Trust Account With Chase

Description

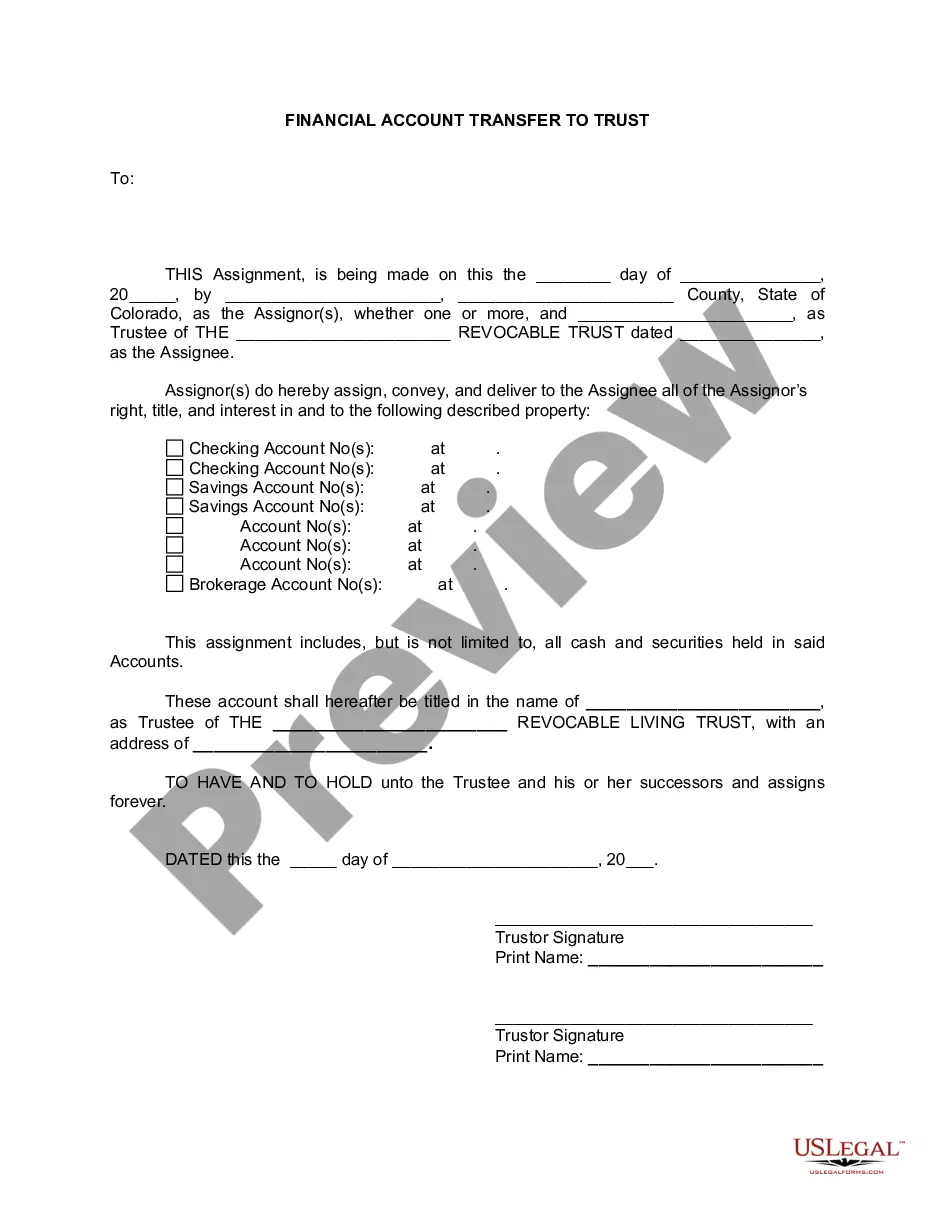

How to fill out Colorado Financial Account Transfer To Living Trust?

- If you are a returning user, log into your account and download the required form by clicking the Download button, ensuring your subscription is active. If it has expired, renew it based on your payment preference.

- For first-time users, start by reviewing the Preview mode and description of the form. Confirm that it aligns with your needs and complies with local jurisdiction regulations.

- If necessary, search for alternative templates. Should you encounter any inaccuracies, utilize the Search feature above to locate the appropriate form.

- Proceed to purchase the document. Click on the Buy Now button and select your desired subscription plan, ensuring you create an account for full access.

- Finalize your payment by entering your credit card information or opting for PayPal to secure your subscription.

- Download your form. Save the template to your device for completion and keep it accessible in the My Forms section of your profile.

US Legal Forms not only empowers users to quickly obtain legal documents, but it also differentiates itself with an extensive collection of over 85,000 editable forms. Our users can rely on premium expert assistance for accurate document completion, ensuring legality and precision.

Take control of your trust account management today. Start with US Legal Forms and simplify your legal document needs!

Form popularity

FAQ

Yes, JP Morgan Chase offers trust services designed to meet the diverse needs of clients. They provide a trust account with Chase that focuses on wealth preservation and growth. Whether you're an individual or a business, working with Chase grants you access to expert advice and a tailored approach to trust management.

To open a bank account for a trust, start by gathering essential documents, including the trust agreement and tax identification number. Visit your chosen bank, like JP Morgan Chase, to complete the necessary forms and provide required identification. With a trust account with Chase, you receive dedicated support to ensure a smooth account setup process.

J.P. Morgan offers a wide range of services, including investment banking, asset management, and private banking. They also excel in trust and estate services, helping clients manage their wealth for future generations. Choosing a trust account with Chase enables clients to benefit from J.P. Morgan's extensive expertise and tailored solutions.

Many banks offer trust accounts, but JP Morgan Chase stands out with comprehensive solutions. In addition to Chase, institutions like Wells Fargo and Bank of America provide similar services. When you choose a trust account with Chase, you gain access to a wealth of resources aimed at maximizing your trust's potential.

Banks typically provide several corporate trust services, including investment management and asset protection. They may also facilitate the administration of employee benefit plans and manage bond indentures. A trust account with Chase allows businesses to utilize these services while ensuring compliance with applicable regulations.

Yes, JP Morgan does offer trust services. They provide various options for individuals and businesses looking to manage their assets effectively. With a trust account with Chase, clients benefit from personalized guidance in navigating the complexities of estate planning and wealth management.

Filling out a trust fund involves completing the trust document while clearly defining your assets and beneficiaries. It’s essential to include specific instructions regarding how and when the assets will be distributed. If you are unsure about any part of the process, using a trusted resource like US Legal Forms can offer guidance and clarity. When setting up a trust account with Chase, ensure all necessary information is accurately documented to avoid delays.

You can set up a trust fund by yourself, but it often involves complicated legal language and considerations. Using online resources or platforms like US Legal Forms can simplify this process by providing templates and guidance. However, consulting with a legal expert can help avoid potential pitfalls and ensure your trust fund meets your goals. Setting up a trust account with Chase can also provide additional financial support and options.

To put your bank account in a trust, begin by ensuring you have a valid trust document in place. Next, contact your bank, such as Chase, and request to transfer ownership of the account to the trust. This process usually involves submitting the trust document and completing specific forms provided by the bank. By transferring your account into the trust, you ensure your assets are appropriately managed for your beneficiaries.

To set up a trust account with Chase, begin by creating a revocable or irrevocable trust, depending on your needs. Once the trust document is prepared, visit a local Chase branch or their website to initiate the account setup. You will need the trust's details and possibly the Social Security number of the trust. Chase staff can guide you through the requirements and options available for trust accounts.