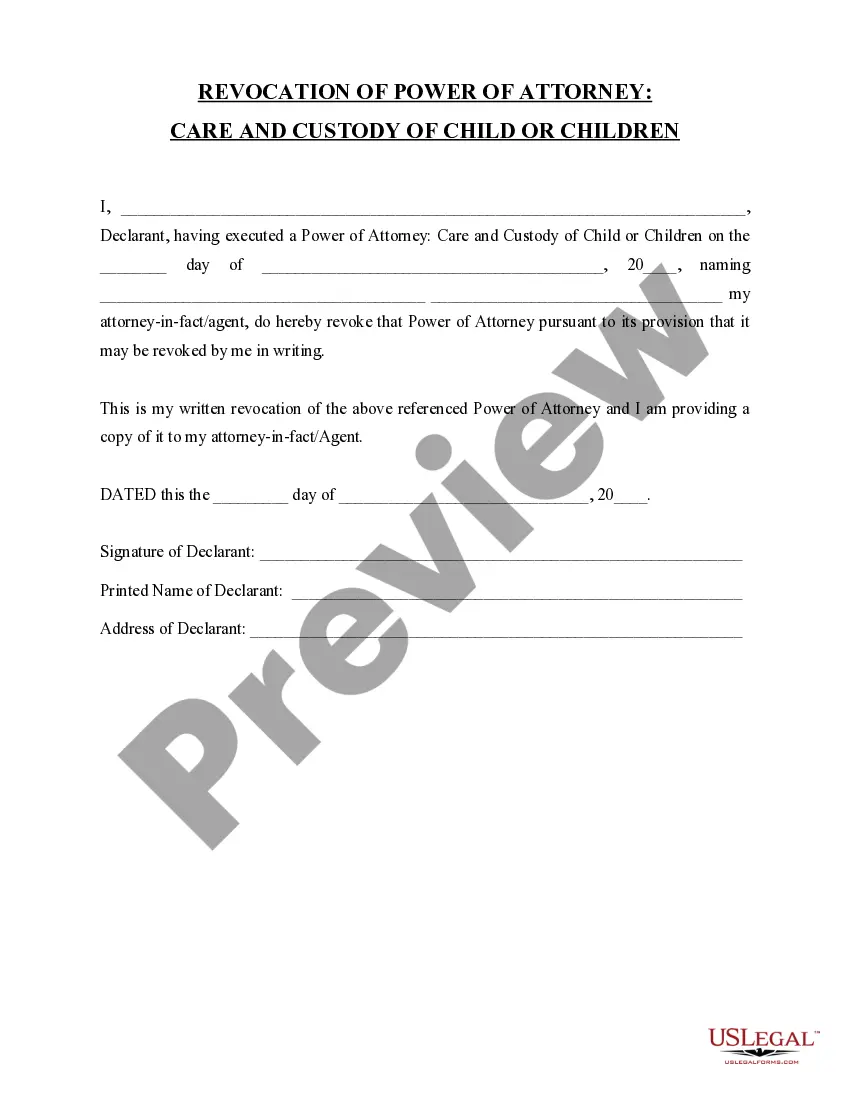

How to fill out Colorado Revocation Of Power Of Attorney For Care Of Child Or Children?

- Start by logging into your US Legal Forms account if you are a returning user. Ensure your subscription is active, or renew it if necessary to access your previously downloaded documents.

- For first-time users, explore the extensive collection of forms. Begin by utilizing the Preview mode to inspect the form descriptions and confirm they meet your state’s legal requirements.

- If you identify any discrepancies, utilize the Search feature to locate the appropriate template for your specific needs.

- Proceed to purchase the chosen document. Click the Buy Now button and select a subscription plan that works best for you. Registration is mandatory to access the forms library.

- Complete the purchase by entering your payment details via credit card or PayPal. Once confirmed, you'll have access to your purchased documents.

- Finally, download the revocation form onto your device. You can also find it anytime under the My Forms section of your account.

In conclusion, US Legal Forms provides a comprehensive platform to effectively manage legal documents like the revocation of power. With the advantage of having a wide range of legal forms and expert assistance, you can ensure that your documents are accurate and legally compliant.

Start your journey with US Legal Forms today and secure your legal needs with ease!

Form popularity

FAQ

Revoking Form 2848 online isn't directly available through the IRS, but you can easily submit a written revocation request or another Form 2848. Clearly indicate that you are revoking the previous document. Using resources like USLegalForms can streamline this process, providing you with necessary templates and guidance for your revocation of power.

To revoke a Power of Attorney with the IRS, you need to file a new Form 2848 or submit a written statement explicitly stating your intention to revoke the previous authorization. Ensure that your documentation is clear and precise to prevent delays. The revocation of power is vital to protect your interests regarding future tax matters.

Yes, you can fax a Power of Attorney to the IRS, but ensure you follow specific guidelines for sending. Make sure to double-check the IRS fax number for the relevant department, as this can vary. For an efficient process, consider using the USLegalForms platform to prepare your documents correctly.

A Power of Attorney typically remains valid until you revoke it or the stated duration expires. For IRS purposes, it's important to verify the terms set out in your original Power of Attorney. If you have questions about the expiration, the proper revocation of power is essential to avoid any misunderstandings.

No, you do not need an attorney to revoke a Power of Attorney; you can do it yourself. However, consulting a legal professional can provide additional clarity and ensure the revocation process goes smoothly. If you're unsure, platforms like USLegalForms can offer templates and guidance to assist you.

Writing a revocation is simple. Begin by stating your intention to revoke any previous Power of Attorney. Include specific details such as the name of the agent, the date of the original Power of Attorney, and your signature. This document should be clear to avoid any confusion regarding your decision.

To withdraw a Power of Attorney from the IRS, you must file a Form 2848 and include the necessary details for revoking the power. Make sure to clearly indicate that you are requesting the revocation of power granted in the prior form. It's essential to submit this request to ensure the IRS updates its records appropriately.

Different types of revocation can include total revocation, partial revocation, and conditional revocation. Total revocation completely nullifies any existing authority, while partial revocation only cancels specific rights. Understanding these types helps you decide how to manage the revocation of power in varying situations.

Rules of revocation require clarity in communication and adherence to legal standards. Typically, the individual revoking the authority must provide proper notice to the affected parties. Utilizing uslegalforms can assist you in ensuring that all rules concerning the revocation of power are met, preventing misunderstandings.

The three types of revocation include express revocation, implied revocation, and statutory revocation. Express revocation involves a explicit statement to cancel authority, while implied revocation occurs when the new actions contradict previous authorizations. Statutory revocation follows laws that dictate when authority is automatically canceled.